WeeklyCryptoNews

22.06.2018

Just for fun!

John McAfee, founder of McAfee Inc.: "All ICOs are Securities! I will not now, nor will I ever, accept this as a reality. I am submitting, now, to this law, but I will fight with every last breath to ensure that this absurd overreach by the SEC will not stand!! It will not stand!”

Several days later…

“Due to SEC threats, I am no longer working with ICOs nor am I recommending them, and those doing ICOs can all look forward to arrest. It is unjust but it is reality. I am writing an article on an equivalent alternative to ICOs which the SEC cannot touch. Please have Patience.” What can we say? Mr. McAfee and show are synonyms.

Cryptocurrencies

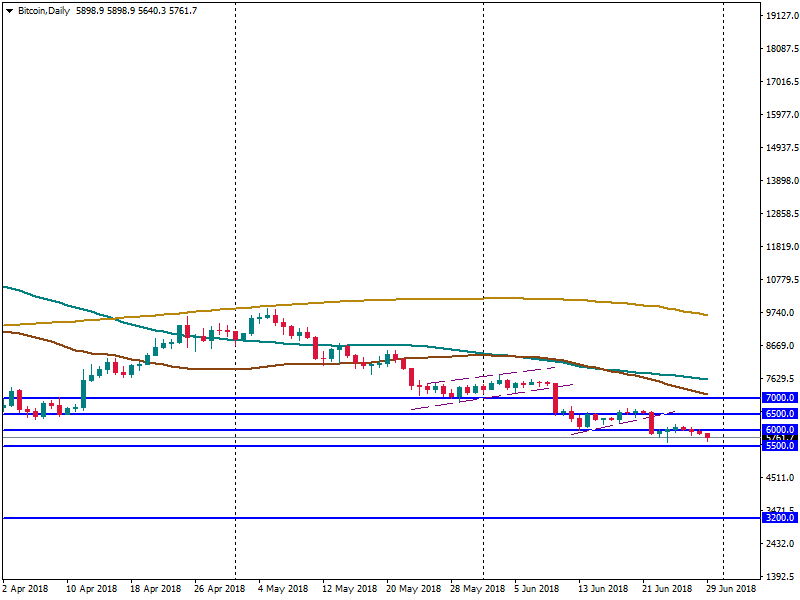

Bitcoin is lower and lower. The cryptocurrency couldn’t stick above the resistance at $6,500 and it plunged. Up to now, the digital currency is trading around $6,250. The support is still at $6,000.

On the daily chart, the “Flag” continuation pattern was formed. It signals the continuation of the bearish trend.

According to Tom Lee, a reason for the Bitcoin’s correction is Bitcoin Futures.

The Bank of Korea won’t launch its own cryptocurrency yet. According to the Bank, digital currencies are too risky and an implementation of such assets will cost a lot to the society and even can inflict moral damages. However, the Bank doesn’t refuse that it can launch it later. But it may happen only if the cryptocurrency will be carefully tested.

The Head of Circle Jeremy Allaire said that every fiat currency will have a cryptocurrency counterpart. He also announced a launch of USD Coin – a stable cryptocurrency that will be dollar-backed.

If you want to use cryptocurrencies, you should go to Australia. A pharmacy started accepting cryptocurrencies as a payment in one of the cities. Buyers can pay for medical supplies with Bitcoin, Litecoin, Dash, and Ethereum. It’s worth saying that you can use cryptocurrencies in different places in Australia. For example, citizens can buy Bitcoin and Ether in news stalls.

A cryptocurrency project Turcoin of an Istanbul company Hipper appeared to be a financial pyramid. One of the founders left the country with the money of investors. Sells of the altcoin started in October 2017. Founders of the token called the Turcoin a national cryptocurrency and had been organizing events for investors with celebrities and expensive presents. However, it appeared to be a scam.

A representative of Goldman Sachs said that the company is working on services to work with cryptocurrencies. The company is going to launch its own flexible version of futures, known as a non-deliverable forward. Moreover, the bank will implement futures, trading payments on which will be carried out in Bitcoin, and not in fiat currencies.

However, previously the СЕО Goldman Sachs Lloyd Blankfien announced that Bitcoin doesn’t deserve his attention and that he doesn’t use cryptocurrencies.

According to a research, Bitcoin mining consumes a half of electricity it is supposed to consume.

Cryptocurrency exchanges

Hackers attacked the cryptocurrency exchange Bithumb and stole 35 billion South Korean Won (about $31 million).

Blockchain

The Bank for International Settlements declared that if blockchain is used for daily payments, the Internet may stop working. The bank thinks that only supercomputers will be able to support retail transactions with the necessary power. It’s well-known that the Bank has a negative attitude to Bitcoin and blockchain. The General manager of the bank said that Bitcoin is a bubble, Ponzi scheme, and an ecological disaster.

The Department of Homeland Security (US) allocated the fourth grant to the blockchain startup Factom. The received financing in the amount of about $192K will be used to test a platform that is supposed to protect data received from security cameras and sensors of the US Border Service. Factom received the first grant from the US government in 2016.

Bitcoin $6,385 (-5.35%)

DASH $244.78 (-8%)

Ethereum $493.80 (-7.74%)

Litecoin $89.357 (-8.24%)