Is the Kiwi in for more gains? It’s moving up towards the top of the rising channel on its daily time frame. From there, the pair could turn and head south towards the .8200 handle in the middle of the channel or the bottom around .8000. Make sure you wait for stochastic to turn from the overbought region before shorting!

Even though the Kiwi seems to be facing a tough challenge heading north, the uptrend still seems to be intact as fundamentals support a bullish NZD position. On the 1-hour time frames, there are potential buy zones around the 50% and 61.8% Fib levels, which coincide with former resistance levels. Do you think it’ll bounce there?

When will the bleeding stop? NZD/USD has been getting battered on the forex charts, as the pair had a steep tumble in the past couple of weeks. It is approaching a strong support level for now and it remains to be seen if the floor will hold or give way. Stochastic is pointing up, which suggests that Kiwi bulls are ready to charge.

Technical analysis trading comes in many different varieties and favours. There are trend lines, elliott waves, breakouts, pattern formations and so forth. Today i introduce another concept in technical trading. It is called trading in the box. Using price action, i have drawn 2 boxes. NZDJPY was trading in box 1. And now it has jump up and is trading in box 2. So the key to trading NZDJPY is to trade within box 2. Buy near the bottom of the box, and sell close to top end of the box. Rinse and repeat. Until NZDJPY decides to move out of the box, into another new box.

The highest price established for NZDJPY in 2013 is set at 86.40-50. There would be in high likelihood another re-test of this significant price resistance. The first attempt to challenge this high should hold.

SHORT NZDJPY 86.40-50

SL 40-50pips

TP 84.00

1 hour after the FOMC statement, RBNZ is announcing their official cash rate and rate statement. RBNZ is widely expected to raise interest rates sometime in March/April.

However, there is a small 20-30% chance for RBNZ to raise interest rates today. If they do, the NZDUSD should go up.

Else the following rate statement should be of a bullish stance, emphasizing on the need to increase interest rates in near future. In this case, market should buy NZDUSD up in anticipation of future rate hikes.

A) Long NZDUSD 3 mins before release

SL 50pips

TP manual trailing stop

B) Long NZDJPY 3 mins before release

SL 50pips

TP manual trailing stop

NZD/USD in recent weeks, has been experienced many reformation with a gradual upward trend that Buyers over price increases obtained the highest price of 0.85213.Currently price in long term time frames(Such as Monthly,weekly and Daily ) is above 5-day moving average and warns about more ascending in long term interval of this currency pair.Price has been stopped from more ascend by reaching to the specified resistance levels in the picture below and with exit of some buyers from their trades at the end of 7th ,10th and 11th days, the Doji , Spining Top and Shooting Star candlestick patterns have been created. These candles shows vulnerability and indecision market in ascending or descending of price that for confirmation it needs closing of a bearish candle

As it is obvious in the picture below , right now in daily time frame ABC descending pattern with the ratio of 161.8 is observable that with the completion of the D point there is a warning about down of price and descend by this pattern.The Stoch indicator is in the saturation buy area and issued the warning of the formation of top price and the falling of the price.Generally until the top price of 0.85213 is preserved, there is a potential for descending and price reformation in this currency pair.

NZDUSD Elliott Wave View: More downside

Short term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 3, 7, or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) looks to be unfolding as a double three Elliott Wave structure where Minute wave ((w)) is expected to complete soon as a Flat Elliott wave structure , then pair should pullback in Minute wave ((x)) to correct cycle from 4/27 low before turning higher again. We don’t like buying the proposed bounce and expect Minor wave X rally to find sellers in 3, 7 or 11 swing for more downside as far as pivot at 0.709 high remains intact.

NZDUSD 1 hour Elliott Wave Chart 05/02

NZD USD Incomplete Elliott Wave Sequence

NZD USD is showing 5 swings down from 2/6/2017 (0.7375) which means it’s an incomplete Elliott wave sequence and calls for another swing lower to complete 7 swings down from 2/6/2017 (0.7375) peak. First 3 swings completed on 3/9/2017 (0.6886) and bounce to 3/21/2017 (0.7091) was the 4th swing. Pair has since made a new low below 0.6886 which means we have started the next cycle lower with a target of 0.6739 – 0.6589 and ideally 0.6607 – 0.6492 area.

We can see 5 swings down from 2/6/2017 peak on this chart (please note these are 5 swings which is not the same as a 5 wave Impulse). As we explained above, 5 swings means the sequence is incomplete and makes the sequence bearish against 0.7091 high as indicated by the red invalidation line and the red arrow. Proposed 6th bounce should stay below 0.7091 high and pivot for the pair to continue lower in 7th swing. Ideally 6th swing should stay below the descending trend line as well which is currently at 0.7018.

NZDUSD Elliott Wave View: Correction in progress

Short term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 7 or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 0.6937 as a Flat Elliott wave structure , and Minute wave ((x)) pullback ended at 0.69. Near term, pair is correcting cycle from 0.69 low within Minutte wave (b) and while dips stay above there, expect pair to resume higher towards 0.699 – 0.7014 area before the decline resumes. We expect Minor wave X rally to find sellers at 0.699 – 0.705 area for an extension lower or at least a 3 waves pullback as far as pivot at 0.709 high remains intact.

NZDUSD 1 hour Elliott Wave Chart 05/03/2017

NZDUSD Elliott Wave View: Correction Ended

Revised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a triple three Elliott Wave structure where Minute wave ((w)) ended at 0.6905, Minute wave ((x)) ended at 0.7053, Minute wave ((y)) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress and unfolding as a double three Elliott Wave structure where Minutte wave (w) is expected to complete at 0.6815 – 0.6846 area, then it should bounce in Minutte wave (x) to correct cycle from 5/2 high before pair resumes lower again. We don’t like buying the pair and expect bounces in Minutte wave (x) to find sellers in 3, 7, or 11 swing provided that pivot at 0.6968 high remains intact.

NZDUSD 1 Hour Elliott Wave Chart 05/04/2017

NZDUSD Elliott Wave View: Downside Resumes

Revised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a triple three Elliott Wave structure where Minute wave ((w)) ended at 0.6905, Minute wave ((x)) ended at 0.7053, Minute wave ((y)) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress and unfolding as a double three Elliott Wave structure where Minutte wave (w) ended at 0.6835 , and Minutte wave (x) is in progress to correct cycle from 5/2 high before pair resumes lower again. We don’t like buying the pair and expect bounces in Minutte wave (x) to find sellers in 3, 7, or 11 swing for more downside provided that pivot at 0.6968 high remains intact.

NZDUSD 1 Hour Elliott Wave Chart 05/05/2017

NZDUSD Elliott Wave View: Extended Correction

Revised Elliott Wave view in NZDUSD suggests the decline from 3/21 high (0.709) is unfolding as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 0.6905, Minute wave ((ii)) ended at 0.7053, Minute wave ((iii)) ended at 0.6844, Minute wave ((iv)) ended at 0.6968. and Minute wave ((v)) of A ended at 0.6835. Pair is bouncing within Minor wave B to correct cycle from 3/21 high before the decline resumes. We don’t like buying the proposed bounce and expect sellers to appear once wave X bounce is complete in 3, 7, or 11 swing provided that pivot at 3/21 high (0.709) remains intact.

NZDUSD 1 Hour Elliott Wave Chart

NZDUSD Elliott Wave View: Showing impulse

Short term Elliott wave view in NZDUSD suggest that the cycle from 5/11 low (0.6816) is unfolding as an impulsive Elliott wave structure . This 5 wave move could be a wave C of a FLAT correction or wave A of an Elliott wave zigzag structure structure. In either case, after 5 wave move ends, pair should pull back in 3 waves at least as the Elliott Wave Theory suggests. The Minute wave ((i)) ended at (0.6948), Minute wave ((ii)) pullback ended at (0.6880), Minute wave ((iii)) at 0.7121 peak, Minute wave ((iv)) pullback ended at (0.7054) low. Above from there Minute wave ((v)) of C or A already reached the minimum extension area in between inverse 1.236-1.618% extension area of previous wave ((iv)) already at 0.7135-0.7161 area. Which means cycle from 5/11 low (0.6816) is mature and pair can start the 3 waves pullback at any moment.

However as far as dip remains above wave ((iv)) dip (0.7054) & more importantly while the Rsi divergence at the peak stays intact pair may see further advance towards ((v))=((i)) target area at 0.7186-0.7217 area or in case of further strength pair may see 0.618-0.764% fibonacci Extension area of wave ((i))+((iii)) at 0.7243-0.7289 before ending the 5 waves impulse sequence from 5/11 low. Afterwards pair should pullback in 3, 7 or 11 swings for the correction of 5/11 cycle or If the decline turns out to be stronger than expected and breaks the pivot at 5/11 low (0.6816) then that would suggest 5 wave move up from 0.6816 low was part of a wave C of a FLAT from 3/09 (0.6889) low and pair may resume lower.

NZDUSD 4 Hour Elliott Wave Chart

NZDUSD : Wait for Pullback then Buy Again

NZDUSD is showing 2 bullish patterns on the daily chart so we are expecting for the pair to continue higher. A move lower will now give bulls a chance to push the pair higher. Below we will show the possible bullish scenarios where bulls can enter the market and catch the move higher.

NZDUSD Daily Chart 2 Possible Bullish Patterns: Traders need to wait for NZDUSD to terminate red point C between the red AB 1.618% – AB 2.24% Fib. levels. A move lower from the suggested area to the red BC 0.50% Fib. retracement level will trigger BUYS. As long as price stays above the red point B low, watch for NZDUSD to make another swing higher. There is also strong support/resistance at the red BC 0.50% area which will allow a possible bounce higher. Watch for move higher towards the blue AB 2.24% Fib. level.

If looking to buy NZDUSD we prefer waiting for a retracement/pullback to trigger the red point D sell at the BC 0.50%. Stops should be placed at 0.6816 (point red B low) and should be bought at the BC 0.50% Fib. level minimum for a better risk/reward trade with targets above the blue AB 2.24% Fib. level.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

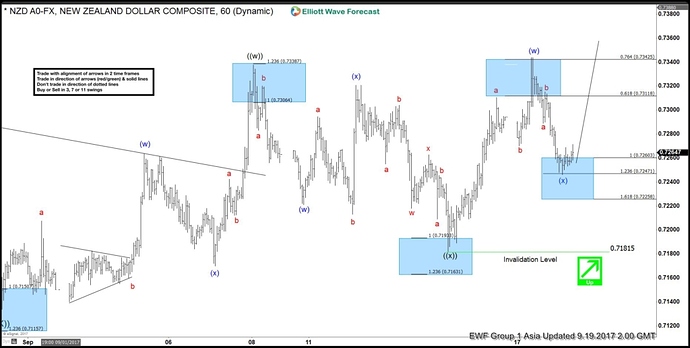

NZDUSD Elliott Wave View: More Upside

NZDUSD Short Term Elliott Wave view suggests that the Index shows a 5 swing sequence from 8/31 low favoring further upside. Rally from 8/31 low (0.7128) is unfolding as a double three Elliott Wave structure. Up from 0.7128, Minute wave ((w)) ended at 0.7338 and Minute wave ((x)) ended at 91.71. Wave ((y)) is currently in progress and the subdivision is also unfolding as a double three Elliott wave structure. Minutte wave (w) of ((y)) ended at 0.7344 and Minutte wave (x) of ((y)) ended at 0.7246. Near term, while pullbacks stay above 0.718, expect pair to extend higher. We don’t like selling the pair.

NZDUSD 1 Hour Elliott Wave Chart

NZDUSD Short-term Elliott Wave Analysis

NZDUSD Short term Elliott Wave view suggests the decline from 9/20 peak remains in progress a zigzag Elliott Wave structure. Down from 9/20 high (0.7434), pair ended Minor wave A at 0.7165. Subdivision of Minor wave A unfolded as 5 waves impulse where Minute wave ((i)) of A ended at 0.7276 and bounce to 0.7362 ended Minute wave ((ii)) of A. Afterwards, decline to 0.7166 ended Minute wave ((iii)) of A and Minute wave ((iv)) of A ended at 0.7239. Minute wave ((v)) of A completed at 0.7165. Pair then bounced in Minor wave B in 3 waves and ended at 0.7243. Minor wave C is currently in progress and unfolding also as 5 waves impulse. Minute wave ((i)) ended at 0.7145, Minor wave ((ii)) ended at 0.7206, and Minute wave ((iii)) at 0.7049. While Minute wave ((iv)) bounce stays below 9/29 peak (0.7243), expect pair to extend lower towards 0.6919 – 0.6983 before ending cycle from 9/20 peak.

NZDUSD 1 Hour Elliott Wave Chart

NZD/USD has an aggressive upward tendency as it is awaiting the RBNZ Financial Stability report. The price is approaching the 50-SMA on the daily chart, near 0.6966. The month is ending in green after sharp sell-off in October.