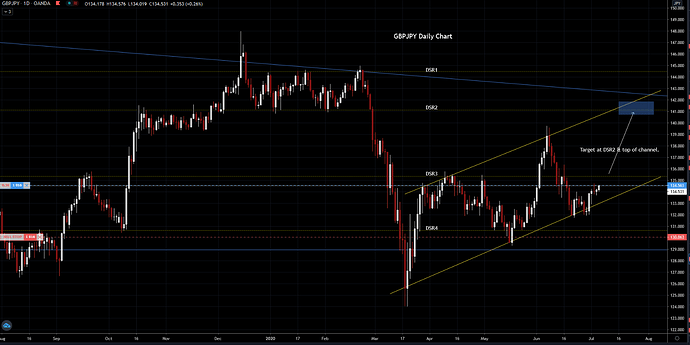

Was looking at daily S/R opportunities and came across GBPJPY, which is in a nice ascending channel.

It is approaching a daily R level (DSR3), however that channel looks pretty inviting, so let’s see if it plays out.

I will watch closely once it gets to DSR3 as it will probably retrace, giving me an opportunity to take some profits, then re-enter.

Long term target is in the blue box. SL is just below DSR4, risking 1%.

1 Like

EURNZD looks promising for a short, providing it breaks through both the daily and weekly SR areas. NZ is strong, so I have a sell order placed at 1.70900.

CADJPY - My short got picked up just below a daily SR level. Tight SL as I’m looking to target DSR4 (yellow line). If it breaks through that area then I’m looking at the monthly SR area (blue line, MSR3).

Well this one got away from me…

I was eyeing the Monthly SR level (blue line) but it turned around at another SR level I did not have marked off,

@QuadPip called it!

I will hang on and see what it does at that daily SR (yellow line, green circle).

Yesterday I posted that I took this long position on GBPJPY. I was waiting to see what it was going to do at that daily R level (DSR3). As you can see, it reached that area:

Looking at the 4H chart, it is now retesting that area:

A week ago I said I was watching AUDNZD, waiting for price to drop back down into that channel on the weekly chart. Well it has, and my short was triggered earlier. I probably could have waited for more confirmation, but I just have a good feeling about this one.

CADCHF - I am watching to see what this pair does.

Price dropped out of that channel and is currently sitting right on a SR level that has been tested multiple times since it turned to support in May. Canadian economy is still weak (something about a pandemic), but slowly improving as oil creeps up due to the country (World) opening back up.

If it breaks through I’m looking at 0.68150 level (DSR5). If it’s rejected again then I’m looking at 0.70100 (DSR4 & test of channel). Not much to write home about, but nothing’s moving very fast right now.

CADJPY - My TP was hit on this one overnight, then price was rejected at DSR4, again. I’ll likely stay out of this one today but will re-enter Monday if price breaks below this level. Next target would be MSR3, which is a monthly S area.

Price broke through that SR level slightly then pulled back up again. Looks like it’s indeed testing DSR4 as well as the bottom of that channel.

In my quest for a simple, reliable strategy to trade short time-frames, like 15 and 60 min charts, I have been playing with one that I call “Break or Bounce - 15M Mid-trend System”. I’m sure someone’s done it before in 100 different ways, but I have not taken the time to research it.

This strategy is designed to enter established, short-term trends, using only 2 indicators. Ich. Cloud and a 20 MA (I have the ATR on there to help determine my SL in pips). The idea is to wait for price to pass through the cloud, then either break the 20 MA, or bounce off of it. A bounce signals when you buy or sell. With the R:R preset you can set and forget.

SL 20 to 50.

RR = 1:1.5.

Enter after price and the 20MA both breaks through the cloud and are above (long) or below (short) the 20 MA, which must slope with the trend.

Here are some examples of buy/sell opportunities:

So far the results have been mixed, so I don’t have much data. But I will play with this over the next few weeks because I’m sure it’ll be tweaked a bit. I might reduce the SL or R:R a bit to give it a better chance of hitting the TP. Or take the TP out and use a trailing stop. Add SR levels, etc. There’s certainly more work to be done with this, I just need the time to do it.

Results for the above trades were:

- TP hit

- Closed with small profit before market closed

- SL hit

CADJPY is back on track. Moved my TP up a bit because there’s an area of support coming up around 78.70. I’ll likely close this one before the EOD.

Price broke through that SR level slightly then pulled back up again. Looks like it’s indeed testing DSR4 as well as the bottom of that channel.

[/quote]

And here we are again, testing this 0.69100 level…Has it finished its correction from the March drop?

I’ve got my eye on EURJPY.

It is in a daily and weekly area of resistance, and the CCI is signalling a sell. However, this is still in a strong uptrend, so I will wait to see if this reverses over the next few days.

Here are the top traded currency pairs, by volume, as of June 2020…in case anyone wanted to know:

This is according to

FXSSI, which has other interesting stats as well. I suppose this list could vary depending on the source.

And the full list (less the exotics):

Anyone trading patterns, here’s a rising wedge EURUSD (4H). These are typically bearish patterns.

AUDUSD - Testing a long term SR area. Double top?

NZDCAD - Regular Bearish Divergence on the daily. This can signify a change in direction.

Probability of a short opportunity coming up on the EURUSD at 1.1606. Stop at 1.1627.

Edit: If you took this trade, I’m very sorry if you got stopped out. I was in at 1.1605 and moved to breakeven when price reached 1.1585. Got stopped out and I’ve reentered at 1.1620.

1 Like

No worries. I am not trading short on this pair right now, it’s just too risky for me.