April 13: starting the week

More at: https://bit.ly/2K0cTYf

13.04.2020

Last week’s trading was passing in hopes for the positive result of the OPEC+ negotiation. The result is there now, and we will quickly scan it for the possible outcomes in the next paragraph. Apart from that, the British Prime minister’s treatment in the ICU was another big factor pressing on the Forex market. Lastly, European infection dynamics and the economic response preparations were the third large element that shaped the trade. What happened to each “story” and what do we have to start with week with? We will see them one by one.

Oil: good, but not enough

Let’s not be pessimistic: the deal is there. 9.7mln barrels per day will be the total supply quantity cut starting from May 1. The market applauded not only to OPEC+ but to Donald Trump personally. A hater of the cartel just a while ago, he is the one who finally convinced Mexico, Russia, and Saudi Arabia to get the deal done. Or so it seems. Anyway, that’s another ace for him to claim in preparing for the November election campaign. How does the oil price look now?

Not really impressive. The hopes for a “definitive victory” which were pushing WTI above $25 are largely erased: strategically, it is now closer to $20 than anywhere else. Why? Mostly, because this 10% output cut comes too late and is too little. The global demand now is roughly 30% lower than the pre-virus level at which the market was stabilized. Cutting 10% leaves the remaining 20% “in the air”. In addition to that, the date which makes the OPEC+ agreement effective is May 1 – that is three weeks away. During that time, the market will be in the free-for-all state. Meaning, everyone pumps as much as they want. That’s why the almost 10mln-barrel-per-day cut appears more like a reality-forced recognition gesture rather than a proactive forward-looking market rectification step.

Boris Johnson: the winner is out

This was the Sunday news headline about Boris Johnson:

Source: Bloomberg

It’s hard to deny that such a dramatic comment makes the victory of the British Prime Minister over the virus even more shining, emblematic, and inspiring. At least, to his British fellow citizens. It should have supported the British pound as well. Has it?

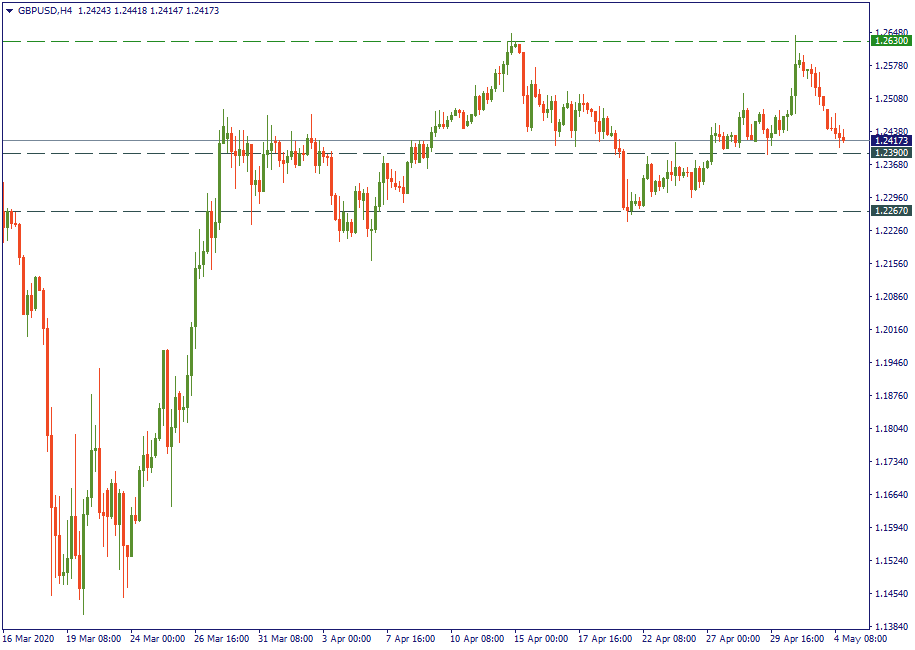

Indeed, the GBP rose to test 1.2540 against the USD. It broke the four-week resistance of 1.2450, converting it into the current support level, and left the Moving Averages below. Moving further upwards, however, will require something more fundamental rather than one famous individual’s (even if that’s a very important individual) victory over the disease. Does the UK economy have that? Time will show.

Europe: trench war

The infections picture in mainland Europe seems to be slowly improving. Spain, Italy, and France are reporting decreasing dynamics of the virus spread. The lockdowns are planned to stay in power for several weeks more, subject to authorities’ confirmation, to ensure that the virus spread is sealed. That pushes the biological threat to the second place and pulls the economic agenda into the front row of the agenda. Recently, a financial aid package was formed by the EU finance ministers, but the problem was for the country leaders to approve them. It remains a problem gives the political and economic discords between the states, and this week, we will say how this card is played. That should be the main reason why EUR/USD is now kept in a “waiting” mode.

Currently traded at 1.0932, it goes into consolidation between the resistance of 1.0970 and support of 1.0920. At the same time, the secondary layer of the movement channel is presented by the Moving Averages: 50-MA and 100-MA support the currency pair at around 1.0850, and 200-MA is capping the upside at 1.1030. Very likely, EUR/USD will be staying pretty silent until some decisive fundamental factor comes to the stage.