Good m…afternoon Journal!

Yeah, this is a switch, being in here in the afternoon on a Sat. Normally it’ll be early in the morning. I’m a morning person. But today’s turning out differently for us. My Trish had to leave for the day (with her girlfriend), but not before we had to get our shopping done. Yeah, we had to do this quite early today.

So now. All done with everything. She’s gone. And very quiet around here. All I plan on doing is working on my business. This will be my first stop. I can explain a lot of things I’ve done this week, which is very helpful for me. And then, when I’m done in here I’ll have to look over my Business Journal. See, I don’t do anything unless I’ve started it in there. I write stuff down, like all my trading decisions, my thinking, actually anything that I do in my business. And well, I need to go over all that stuff. The weekends is definitely the time for that. Right?

Anyway. That’s nice.

Let’s see. How about looking over what happened in the market this week. Look. I don’t know about you, but when it comes to this review stuff, I’m not all that keen about it. My first instinct is to say something like this. “All of this is the past! We’ve lived through it already. So why rehash all this nonsense? What happens in the future is new stuff, not old, right?”

That is one point of view. But when I think about it, there’s another point of view. I think I’ll call this a narrative. Kind of like a story. We kind of need to keep up with it. There’s things that have been happening that we shouldn’t forget. So, let’s talk about these things. You’ll see what I’m talking about.

I’ve come to learn the best way to look at these currencies is on a weekly basis. In that context, I believe, is most prudent to look at. Back and forth they always go, but there always comes that break in the action on the weekends. We are all forced to step back and analyze the sentiment.

Last weekend was going something like this.

- USD been bullish. Most bid currency in the first week of this month.

- CAD been bullish. Been wondering which side of the fence they’re riding on. With the Comms…or with the USD?

- Comms (AUD, NZD). Seem to be faultering a bit. Just not too strong this month so far.

- Safe haven buying been happening (last Thurs quite prevelant).

Alright.

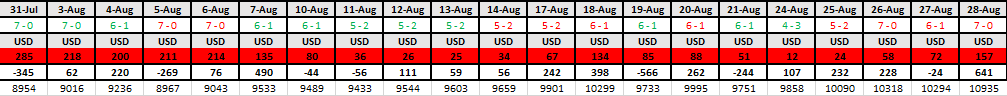

With all that in mind, let’s see some numbers this past week.

The top part is the month running. Each day been added onto from the last. The bottom table is the individual daily results by themselves. Lastly, results of that week.

So. Some questions.

Who was the most bought currency this past week?

Who was the most sold currency this past week?

Risk on currencies compared to the safe haven currencies?

- The safe havens are more bought. This past week, and since the beginning of the month.

The CAD is running in confluence with who more?

- The Comms, moreso than with the USD. In the monthly context.

Big game changer day.

- Tuesday. USD and the JPY most bid currencies. But also their respective bear trends changed to bull trends at this EOD.

The most volatile currency.

- The GBP. I’m pretty sure the BREXIT scenario has caused this nightmare.

Alright. That gave us some kind of feeling about the field. Right?

How about we zoom in a little more. Let’s look at some trends.

I’ve already mentioned the USD, and the JPY. So, we’ll start with them.

Well, remember at the onset, how I mentioned that they’ve been having a bought up month? And been wondering whether that will continue? Well, there’s the numbers. They go from quite a strong bear market right into a bull market and continues pretty deep in, so far.

Journal, I’ve always told you how similar those 2 run. Here’s the proof. I don’t make this stuff up.

I want to make a point about context.

Look at Wednesday. If someone just woke up and seen all that selling of the USD and the JPY that day, without the knowledge of what’s been happening lately, they would’ve thought their respective worlds are crashing. Nope. On the contrary, they’ve just retraced a good portion of what they lost the day before. And the market goes for some more on Thursday.

It all needs to be put into the proper perspective. My estimation of their trends change over from bear to bull, on that day. I remember it. I did feel the change in the air that day. Anyway. The complete currency pip count is as follows.

USD

Monday = +236 pips

Tuesday = +488 pips

Wednesday = -309 pips

Thursday = +263 pips

Friday = -88 pips

Total = +590 pips

BTW…For the USD, on Monday, that’s a -236 pip result due to being in a bear market. But up above I counted it as positive.

JPY

Monday = +234 pips

Tuesday = +638 pips

Wednesday = -423 pips

Thursday = +302 pips

Friday = -121 pips

Total = +630 pips

So. Remember all last month I was thinking that the USD was gonna turn and burn? Into a bull market? But never did!!! Well, now it comes. Better late than never, I guess. That’s so typical. We always seem to get things right, just not at the correct timing. We should all know by now, that timing is everything.

It was a busy week, this past week. Not only did these 2 change trends, but others did also. Can you guess who?

Sorry to even mention it. But the Pound lost their butts. I’ll go over this quickly.

Monday = -719 pips

Tuesday = -843 pips

Wednesday = -399 pips

Thursday = -1360 pips

Friday = -246 pips

Total = - 3,567 pips

I’ll have to go over how I navigated these trend changes, in regards to my trading. You remember Journal, what I do, right?

FOLLOW

Well, the quick of it, was… I lost that first day of the week, of course. But then I was short the GBP every day thereafter. So yeah, I made the pips.

Let’s don’t stop here. We got more currencies that turned the bend.

The CHF and the EUR.

Now the Swiss makes sense. I think they are being caught up in the safe haven buying. And well, the EUR. IDK. Probably because of what’s happening with the Brexit situation.

CHF

Netted +857 total pips this week (for long).

EUR

Netted +611 total pips this week (for long).

And again. I had to navigate these 2 for my trading. When they switch, then so do I. But I had to wait until Friday mid day to do it. Needed to make sure they would end up this way going into the weekend.

I do have to tell you. My numbers are very skewed because of the Pound. Let me explain.

What do you notice different on how they ended?

Everybody is in a bull market, except the GBP.

This has never happened before.

How can this be?

Let’s look closer at the GBP.

Last weekend at this time they were sitting on a bull market. 67 pips in.

To come up with the aggregate total (on the right), all I am doing is adding up the individual pip spreads, per each of the 7 other currencies.

Well, those are some big pip spreads, per each pair. That, in effect, will make those other currencies quite plentiful with their totals. Skewing them majorly. Look at the worst one. The CAD.

They are in a bear market against every other currency, except the GBP. Right? But add up all of their totals. That puts them aggregately in a bull market. Cause that 105 is so large, that it covers all of the other ones. What does this mean? Really.

There’s 105 pips of a difference between the 5 ema line and the 9 ema line on the GBP. But not all that many between all of the other ones. See that 1-6 number? That means they’re bull against 1 currency and bear against 6 currencies. Normally that number won’t drop below 3. But it sure does now, huh?

Here’s the GBP chart.

So. If you look back at their table. The GBP/USD pair has 93 pips there, right? That’ll be 93 pips in between the 5 and 9 ema lines on that particular pair. That’s the latest result on that pair. And so on, with the other pairs.

But that’s all I’m doing in order to find out these currencies’ trends. I’m adding up the 5/9 pip spreads. Getting a sum total aggregate number. That’ll be the answer.

Let’s look at the CAD chart.

You can see that on all of the pairs (except the GBP) that the 5/9 pip spreads all favor the non-CAD currency. You can just look above at their trend table. Those are the spreads. Like with the USD. There’s 13 pips in between the 5ema line and the 9ema line. Favoring the USD of course.

Well, all I have to say is. This is one of the perks of trading a basket of currencies. You don’t have to be correct on all of the pairs. In fact, even most of them, either! Cause just take a look at my GBP/CAD pair. See where I got in on that one? Yeah. What’s up. That’s the top. Been riding that sucker all the way down.

And why is that? Cause the CAD has not changed trends yet! Technically they’re still in a bull trend, thanks to the GBP of course. You’ve seen those numbers up there. Sure. It’s skewed. But my account is in the positive. Look.

Look at the pip count, for my trades, on the top right. And how many am I in with the GBP?

A lot.

Anyway. This is basket trading for ya. I love it. I don’t have to be right a whole lot. Just aggregately speaking.

So. Getting back to the point.

Which is…

The GBP skewing up my numbers?

shrug

I took profit twice from them this week.

And as far as every currency being in a bull trend, except the GBP, then so be it. Someone can just look at that one pair (GBP/CAD) and say it’s in a bull trend, right? Right! So then, that’s just the way it goes I guess. I know that the CAD is slipping away, aggregately speaking, but not as much as the GBP is. In effect, the GBP is the only thing keeping them in the game. What can you do though?

Well, I better wrap this up.

So, let’s see. What can we say about the current state of the market?

- Most of the attention has gone to the GBP. It’s a sell.

The monthly running %'s.

- The safe havens are being more bought than anything else.

- The Comms are slipping away.

- God bless the Queen.

Alright Journal.

Gonna fly.

I’ll come back with what my trading has been up to.

Mike