Forex today: the greenback is losing ground

22.05.2018

It seems like the rally of the greenback has ended. On Monday, the US dollar index closed below $93.50. Tuesday’s attempts to recover are not successful. The index is below $93.40. No important economic data will be released today. As a result, risks of the further fall exist.

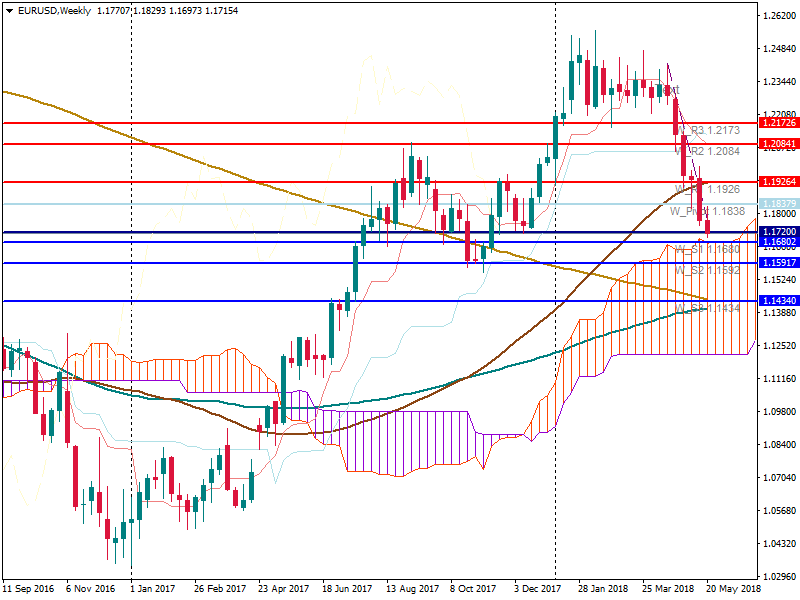

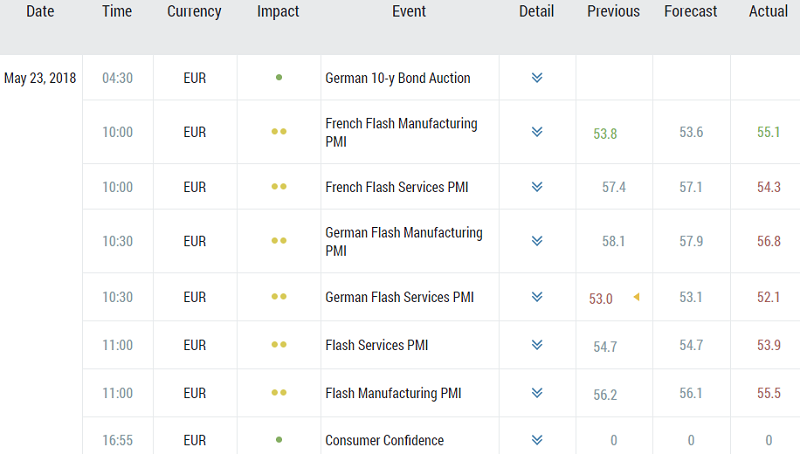

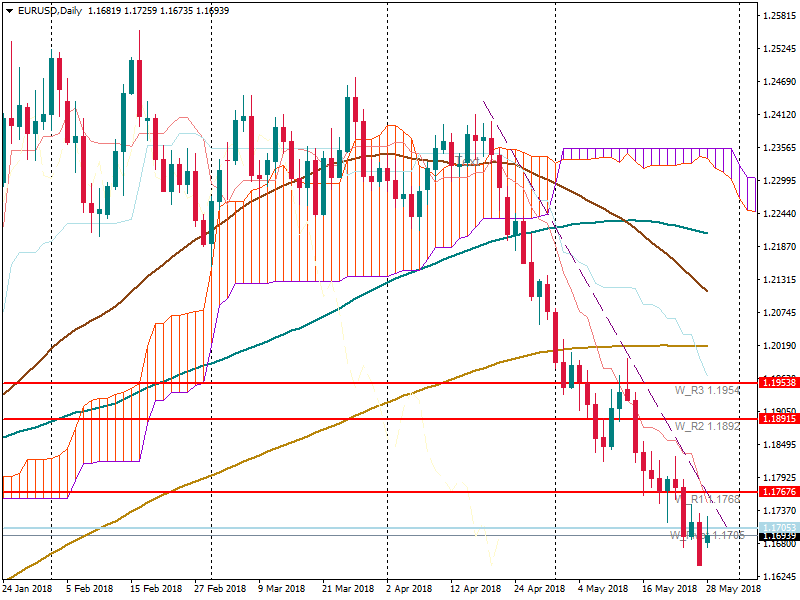

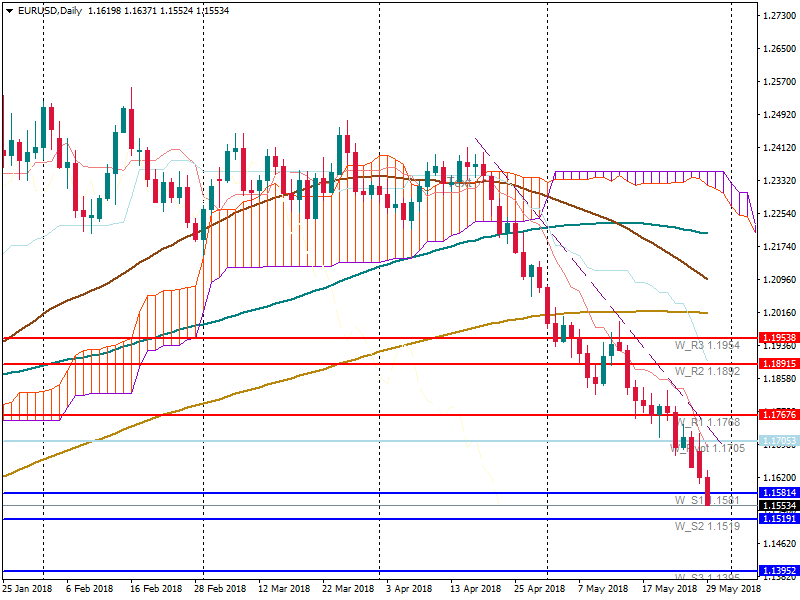

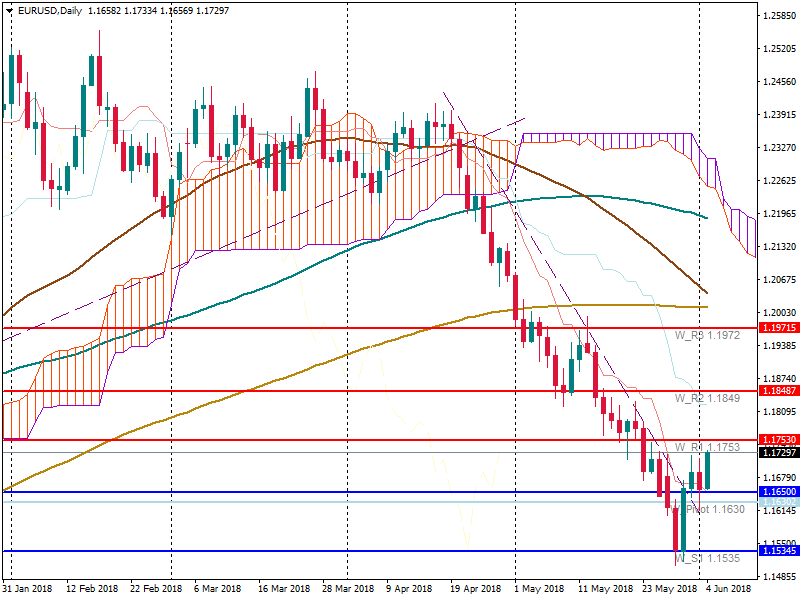

The euro managed to recover after a weekly drop. EUR/USD is moving to the pivot point at 1.1840.

No notable data will be released on Tuesday, however, a further decline of the US dollar will let the single currency to close above the pivot point. On Wednesday, a lot of significant data for the euro will be released. Forecasts are not encouraging, however, if the actual data are greater than the forecast ones, the euro will have chances to stick above 1.1840.

Tuesday is full of events for the pound. The next round of the Brexit talks starts today. Inflation Report Hearings will be released at 12:00 MT time. Whether events will be encouraging, the GBP/USD pair will be able to continue its bullish movement. Up to now, the pair managed to rebound from the support at 1.34 and is moving to the pivot point at 1.35. If Brexit deal meets a deadlock again, there are risks of the GBP’s return to 1.34.

Oil is at good levels amid tensions around Venezuela. The US imposed new sanctions on the country after a re-election victory of Venezuelan president Mr. Maduro. Penalties bar US companies or citizens from buying debt or accounts receivable from the Venezuelan government. Moreover, analysts forecast a further decline in American stockpiles.

Brent is near $80 again, WTI is above $72.70. For WTI it is the highest level since the end of November 2014. Brent has already tested levels above $80 but couldn’t stick there. Let’s see how strong the factors are for the further oil’s rise.

A significant rise of oil highly supports the Canadian dollar. On Monday, USD/CAD broke below two important levels: 1.2850 and 1.2825 (50-day MA). Tuesday is a good day for the loonie as well. The USD/CAD pair has broken the support at 1.2780. No important data are anticipated to be released during this week. The loonie can only rely on the weak greenback and strong oil. Otherwise, it will return to levels above 1.2780.

On Monday, USD/JPY tested the highest level since the end of January - 111.40. However, the pair didn’t gain a foothold and plunged. USD/JPY is near 61.8 Fibo level. If the pair breaks below this level, the further fall to 110.35 can be anticipated.

A forecast of Tom Lee, head of research and strategy at Fundstrat Global Advisors, failed. According to the analyst, Bitcoin was supposed to rise up to $15,000 after the conference Consensus 2018. The digital currency continues trading within $7,700-$8,700. Up to now, Bitcoin is trading around $8,200. The 50-day MA is putting pressure on the cryptocurrency. A significant trading is not anticipated; Bitcoin will continue to trade within the $7,700-$8,700 range.

That is all for today.

As a new user I can’t put all the pictures I wanted so I apologize for that.