Tradervue is such a nice improvement over edgewonk, it even has a p&l over time, scatter plot graph, something I always wanted

Go through the Babypips course, don’t pay for anything except books.

I know I didn’t do the course, but I have been heavily involved in finance background, read hundreds of books and used to run/write a dividend investment blog.

And I had extensive one on one mentoring with a retired VP of a trading firm, until he died unexpectedly  .

.

Suggestion: It would be interesting if you post some charts of how you are viewing things, no need to explain if you don’t want to

I take my queue from one of people who taught me, what I trade is less important than how I trade.

My analysis and trades fits my parameters, and will never be anyone else’s.

Everyone trades different and sees different. No two setups organically will ever be the same.

I dont believe everything I hear. There is a damn good reason why I dont touch crypto currencies with a long stick.

Yeah, they can be very volatile, space is full of scammers.

Legitimate users are being developed, like GameStop and things like xrp and CasinoCoin.

Blockchain has the ability to help stop a lot of corruption, things like food source/ goods getting traced/verified, voting and campaign donations trackable, verification of luxury goods, medicine etc.

Imagine if all currency was trackable in real time, you could curb a lot of illegal actions, drugs, real time audit and taxes.

I don’t have much free time to post, I am an avid gamer, with a set 40 hour job, family, friend commitments.

As an introvert/ INTJ/INTP with a somewhat social job in the tax industry, it leaves me drained most nights, and I need the solitude to recharge.

I don’t really go out week nights, so get in touch with me after 6pm EST.

I do not post to claim to be a trading savior/messiah, my last two weeks alone prove that I am not perfect and can make back trades/calls.

My trading setups need a wide margin/setup/draw down.

Hard to work on sub $5k accounts, which is what most people here use.

I am much more likely to talk in discord and talk your head off for hours while I play games.

Feel free to look me up.

What a great experience? What was it like being mentored? Was it confusing at first? Frustrating?

How different do you think you would have turned out if you didn’t have a mentor?

It was not very long or involved, I actually ran into him at a coffee shop picking up drinks for work, I saw him trading on his laptop, and we talked while my order was being made.

I was eager to get an outside perspective, and he liked how I had jumped into trading.

I had been trading stocks since 2006, and had read hundreds of finance and investing books by this point.

We met in 2014.

I had ran a dividend investment blog, written guest articles on a few other blogs, and a couple local radio podcasts.

I really just liked to know more about his capital allocation and systems for handling changes in market structures over decades.

How he remained profitable in down and sideways markets. His insights were great!

He died unexpectedly from a heart attack, he was very obese, at least he didn’t leave behind any kids.

He didn’t teach me much about forex trading, since I already knew how to trade, just the broader market analysis, especially independent research, macro trends.

Since he did for decades before computers and hand drawn his plots like my multi-millionaire great Uncle too.

Who was another influence on me growing up.

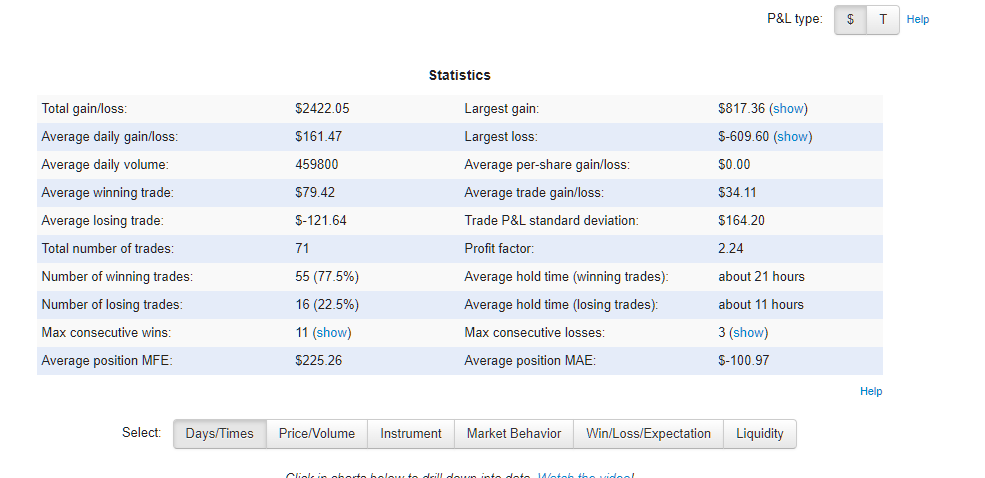

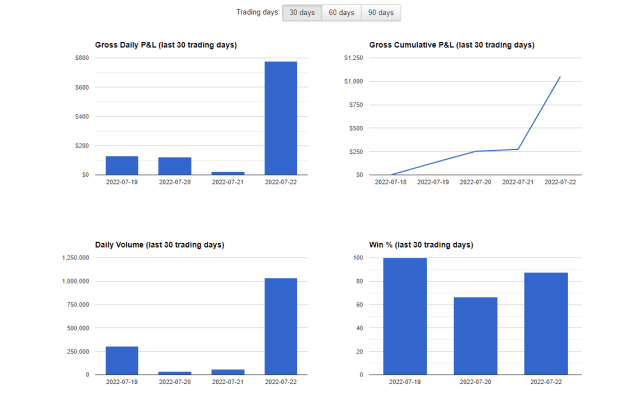

This was last week in focus:

Attached Image (click to enlarge)

this was a good week

about a 30% ROI

The reason my profits look like this, is because I scale into winning trades, so my profits go up quick on days when I am right, like how much I made on Friday, relative to the other days.

And had more time to trade, since I didn’t have to do much at work.

Do you just trade in one direction only for a specific pair, or do you have trades going in both directions at the same time for the same pair (i.e going long and short on the same pair?) I’m tying to guess what your trading strategy is.

Nothing to guess at, it’s very simple.

I have explained that numerous times, but I trade setups from both sides over a period of time, say 8-18 hours, ride a pair up to a resistance point, exit profit, then get a ticket for the retracement ride down.

This is my “wave trading” methodology, as I look to profit from the median range off of the weekly charts, so I want trades hitting that middle 60% ADR multiple times, cross-over from multiple points.

Another good thing about my strategy; this is a way to profit even in ranging markets.

Something that a lot of traders struggle with.

Since so many just are trying to find breakouts to ride a channel move up or down.

Just need to learn how to read the charts, why naked trading price action fits so well with how I trade, all I have to do is eyeball the bars, and I am good to go!

Decided to open an account with myforexfunds in the next few weeks.

Going to go with their $10k accelerated emphatic option for $970.

Good starting point for their scaling system.

I was looking at the one called Fundednext.

I’ve been looking at myforexfunds and fundednext they are both good.

But I’m seriously looking at fundedtradingplus - one-off payment very easy rules and not expensive. In fact all pros and no cons that I see. They are fairly new.

|attachment

|attachment