Today it turned out to be quite interesting to trade. I hope not only for me

Usually, the gold price is driven by political and economic uncertainty, like economic crises, election pressure, pandemic effects. But in the face of a year-and-a-half-lasting monetary stimulus program, the price of the haven asset acts differently. What drives gold price and how to trade it – in this article.

Latest news:

- Gold breaks beneath $1800 with $1700 as a reachable target.

- US 10-year Treasury yields rise, emphasizing the demand for the US dollar.

- Fed plans to start bond tapering this year.

- US inflation rate has already hit 5.4% in June and July 2021.

Retrospective gold movement analysis

Fundamental analysis of gold should start with an explanation of gold nature. In the past, there was the Gold Standard. It was a system under which nearly all countries fixed the value of their currencies in terms of a specified amount of gold or linked their currency to that of a country that did so. Also, the supply of gold hasn’t been increasing greatly with time. Thus, when the amount of money was increasing (inflation rises), to buy the same amount of gold we needed an increased amount of currency. Since the economic crises usually come with high inflation, gold has become the haven asset for every country.

But nothing lasts forever, and in August 1971, US President Nixon severed direct convertibility of US dollars into gold. From this very moment, gold has become a more independent asset, but the rules of the game didn’t change much. Demand for gold is still high due to several factors: gold is resistant to corrosion, easy to process, hard to imitate, and looks beautiful (the last factor is subjective).

From this point we have several considerations about gold price movements, let’s go through them:

- US treasury yield rises USD demand rises USD rises.

- When USD is rising, gold (XAU) is plunging (this has come from times of the Gold Standard and remained even after it).

- Gold supply isn’t increasing as fast as demand, thus, in the long-term gold will continue to rise.

What is affecting the price now?

Let’s go through several economic events and check whether they are affecting XAU price or not:

- March 31, 2021 : US ADP NFP data is worse than expected (517K vs. 552K; positive for gold, negative for currency). Gold has been skyrocketing for the next 6 hours and has gained 2%.

- June 16, 2021 : Federal funds rate remained at the same level (0.25%), which is positive for the currency. Also, there were intentions for rate hikes in the future. Gold has plunged 3% in 3 hours.

- August 6, 2021 : positive US NFP data (943K actual vs. 870K expected). Gold has “flash crashed” by 6.2% in less than half a day.

- August 12, 2021 : US PPI is higher than expected, which is positive for currency and negative for gold. XAU has fallen by 0.5% and surged 0.75% later that day.

- September 1, 2021 : OPEC+ reconsider oil output increase by 400 000 barrels per day. Negative ADP NFP data (330K actual vs. 695K expected). Gold price has remained the same.

- September 3, 2021 : US NFP three times worse than expected (235K vs. 720K). XAU has risen 1.15% in the next 3 hours, but in the next 3 days, gold had fallen more than 2%.

To sum up, this data, even if the events and the results are the same (March 31 and September 1), gold can act in a completely different manner. Besides that, we can expect gold to rise when any data is bad for USD and vice versa. This can be proven by looking at XAU/USD and US dollar index charts, or by looking at correlation charts.

What to expect from gold?

So far (September 13, 2021) the economic recovery is not as fast as everyone wants and while tapering has been postponed, again and again, the demand for the US dollar is present and gold is not in a good shape. You might think: “Wait, if the economy is in a bad shape, then it’s good for gold, isn’t it?” Yes, usually in times of uncertainty gold is showing better results than other assets, like stocks and currencies. But this doesn’t mean that gold doesn’t fall at all.

From the side of technical analysis, gold is looking bearish too.

XAU/USD weekly chart

Support: 1750.0; 1685.0

Resistance: 1840.0; 1900.0

Gold is a perfect instrument to keep your money safe because it tends to maintain its purchasing power and save you from the volatility of other assets, but as global markets tend to rise on a bigger time scale, gold won’t earn you a lot.

Reference: FBS (13.09.2021) Gold is acting randomly? FBS Analytic news

About Conflux

Conflux is an open blockchain network with an economic incentive-based governance mechanism designed to reward community members who contribute to ensuring a safe, stable, and predictable environment for economic activity. Conflux is focused on developing decentralized applications (dApps), creating smart contracts, and making simple payments. In simple words, Conflux is an exact copy of all known Ethereum, but more scalable and flexible.

Conflux history

Conflux is headquartered in Beijing, China. The Financial office was registered in Singapore in 2018.

Developers raised initial funds by selling the part of 1 billion CFX tokens issued on the Ethereum blockchain. After the launch of the main Conflux network, the developers generated 5 billion CFX tokens (most of them are still frozen) and launched the mechanism of additional emission of CFX coins (internal tokens of the Conflux network) available to earn by miners and stakers.

CFX is the main fuel of the Conflux platform and is used as a tool to interact with solutions in the Conflux Network ecosystem. Major CFX holders include venture giants such as Sequoia China, Huobi Group, Shunwei, and Rong 360.

Token holders receive a reward for their storage depending on the staking time.

Conflux features

The Conflux network has many advantages.

- The throughput is 4000 transactions per second (for comparison, Ethereum has 15).

- Proof of work algorithm, which means the cryptocurrency is available for mining on video cards.

- Unlike many other blockchains (for example, Bitcoin, Ethereum), in which blocks are generated sequentially, one after another, in the Conflux blockchain network, parallel construction of a blockchain and transactions is possible.

- Ethereum virtual machine support, so smart contracts can be ported from Ethereum to Conflux Network.

- Block generation time - 2 blocks per second (172, 800 blocks per day).

- Annual inflation is at 8.83%.

Conclusion

The main goal of the Conflux blockchain network is the development of digital technologies. Creators used Bitcoin and Ethereum’s developments as well as other innovative technologies to create a high-quality cryptosystem.

Despite this, Conflux is a young project, comparing with such giants as Litecoin, Bitcoin, Ripple, and Ethereum, which already recommended themselves as a reliable cryptosystem. That’s why we suppose the risk of trading CFX remains on a high level and suggest trading more sustainable coins such as XRP, ETH, BTC, and LTC.

Reference: FBS (14.09.2021) Conflux: Ambitious chinise project. FBA Analytic news.

USD/ZAR is mainly driven by the US dollar, that’s why the US economic data is highly impactful. The US has published strong retail sales for August. It pleasantly surprised investors as they were concerned that consumers would limit their purchases amid the spread of the Delta virus strain. However, retail sales posted a gain!

In comparison, South Africa’s July retail sales (the freshest data so far) revealed a significant -11.2% year-on-year, versus market expectations for -2.7%. Such a huge drop was caused by the jailing of former president Jacob Zuma, which lead to the escalation of civil unrest.

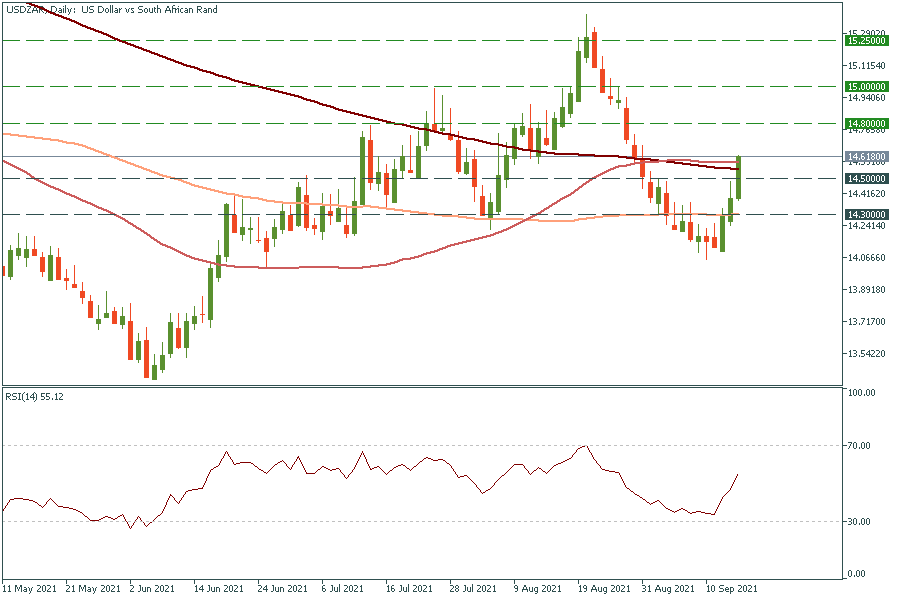

Technical outlook

USD/ZAR has been rising at a quite fast pace for the last three days. It has even broken through all three moving averages: 50-, 100-, and 200-day. The growth has been too quick though, we might expect a retracement (correction) to the support level of 14.50. However, the rally may continue till the price reaches the highs of early August at 14.80. The breakout above this resistance level will lead the pair to the psychological mark of 15.00.

Reference: FBSN (16.09.2021) Greatest sale of South African Rand. FBS Analytic news.

GBP/USD is moving inside the ascending channel. Since it’s in the lower part of this channel, the pair should reverse up and continue moving in zig-zag.

Short term

However, fundamental factors ruined that plans. The UK has published poor retail sales for August. Analysts forecasted the 0.5% growth, while the actual numbers showed a drop of 0.9%. Thus, the pair is moving back and forth near 1.3785 as technical and fundamental factors are opposite in the short term.

Long term

On Wednesday, the report revealed that the UK inflation reached a 9 year high in August, so the Bank of England can start taking actions earlier than the markets expect. The bank may start discussing the tightening: hint at hiking rates or cutting bond buys. If it happens, the GBP will surge.

Tech outlook

The long lower tails signal us that bears were trying to push the price lower, but by the end of the sessions more bulls appeared, and they pushed the price higher. In other words, lower prices were rejected, so the price moved up. That’s why the price is likely to go up in the next session as well.

Thus, we might assume if the pair manages to close above the 23.6% Fibonacci retracement level of 1.3810, it may jump to the next round number of 1.3825 near the 38.2% Fibo level. Support levels are the recent lows of 1.3780 and 1.3750.

Reference: FBS (17.09.2021) GBP/USD Is ready for reverse up. FBS analytic news.

What happened?

It’s unbelievable but China’s government prohibited all transactions with cryptocurrencies (yes, even Bitcoin) and promised to stop illegal crypto mining. While the rest of the world is taking steps to include crypto into the economy, China denies it.

What does China mean for crypto?

China is home to a huge part of the world’s crypto miners. As we know, mining requires a lot of energy resources and it prevents China from curbing greenhouse-gas emissions. Bloomberg says 46% of the global hash rate (computing power used in mining) occurred in China in April.

What will be the circumstances?

It is a negative factor for the whole crypto market in the short term. Today, BTC/USD has dropped by 3168 points in one day. The downtrend is likely to stay with us for longer. So good that FBS traders can open both buy and sell trades. Besides, it can be also a negative factor for chip producers such as Nvidia and AMD as demand for GPUs is going to drop in China and press the prices of GPUs down.

Tech outlook

Bitcoin has dropped to the support level of $41,000, which lies at the 50-day moving average and the 50% Fibonacci level. It makes this level a strong barrier, which the cryptocurrency will struggle to break on the first try. If it manages to cross, BTC/USD will plunge to the 61.8% Fibo level of $38,000. Resistance levels are $44,000 and $45,500 (the 200-day moving average).

Reference: FBS (24.09.2021) Crypto becomes illegal in China. FBS analytic news.

Like oil, natural gas is a product of decomposed organic matter, typically from ancient marine microorganisms, deposited over the past 550 million years. Often, gas and oil are neighbors, who are located deep under the ground. Because of that, their prices sometimes correlate. But for the last several weeks gas was skyrocketing at an enormous pace. It has gained more than 17% from August 18. What is the reason for such moves and how can we earn on global gas trading?

Latest news:

- Hurricane Ida shut down oil and gas production.

- OPEC+ meeting is expected to stall oil production increase.

- Natural gas prices have risen sharply over the past week, with futures hitting two-year highs due to rising inflation and continued production cuts.

What affects the gas price?

Assessment of the Natural Gas market should start with basic points. Usually, there are a set of reasons for the commodity price to change:

- The law of supply and demand regulates prices, as it does in nearly all commodities.

- As a longer-term general trend, the supply of high-quality oil and gas is fixed while global demand is increasing with a rising population and economic growth.

- There is a growing consensus that the world is facing a structural shift, driven by the energy transition and companies’ desire to reduce their carbon footprint.

Let’s go through every reason to create a natural gas price forecast. As for now, demand isn’t showing any signs of slowing down. Between 2009 and 2020, global gas consumption surged by 30% as utilities and industries took advantage of booming output. Even in the covid-19 environment, experts are expecting the demand to rise even more in the next 10 years.

As for ecological reasons, companies and countries are implementing gas in their electrical supplies. The shift to natural gas can be done relatively quickly and cheaply while having a significant impact on lowering emissions. Natural gas is the cleanest burning fossil fuel and emits almost 50% less CO2 than coal. Meanwhile, non-fossil-fuel alternatives such as wind and solar are at a relatively early stage to produce enough energy and offer a cheap deployment.

Gas’ bright future

Already, there are signs around the world that supplies will fall short:

- Beyond a massive expansion in Qatar, few new liquified natural gas (LNG) export projects have been started since 2020.

- Government is uncertain about emissions-reducing policies, thus, producers have been less willing to sign long-term supply deals.

- Key pipeline projects struggle to move forward, and drillers are under pressure from investors, that want to avoid a surplus of gas. Moreover, major producers of natural gas are having too much power in their hands. That gives them the opportunity to control prices remove weaker competitors.

Even if the prices will rise even higher over the next decade, it won’t be enough to drastically reduce demand for the fuel. All we can say for now is that gas is increasingly less dependent on oil prices and this trend is going to continue.

Technical analysis

As for the chart, US natural gas is several days away from volatility increase. For now, the price is consolidating in a triangle and the breakout will decide its fate. In case of further growth, it is highly likely for the RSI divergence to form. That would be a sign of a pullback.

XNG/USD H4 chart

Support: 5.60; 4.94; 4.20

Resistance: 6.30; 6.50; 7.00

To trade natural gas, we need a trading strategy. And to have one we need to better understand the asset. Here are some tips for traders that will surely help you.

- Look through [short-term energy outlook] articles on our site to be in touch with the latest trends.

- To calculate your risks, it’s wise to check

- Analyze related assets, like Brent and Crude oil. The price tends to correlate between them.

- Use technical analysis and define the support and resistance levels for the price.

If to perform trade analysis via technical indicators, the best for gas right now is RSI, because it can show you the divergences between the indicator and the price and spot possible reversal earlier, than others.

No growth is everlasting, and though the gas price has been skyrocketing for the last weeks, most of the time it lacks the volatility. So when this “Gas season” will be over, consider looking at the [cryptocurrency] because it’s much more volatile. Also, 24\7 crypto trading means that you don’t need to wait for the market opening, just open your FBS Trading Platform or Meta Trader and enjoy the possibilities of a [crypto trading account]

Now you know how to trade natural gas, so what are you waiting for?

Reference: FBS (05.10.2021) Gas lights up. FBS analytic news.

What affects oil price?

Oil is one of the most important assets, which presents the whole economic situation in the world. Just like the prices of most assets, oil price depends on the demand-to-supply ratio. During periods of economic growth, countries increase demand which leads to price gains. On the contrary, when the economy enters a regression phase demand drops and price follows it.

How to trade crude oil online?

There are two ways of trading crude oil online. You can trade contracts for difference (CFDs) or futures. While CFDs display the price in real-time, futures predict a future price change. Futures are the most volatile and risky instruments as they can be manipulated by traders with high capital. During March 2020 collapse Brent futures have been trading under the $0 level, while CDFs only reached $17. That is why we believe that trading contracts for difference is less risky.

You can trade oil and energies contracts for difference with FBS. Learn the contract’s specifications and pick the best option for your trading strategy!

When is the best time to trade oil?

Oil price is influenced by the Organization of the Petroleum Exporting Countries, that is why the meetings and statements of this organization make a huge impact on an oil price movement. Their statements raise oil price volatility, but moreover, they define the future trend. That is why the best option for trading oil is to wait until one of this OPEC’s meetings or statements and follow the trend.

Another highly important data, which usually influences the price, is the US crude oil inventories data as the United States is the largest exporter of crude oil. Bigger reserves mean that the oil consumption stays under pressure, which is the first sign of upcoming economic stagnation. On the other hand, lower-than-expected reserves data points traders to the fact that the consumption grew in the past and the necessary replenishment is needed. In this case, additional purchases will stimulate oil price increase.

OPEC+ said it had “reconfirmed the production adjustment plan”, which referred to its previously agreed decision to add 400,000 barrels per day to the market for November. The recovery in global oil demand from the coronavirus pandemic has been quicker than many expected, while global supply has been disrupted by hurricane outages and low investment. As long as these two factors remain unchanged oil will gain constantly.

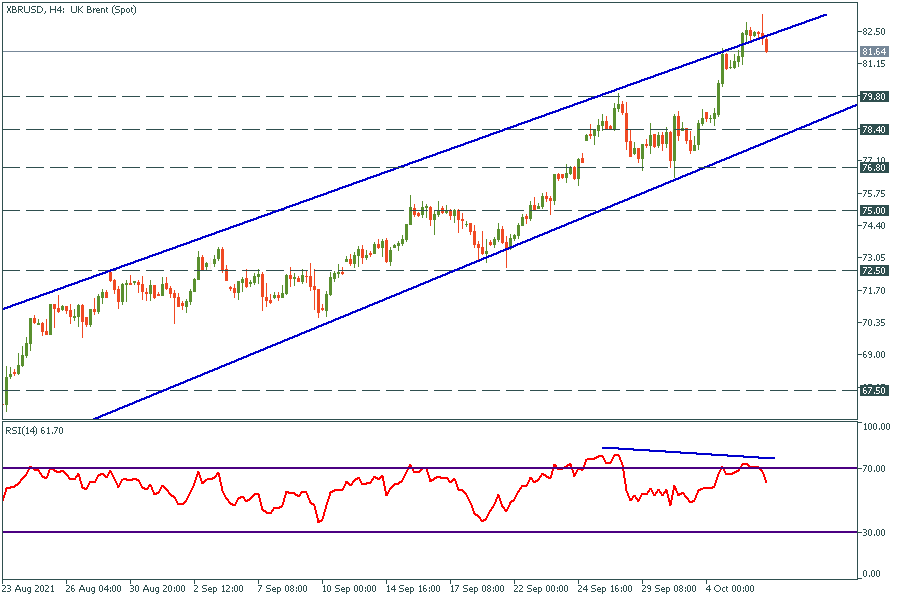

Brent’s price is moving in the rising channel. The bearish divergence occurred on the RSI chart, that is why expect a tiny correction to the $79.8 support level. After that, the price might reverse and head towards $86.3, where the 2018 high locates. To break this level buyers need to get some strong news, which will act as a buy signal. Without them, the price will get rejected from the $86.3 level and solid correction will happen.

Reference: FBS (06.10.2021) How to trade oil. FBS analytic news.

What is happening?

Just look at the charts above – the Canadian dollar has skyrocketed! Such strong growth has been caused by several reasons.

First, oil prices have gained from the global energy crunch. Crude oil has hit the highest level since 2014 as the demand is growing ahead of winter, while OPEC+ doesn’t rush to increase output significantly. Canada is one of the world’s largest oil producers and its currency has historically positively correlated with oil prices.

Second, Canadian employment figures came out better than analysts forecasted on Friday. It can signal another taper from the Bank of Canada later this month, which may push the CAD up. Just to remind you, the BOC was the first bank that tightened the policy after the Covid-19 crisis. Thus, it’s quite reasonable for the bank to continue tapering after a strong job report. Meanwhile, the US has revealed the worse-than-expected NFP numbers. Canadian Dollar strength and US Dollar weakness pressed USD/CAD to its lowest level since July.

Tech outlook

USD/CAD has broken through all the moving averages and the support line while moving down. It has stopped ahead of the support level of 1.2445 – the July lows which the pair has failed to cross and reversed up. Let’s wait for a breakout. If it occurs, the pair is likely to drop to the psychological level of 1.2400. However, before the breakout happens, we might see a pullback to the 200-day moving average of 1.2500.

Reference: FBS (11.10.2021) All is good for canadian Dollar. FBS analytic news.

Over the last 18 months, governments have printed an unbelievably large amount of money. And while these measures help the economy to rise and thrive, the consequences can be severe for everyone. Let’s discuss, what role do banks have in all this and how can we forecast their future actions and stock price’s prospects.

Banks during the Covid-19

As one of the crucial members of society, financial institutions have several main functions to maintain the economy in a good state. During the pandemic, banks have been active on a number of fronts. Among them are:

- Providing cash flow support. Governments implementing lockdowns mean businesses and individuals are being starved of income. Expenses, however, still have to be met. Since the biggest cash outflow for individuals or small and medium-sized enterprises (SMEs) tends to be for a mortgage or some other loan, banks have announced moratoriums on interest and principal payments until the year-end. This is affecting the overall banks’ income badly, but government helps banks by printing more money.

- Change of lending rules. In 2019 interest rates on bank credit to the private sector in the US was 5.5%. Now it is around 3.25%. The Government has stepped in to cover risk up to 80% of some SME loans. This improves a bank’s ability to give a loan to the borrower.

- Helping customers do their banking digitally. With employees working from home, it makes no sense to still have to go to the branch to carry out banking transactions. Also, it is a safety issue.

In a nutshell: banks were trying to help SMEs amidst lockdowns and sharp reduction of economic activity. Their goal is to maintain as many payrolls as possible and keep the unemployment rate under control. That’s why we are watching after NFP data closely, it reflects broad market conditions.

The post-pandemic era

Banks’ stocks have risen for the last year and a half because of:

- Government, that printed trillions of dollars and stimulated the economy.

- Banks’ investment activity. The stock market soared, alongside banks’ profit.

- The rapid growth of the deposits in the banks. Only in Bank of America the overall amount of deposits have increased by 20% for the last year and has almost reached $1 trillion.

Moreover, there are prospects for banks to gain even more. Accelerating economic recovery contributes people to borrow more money, though, not as much as expected. As the result, banks gain the potential to increase their buyback programs. Morgan Stanley and Wells Fargo were among the banks that said in June they would increase dividends and buy back more of their stock. Collectively, JPMorgan, Bank of America, Wells Fargo, and Morgan Stanley have announced they’ll repurchase $85 billion in shares.

It would be weird not to mention the consequences of rate hikes. As the banks now have enormous sums of money in loans, and floating rates are used widely, raising the federal funds rate by 1% will result in billions of dollars profit in a matter of a year. And we know that rate hikes are just a matter of time.

What now?

The nation’s biggest banks are about to report profits, and for behemoths including JPMorgan Chase and Goldman Sachs they are expected to fall when the banks report third-quarter results this week. As we can see, rapid growth in S&P 500 earnings will decrease over time as tapering comes into full strength.

This week, 6 biggest banks will release their quarterly earnings report, including:

- JPMorgan Chase (Oct 13), expected to lose 3.7% revenue growth,

- Bank of America(Oct 14) expected to lose 0.2% revenue growth,

- Citigroup(Oct 14), expected to lose 15.5% revenue growth

- Morgan Stanley(Oct 14), expected revenue growth at around 11.8%

- Wells Fargo(Oct 14), expected to lose 9.0% revenue growth

- Goldman Sachs (Oct 15), expected to lose 8.8% revenue growth

Notice, that you can trade these banks’ stocks with FBS!

It’s understandable for banks to lose the pace of growth. Previous reports were positive due to stimulus, but the time of trillion-dollar money printed out of thin air is gone. Current supportive measures just aren’t strong enough to increase banks’ revenues compared to last quarter. What is in our sphere of interest, though, is Morgan Stanley, which is expected to increase revenue. We suppose the following reasons:

- The growth was complemented by a rise in wealth management revenues. Notably, the wealth management total client assets received a big boost from the acquisition of E*TRADE in the last quarter of 2020 and may continue now in the light of unending growth in broker companies’ clients.

- Asset management and related fees increased because of the Eaton Vance acquisition and higher AUM (Assets under management).

If to say for the whole financial industry, the end of the pandemic will keep the Covid-19 legacy. We are talking about the transition to online banking and the increase in the number of retail investors and traders, who are trying to deal with the market by themselves. This, in turn, will help the banks to refrain even against tapering and rates hikes.

Morgan Stanley daily chart

Resistance: 106.0; 109.0; 125.0

Support: 96.5; 91.0; 87.5

At the end of the day, banks anticipate rate hikes, so future tapering doesn’t seem to be so crucial for them. For now, expectations from the reports are mostly negative (Morgan Stanley is a reasonable exception) due to stimulus reduction. What’s more important is the bank’s forecasts of their future revenues. We will hear from them shortly. As for now, it is a perfect opportunity to consider increasing the bank’s share in your investment portfolio.

Reference: FBS (12.10.2021) It’s all about those banks. FBS analytic news.

The stocks of the vaccine producers have gained a lot during 2021 due to the wide vaccination campaign around the world. Still, the Covid-19 pandemic is still not over as the virus is mutating and the scientists need to create new and new vaccines. What does it mean for traders? A great opportunity to invest in pharma stocks especially the ones engaged in the production of vaccines.

Moderna

Moderna has joined the S&P 500 index this year. It skyrocketed to almost $500 – the all-time high on this news, but then dropped back to $300 amid the broad market correction. Moderna has recently submitted its COVID-19 booster shots for adults to the FDA. If officials approve it, the stock price of Moderna will rocket! The first resistance level lies at the round number of $350.00. If the stock manages to cross it, the stock may jump above the 50-day moving average at $400.00. Support levels are $295.00 and $250.00.

AstraZeneca

Many hedge funds have added AstraZeneca into their portfolios. Among them are Fisher Asset Management, GQG Partners, and other heavyweights. Apart from producing vaccines against Covid-19, the company produces other medicines and also working on an advanced breast cancer treatment. The key level of $8750 acts now as support, while it was acting like resistance during August. Thus, we might expect the price to retrace to this level and then reverse up to $9000. When AstraZeneca breaks above this level, it will rally up to $9250

Johnson & Johnson

JNJ sells pharmaceuticals, consumer health products, and many well-known consumer goods (Johnson’s Baby products, Acuvue contact lenses, etc). Apart from that, it’s a vaccine maker and quite a successful one! The FDA claimed that the second dose of the JNJ Covid -19 vaccine is effective two months after the first. As a result, the JNJ stock skyrocketed.

The stock of JNJ has failed to cross the psychological level of $160.00. If it manages to break it and the high of October 7 at $162.00, we might expect the downtrend to change to an uptrend. So far, the stock price is moving in the descending channel. Still, if we look at the weekly or monthly chart, we’ll see that it’s just a correction in the long-term uptrend. Thus, wait for the confirmation of the change of a trend.

Reference: FBS (15.10.2021) Top Pharma stocks to buy now

Netflix

Netflix published better-than-expected earnings results for the third quarter and also surprised investors with the huge subscriber growth due to the popular “Squid Game”. Netflix added 4.38 million subscribers, while Wall Street analysts forecasted 3.86 million. Wow! However, the market reaction was mixed. Yesterday’s session finished in a goalless draw: nor bears neither bulls took control. The candlestick closed with no shadow, which means the opening and closing prices were equal.

Why did Netflix drop on good results?

In short, ‘buy the rumor – sell the fact’. All investors knew that the “Squid Game” has astonishing popularity, that’s why they were expecting good results from the company and priced in the good outcome well ahead of the release. When the actual number was known, the stock fell.

On the daily chart, we can notice the bearish divergence, which means the stock price can fall in the short term. It may correct down to the 50-period moving average of $610, which should support the stock from falling further (it has done that several times before). Still, the long-term trend remains bullish.

Tesla

Tesla has reported better-than-expected earnings results for the third quarter. EPS: $1.86 vs the forecast of $1.52. Notably, the report marked the 9th quarter of profit in a row. Earlier, Tesla announced it delivered 241,300 electric vehicles globally in the third quarter, which was Tesla’s record number for quarterly deliveries.

The Tesla stock tends to rally (look at the long green candles at the chart below) ahead of the earnings releases but then drops when the actual numbers are known. Thus, today, the stock can fall in the short term. However, it is going to gain from such good results in the long term as it showed investors that it is doing its business great.

Tesla was rallying so rapidly as it even broke the upper line of the channel. Now it’s just below the resistance level of $880.00. If it manages to break it, it can rocket to the psychological mark of $900.00.

JNJ

The pharma giant Johnson & Johnson published earnings that beat analyst expectations, sending its price soaring (look at the long green candle in the chart). The Covid-19 remains the main threat, that’s why JNJ is likely to gain in the 4th quarter due to its vaccine. Besides, the Food and Drug Administration authorized Covid-19 vaccine booster shots made by Johnson & Johnson, which is really great for Johnson & Johnson.

The stock price of JNJ has failed to cross the resistance zone of $165.00-166.00 (the 200-day MA and the 38.2% Fibo level). If it manages to cross it, the way up to the 50- and 100-day MAs at $168.00 will be open. Support levels are $163.00 (the 23.6% Fibo level) and $160.00.

Reference: FBS (21.10.2021) Earning overview. Tesla, Netflix, IBMS. JNJ.

What will happen?

Brent’s price fell after a less than expected oil crude inventories report. Usually, the less expected report pushes the price higher, but this time everything went the opposite way.

It might be the signal of investors’ growing concerns about the OPEC+ upcoming conference, where oil global supply might be increased. Earlier, the CEO of Saudi Aramco called for a supply increase, since global oil inventories decrease too fast. From his point of view, if OPEC+ will not change its policy, it might lead to the continuation of the global energy crisis. In this case, XBR/USD will explode and reach $100 shortly.

}On the 4H chart, Brent fell under the 100-period moving average. At the moment it is consolidating between $81.7 and $83.3. Locally, it looks oversold according to the RSI, that’s why we can see a pullback up to $84.2 first. The main resistance will be the 50-period moving average, which has been holding the price since the middle of September 2021. If XBR/USD breaks through this resistance, it might rise as high as $85,6 again. Otherwise, if it gets rejected, it will be another proof of a downtrend beginning. The main targets for the down movement are $81.7 and $79.5.

the situation which happens in 2018 repeats. The price drew 3 highs with the RSI divergence just as it did in the previous time. Later, after that pattern appeared, the price has been falling for 7 weeks straight. OPEC+ conference on August 4 will answer the question: “can technical analysis predict the future?”

Reference: FBS (28.10.2021) Brent: OPEC+ Might Intervene. FBS Analitycs

Predicting oil prices is a difficult job at the best of times. Still, it is increasingly difficult as COVID-19 and its variants continue to suspend consumers’ plans and disrupt the balance between oil demand and supply. In addition, governments are also working to dismantle the current global energy system and shift to clean energy. All this puts oil prices and energy companies under the fog of uncertainty.

We expect crude oil prices to decline in the coming months, as it appears that supply will outpace demand, and we will find a surplus that turns things upside down. However, this does not mean that oil will not continue the rally that began late last year in 2022.

The potential failure to revive the Iran nuclear deal, the expected return of higher oil demand during the summer season, and the inability of OPEC+ to commit to pumping the agreed on amounts of supplies due to slowing production may push oil prices up.

Prices will begin to rebalance in the first quarter of 2022. According to Energy Information Agency (EIA), the average price of Brent crude will average $70 a barrel during 2022 , according to Energy Information Agency (EIA).

Oil price, supply, and demand forecasts

The International Energy Agency (IEA) has forecasted that the global oil supply will exceed demand this year.

Global oil supply is expected to increase by 6.4 million barrels per day in 2022, compared to 1.5 million barrels per day in 2021. According to IEA, global demand will expand by 3.3 million barrels per day in 2022, compared to 5.4 million barrels per day in 2021.

According to the agency’s report, the first quarter of 2022 could see a surplus of 1.7 million barrels per day and grow to 2 million barrels per day in the second quarter of 2022.

This surplus may push oil prices to calm down a bit and return to levels of $70 a barrel during this period.

Will oil return to $60 a barrel?

Oil prices may be at risk of dropping to $60 during the coming months due to the slowing demand associated with Omicron, and its effects on economies, production, aviation, and travel. This will happen if:

- OPEC+ meets its collective production obligations.

- The United States takes back its role as an influential producer, and the US shale oil comes back strongly to the field.

- A breakthrough occurs in the Iranian nuclear deal with Western forces, and Iranian oil returns to the market in 2022.

The oil price may collapse to $60 a barrel. However, it will be an excellent opportunity to buy because the long-term trend will be bullish.

Is it possible for oil to jump to $100 a barrel in 2022?

As global economies reopen from the pandemic, oil demand may exceed global supply. However, forecasts of an oversupply in the first quarter of 2022 will disappear for good, as OPEC and its non-OPEC allies led by Russia can still not deliver the planned 400,000 BPD increase each month.

Excess supply will turn into tight supply , as demand for oil fuel increases as economies recover, and the driving season begins during the summer. This may push prices to $85-$90 a barrel during 2022. In addition, OPEC+ is expected to maintain a tight grip on production, which is an excellent recipe for pushing prices higher.

The absence of Iranian oil in the market, as we wait for the possible failure of the Iran nuclear deal talks, may open the door for oil to break $100 a barrel , especially if inflation and rising production costs reach the oil services sector.

In the end, to sum it up, we expect oil to continue its rally, but it will calm down a bit, and prices will range between $73-$85 during the year. According to the circumstances, oil should witness some volatility between ups and downs.

Last week was shocking!

The US dollar gained more than 2.5% against other currencies ahead of the NFP statement on Friday. As a result, EURUSD plunged to the 20-year low at 1.0100. The US stock market keeps retesting the global ascending channel from below. As a result, US500 and US100 are still trading below the 50-day moving average. The oil market lost around 10%. XBRUSD dropped to $98.00 support and bounced back to $102.00 by the end of the week.

Trade ideas

Forex

The head of the Bank of England, Bailey, will give his speech about the monetary policy on Tuesday, July 12. GBPUSD is trading around a historic low of 1.1920. If Mr. Bailey gives any hawkish hints regarding the monetary policy, the pair might return above 1.2200. However, we believe that the US dollar strengthening will press the pair to 1.1680 first.

On Wednesday, July 13, investors and traders will be looking at the US CPI data, the main driver of the markets in 2022. The inflation in the United States positively correlates with the oil market, which has been cooling down since June. However, if the inflation is higher than expected, EURUSD will go to 0.9600.

Also, on Wednesday, the Bank of Canada will make its monetary policy report. The markets expect to see a 50-basis-points rate hike. That might pressure the USDCAD currency pair trading under the global resistance line. We expect the pair to head towards 1.2650 support after in the middle term.

Stocks

The US stock market made a solid bounce. However, US500 is still trading under 4000, meaning the downtrend isn’t over yet. The traders should observe this level and open buy trades in case of the breakout. Otherwise, US500 might keep going down with the target at 3500. For US100, the critical resistance is 12 700, and the primary support remains at 11 000.

HK50 broke out of the ascending channel. When the price breaks below the 100-day moving average, it will head to the 20 000 support.

Oil, gas & metals

XBRUSD was trading at around 100.00 by the end of the last week. The price is heading to the 200-day moving average at 96.00. At the same time, XTIUSD is heading towards the support level at 92.50, which also matches the 200-day moving average. Traders might look for buy trades around these support levels.

XAUUSD dropped hard. The price is heading towards the 1690 global support, and it seems like buyers won’t enter the game until then.

[Removed for Forums Policy Violation]