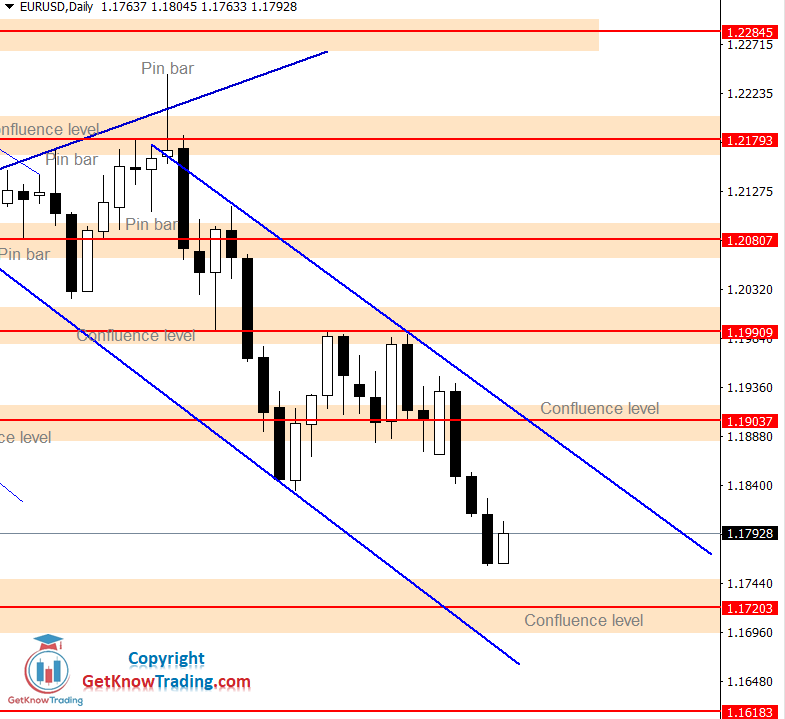

What we can see from the start of the week is that the price has moved to $1.19037 and from there reversed back up next to resistance level at $1.20000.

From there the price returned back down and ended the week with the close right on the support level.

I am still bearish oriented because the price is returning back to support level at $1.19037. It means the selling pressure is strong and eventually will break down.

On Tuesday the price has strongly broken below $1.19000 which was a sign of bears strength.

$1.17000 is lower end of the old range area so I am expecting to see the price first reaching $1.17500 and then reversing back up to around $1.19000.

This could be a nice opportunity to catch the selling wave down to $1.17000.

1 Like

Strong selling pressure pushed the price down to $1.17203 support level where the minimum price $1.17030 was reached.

It will not be too easy to break below $1.17000 support, so I am expecting the price to reach $1.18400 which is the level that previous bullish candles has reached after hitting $1.17200 support.

Looking on the weekly chart it looks like it is ready to move down to reach $1.16183 support level.

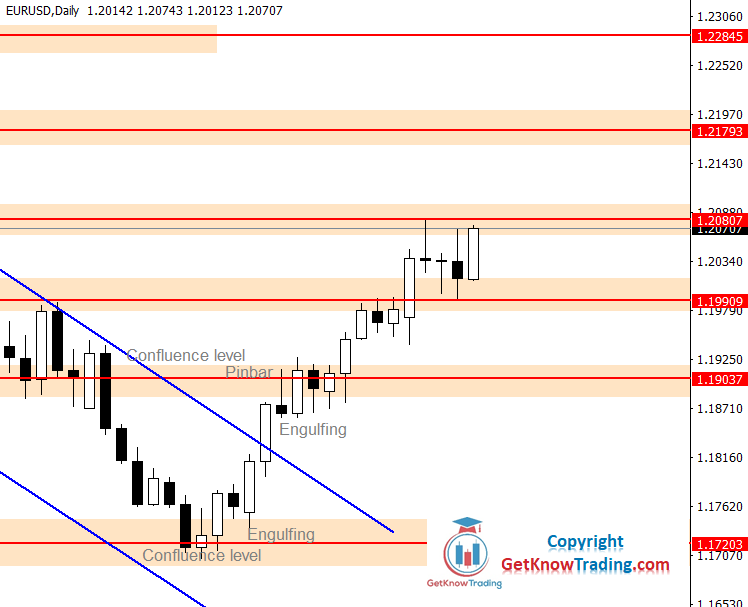

The price reverse happened and the $1.18400 was reached as was said in the previous weekly analysis.

But, the price managed to get out from the descending channel and reach major resistance at $1.19000.

f the price ends next week above $1.19000 then it will move market sentiment to slightly bullish.

If the price manages to close above $1.20800 then the next resistance is at $1.21080.

After last week engulfing candle the pair has found strength to move 100 pips up and reach key level at $1.20000.

As I said in the previous week analysis the price will look more bullish if it closes above $1.19000.

Now I can say that the market really looks bullish and I expect the price to reach $1.20800 which is major resistance for the pair.

The price played out just like it was mentioned in the previous week’s analysis.

The price broke above $1.20000 and reached $1.20800 level.

Resistance at $1.21800 is stronger resistance and it will play a major role for the price to break above and to reach levels above $1.22000.

If the price manages to close above $1.22000 it will have a clear path to $1.23000 as a new high.

The week has ended with the price close to $1.21800 level which is now resistance for the pair. ,

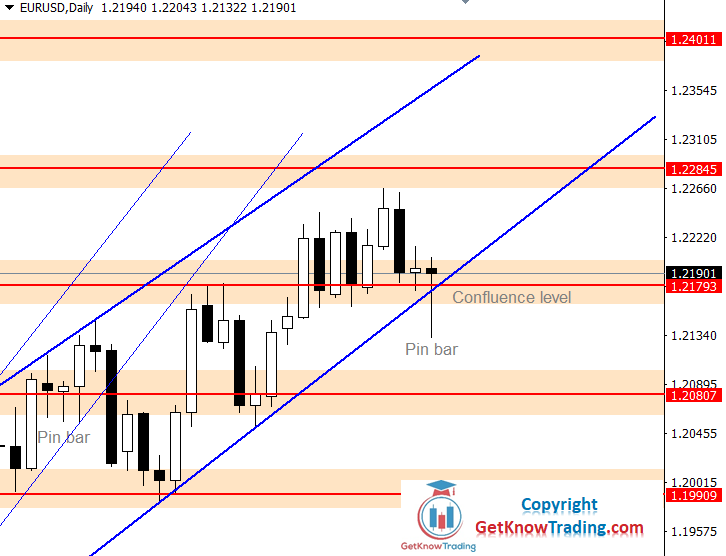

The resistance area around $1.21800 was active two weeks ago.

I am expecting the price to go down around the $1.20800 level and find support for the next attack upside.

The next target is $1.22000 which is strong resistance that prevented the price from stabilizing to make a next move to $1.25000.

The price has done what was discussed in last week’s analysis. The price touched $1.21800 and returned back down to $1.20800.

The $1.21800 is close and I am expecting it will break above.

Weekly time frame shows me a clear bullish scenario with a $1.22800 target.

The price broke above $1.21800 on Tuesday and we had strong buying sentiment.

Then the market reversed back down to find support on the $1.21800 which happened on Wednesday.

I like to look on the weekly time frame and what I can see it just started the move up.

So I am expecting the price to move up and try to break above $1.22800.

The week started with a bullish scenario at the $1.21800 with the target at around $1.22800.

Price reached $1.22660 and then reversed back down to $1.21800.

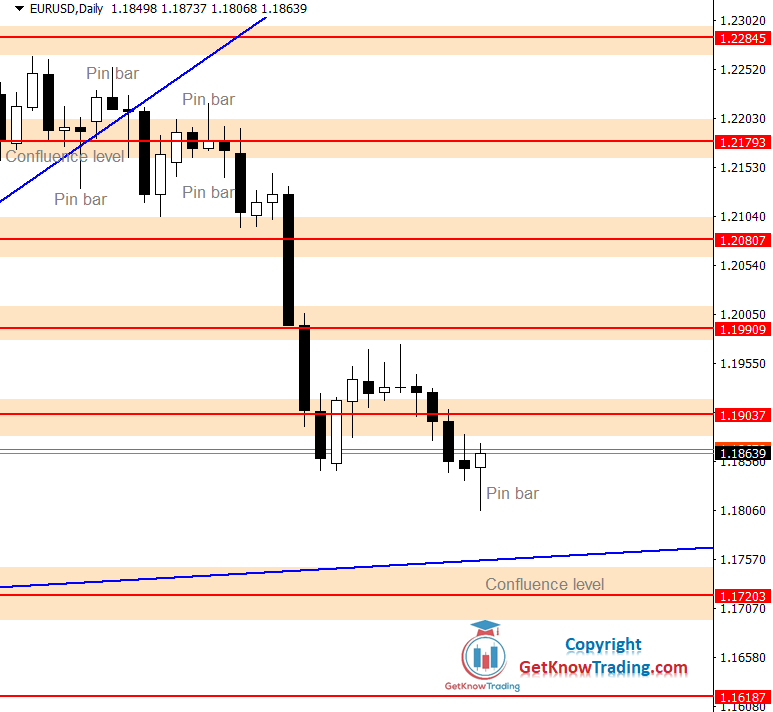

The price is currently on a strong support where we have a confluence of support levels

First target is $1.22800 which is now a strong resistance that must be broken so the price can create its new highs

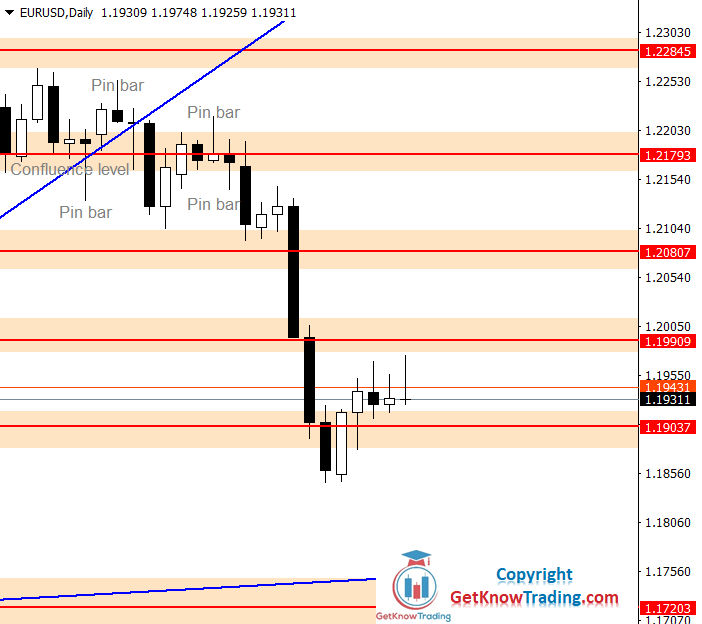

With two Pin bars the price could not reach new highs.

With the start of a week the price moved higher than last week’s ended, but it has short lasted.

The price is below strong resistance that has held the price above for two weeks which means it will need more buyers strength to move again above $1.21800.

Last two weeks were pretty bad for the Euro currency because the price has fallen down to low levels which we have not seen since April 2020

The current scenario does not look good for buyers because the price has support only next to $1.17200.

$1.17000 is an area of support where weekly trend line and horizontal support are crossing so I am expecting that the price will stop there.

The price closed the week above $1.19000 which means the next resistance is at $1.20000.

For the next week I am expecting the price around $1.20000 and then I will see what will happen.

Market does not look so strong to go beyond $1.20000, but it looks more likely to find resistance and then fall down to $1.19000.

The week started with a small bullish Pin bar, but the formation of the Pin bar was not at the right place to give significant meaning.

That is why the market continued to fall down on the following days.

Currently because of the bullish Pin bar we could see the price moving higher up to $1.19000 and then going back down to $1.17000.

The week ended with the price above the weekly starting price which was around $1.18600.

The current price is $1.18729 which means bulls have made to close the week above open price.

The bullish Pin bar from last week was not so strong indication of bulls, but this week’s engulfing candle shows me more bull’s strength.

The price reached a weekly up trend line and found support.

It reversed back on Wednesday, but the following two days were bearish.

If the price forms a bullish engulfing or Pin bar around $1.17200 it will be the sign of a bullish move which could be the start of a bullish trend.

If the $1.17200 does not hold then $1.16180 is the next target.

The price managed to close below previous week low and this is the second week in a row the price closed the week lower.

The whole week was moving slowly down where four of five days were bearish.

Strong confluence of support is losing the battle and we could see the price next week close to $1.17000.

The weekly overview is pointing out that $1.16180 is very close and it is stronger than $1.17000 so I am gonna pay attention on that level.

The week behind has shown bears breakout below previous day candles lows which led the price to $1.17200 support level.

$1.18000 is a round number which acted as a resistance for the price and now the market looks like it has tested the resistance before the next move down.

As a first step for the price to move down and to confirm the $1.16187 as the next target is to close below $1.17200.

The price has reversed from the weekly up trend line and closed below $1.17200 support level I was mentioning last week.

$1.17200 was a breakpoint for the sellers and now it is resistance for buyers.

Start of the week could have a small test of the $1.17200 before moving further down to $1.16187 which now is the next target.

The price nearly reached $1.17200 two days in a row by retracing back, but it could not stay there for too long.

Same day the price moved higher and closed the day higher than the previous day.

$1.18500 is a confluence of resistance where the sellers could find more strength to push the price back down.

The current market overview shows the $1.17200 as a support that needs to be broken in order to see the price moving down.