EV’s market is going to explode in the 2020s

By the end of 2020, there were 10 million electric cars registered in the world. The number of electric cars registrations increased by 41% in 2020. Electric bus and truck registrations reached global levels of 600,000 and 31,000, respectively.

Three factors supported EV markets during the pandemic:

-

A legislative framework. Many countries accepted regulatory laws about the amount of CO2 emission and zero-emission vehicles.

-

Government protection of EV market additional intensives. Many European countries kept electric purchases stimulation and China continues its subsidy campaign.

- Battery cost decrease.

Vehicle manufacturers stay optimistic about the electrification of the car industry. 18 out of 20 announced plans for new electric vehicles models. The availability of heavy electric models is also going to grow together with the four main manufacturers pointing towards the electric future of this segment.

Despite the great support from the government’s campaigns for the EV markets during the pandemic, the amount of stimulus governments spend to support this sector decreases year-to-year. This fact points to the increasing consumer demand: producers are now able to survive on their own.

The near-term perspectives are looking great as, during the Q1 of 2021, global electric car sales grew by 140% compared with the same period of 2020.

In the most common scenario, analysts predict global EV markets to reach 145 million models by 2030, which will be 7% of the road vehicle fleet. However, if governments activate their plans to achieve global ecological plans the global EV market might grow up to 230 million units (12% of the road vehicle fleet).

Despite the success of the EV market during the last years, the ecological problem is still far from being solved. Although new technologies in battery and mass manufacture will reduce the costs of EVs, governments will have to cooperate to reach the climate goal by creating and promoting zero-emission EVs.

Global EVs programs

Electric Vehicles Initiative

In 2010 the Electric vehicles Initiative (EVI) was established under the Clean Energy Ministerial (CEM). The main goal of this forum is to understand the main political problems connected with electric mobility and accelerating the adoption of EV’s worldwide. At 2020-2021 15 countries are taking an active part in this organization, these are Canada, Chile, China, Finland, France, Germany, India, Japan, Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, and United Kingdom.

EV30@30 Campaign

In 2017 the EV30@30 Campaign was launched. The main goal of this campaign is to accelerate EVs deployment all over the world and reach the number of 30% EVs sales in each country member. By 2021 besides 14 countries this campaign is supported by 30 organizations including C40; FIA Foundation; Global Fuel Economy Initiative; Hewlett Foundation; Natural Resources Defence Council; REN21; SLoCaT; The Climate Group; UN Environment Programme; UN-Habitat; World Resources Institute; ZEV Alliance; ChargePoint; Energias de Portugal; Enel X; E.ON; Fortum; Iberdrola; Renault-Nissan-Mitsubishi Alliance; Schneider Electric; TEPCO; Vattenfall and ChargeUp Europe.

Trends in EVs markets

Europe

In 2020, the overall European car market fell by 22%. However, the amount of EVs doubled to 1.4 million overall. Germany registered 395,000 new EVs, France reached the level of 185,000 new units. The UK doubled the number of EVs and reached the level of 176,000 EVs over the country.

China

The overall number of new car registration dropped by 9% during 2020 in China. However, EVs sales grew up to 5.7% comparing with 4.8% in 2019. Subsidies aimed at EV market growth were due to expire by the end of 2020, but the government decided to cut them by 10% and extend them till 2022.

The United States

The overall US car market dropped by 23% in 2020, but the electric one felt stronger. In 2020, 295,000 new EVs were registered. Government stimulus decreased in 2020, as the federal tax credits for Tesla and General Motors reached the limit.

Consumer spending vs government spending

Governments across the world spent USD 14 billion on EVs market stimulus during 2020. This is 25% higher than in the previous year, but the overall tendency declines as the total amount of spending dropped by 10% from 2015.

Consumers, on the contrary, spent USD 14 billion, which is 50% more than they did in 2019. These facts describe the global tendency of rising interest from consumers and a great potential for the EVs market in the future.

Tesla, GM, Ford stocks analyses

Tesla

Tesla became profitable in 2020, for the first time since it was founded. Earnings are forecast to grow by 32% per year. Short and long-term liabilities can be covered by short-term assets. Fundamentally Tesla seems to be a strong company, but the giant P/E ratio makes investors feel scared about the future of the stock price. On the daily chart, the descending triangle has occurred. Moreover, the price “retested” this triangle from the top twice, which means the pattern is strong enough. The closest resistance is $700, which is a strong psychological level. If the price breaks this level, it will fly up to $770 shortly.

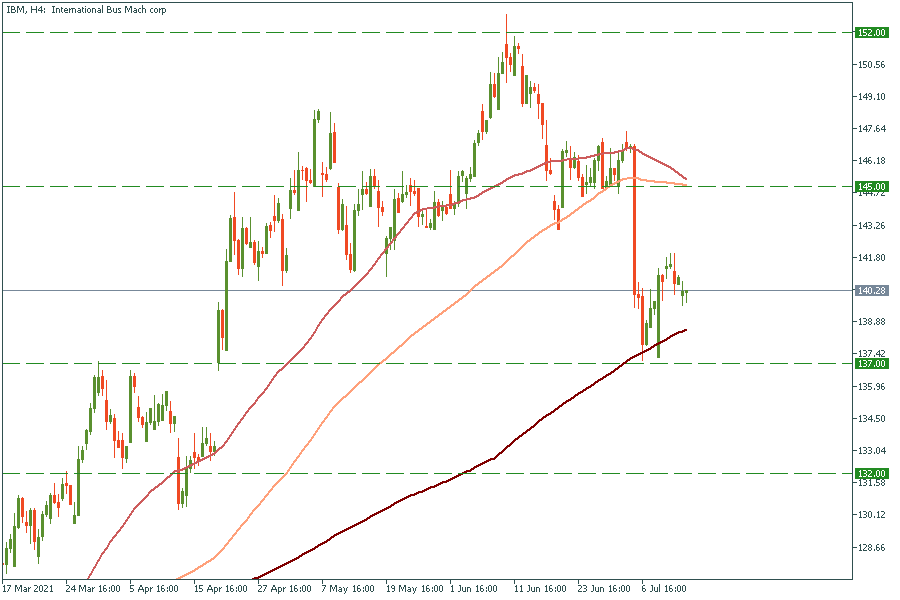

GM

General Motors’s earnings grew by 90,6% over the past year. Moreover, earnings are expected to grow by 8.15% per year in the future. GM’s current net profit margins (7.3%) are higher than last year (3.5%).

It looks like GM stock price follows the S&P500 movement since the market crash in March 2020. After the price dropped on Monday, July 19, it shows decent growth. If it breaks the resistance at $58, which is the cross point of 50 and 100-day moving averages, it will have a chance to renew the historical maximum, overwise, it will go down at least to the 200-day moving average at the price range between $51 and $52.

Ford

Company’s earnings are expected to grow 17.3% yearly. Ford stock looks to be undervalued based on the predictions of future cash flows. It has a good PE ratio (13.9x) compared to the US Auto industry average (23.9x), which makes Ford an attractive company for investors.

As well as GM’s, Ford’s price will try to break through the 50-day moving average. In the positive scenario, the price will have a chance to fly up to $16 resistance. On the flip side, it will try to break the 100-day moving average again and go down to the $11.5 price level if it does.

Reference: Electric vehicles: infinite potential. FBS nalytic news