Market updates on September 19

19.09.2019

Key events ahead:

BOE monetary policy summary – 14:00 MT (11:00 GMT) time

US Philly Fed manufacturing index – 15:30 MT (12:30 GMT) time

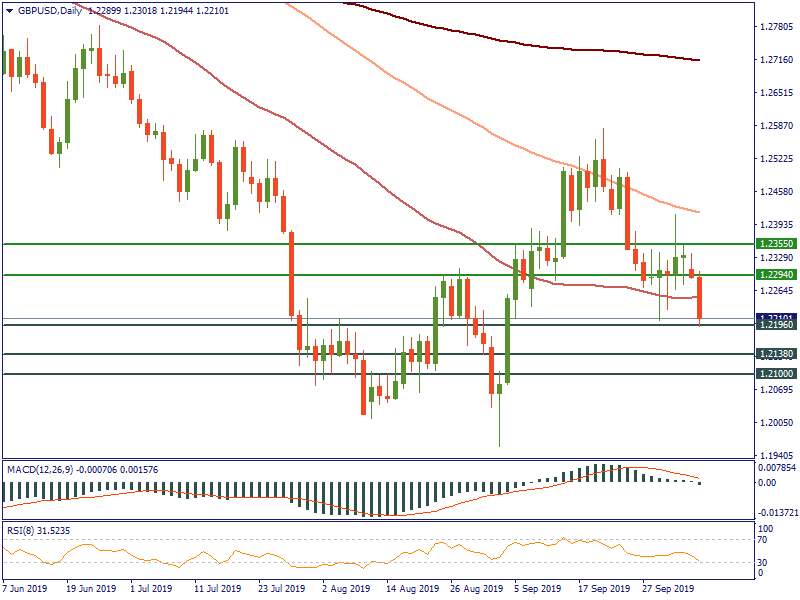

The European trading session will be highlighted by the events for the British pound. Traders will pay attention to the BOE meeting at 14:00 MT. This is the last interest rate decision by the bank before the current Brexit deadline set on October 31st. After the inflation rate fell yesterday to the lowest levels since the end of 2016 (below the BOE target rate of 2%), it would be interesting to hear the hints on the possible slash in the interest rates in the upcoming months.

At the moment, GBP/USD is trading within the triangle pattern on H4. If the GBP is supported, the pair will break the upper border at 1.2503. The next resistance levels will lie at 1.2517, 1.2537 and 1.2555. In case of the pound’s weakness, the cable will slide below the 1.2457 level (lower border of the triangle). If this level is broken, the further support levels will lie at 1.2438 and 1.2422. Strong bearish pressure will pull the pair even lower to the 1.2391 level.

On H4, EUR/USD has risen back from the lower border of the triangle and has tested its upper border near the 1.1067 level. If the USD is supported by the Philly Fed manufacturing index, the pair will fall to the 100-period SMA towards the support at 1.1035. After that, the next key level will lie at 1.1014. If the USD is weak, the break of the 1.1067 level will be inevitable. The next resistance levels will be placed at 1.1074 and 1.1087. (200-period SMA)

The Japanese yen strengthened during the Asian trading session. As a result, USD/JPY tested the 50-period SMA. However, the pair has inched higher towards the resistance at 108.24. Further resistance levels lie at 108.37, 108.47 and 108.63. Pay attention to them if the USD is supported. In case of risk-off sentiment, the pair will fall below the 107.91 level. Further support levels in focus will lie at 107.79 and 107.61.