Good Morning Journal!

Good Morning Mike.

Well, I figure I should get you up to date on things.

I don’t know, this week has taken a bit of a turn. As I have seen on the very last thing that I posted about, I’ve been wandering lately. I’ve just been wondering what I should be sinking my teeth into. Well, it goes like this. I’ll put it all into perspective.

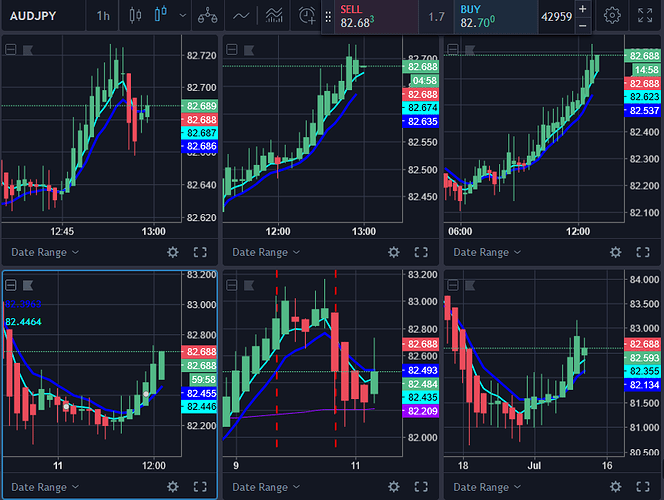

The first week, which it all started at the beginning of this month, turned out to be an acclimation period. To the day trading thing. You seen it. I thought I should be, well, day trading. And as it turns out, I realize that I just can’t work off of the 5 minute charts. And then the 15 minute charts. Man, just too up and down for me. But then, I settled on the 1hr time frame chart. That was all settled at the end of that first week, on the weekend.

So then, I knew what I should be doing next. That was to put all the building blocks into place, via my mind maps. That was a long time coming, in which I learned from being mentored back almost 2 years ago. And yes, by the end of that week, I felt good with the structure, my routine, just all of the base stuff that I would work off of. I’m a very organized person.

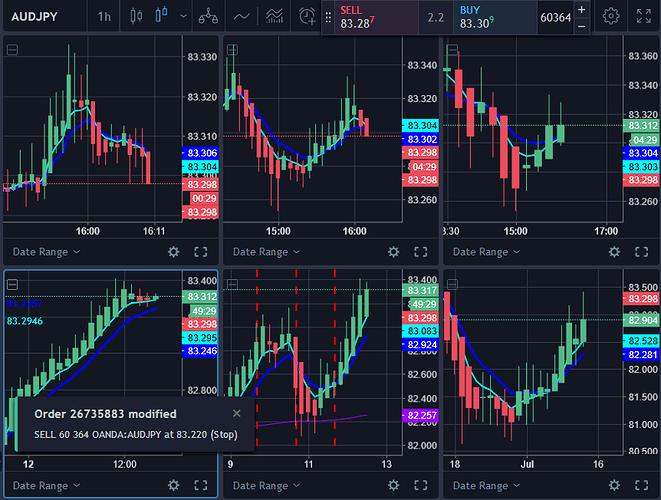

The third week mostly centered around the specifics of my strategy. I felt I needed to get to the bottom of the specifics concerning how I generate money. Each and every trade got some serious diagnosis. And we’re talking about as it happens live. By the end of the week I came up with a good trades templet to work off of. So, the microscope has been out concerning my trading. Resulting in rules, lessons along the way. And now I’ve gotten to the point where I can’t tweek my strategy too much more.

And that has been continuing this week. But, given the circumstances of much waiting, in the market, I’m not as busy as I would like to be. See, I want, and strive for productivity. I’m talking about getting the most important things accomplished. So, that requires a lot of thinking. I remember at the beginning of this week, been killing myself about what’s next. But what keeps me in check is trying to figure out the best thing to work on. I don’t want to waste time by digging into stuff that’s just not the most important things.

Well, that’s exactly what the theme has been, in fact, all week. What should I be working on? And now it’s Friday. All I can do is hope for a plan to come to mind.

I will tell you my latest, getting ready to pull the trigger, idea. This is the thinking that got me this far on it. Tell me what you think, Journal.

Doesn’t it make sense to broaden my scope on the way in which I will generate an income? We would be talking about strategies. Like another one. See, the first thing that comes to mind about all of this is the whole anchor trade thing. Yeah, it does make sense to start there. Well, my question is, then when do I start developing other avenues? Like my son would say, streams of income. Sure, you need more than one. But, I don’t want to spread myself out too thin. I mean, I’ve read so much lately about how it’s smartest to get good at one thing. Excel in that. Perfect one thing first. And that’s exactly what the purpose of the anchor trade is all about. I can hear Terry in my ear now. “You should always have an anchor trade in which you know you can make money on.”

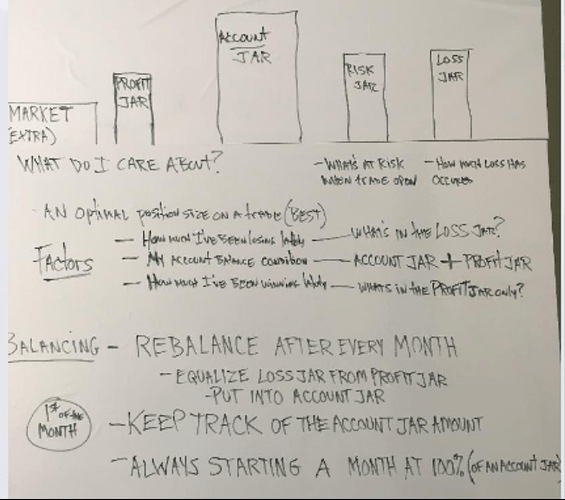

Alright, I agree. It’s where you start. So therefore, do I have that now? Well, I’m making some serious headway with it. It’s progressing in real time, with the market. I’ve been making a profit from it. Definitely the gains are larger than the losses. That’s mostly due to my awesome money management system in place. Geeez. I will have to show you the latest numbers. I’ve been realizing, as the way my strategy works, that you don’t need to risk a whole lot to make some good gains. Some trends are bigger than others. And I know, well, I truly believe anyway, that down the road, this will be successful. I do need time to bear it out though.

Anyway, back to my idea. Why wouldn’t I start thinking of other strategies? I mean, it’s got to be endless, the amount of different ways to take advantage of the market. And how about other markets also? Now, that’s gonna take some learning. See, why couldn’t I start reading, and learning about these things? Look. I’m not saying to forsake what I’m doing now, whatsoever. I will continue to document each trade like it’s life or death.

This is a business. The engine that produces the income, in my business, starts with the strategy. Sure, all of what goes into a strategy is monumental. Well, for me it is, cause I need specifics. Ok, yeah, given that I’m a perfectionist, it takes awhile to develop. But, I need to stay on the cutting edge. I need to get creative. And I’m not talking about reinventing the wheel here. I’m sure I keep some foundational principles, on what I feel works best for me.

The possibilities are endless. I can just start learning about another market. Say the futures one. And keep a lot my principles the same, just with a different instrument. Or, I can get away from the risk-on, risk-off whole premise. Let’s see, what else is there? Uhhhh…well…how does the money flow, in another way? Everything seems tied to the stock markets. Which are risk on. And commodities the same. Well, I guess there’s always the bond market. Man, that’s going to take some learning. I don’t know anything about how that works. Well, lets’ see. From the beginning, I’ve always thought that currencies was the best place to start. Then I would work my way from that. So, would I want to laterally move to a different currency? Or move out into another market? See, the currency valuations seem to correlate with their particular stock markets. See, that’s the thing that I hate about the equities. The only way to go with them is up. It’s a no brainer. Everybody is wanting growth, by way of investing in the particular companies. So, I guess it could be good to find when it’s most conducive to get in there. When there’s buying going on. Which would correlate to a weakening dollar. I know, it’s not all the time that that happens.

Well, I definitely think the correlation of the bond market is more closely tied to the equity market, within that country. I would rather go with the bonds than the equities though. I just hate stocks. I like to see the bigger picture, than for individual companies. Probably because everybody’s doing it, seems like. I don’t know, I’ll probably only go as far as indexes, in regards to equities.

Ok. I’m getting a little off track here. See what I mean? The possibilities are endless. That’s the point of all that nonsense up there. Sorry.

I should probably build. Somehow. But, the question still remains. Do I stay in the currency market? Make a lateral move somewhere? Well, in any case, this is where I get out my marker and start writing on my wall. I would ask question after question. Figure out where I want to go next.

The whole point here is that I want to build another engine. I guess that could mean come up with a different method. Like, what’s the opposite of a trend? Well, that would be a contrarian. Reminds me of an awesome article someone recently wrote up about, here in B.P’s. Or, how about taking my indicator into another pair? I don’t know, maybe it works better on another pair. Hey, maybe the trend is more consistent and manageable there. See, I don’t know this if I don’t do some leg work.

Now, that might be a good idea. Because, I’ve done so much work on it, and all I would be doing is changing the pair. Therefore, I can alleviate much of the learning part that comes with changing stuff. That seems like me. I can’t pick up things too quickly. Need to branch out slowly. This is important business. I can’t afford to be making too many mistakes, as I go.

Alright Journal, sorry about all that nonsense. I think I’ve figured it out. It’s too soon to branch way out. I need to stick to my first love. Currencies. But, I am a trader. It shouldn’t matter what I trade, actually. But, my methods of getting in and out shouldn’t change. Maybe later on after I’ve gotten so good at it that I could experiment with another way. Same with the markets. I need to get really good with this one first. Then again, how do I know this? Do I have experience in any of the others? No. How do I know whether this one is the hardest or not? I mean, if I can trade, and I have started with the hardest one, and if there is an easier one to manage, wouldn’t I gain success quicker there, than here?

Well, I’ve spent so much time in the currency market. Yeah, my entire existence. I need to see it to the end. First and foremost. All this work needs to produce. Kind of like me reaching the end of the road, and not sticking around to see the fruits of my labor. Which should be the best part!

I’m on it Journal. The plan is going to come together today, for to start next week. I’m going to keep my tool box in hand and travel a little, across the way.

So, tomorrow’s Saturday. Yay! I’ll get one more good run in, for the week. And then, grab the coffee, sit down here with you and talk some more.

Don’t worry, I won’t talk stupid. Let’s see. I can talk about all the trades that have been taking place. I got much data that I can throw out to you.

Alright Journal, see ya in the am.

Mike