The pair ended the week in the middle area between two strong resistance levels. On the upper side we have $1.17000 and on the bottom side we have $1.16178.

Well, as it now looks like the market is heading down and the first support that is ahead is $1.16178 which stopped the price last time. That stop was a month ago, on October 25.

The first support $1.16178 likely will not hold the price so the next support is at $1.15462 which is a confluence of support levels.

EURUSD Buyers Lost The Battle, $1.1546 is the target - Get Know Trading

In the previous analysis I have pointed that the price could reach $1.16178 level and then make a pullback to $1.16700 – $1.17000 area.

The price did just that and reached uptrend channel support level which is a confluence of horizontal resistance and uptrend support line. From there the price returned back to $1.16178, but since then the price changed from the bearish into the bullish sentiment.

When the price reaches $1.19000 – $1.19300 level we could see the price making a pullback back to $1.18200 before moving further up. The $1.18200 is an uptrend channel support area which will stop the price from falling down to $1.17000.

In the previous analysis I have pointed out that the two things can happen.

the pair could reach $1.19000

and then make a pullback to $1.18200

Both points were realized last week in just one day, on Monday.

Since the price broke below the uptrend channel support line and it bounced back to the same level I am now open to sit and wait.

In the analysis from the last week I said that the market does not look too bullish that would move the price easily up to $1.19000. The market overview shows just that.

The pip range this week was 80 pips and it means that the price was in the indecision area. The middle of the range area between $1.17000 and $1.19000 is still holding the price from large movements.

I am expecting the price will try to break above $1.19000, but before doing that it could make a pullback to the area between $1.18150 – $1.18200 which is the current support that held the price two times this week.

The market week behind us has done a huge move forward. The price has done two things I have mentioned in the previous week forecast.

The price:

Made a pullback to $1.18150 – $1.18200 area

Bounced back above $1.19000

New highs for EURUSD are in this order.

First high is around $1.20800 where the price will probably stop and make a pullback. This level acted in the past as a strong resistance.

On the chart it is visible that the uptrend channel resistance line is making a confluence of resistance at that area together with the horizontal resistance line.

https://getknowtrading.com/eurusd-breakout-from-the-uptrend-channel/

After reaching the $1.20000 level the price bounced down as a reaction to strong sellers and buyers who took the profits.

Strong resistance level acted as a strong psychological level(round number) that forced buyers to exit and sellers to enter.

At the $1.20800 level price could find support to move higher and head towards $1.25000.

The first resistance level that is stopping the price reaching $1.25000 is $1.22845. It is an area around $1.3000 level.

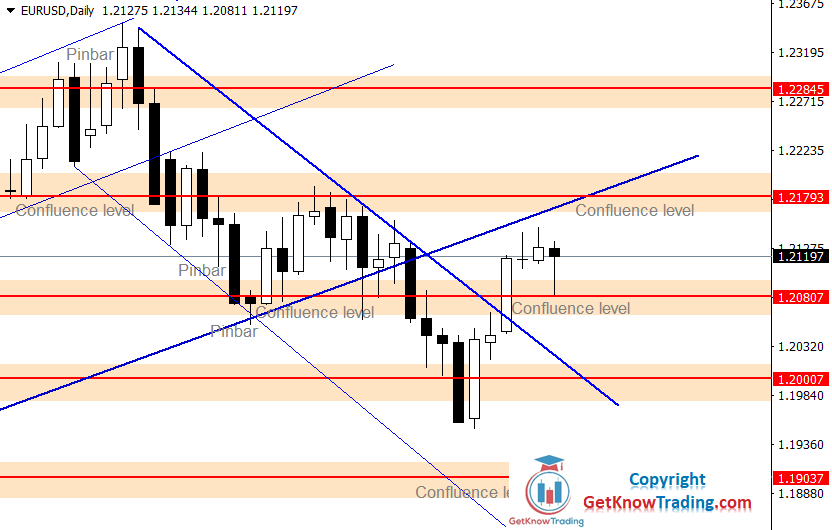

EURUSD chart shows the price behaviour in the previous week. What is visible is the price pullback from $1.21793 to $1.20800 which is the first support level.

The daily close of Thursday candle was not above previous daily candles close, $1.21430 level, which is now an important resistance level to break in order to continue moving up.

I am bullish oriented for now until the price is above $1.20000 and until the price reaches $1.25000.

At the beginning of the week the price has stalled at that level. The price returned back to the previous uptrend channel resistance line and then bounced back up.

The next day, on Tuesday, the price made an indecision candle, but the candle closed with price above $1.21430.

The next week will be a slow week due to holiday, but I am expecting the price to reach the $1.25000 level eventually.

The next resistance will be again on the $1.22845 and after that $1.24000. What we can see is that the price for now does not have any strong resistance except $1.24000 level.

In the previous week forecast I have mentioned that the pair could make a retrace back to $1.21793 which happened already on Tuesday.

The price retraced back strongly and formed a bullish Pinbar. The Pinbar shows us that the market is still supported with strong buyers waiting on the support level. The $1.21793 level is a confluence of support.

The market is moving steadily to the upside. The resistance levels are $1.22845 and $1.24000 which will hold the price from reaching $1.25000.

We had EURUSD making a bullish candle on the confluence support area right at the start of the week.

As I said in the previous week EURUSD forecast the support $1.21793 was the support that holds the price from falling down.

We can expect the price to reach a confluence level of support and from there move up. The $1.22845 is the resistance that will be harder to break above.

When that happens the price will have $1.24000 level as a harder level before it reaches $1.25000

The return inside range was strong. Two large bearish candles have wiped two weeks’ bulls’ work.

The price stopped at the support level $1.21793.

That level is the previous confluence of support which is now preventing the price from falling down.

If the price does not close below $1.21600 it could stay inside the range between $1.21793 and $1.22845.

Strong bearish candles last week was a sign of bears strength and that has been confirmed on Monday.

The price has fallen down to $1.21500 which was a sign that the price will move down and by end of the week the price reached $1.20800.

$1.20800 is a support level that held the price from falling down in the strong bullish move in December 2020.

We will see the price bouncing up from this level.

Last week I pointed out the price could reach $1.20800 level and bounce back to $1.21793.

The price reached $1.20800 and bounced on Monday back up.

For the next week I am waiting for the price to make a move.

If the price closes on a daily basis above $1.21793 I am expecting to reach $1.22700 level where it could find resistance.

This week the price has made a bounce down to the first support at $1.20800.

The price took three days to reach the support which means bulls were strong enough to hold the price on the upper side.

In the next week I am expecting the price to break out fromt this small range.

If that happens and the price closes above $1.21793 on a daily basis the price will move towards the $1.22845 level.

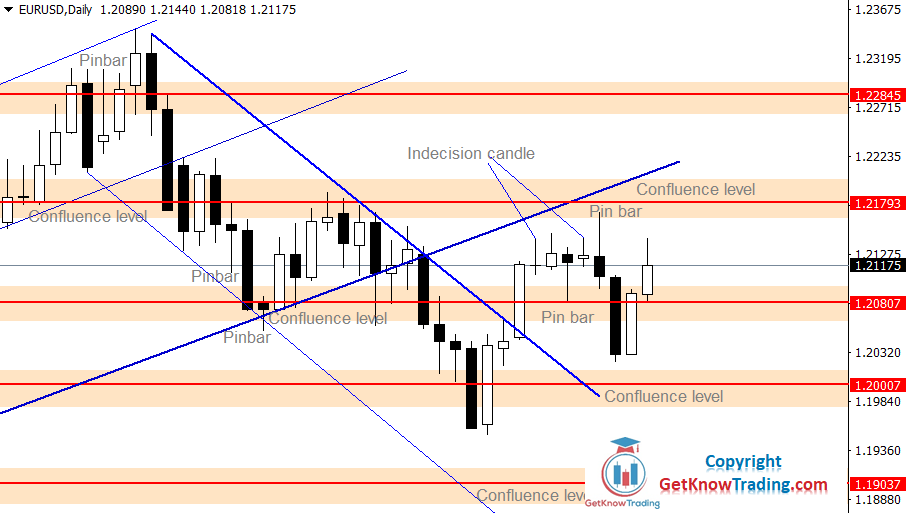

The market has changed its direction and price managed to break below uptrend channel.

The price has broken even below first support $1.20000 which did not show too much strength.

The price could find resistance at the confluence of resistance around $1.20800.

From there the price could move down to $1.20000 to try breaking again down.

The price managed to return back into area between $1.20800 and $1.21793 leves.

It is an area where the price has been around since December.

In the next week I will wait for the price to define where it will move for the next few weeks.

If the price close above $1.21793 level I will look for bullish signals on retrace.

1 Like

This week has shown indecision in the market where the first few days the price did not show clean direction.

With the support of bullish traders the price has changed the direction and ended the week above $1.20800.

If the price could close above the $1.21280 price it would mean the buyers have succeeded to break above the wall that is preventing the price from moving up.

The price has managed to break higher this week, but the break was short lasting.

In the previous week analysis I have said that if the price manages to break above $1.21280 we could see it moving higher

What I am looking now is for a bullish price action signal on the $1.20800 support level that will prevent the price from moving down and which will make a base for future move up.

Strong selling pressure on the $1.21793 level shows me that it is an area where bears are not allowing the price easily to break above.

We can see the price has reached $1.20000 on Tuesday and made a retrace which was just bears getting out and cashing profits.

The price could find a support at $1.19000 level which will allow the price to move up.

Current market formation does not look so bullish so I am more inclined to sell the pair on the retrace at around $1.20800 and $1.20000.

The pair is in the indecision area because strong support $1.19000 has held the price from moving below and $1.20000 has held the price from moving up.

If the price comes back again to $1.20000 and makes a bearish price action signal it will be a sign the price will move down below $1.19000 support.

That will open the road to $1.17000 which is the lower end of the previous range area from the end of the last year.