I’ve thought about starting a public trading journal for a long time and I’ve finally decided to do it. This is a ‘business’ decision first but I also really enjoy writing so hopefully I can provide some entertainment along the way and even make some friends.

TL;DR (Too Long; Don’t Read) version:

- Been trading almost 4 years, since mid-2017.

- Lost somewhere in the $175 - 200k range to date (

Terrible Trader in the house).

Terrible Trader in the house). - Traded everything from Equities to Options to Futures.

- Recently shifted to FOREX.

- Had some early success in FOREX trading Long-only and zooming out to the 1H timeframe.

- Trade all Major Pairs and anywhere between 0.5 - 50 Lots.

- Strategy: mean reversion / retracement.

The Detailed Story

Brief History

I am from the UK and I live in Dubai, UAE. I have a successful career in an industry I hate which is why I am so motivated to make it at trading; something I love passionately. I’ve been actively day trading since the summer of 2017 … with zero success to date. I’m the guy the MarketMakers rub their hands together about when they see me log onto whatever broker/trading software I happen to be using that week. That means I’m approaching 4 years of pursuing this dream without anything to show for it. That’s a little demoralising but it’s a testament to my perseverence I guess.

2017 - 2019: I spent the first 2 to 3 years trading Equities predominantly. I threw in some Options trading from time to time but I never got to grips with the mechanics of Options. I tried every market and every strategy known to man and it was an utter disaster.

2019 - 2021: I discovered Futures. I really liked Futures because (a) the leverage and (b) the timings. I could trade /ES and /NQ all day, every day, which was attractive given my location. I traded my own money during much of 2019 and part of 2020 without success. There were some big, vomit-inducing losses (low 5-figure) during that time so around September 2020, I decided to try out for one of the online Futures prop firms (TopStep, Earn2Trade etc.). If you’re not familiar with these, you basically pay a monthly subscription and you have to complete a challenge/combine without breaking their rules. If you break their rules, you pay $100 reset penalty and you start over again. I cannot count how many resets I’ve had over the last 6-9 months. I’m guessing it will be in the mid to high 4-figure dollar range.

2021: I persevered with Futures right up until a few weeks ago. I got to a point where I was banging my head against a brick wall … again. I needed a fresh start. A clean slate. I never thought I would move to FOREX but I was running out of markets and instruments to try my hand at so I didn’t have much choice!

Like everything else in trading, I started at ground zero with my FOREX education. Up until a few weeks ago, I thought a Pip was something I found in an apple and a Lot was something my grandparents grew vegetables in. I don’t think I’ve come much further with my education of the lingo but I’m sure I will pick it up.

Why have I been such a terrible trader to date?

I put this down to a combination of technical and psychological reasons. I’ve never really settled on a defined technical strategy. To add insult to injury, as soon as I felt like I’ve found something that works, I get distracted by a new strategy and think the grass is even greener elsewhere. My psychological issues revolve around greed and impatience. I’ve been in such a hurry to leave my career behind that it’s had a profound impact on my ability to be disciplined and consistent. In short, I’ve probably set a record for being so bad for so long that it’s a wonder how I’m still persevering with trading.

Why am I starting this journal?

I feel like I’m finally seeing a little light at the end of the tunnel. I’ve had some early success in FOREX and I feel comfortable enough to start sharing my journey. I obviously want this to be a positive story and outcome, but I was never going to start a journal while still wandering around like a headless chicken without a strategy I believed in. I also think this will give me more accountability and keep me in check. The thought of posting a big loss is all the motivation I think I need to stick to some rules.

What is my strategy?

The only lightbulb moment I’ve ever really had during my trading career is to trade Long-only since moving over to FOREX. With the benefit of hindsight, my bias was so clouded and conflicted when I was looking for both Long and Short opportunities that I never had a feel for the market or instrument I was trading. I’m sure most of you are thinking, “Well, duuuuh!” but for whatever reason, I never grasped this fundamental concept, or, I was too arrogant to assume I could trade in both directions on any given day.

Something else that’s really helped since moving to FOREX is my decision to zoom out to a slower timeframe; specifically the 1H. I’m sure you guys are now thinking, “Oh jeeze, DXB has only discovered this after four years!? Get me some popcorn sweetheart, we’ve got ourselves a basket case here.” You’d be right. I have exuded all the qualities of a basket case and then some! But, for everything I’ve lacked in my trading career so far, I’ve got a plethora of determination and nothing is going to stop me pursuing my dream.

From a macro perspective, I’m looking for any pair that is oversold/over-extended to the downside and is primed for a reversion or retracement to the mean, and, by ‘mean’, I’m referring to the 20sma. If you’re looking for an example of something I love to see, look no further than the massive sell-off in USDCAD on 21st / 22nd May. Occasionally I will look to join a clear uptrend but those trades do not come naturally to me.

When I’ve identified a pair that is massively oversold on the 1H and is starting to find some support, I then start to zoom in to as low as the 15-min and look for a few different reversal patterns like Bearish Deep Crab to name just one. Like I said, sometimes I will look at bullish trends but I think I have a much higher win rate with oversold mean reversion trades.

Hopefully this will become a lot more clear as I post charts with my executions as this journal progresses.

If you’ve stuck with me for this long, here’s the fun bit for you readers. I trade anything between 0.5 Lots all the way up to 50 Lots. I’m sure you are certifying me as nuts at this point but don’t worry, it’s not completely irrational gambling. I’ve worked seriously hard in my day job such that I earn a very good living. I definitely don’t have liquid money to burn - a lot of it has been burned on trading - but I benefit from being able to replenish quickly due to my regular salary.

What have I lost to date since starting on my trading journey in 2017? I am deliberately avoiding answering this question with any accuracy because I don’t think it will benefit me in any way. But, in the spirit of entertaining my readers, I reckon it’s somewhere in the $175-200k range.

When/If I surpass $100k in FOREX profits on my Tickmill account, I will have the courage to upload all my statements onto a trading journal website and post a lifetime chart. It will still be negative at that point but I know I will be well on my way.

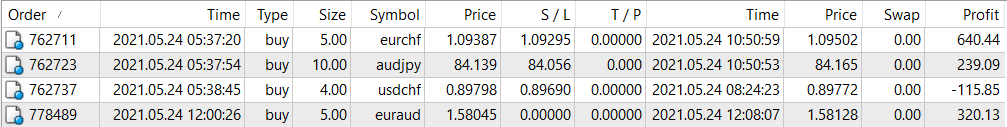

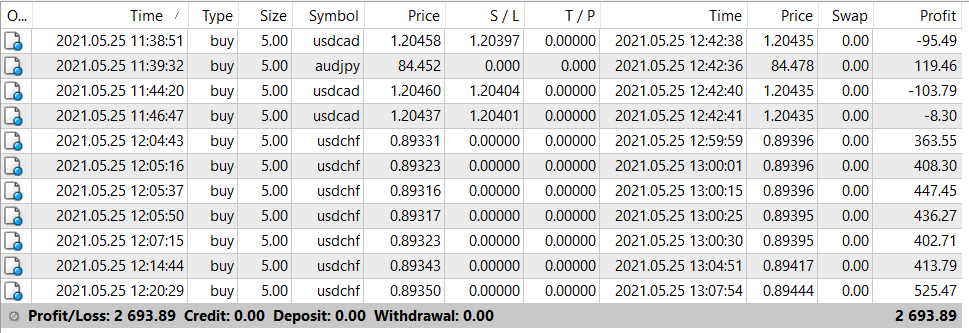

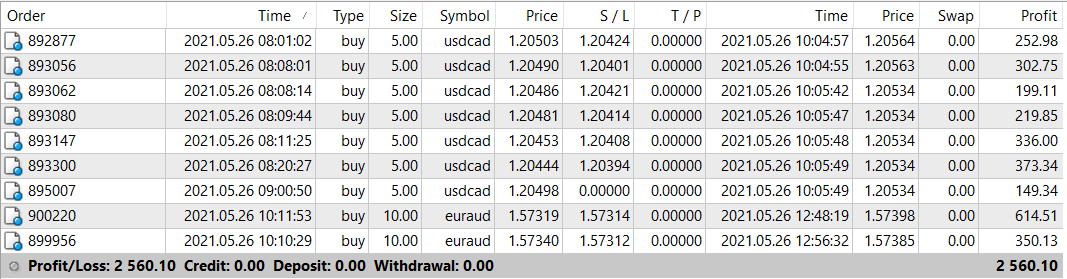

Tickmill sends a really nice Daily Confirmation email so I will take a screenshot of that for the time being while I decide on a trading journal to upload and publish my results going forward.

I look forward to contributing to babypips and enjoy the read!