I am bearish on this pair. A good area to enter a sell trade would be the 50/61.8 Fib zone, around the 1.24680/1.25080 area; provided a feasible set-up is seen there on the H4 time frame. For me, a buy trade is not in the offing from the standpoint of a swing trader.

If you are tracking GBPUSD, price action is likely to go southward after the current pullback northward. Price action is struggling around a significant S/R zone which is in confluence with the 32.8 Fib retracement zone of the swing down from the high of June 2015.

Trade safe and prosper.

Eurusd today on bullish strong, after three day this pair on bearish trend, we can see on daily timeframe, start from monday movement this pair on bearish, but now move bullish trend very strong, today there are news high impact was released then influenced to the market being high volatile

Thank you for contributing. Please, could you provide some charts and more detailed analysis in future?

Trade safe and prosper.

USDJPY Weekly Technical Outlook

Until last week, price action on USDJPY was in sideways operation for five weeks. On the weekly time frame, last week price action broke down the sideways channel with a relatively big bearish candlestick. Price action is now located at a horizontal support around the 111.340 area. This area has held as support since late September 2017. Is it time for price action to break down the area? If bears follow through on the southward move this week, an initial target is likely to be the immediate minor support around the 110.280/108.830 area.

On the H4 time frame, price action is operating in a descending channel (bound by magenta coloured lines). Last week, price action, which has been operating above the mid-channel line (red colour) since December 7, 2017, moved below the mid-line to hug the horizontal support around the 111.340 area. The channel support is likely to be exposed for the attraction of bears. Alternatively, should bears fail in a southward follow-through move, we may see price action retrace to above the mid-channel line, perhaps with a view to retesting channel resistance.

I may be wrong. Trade safe and prosper.

NZDUSD Weekly Technical Outlook

NZD has been one of the strongest among the majors recently. On the weekly time frame, price action has entered a major resistance zone, which is around the 0.72590 area. However, the larger picture is that of a market operating in a consolidation area or horizontal channel (bound in magenta coloured horizontal lines). Thus, if price action breaks above the resistance around the 0.72590 area, a likely target of bulls is the channel resistance around the 0.73460 area.

On the daily time frame, both the order flow context and the technicals are strongly in support of bulls. So we may expect a bullish continuation.

On the H4 time frame, price action has breached to the north a resistance trendline (navy colour) from the high of July 27, 2017 and flipped it into a support. The most recent price action is struggling around the horizontal resistance around the 0.72590/0.72620 area but a support trendline (magenta colour) from the low of December 8, 2017 is still very much respected.

I may be wrong. Trade safe and prosper.

GBPUSD Weekly Technical Outlook

Since mid-December 2017, price action on the GBPUSD has been northward in disposition. The northward mode continued last week with a relatively big bullish candlestick on the weekly time frame. Technicals on the weekly time frame are still in favour of bulls. Should there be a follow-through this week, a likely target of bulls is the immediate resistance around the 1.38350/1.39150 area. The support trendline (chocolate coloured) from the low of March 2017 is still very much in play.

Price action on the daily time frame is respecting an ascending trendline (navy colour) from the low of March 2017. This is further northward away from the support trendline (chocolate colour) seen on the weekly time frame. An inner support trendline (magenta colour) has also emerged and indictes an increased northward momentum. Although generally the northward disposition on GBPUSD is not yet breached technically, as price action was parabolic last Friday and has moved further up away from the mean value area, I expect it to retrace southward early this week. The inner support trendline (magenta colour) is likely to be broken southward by such a retracement, which may target the immediate horizontal support around the 1.34460 area, or even the main support trendline on the daily time frame (navy colour), before a northward turnaround. Thereafter, we may see price action operate sidways around the 1.38350/1.39150 area for a while.

I may be wrong. Trade safe and prosper.

EURNZD Weekly Technical Outlook

On the monthly time frame, bears pushed price action on this pair southward from a major resistance and hit a minor support around the 1.65190 area before it was pushed back northward by bulls. Generally, on the monthly time frame, price action is still hugging the horizontal resistance around the 1.69350 area but the candlestick is printing bearish.

On the weekly time frame, price action is respecting a support trendline (chocolate colour) from the low of February 2017. This trendline formed an ascending channel with the highs of recent candlesticks. Last week, a pinbar-like bullish candlestick was formed and tested the channel support. Should bulls follow through on this pinbar, the horizontal resistance around the 1.69350 area is likely to be an initial target and it is within reach. This area is proximal to the monthly central pivot. As price action is around the mean value area, such a bullish move is likely to be feasible and may gain momentum if bulls significantly clear the 1.69350 area.

On the daily time frame, price action has formed four corrective price waves in the ascending channel seen on the weekly time frame (bound in chocolate coloured lines). A fifth price wave was bearing southward from channel resistance but bulls were resisting the move. Recent price action is under the influence of bulls and they may take price action to the next horizontal resistance around the 1.69350 area. This is in confluence with the 38.2/50.0 Fib retracement zone of the swing down from the high of December 1, 2017. It is also proximal to the monthly central pivot. This is an area I will be watching for a sell trading opportunity should a setup be seen on a daily or H4 closing basis. A breach of that zone northward on a daily closing basis will see me step aside and wait for a buy setup with a view to targeting the channel resistance.

On the H4 time frame, price action is operating in a descending channel (bound in navy coloured lines). This represents the fifth price wave being formed on the daily time frame. The most recent price action is around a minor support and under the control of bulls. We may see price action retrace further northward but there are a few minor barriers to the north. The major resistance is around the 1.69350 area and this will be an area of interest to me for a sell trading opportunity should a setup be found there. It is in confluence with the 38.2/50.0 Fib retracement zone of the swing down from the high of December 1, 2017. It is also proximal to the monthly central pivot.

I may be wrong. Trade safe and prosper.

I am bearish on this pair. I will look for a sell trading opportunity around the 38.2/50 Fib zone, in fact it may extend to the 61.8 Fib level. The area I will be watching is shown bound by the two horizontal magenta coloured lines on the H4 time frame, i.e. between 1.69230 and 1.70680. A breach of that area northward on a daily closing basis will see me step aside and wait for a buy setup with a view to targeting the channel resistance.

I may be wrong. Trade safe and prosper.

The fact that price action on GOLD is southward atm does not mean a trend change is imminent. The price action is around a significant S/R zone and we should expect some struggle, e.g. a retracement or sideways operation.

Trade safe and prosper.

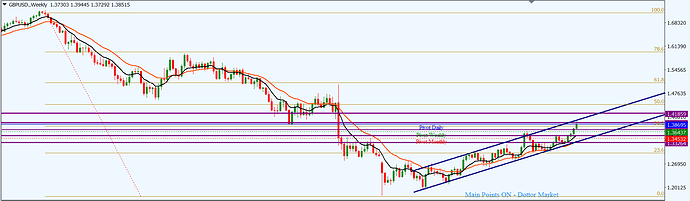

GBPUSD Weekly Technical Outlook

Price action on the GBPUSD has been disposed northward for quite a while. An ascending channel (bound by navy coloured lines) can be seen on the weekly timeframe from January 2017. This followed a decline which began in July 2014. The most recent price action is around the 38.2 Fib retracement zone of the decline and bulls are in control of the recent order flow. Last week, the bulls took price action to the channel resistance and in an area that is in confluence with the horizontal resistance (i.e. the 1.39750 area) but bears resisted the move. This area was last traversed southward by price action in June 2016. As this is is a confluence of resistance, we may see further southward pullback into the channel in the days ahead. However, anything can happen. If bulls beat the confluence of resistance, we may see a strong northward momentum.

On the daily time frame, price action printed a bearish rejection candlestick around the confluence of resistance last week Friday. This confluence of resistance includes an ascending trendline (chocolate) from August 2017. This confluence of resistance technically lends weight to the possibility of a southward turnaround of price action in this area. And an immediate target of bears for any follow-through this week is likely to be the 1.37000 area, which is the next minor support. This may extend southward to test and validate a support trendline (magenta) from the low of December 27, 2017 before a northward turnaround. Should bears fail to follow through, bulls are likely to seize the initiative for a swift northward turnaround. As a technical trader with a swing trading style, I will wait to see how price action on this pair develops on Monday even though technically the short-term mode favours bears.

I may be wrong. Trade safe and prosper.

EURUSD Weekly Technical Outlook

EURUSD has been on the upward mode for quite a while. On the weekly time frame, price action on the pair has entered a resistance zone around the 1.23420 area. Last week, the candlestick printed on the weekly time frame was ambivalent, but bears became influential by the close of session. We may expect bears to push price action southward in the early part of the week. A sideways operation is also a possibility given that price action is in a resistance zone that was last traversed southward in December 2014.

On the daily time frame, price action is respecting an ascending trendline (navy) from the low of December 18, 2017. Notice, however, that price action has breached to the upside a resistance trendline (chocolate) from recent highs. Since then, and for much of last week, price action was operating sideways above this trendline and below the significant resistance zone around the 1.23420 area. We may expect a pullback of price action early this week to retest this trendline and validate it as support before further northward momentum. Nevertheless, should bears push price action further southward we can still expect a bullish mode on this pair as long as the support trendine (navy) from the low of December 18, 2017 is still intact. I will see such a move as an opportunity to look for a buy trading setup on this pair.

On the H4 time frame, recent price action has been operating within an ascending channel (bound by purple coloured lines) after some topping pattern. A breach of the channel to the south is much likely in the offing as price action in the latter part of last week saw bears strongly influential. A breach of channel support is likely to see bears target the ascending trendline (chocolate) below the channel or the minor support around the 1.20700 area. Such a move is very likely to be a corrective one as the market mode favours the bulls.

I may be wrong. Trade safe and prosper.

GBPJPY Weekly Technical Outlook

Price action on the GBPJPY has been disposed northward for quite a while. An ascending channel (bound by magenta coloured lines) can be seen on the weekly timeframe from April 2017. This followed a decline which began in August 2015. The most recent price action is around the 38.2 Fib retracement zone of the decline but operating in a consolidation phase. Within the middle of the main ascending channel (magenta), a minor and narrower ascending channel (navy) has formed. In the last three weeks, price action has been sideways in this minor channel and proximal to a horizontal resistance zone around the 152.150/154.140 area. Technically, the market mode is ambivalent and requires further clarity of price action in the next few days; stepping aside is advised.

On the daily time frame, price action is operating around the resistance of the minor ascending channel (navy) seen on the weekly time frame. The shooting star candlestick formed at the channel resistance last week Thursday was followed up by a bearish candlestick on Friday but bulls managed to push price action upward. Wave traders may look at the larger picture of the impulsive move on the left and treat current price action as part of a correction to consummate a leg down to the support line of the bigger channel (magenta) seen on the weekly time frame. However, we need further clarity of price action in the next few days.

On the H4 time frame, price action has rejected the resistance of the minor channel (navy) seen on the weekly time frame. However, on Friday, bulls managed to push price northward to around the 32.8 Fib retracement of the most recent swing down. Bears resisted the move and pressed price action southward. If bulls successfully resist bears in the early part of this week, we may see price action move further north to around the 50/61.8 Fib zone before a southward turn around; this area (153.690/154.020) is bound by blue coloured lines on the attached H4 chart.

I may be wrong. Trade safe and prosper.

If you are tracking the EURUSD this week, you may be seeing a technically bullish pair; at least the EUR is technically stronger than the USD at the moment. But there is need to be wary of the market mood and the location of price action. You may want to ask: How bullish is ‘bullish?’ Basically, realize that price action on the EURUSD is operating in a strong resistance zone and the intra-day chart (H4) shows price action contained in a symmetrical triangle. It is important to wait for clarity of price action in the first 1-2 days of trading this week.

I may be wrong. Trade safe and prosper.

GBPUSD Weekly Technical Outlook

The GBP has been the strongest among its peers recently. Last week, GBPUSD continued a bullish move that started in December 2017. In fact, the weekly candlestick printed last week was the largest since December 2017. However, bears managed to curtail the bullish momentum towards the end of last week. Price action has not yet breached an ascending trendline (chocolate) from the low of January 2017. Furthermore, current price action is located around a minor resistance at the 1.41870 area. This is in confluence with the 38.2 Fib retracement zone of the swing down from the high of June 2014 to the low of October 2016. The fact that price action struggled in this zone last week signposts a likely retracement or further sideways operation in the early part of this week.

On the daily time frame, price action has been operating in an ascending channel (navy) for quite a while. But last week Wednesday, price action broke above the channel resistance ; bears pushed it back for a retest of the channel line on Thursday although the attempt was feeble. The Friday candlestick was ambivalent and we may expect further sideways operation around the channel resistance in the early part of this week. Should bulls manage to take price action northward, we may see a natural target of such a move around the 1.44460 area. Alternatively, bears may push price action back into the channel and retest a support trendline (magenta) being respected by recent price action. This appears to be a much more likely possibility as recent price action has moved too far from the mean and a correction is likely to be in the offing.

I may be wrong. Trade safe and prosper.

GBPNZD Weekly Technical Outlook

On the weekly time frame, price action on this pair has bore northward for much of the past six months. Seven weeks ago, an ascending trendline (chocolate) from the low of August 2017 was breached southward by price action. However, since then price action has been largely sideways. Three weeks ago, a tiny bullish pinbar was formed and bulls have followed through since to push price further northward, perhaps to target and retest the ascending trendline which was earlier breached. But bulls will have to contend with a major horizontal resistance around the 1.96300 area before such a target can be attained. We should note that the bullish candlestick printed last week was strongly restrained by bears towards the close of the session. This means that bears were stepping in to curtail further northward move. Thus, we may see some sideways price action, or a retracement southward, in the early part of this week.

On the daily time frame, price action is operating in a symmetrical triangle. Recent price action has just moved southward of the resistance line with a bearish print on Thursday and Friday last week. It is apparent that the bullish candlestick printed last week Wednesday is acting as a control candlestick; and we may see price action move further southward to test the low of this candlestick, which is in confluence with the immediate support around the 1.90200 area.

I may be wrong. Trade safe and prosper.

USDJPY Weekly Technical Outlook

Price action on this pair has been operating within a 700-pip range (magenta) on the weekly time frame for quite a long while. Price action is currently located around the support line of the range. For much of December 2017, price action consolidated a 160 pips below the resistance line of the range. But since the first week of January 2018, bears have pushed price action southward covering more than 450 pips within three weeks. This represents a strong bearish intent. However, although last week bears made a strong attempt to breach the support line, bulls curtailed the move and bears failed to take out the support. We can expect a struggle for control between bulls and bears in the early part of this week. The technicals are in sync with bears’ mood and the support line is only about 80 pips from their reach.

On the daily time frame, price action has moved southward and rather too far from the mean and a retracement may be in the offing. However, because recent order flow has been largely influenced by bears we may see a brief southward move or a sideways operation before the retracement. A retracement of price action northward is likely to validate a resistance trendline (navy) before any further southward move. The 110.780/111.200 area is likely to be a target of bulls for such a retracement; this area is in confluence with a minor horizontal resistance and the 50.0/61.8 Fib zone of the most recent swing down.

On the H4 time frame, it is apparent that recent price action has seen bulls and bears struggling for control and a sideways operation taking place. It is better to wait for clarity of price action in the early part of this week before a directional bias can be confidently taken.

I maybe wrong. Trade safe and prosper.

Yesterday, I was watching price action around a zone (bound in deepblue coloured lines) on GBPUSD. Price action was sideways at the zone for a long while. It went northward for a while for about 60 pips and turned around at the 61.8 Fib zone of the drop from the high of January 25, 2018. It gave a bearish engulfing setup on the H1 time frame but it was not significant enough. So there was need for me to wait for a price action follow through. Based on the W1 time frame I was holding a bearish bias, a reason why I did not go long yesterday at the zone. Price action is now at the zone and I have taken a southward trade. My stop loss is a few pips above the 61.8 Fib zone. See attached charts.

I may be wrong. Trade safe and prosper.

Why am I taking this trade so close to a high impact USD fundamental news? Because I am ready to risk the stop loss. As the weekly bias is southward, if market’s perception of the fundamental news favours my direction I stand to gain more than I lose. Besides, fundamental news by themselves do not move price action; it is how the market perceives and reacts to the news.

Trade safe and prosper.

EURUSD Weekly Technical Outlook

EURUSD failed to maintain its northward momentum last week. On the weekly time frame, two weeks ago price action moved over 300 pips to break through a strong S/R zone and entered the next resistance zone where bears curtailed further upward move. Last week, bulls attempted to take price action further northward but failed to take out the high of the bullish candlestick formed a week earlier. In fact, price action printed a small doji-like candlestick. Nevertheless, it should be noted that the trend is still northward on the weekly time frame as an ascending trendline (chocolate) from the low of April 2017 is still intact. But we may expect a pullback as the location of price action is far from the mean. Alternatively, should bulls manage to take price action further northward, we may expect them to target the 1.25900 handle, which was last visited and crossed southward in December 2014.

On the daily time frame, price action has been ranging for several days. Last week Friday, bears managed to push price action southward but failed to breach below the base (magenta) of the consolidation formed several days earlier. As price action is at a resistance zone, we may see further sideways operation or pullback before any further northward momentum can be maintained. A likely target of such southward pullback is the immediate support around the 1.22880 area. Should bears become too strong for bulls, we may see the pullback retest a support trendline (navy) from the low of December 18, 2017. Such a move is likely to be corrective in nature. However, should the support trendline (navy) be breached southward on a daily close basis, it may open up a technical reassessment of the market on this pair.

On the H4 time frame, price action has been respecting an ascending trendline (magenta) for quite a while. However, recently, price action has been hitting the trendline too often; which suggests a possibility of a southward breach of the trendline. Should that breach materialize, we may see bears target the immediate support around the 1.22880 area.

I may be wrong. Trade safe and prosper.