Hello, good day everyone.

In my previous post I showed how I managed to pass the FTMO challenge 3 times in a raw

Check it here:

Passing FTMO challenge multiple times (6 accounts) with consistent results on all of them, considered a success?

A lot of people massaged me, and asked for my trading style & tips and so on …

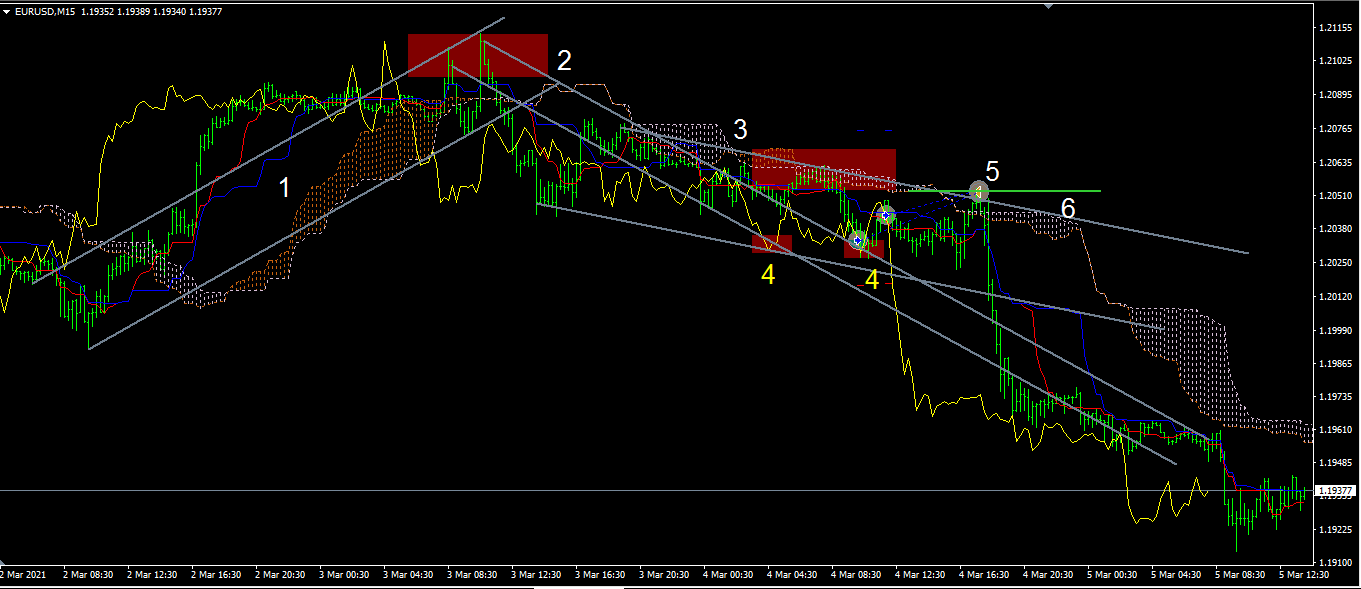

I decided to take a 4th challenge, and share it here live and show everything with complete transparency.

I contacted FTMO, and according to them no problem in sharing Investor’s credentials, so once I receive it I will post it here.

Please note:

- Don’t buy a challenge to follow this topic, if you can’t trade after passing the challenge there’s no point of taking the challenge in the 1st place.

- This topic is mainly for people who already have a challenge going on, and they struggling with it, as it become more stressful and it might influence your performance.

- Yes I passed it 3 times, doesn’t mean I will do it the 4th time.

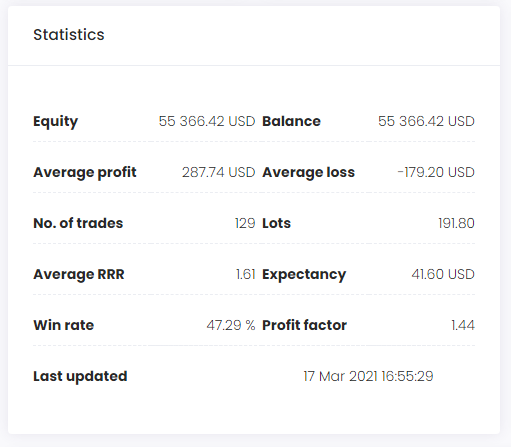

- I have win-rate of 55-65%, and there will be RED DAYS for sure, I lose 2-3 days in raw from time to time, don’t be surprised it’s part of the game.

My main Rules are:

- I will take 50,000$ account

- My Max daily DD is 2% (1000$) and (0.4-0.6% per setup), and it’s my max daily risk, although FTMO allow up to 2500$.

- Risk per setups are similar, no matter how the trade looks attempting, However, scaling will change from setup to another according to the market.

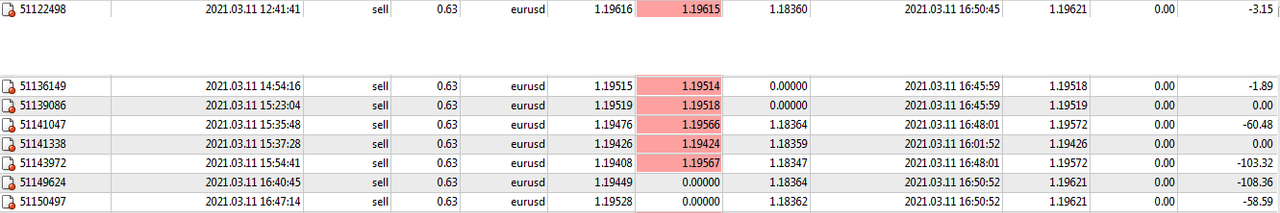

- All trades will have clear risk, and SL.

- I’m Intra-day trader, I close all trade before the end of the day or once I get to my max DD and call it a day, never hold trades even if they still valid.

Any Questions, feel free to ask.