What moves the market on May 8?

08.05.2020

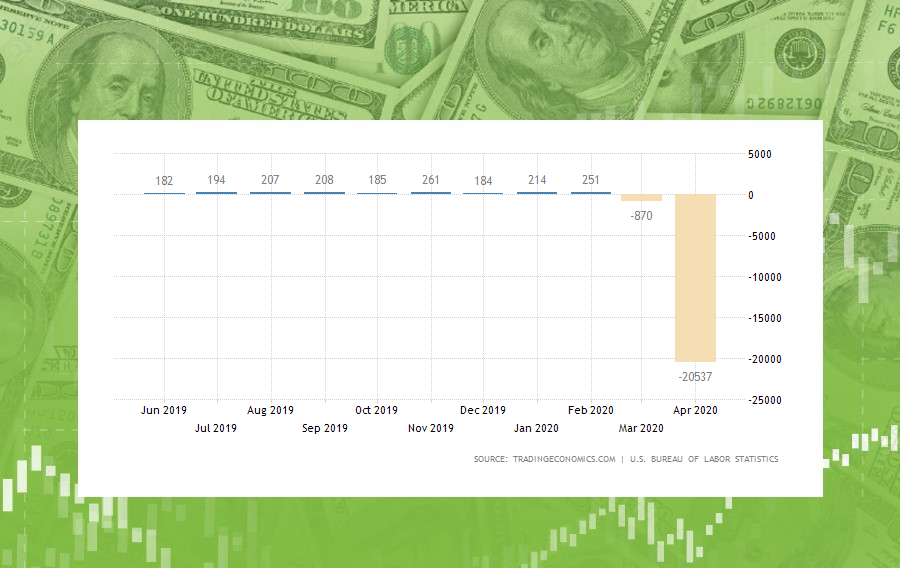

Yesterday we got a poor data from the USA. There were 3.2 million new jobless claims, less than on the prior week, but more than analysts anticipated. That means, in total, it’s already 33.5 million people lost their jobs during the coronavirus. That’s terrible.

So, today we are waiting for non-farm payrolls at 15.30 MT time. It’s expected the worst ever. That means, Japanese Yen and Swiss Franc can gain against the US dollar today. However, if numbers are in line with expectations –USD could rally. The best you can do is to sell ahead of the report and close before or wait for the numbers to be released, prices to stabilize and see what becomes the real move of the day.

Now EUR/USD gains ahead of critical Non-Farm Payrolls. It recovered from 1.0765 yesterday and rose above 1.0800. There are several resistance levels on the H4. The pair has to rise above 1.0885 to get a chance to rise to 1.0965. Support is at 1.0775.

And now, for the good news, countries made first steps to reopen their economies, based on that, risky assets will continue to recover. The Australian and New Zealand dollars went up because of the encouraging Australian and Chinese trade data.

The pound also climbed. The Bank of England left its bond purchase program and interest rates unchanged, but they are ready to ease further. GBP/USD needs to rise above 1.24 for bulls to regain power.

S&P 500 futures hit their session highs after reports that China and the US had a phone call on trade. The yuan moved up.

Elsewhere, oil is benefiting from the improvement in the risk appetite. Yesterday the were wild price swings as investors weighed supply-and-demand fundamentals against Saudi Arabia’s global price hike.