It simply means that we have greater chances of winning in our next 2 trades =)

USD JPY will confirm the cross over in 15 mins time, but I am suspicious on this one as this cross over is based on a NEWs that arrived

Anyone having the same feeling?

Have the same feeling bro. Maybe wait for BCLO +1?

Yes, I have decided to stay side line on this one

I think better to stay side lines the whole day

Grabbed 6 dollars for today and I think I am done for the week

This is paper trade I am in, I want to know how to determine the point B, Point A is at 100 but I am confused about point B, and the pair was in a strong down trend and retraced and is going down again. Can anyone help me

I think these are the points. Please have a look at my chart and see whether I got Point A spot on. Point B will be the highest wick on the current wave of the trend.

After using Macfibo for all my trade this week, I added a few steps that I believe will improve the winning chances. These are the steps that I plan to strictly follow with Macfibo starting from next week.

Trading Strategy

- Trade only on Tuesday, Wednesday, Thursday and Friday

- Trade only during London session (beware of reverse trend during last hour of London)

- Look for pairs with D1 and W1 trends are in agreement

- Determine whether fundamentals have any impact on entry for the day

- Draw 4 weeks S/R lines on H4

- Wait for 5EMA and 20SMA cross on H1/H4 and draw fibo after candlestick completion.

- Enter 2 trade positions only when daily trend and cross signal + D1 RSI (50 value as guideline for bull and bear signal) in agreement

- If any S/R line between 127.2 and 161.8, SL will be at 38.2 for both positions and set TP for 1st position at 127.2 and 2nd position at 161.8. Move second position SL to 100.0 after 1st position TP

- If no S/R line, SL will be at 38.2 for both positions. 1st position set TP at 161.8 and 2nd position at 200.0. Move 2nd position SL to 127.2 after 1st position TP

- Exit trade for both positions whenever 5EMA and 8SMA cross confirmation after candle close if TP has not been triggered for 1st position. If 1st position TP has already been activated and 2nd position SL already moved, let the trade runs.

Do comment. Thanks

[B]1. Trade only on Tuesday, Wednesday, Thursday and Friday

[/B]

I’d rather trade on a Monday and NOT trading on a Friday to be honest.

It’s proven that the week High/Low is shown with 80% probability on a tuesday, so you can understand the importance on a Monday together with a wednesday  - Friday is risky by nature, avoid it !

- Friday is risky by nature, avoid it !

[B]4. Determine whether fundamentals have any impact on entry for the day

[/B]

You shouldn’t be worried of the fundamental impact, but rather on how big dealers and banks react on it, as the news comes out NOW, within 1 minute market will react on it, and that’s what you want to predict.

Bottom line is: avoid trading prior to important news (especially the ones occuring on a regular base) that are used to provoke “weird” big candles(eg FOMC)

Cheers

No plan or rule is a bad plan or a bad rule unless proven otherwise. In Forex trading, that is what I believe in. My rule of thumb is that, EVERY system parameters/rules/ideas etc etc is GOOD unless proven otherwise. I am quite happy to see you are now actually acting like a true trader. Adapting, modifying and try to improve some well-tested mechanical system and make it your own. You know the next thing you need to do now that you already sure your trading parameters/rules are… back it up with hard statistics via unbiased and super critical Backtesting alonsgside your paper trading/forward testing.

Not trading on Mondays : Your decision not wanting to trade Mondays has it’s own advantage ofcourse, based on my own experience trading for the last 5 years, Mondays price action during Asian Session are very thin and in trading Macfibo (especially secondary signals) always gives fakeouts more than any other day’s Asian Sessions. I am sure you have your own strong reasons why you want to avoid Mondays, but it is not exactly a strict rule. I personally know two successful traders and both of them trade as early as Sydney Session on Mondays. Like you, I too avoid trading secondary signal during asian session on mondays. Plus, you do not need to trade everyday. I do however concur Tuesday until Thursday are the times when price has more volume but I have concluded based on my statistics (in over 1000 trades), Macfibo doesn’t have a definite pattern on which days does Macfibo is most profitableIt’s good to have an off-day from trading. Don’t trade like you are running a 7/11.

Trading during London Session: Do you include Asian-London session and London-US session? I can assure you now that you probably have less chance to experience losses as London Session, for the past 4 plus years, it has been the most profitable sessions. Though it will give you less trading signals but I am sure it is not exactly a main problem. Sometimes less is more.

Trading with the Trend : As I said no idea is a bad idea unless proven otherwise. I understand you want to employ an orthodox way in trading a trend-following system (Macfibo is that actually, Macfibo signal is following the ‘now-now’ trend). Just allow me to instead of using Macfibo signals on D1 and W1 as your ‘trend setter’, perhaps you could use quicker MAs like 5ema and 8sma as your trend setter or 3ema and 5sma. It’s not my official suggestion, just a thought.

Fundamentals : Just keep it simple buddy. If there is a signal few hours before a major news comes out, you either want to stay on the sidelines or just enter the trade but put your SL @ 32.8. Keep things simple for now.

RSI Filter : RSI is a good technical tool in confirming a trend or strength of wave/trend. I do not use it so I can’t comment. No idea is a bad idea right. Backtest it over big sample test trades and see if it gives you the result that you are looking for.

Trade Management : I admire your thinking outside the box regarding on scaling out your positions. Backtest this thoroughly and see if it meets your objective. Well done.

Well done on your attempt to make a trading rule and wanting to strictly following it. I know i’ve said this many many times but its only because it is very important. Test this trading parameters over big sample and if it meets your objective, then congratulations… you have made your own trading system!

It is ok mate. Losses happen.

This really reminds me what I’ve told some of trader friends. I said the power of Backtesting is that it allows you to say something like this but have a hard numbers/statistics/historical log to back it up :

“If i have lost three times in a row, there is 80% chance I am going to win the next trade”.

yes, I can say it now that when I loss a trade, I know I am just atleast halfway towards returning to the winning ways. (Until the day comes when I lost 8 losses in a row, I will go back to the drawing board, SUSPEND Macfibo Trading until further notice)

MACFIBIO SYSTEM UPDATE 28/4/2012

Three signals came yesterday but only two valid signals occurred and I took only two as well.

Trade No 1 : Entered the trade, set my SL @ 38.2. It hit my SL. Moving on…

Trade No 2 : One of those good fridays ey…

Pretty straightforward trades that.

MACFIBO STATISTICS Updated 28/4/2012

Avg Win : 32.2

Avg Loss : 21.1

Net Pips : 1583 pips

Win Percentage : 66.1%

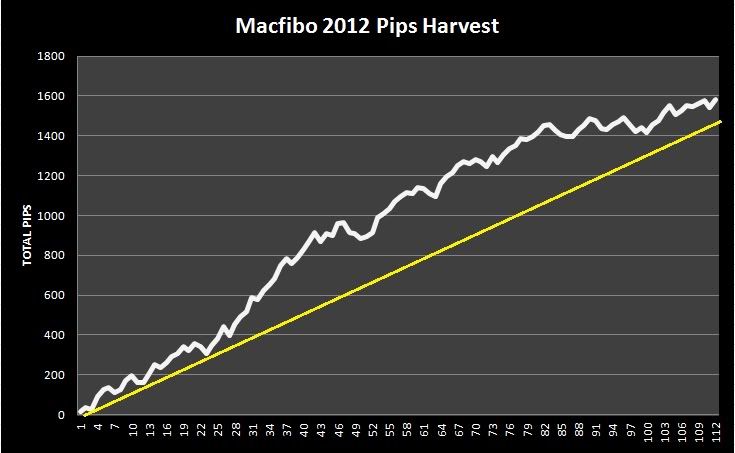

In chart view, this is how Macfibo have been performing in Q1 + til end of April 2012. We are in an uptrend Hehehe… (I even drew a trendline just for fun).

EDIT : [B]Another stats that I want to share to you is this : WHAT IS THE WORST FORM MACFIBO HAVE EXPERIENCED SO FAR IN 2012. What I mean by this, as I always calculate how Macfibo is doing in the last 5 trades and 10 trades for every new signal occured. Based on the logs, the worst form for LAST 5 TRADES form for Macfibo is -69 pips whilst the worst LAST 10 TRADES form for Macfibo is also -69 pips.

The best form for LAST 5 TRADES are 208 pips, whilst the best form for LAST 10 TRADES are 387 pips. Average form for LAST 5 TRADES is 71.1 pips , Average Form for LAST 10 TRADES is 143.8 pips[/B]

PDF ATTACED FIRST PAGE

Brothers,

Thanks for the input. Here are my arguments for the trading strategies:

-

Not trading on Mondays… As pointed by Bro sufiansaid, in my time zone, Mondays trading, especially during the early sessions (Sydney, Tokyo), is thin. As I like to see how the daily trend forms during Asian session and confirmed during the first hour of London session, I avoid entering the market on Mondays. I do include Tokyo-London and London-New York.

-

Trend Indicators - As you can see, I do go for quality trading rather than quantity trading. I believe following the higher time frame (W1 confirmed by D1) trend, combined with trend following trend following Macfibo signal gives better chances. But this remains to be confirmed through backtesting and in my case, forward testing.

-

Fundamentals - As pointed out by Bro CryAgony, I do avoid entering any position before fixed monthly news or any high impact news.

-

RSI - As somebody who is quite green in trading, I do compare my chart with other greenhorns. And boy! Their charts are really full with different indicators compared to my chart. So, after doing some reading and testing of the “normal” indicators that come with MT4, I chose RSI on D1 TF so at least I have one indicator to confirm a trade (I use 50% value, >50 bull and <50 bear). For every one info, I only started trading FX in February this year. But I do have some experience trading stocks back in 1997 before the Asian Market collapsed.

-

Trade Management - Protecting profit is high on my agenda.

Once again, thanks for the feedback. Hopefully it goes well for me next week.

Its my first post here on babypips, I just wanted to say well done sufiansaid, I just finished reading the pdf file, it seems pretty nice, I will start testing it next Monday, thanks for sharing.

Good system. And the best thing is it can be automated. Has anyone tried creating indicator/ea for this.??

I am mql4 coder, so let me start on it. Will post once done. Thanks sufiansaid for sharing this strategy…

Looking forward to it.

Hello there dinesyhdv,

honestly I can say 5 programmers have tried to code Macfibo (they all started to code Macfibo without my knowledge, not until they told me that they failed to code it) and I only have requested a code once but only for the 5x8 exit EA… and until today, bugs still unfixed.

To answer your question, yes several progmmers/traders attempted to code Macfibo but apparently they unable to. If you think you can code it, good luck.  In all honestly, if theres a part of Macfibo I want to be automated, it would be only the exit mechanism (TP and SL is already available in MT4) which is 5x8 because my exit mechanism rule is to exit when 5x8 crossover even before price hit SL/TP.

In all honestly, if theres a part of Macfibo I want to be automated, it would be only the exit mechanism (TP and SL is already available in MT4) which is 5x8 because my exit mechanism rule is to exit when 5x8 crossover even before price hit SL/TP.

Thanks for the interest buddy. Keep posting and reading.

You enter with TP accordingly. Set your fixed SL whilst exiting on 5x8 when it happens before it hits SL.