Hey Mondeoman.

This will be good for me.

Simplify.

I guess I need to preface a lot of this with some things (I’m not your conventional, by the book, trader).

See. We are all taught this. With every trade, we are juggling these important factors.

- Take profit place

- Stop loss place

- Position size

- Risk/Reward ratio

All of these factors will help you in knowing, beforehand, what to expect from a trade. It’s setting up all of the boundaries. It’s all the controls we could possibly need to protect ourselves. Right? Plus, it does make sense to go about it this way. Can’t be too careful with your money. Especially with new traders.

Well, everyone usually starts out with these variables. On the contrary, no one should be having identical parameters on each of those factors. Everyone is different. Some want the trade to travel longer or shorter than others. And if shorter, then the position sizing usually will be larger, to make up for the distance needed to travel.

Basically, all I’m saying here is, where you normally begin a strategy usually boils down one of those factors, and how it will affect something else. Usually, where you want your take profit or stop loss usually will tell you how much of a position size you will go with. Just by plugging in those things into the position size calculator tool.

I’m hoping I’m sounding simple minded here. I think we all know this stuff. Sorry. But. I think it needs to be said. Why? Cause, I don’t approach my trades this way. Sure, there are some things I need to know (take profit place) in order to know how much of a position sizing I need. But. My whole entire point here, so far, is that I don’t play with some of those variables. Like a formidable stop loss. Even the R:R ratio thing. That is not in my vocabulary. Or my mind. It’s just not the way I prefer to think, about what happens with my trades. That’s all.

Let me try to explain my thinking that makes me arrive with my position sizing.

- No stop losses

- No time limits no how long they will run (swing trading)

- Basket of trades

- I track the market and follow it

-No stop losses

What happens if I’m wrong, or losing? Well, due to the fact that I track, monitor, and know how all the currencies are relating to one another (on a daily basis), I am aware of what’s going on. That means something. If my bias is wrong, then I’m able to change it (my direction).

-Trades run

I’ve learned not to put time constraints on my trades. You know how many times trades eventually come back around to what you originally were thinking? Yeah. Way more times than not. So, when it comes to trading, the biggest, most important factor is time. Just give it the time it needs to play out. Chances are better that it comes around to you, than if you put up these boxed up take profits and stop losses parameters.

-Basket of trades

This is a major dynamic that affects your balance differently than with only one trade going. It’s the difference between putting all your eggs in one basket, and spreading them out. There’s a hedging characteristic with this. And the only way to have any kind of control this way is to know what’s going on with all of the other currencies. But I have that covered. I do know what’s going on. Like, in a very detailed way.

-I adapt & follow the trend

See. I have accepted the fact that I don’t know what’s gonna happen in the market. Surprises happen all the time. I realize that. So much so, that I am ready to adapt and change when the time comes. I mean, I don’t care who you are, traders are always wrong, at some time or another. But, over a longer time period are we able to be more correct than not. I’m sure everyone’s read of the fact that the daily time frames and above have proven to be more reliable than any shorter time frames than that. See. All we can hope to get is an edge. I believe in the edge of patience. Give the trade the time and patience it needs to play out. But, you won’t find me putting parameters and conditions all around a trade, in order to be consistent. I think that’s impossible.

Anyway. Sorry about that nonsense. I’ll get into some very particulars now.

Well, Mondeoman, I’m trying very hard to understand your questions.

- Converting pips into lots?

- $'s per pip?

How about I go about it this way. Let’s look at the position size calculator, and the pip value calculator. But first, my account balance is $10,000 per currency I trade. That’s apportioned.

My total account balance = $80,000

Each currency will have $10,000

USD - $10,000

EUR - $10,000

GBP - $10,000

CHF - $10,000

JPY - $10,000

AUD - $10,000

NZD - $10,000

CAD - $10,000

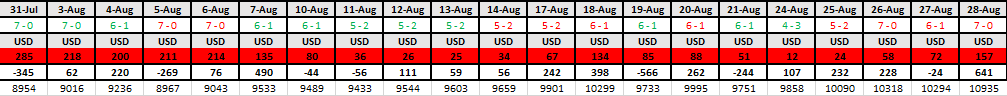

That’s 8 separate account balances. All tracked separately, according to how I trade that particular currency (my complete currency trade).

Think of it as being diversified.

If I trade, say the USD, then I go to that account. It’ll have $10,000 in it, in the beginning. It’s like having all my money divided up into 8 different buckets. It’s what’s apportioned to those different trades I could be in. Of course I won’t be trading all of them. It depends on what trading opportunities present. But I have to stay within those confines. Maybe I’ll find down the road that I have better luck with one currency than another. But, there’s many reasons why I have to do it this way. But the biggest reason is to be able to keep track of these basket of trades that I do (7 pairs at a time).

So, let’s take that example again.

The USD.

This is a complete currency trade. Aka…a basket of (USD) trades. 7 of them. Well, I need to put on some kind of position size on each of those 7 pairs. Right? Well, I’m putting on 20,000 units of size. On each pair.

This is what the Position Size Calculator shows. For 1 USD pair (USD/JPY)

Even though I don’t have a stop loss, or a take profit, I still need to have some kind of travel I want the pair to demonstrate. And, for me, that would be around 100 pips. Of a stop loss, and a take profit. If this pair would travel around 100 pips, to the positive, I would be pretty close to taking profit. And if it travels around 100 pips to the negative, then I would be switching directions.

Anyway. On the right side, up there, shows what 20,000 units of a position size looks like, of a notation. Their all the same thing. You can call it 20k

- units

- lots

- mini lots

- micro lots

I think it’s in MT4/5 where they make you use the .20 terminology. Which will actually be how many actual lots. One lot is really 100,000 units. So, only 20,000 units will be equal to .20 lots. Right?

And here is the Pip Value Calculator

So, if you would want to know what one pip of a travel equals, it’s $1.89 for every pip it goes. On this particular pair.

I guess you won’t understand how this type of trading (basket of trades) actually turns out, unless you’ve tried it. I’m telling you, the dynamics are something to get used to.

On your account, you will have 7 USD pairs running at the same time. With 20k units on each pair. So, your account balance will be going all over the place. But…that’s exactly what I am looking at.

The account balance.

It’s the net outcome of what 7 pairs are doing. It’s not what one pair is doing. It’s what all 7 are doing. 4 pairs can be going strong, and 3 pairs can be going weak.

All I can say is that unless you’ve tried it, you won’t understand. I remember when I first traded this way. Probably around 5 years ago or so. The swings that can occur are really something. There’s a particular dynamic that takes a lot of getting used to. Trust me. It’s not even close to what one pair does.

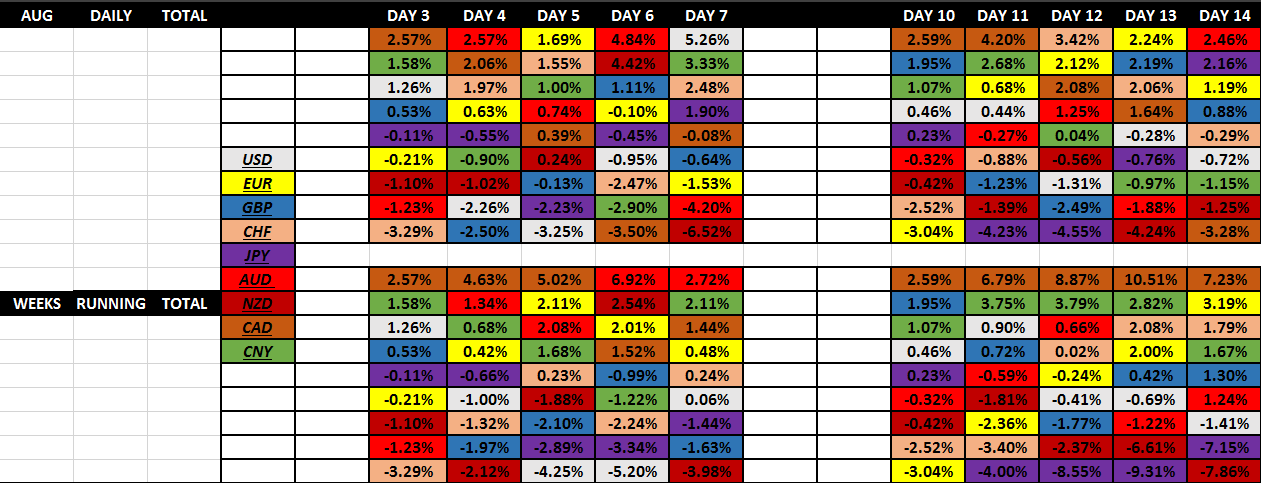

Look. This is how I see the market. In aggregate. Meaning, the total sum of all the parts.

It’s how I track the market. As complete currencies.

Oh, but let me back it up a little. To finish a trade of mine.

A trade runs until it hits a take profit place. Which will simply be a level of where my account balance gets to. If it reaches the amount, then I jump. Manually. And of course, I have to be awake for it to happen. No automatic amounts on each of the 7 pairs. Nope. It’s the aggregate amount, remember? I’m not gonna know who outdoes who when it comes to the 7 particular pairs. What I want is a specified amount of increase, of my account balance.

Well, when my account increases 49% of that particular account balance (10K), or 6.12% of the total account balance (80K), that’s when I will exit out of my trade. It’s not the where. I should throw this up there again.

Presently, I’m in 3 trades. I won’t touch it until the T.P. Point is reached. Which will be $14,900 of an account balance. That’s all I’m doing, is letting these ride until the account balance is reached. It could be days. But you’ll see how it all plays out as I update it.

Look. This is just how I do it. It fits. It’s the only way I will trade.

And it all originated back when I came across the best thread that ever got posted.

Now that thread explains a whole lot on how to trade a basket of trades. I even think Clint tries to explain the risk reward dynamics of basket trading. It’s almost impossible to do. I think that was his final estimation about that. Anyway.

Mondeo…What else can I say?

If you are trying to understand the way I trade, I would suggest you read that thread. At least you’ll definitely see where the roots of my trading originate from. This is just my version of the way MasterGunner traded. That’s all.

Alright.

Let me know if I can answer any other questions.

Thanks.

Mike