At the moment, please be noted that market have a good potential to perform another bullish rally either to complete major wave 5 in yellow or aqua. Otherwise, I believed market in progress to perform a bearish reversal trend to complete corrective wave a,b and c in white. Good luck.

Favourably, I am expecting market to perform another bearish continuation trend scenario either to complete wave 4 in yellow or corrective wave c in white. Otherwise, we may see market bounce back to perform major wave 5 in aqua. Good luck.

At the moment, I am looking toward a potential of another bullish continuation trend scenario in yellow. A Bear Trap pattern would bolster to this scenario. Otherwise, we may see another bearish continuation trend scenario in white. Good luck.

Very useful analysis, thank you.

You are most welcome. Good luck in your trade.

Preferably, I believed market in progress to perform major wave 5 either in yellow or aqua. Please be extra careful that market also have a potential to complete a corrective wave b in white either at (FR61.8%) or a double top pattern. Good luck and happy weekend.

Gbp vs Jpy (1H)

At the moment, market either in progress to complete subwave 3 @ iii either refering to the alt count in yellow or aqua. Therefore, I am execting toward a bullish retracement trend scenario either to perform subwave 4 @ iv in yellow or aqua later. Otherwise, we may see an extension of subwave 3 in white.

Gbp vs Jpy (Daily)

Preferably, I believed market either in progress to complete subwave 4 in aqua or corrective wave a in yellow. Otherwise, we may see another strong bearish rally to complete corrective wave a in white. Happy New Year and good luck.

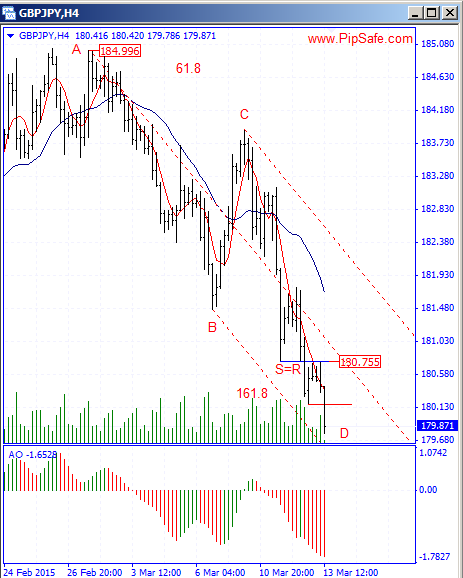

Technical analysis of GBP/JPY dated 13.03.2015

GBP/JPY with formation of the top price of 184.996 has started to descend and Sellers were successful in achieving the lower price of 180.185.Currently price in weekly , daily and H4 time frames is under 5-day moving average that shows a consistent descending trend with the potential of more downfalls in long period of time.

Price is going toward the support level of 180.000 (the important psychic level of Sellers) and there is not any clear reason of buy signal in long term time frames such as weekly and daily.As it is obvious in the picture below, according to the formed movements in H4 time frame, there is AB=CD harmonic pattern that the D (formation of a bottom price) point of this pattern is the first warning for a price Increase.

Hello,

If GBPJPY fails to clear 140 level on a daily close, I see more pain on the downside towards 120 level…the Brexit hasn’t yet hit the GBP hard enough and we may be seeing a ‘dead-cat bounce’. Lack of strategy to deal with brexit and unknown nature of how harsh EU will treat GB post exit will make lot of folks nervous around GBP in the coming months.

At the same time, we are in the initial phase of a once in a lifetime opportunity to make money on the long side of GBP, but IMHO that time is at least 12-18m away…

martha, dad cats dont bounce, but I am long GBP/JPY again

and more importantly the banks are buying

GBPJPY Elliott Wave Analysis: Extension Lower

Short term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has scope to retest 4/16 low (135.58). Support can be seen at 135.7 – 137.3 area for at least 3 waves bounce.

Subdivision of Minor wave Y is proposed to be unfolding as a triple three Elliott Wave structure. Down from 6/1 peak (143.96), Minute wave ((w)) ended at 140.68, Minute wave ((x)) ended at 142.77, Minute wave ((y)) ended at 139.52 and Minute second wave ((x)) ended at 141.11. Near term, while Minutte wave (x) bounce stays below 141.11, and more importantly below 143.95, expect pair to extend lower. We don’t like buying the proposed bounce.

GBPJPY 1 Hour Elliott Wave Chart 06/13/2017

GBPJPY Elliott Wave Analysis: Bearish Below 143.9

Short term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has scope to retest 4/16 low (135.58). Support can be seen at 135.7 – 137.3 area for at least 3 waves bounce.

Subdivision of Minor wave Y is proposed to be unfolding as a triple three Elliott Wave structure. Down from 6/1 peak (143.96), Minute wave ((w)) ended at 140.68, Minute wave ((x)) ended at 142.77, Minute wave ((y)) ended at 139.52 and Minute second wave ((x)) is in progress as a flat and expected to complete at 140.2 – 14.1.2 area. While near term bounce stays below 142.75, and more importantly below 143.95, expect pair to extend lower. We don’t like buying the pair.

GBPJPY 1 Hour Elliott Wave Chart 06/14/2017

GBPJPY Elliott Wave Analysis: Resuming Lower

Short term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has scope to retest 4/16 low (135.58). Support can be seen at 135.7 – 137.3 area for at least 3 waves bounce.

Subdivision of Minor wave Y is proposed to be unfolding as a triple three Elliott Wave structure. Down from 6/1 peak (143.96), Minute wave ((w)) ended at 140.68, Minute wave ((x)) ended at 142.77, Minute wave ((y)) ended at 139.52 and Minute second wave ((x)) is proposed complete at 140.9. While near term bounce stays below 142.75, and more importantly below 143.95, expect pair to extend lower. We don’t like buying the pair.

GBPJPY 1 Hour Elliott Wave Chart 06/15/2017

GBPJPY Elliott Wave View: Ending correction

GBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.27 ended Minor wave W. Minor wave X bounce is currently unfolding as a double three Elliott Wave Structure. Minute wave ((w)) of X ended at 141.47, Minute wave ((x)) of X ended at 139.98, and Minute wave ((y)) of X is subdivided into a FLAT. Minutte wave (a) of ((y)) ended at 141.09 and Minutte wave (b) of ((y)) ended at 140.39. Minute wave ((y)) of X has now reached 1.236 extension of ((w))-((x)) and thus the cycle from 8/23 low (139.27) is mature. Sellers may appear anytime from 142.65 – 143.49 area for an extension lower or at least a 3 waves pullback. We don’t like buying the pair.

GBPJPY 1 Hour Elliott Wave View

GBPJPY Elliott Wave View: Wave Red X Still in Progress

GBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.27 ended Minor wave W. Minor wave X bounce is currently still in progress as a double three Elliott Wave Structure. Minute wave ((w)) of X ended at 141.47, Minute wave ((x)) of X ended at 139.98, and Minute wave ((y)) of X is proposed complete at 142.93. The move higher from Minor W can be counted as a triple three. In this case, it will open extension higher to 143.75 – 144.27 area before pair turns lower.

GBPJPY 1 Hour Elliott Wave View

so everyone lost interest in gbp/jpy or lost interest in E wave?>

I personally think price will reach 154.678. And it seems that it can go higher, but I think it is unlikely and the price will again go to 152,631.

Hello traders,

There’s not much activity on this thread, but IMO, gbpjpy is the best pair to trade.

Here’s my take on gbpjpy’s potential over the next few days. I think we have a little upside, but its limited. A few days ago I calculated a measured move to 155.00 from a H&S pattern on the 4H chart. The weekly chart also shows 155.00 as being a possible to the rising channel. Of course time will tell. Good luck

Although British Pound was high against the Japenese Yen on wednesday which showed a havoc on the day .It is 150.But later it i went down to 152 .

According to trading session ,it will eventually for 160 for long term.