Great to see you back Mike

Hey Journal…

Well, I have some time on my hands now. I was thinking about continuing more of what I have been explaining lately, my strategy. But no. I have some catching up of some numbers. That’s what I’ve been doing here. But you know what?

I thought of you!

I thought this would be a good time to explain where I am coming from. I can walk you through the heart and soul of how I determine what a trend is. But, let me explain a little bit more, first.

I trade the JPY. You know that. But. I have a system in place. And my system has nothing to do with the Yen. Remember? It’s following the market. Pure and simple. Well, I figured that, as the year progresses, there should be no reason why I can’t follow proof of concept along with the other currencies. Right?

I mean, will this work with the USD, the EUR, the GBP, etc…? I’m not gonna know if I don’t keep track with those others. I mean, what else am I going to do with my time? Right? And that’s what I’ve been doing now. But, I want to walk you through this process. And believe me…this is exactly how I do it with the JPY. The only thing is that I just do not trade any other currency. I will have the numbers though, for all the rest of them.

Alright. I progressed all the way up to the AUD. I will walk you through the process, as I’m doing it right now.

This is the AUD.

What’s their trend look like? I’m gonna show you how I come up with the aggregate number. Ok. I’ll start with the top left (USD). That’s in a bear market. See how the 5 ema line (yellow) is below the 9 ema line (green)? By 13 pips. There’s 13 pips of a difference between those 2 lines. Ok. So, on my calculator I’ll put down a positive 13. Why? Because I know that they are in a bear market. Look.

I’m working on Jan 10th’s number right now. Well, see the red for Jan 9th? I made it that way to tell me that they have been in a bear market. What that means is that if I was trading them, I would want to short the AUD. Right? Their trend is a bear market. They started out the year in a bull market (the green blocks in Jan 1st through 3rd. The number inside there is how many pips in that market. You can plainly see that the totals have been declining. Then they eventually turned into a bear market (their weak). That is the trend. They do seem to be leveling out up there around 172-173, right? Let’s see what Friday’s end of day figure is gonna be.

USD equals 13 pips (bear market). EUR equals 21 pips (bear market). GBP equals 26 pips (bear market). CHF equals 16 pips (bear market). JPY equals 7 pips (bear market). NZD equals 9 pips (bear market). CAD equals 20 pips (bear market). Let’s add them all up. 112 bear market. I have to input that.

Look back up to their chart. All I’m doing is adding up the width that’s between both the yellow line (5 ema) and the green line (9 ema). I mean, you can see that in the last couple days that there has been some kind of turn going on, right?

Ok. Moving on. I need to fill in the “DAILY TOTAL” number, and then my excel spreadsheet will automatically fill in the “RUNNING TOTAL”. And all I’m doing here is simply adding up all of the 7 daily candles, in pips. As you can see we’re going to have a pretty large number. I’ll add them up. They totaled 389 pips.

You got to remember. They are in a bear market. So, all those pips for the positive is not good. It’s on the counter trend. Let’s start with the beginning. Jan 1st, if you were trading them, you would be going strong AUD (bull market, green). And that day would give you -8 pips. Then Jan 2nd gave you +25 pips, resulting in a running total of 17 pips. Then the 3rd would have produced a -294 pips, resulting in a running total of -277 pips. Then, the 6th. Ok. Well, this is the hardest part. It’s the switching of the trends. I simply do not know how to reconcile this, because at the end of the day (literally), only then do I know that the trend has changed. Actually, I do have some ideas. I’ll talk about that at a later time. In any case, that day, the 6th, produced 335 pips for a bear market. Meaning, on the charts, you will see that all of the AUD pairs will equal a negative -335 pips. And the total running amount of pips that day will come to 58 pips. Well, the next day, 7th, the AUD really went negative. It was a total of 536 pips for a bear market (negative on the charts). See. All I care about is whether I’m going with the trend, or against it. Oh, and that middle number, again, in the blocks, is the pip spread. That’s kind of like showing how strong or weak the trend is. Right? All I’m doing is looking at the spread between the 5 and 9 ema’s. Adding them all up for a total aggregate number.

Let’s look at the NZD.

Nothing real exciting going on there. On Friday, they, along with the AUD, boosted up high. Well, their respective markets have both been in bear markets. And that just results in negative pips for that trend. Or I can just say that they have been counter trending, on that last day of the week.

Ok. So. Bottom line is this. If you see positive numbers, that means they are trending in that particular trend. If you see negative numbers, that means they are counter trending, in whatever trend they happen to be in with. It’s that simple.

How about the last one. CAD.

They have been in a bull market, since the beginning of the year. Quite strong. But, since the 7th, they’ve been counter trending. See the middle number in the blocks? 119, 108, 99, 76. Again, those are the totaled pip spreads out all of the 7 CAD pairs. I like to call it the aggregate total. It’s just one number that tells me how they are doing in relation to all of the other currencies. And yeah, all of the other currencies have that one number also. Now, with this one. If you would have traded them long with the 7 pairs, year to date would have produced 385 pips (the running total).

I’m not trading any of these other currencies. But, what I am doing is coming up with proof of concept of my system. And more precisely, it would be that running total number. All I want to see is that it’s a positive number. And of course, over time, to see it increase.

Look. I know I threw out there a bunch of nonsense. And it’s getting pretty late for me. I’m gonna come back in here in the early morning. I will concentrate on my JPY numbers. Like, I’ll show you how this year has been panning out already. And that’s what I want to be doing. Nothing but a simple tracking of my system.

Alright.

Good night Journal.

See ya in a few.

Mike

Good morning Journal.

Well, the coffee is nice and hot. Very quiet around here. Still dark, but we still do have our Christmas tree up. I just love the lights on it. We have multiple settings with the lights. And different color patterns. I can get it to blink rapidly, or slowly, or just stay softly lit. It’s an awesome tree. And I don’t want to take it down just yet. Nope. But, we did, yesterday, take down our lights outside. That’s because our neighbors have also. It’s kind of like the competition is over. Our street was looking good. See. We live at the end of a circle. And, yeah boy, we lit up the circle alright. If you would drive, in the dark, coming down to the end of our street, we lit it up nice and bright. We had lights strung all around our bushes. In a couple big tall trees in our yard. On our porch we had the icicles (lights) hanging down. On our 2 big columns (that holds up our porch), from top to bottom, we had some nice red lights twirled on down. Man…I think we do a good job every year with that. It’s like…we’re worthy neighbors.

Well Journal…this is probably gonna be the last year here for us. I mean, we have to move. The rent is way too high. And the biggest reason why we stayed here was because of Ben. It’s not easy to find a place to rent that excepts pets. That surely is a deal breaker for many landlords. It was an absolute miracle we found this place, I remember. Plus, this is a 4 bedroom. And all the kids are out. And now it’s just me and Trish. Our yearly lease is up around April. There is no way we can do this for another year. It’s been 6 or 7 years ( I can’t remember exactly ).

Anyway. That’s nice. This year moving forward is gonna be interesting. It just might be the year of change. I mean, a major change took place already, and we just started! Well Journal, as I have stated before, I do plan on journaling my way through it, in here. Look. I’m sorry for all the nonsense. On the one hand, it does seem so stupid. I realize that. It’s like a one way street. All I’m doing is talking away here with really no one there to respond back. Like it’s just weird. I know.

But, on the other hand. It is therapeutic. I mean, I do like getting things off my chest. I always feel better afterwards. And…I do have to say…I feel drawn to be doing this. I kind of think God actually wants me to. Man…I know I’ve went off the deep end. With that. You know…God. But I’m sorry. That’s how it is. See. I don’t think there’s any more important characteristic quality to me than honesty Seriously. In my life. What I truly want, and expect, from myself, is honesty. Also from others. Man, if everyone was as honest as possible, this world would be a much better place. But, what we have (the opposite of that) is a lie. Boy do I hate lying. I despise lying. Well, I’ve been that way for such a long time now. I have not lied to Trish the whole time we’ve been together.

I’m an open book. And the reason is because I have nothing to hide. Trust me, I understand how humans are. Humans lie. But, to be most correct, I would have to say that it’s what we really want to do. Look. It’s the sinful nature. Anyway. For as much as I demand truth to be coming out of me, I guess I expect that to be the case from every other human. But, it’s not the case. Everybody is different. And I’m sure a lot of human beings just rationalize away the importance of being honest to one another. Even to themselves!

Anyway. For as honest as I can be, I’m gonna have to include God. More than anything, I believe He’s the truth. About everything.

Ok. I won’t expound a whole lot on that. I’m just gonna say that we are close and getting closer.

So, how about some more coffee!

BRB

Alright. Much better now.

I want to get into my strategy.

It’s the JPY.

See, when I talk about them, my trading, it will revolve around them entirely. I’m not talking about one pair, I’m talking about them aggregately. 7 pairs of Yen.

Ok. So. More precisely, it’s in whatever trend they are in.

All I’m gonna do is follow that trend. And change when it changes.

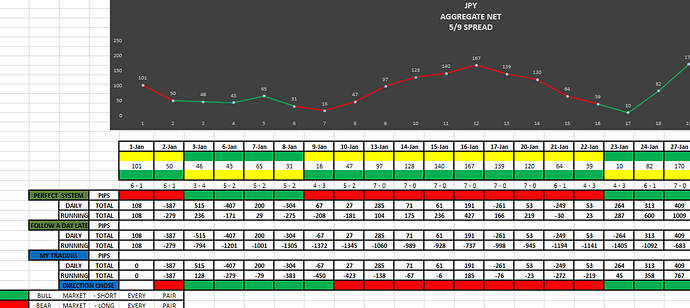

Ok. I’m gonna show you my most loaded, important, piece of data.

First off, forget about all the writing on the left hand side.

All I’m gonna do is follow the chart, above. If the line is red, that means the JPY is in a bear market. Makes sense, right? If it’s a green line, means the Yen is in a bull market.

So Journal, that’s my strategy in a nutshell. There’s nothing else so important than for me to follow whatever color (trend) it’s in.

Just below that line chart is where those numbers came from. All they are is the daily total aggregate outcome from that day. Let’s move along as the year did. Well, the JPY has been in a bear market since Nov. 26th. So, that’s how the first of the year started (red). At the end of Jan 1st, I tallied up the numbers and the JPY continued in a bear market with a result of 101 pips (of the 5/9 spread). During this time I didn’t start trading yet. I was in between thinking of when to start my first trades. So, right now, we’re at end of day Jan 1st. That’s my result. And then that’s when I place my first trades. BTW…all my decisions and trading will be at end of day only. I remember being nervous. This was my thinking at the time.

Ok. So what market are we in? Bear. Ok. Then that means I place my 7 trades shorting the JPY. That’s: long USD/JPY, EUR/JPY, GBP/JPY, CHF/JPY, AUD/JPY, NZD/JPY, CAD/JPY. 7 trades. I have my already determined position sizes. 30,000 units per each trade. Why? Because my account balance is $30,000. Demo account. Of course, real to me as much as a live account.

So, now what? They are just going to run. It’s that simple. No take profits. No stop losses. Just run. Of course, I’m pretty much always abreast of what’s going on in the market. Check in from time to time (due to no stop losses set). So now, Jan 2nd comes. End of day. First thing I do is run all the numbers (btw…I still keep track of all 9 currencies…CNY added last year). Remember my thread Currency Dynamics? Still doing it. And probably will till I die.

It doesn’t take all that long. Now I have my results. I need to throw up again that pic, cause it really is loaded.

The result was 50 bear market. It dropped down from 101 the previous day’s result. Still in the bear market territory, right? So, the pip count comes out to be -387 pips. Meaning, the JPY has a strong day. Oh, I remember that day. Yeah boy, the pip count got really high that day. I seen it up around 500 pips. Of course the end of day always levels things out. The JPY got super strong. So now what? Well, I have a rule of thumb, that if I see more than 380 pips of a counter trend take place, I switch trends. Man…Journal…I remember that night. I was sitting there pretty scared. I know what I got to do. The JPY is changing trends, man! So, just do what I got to do. Alright. That’s what I did. I jumped out of all 7 pairs, took a loss ( -387 pips remember?), and got right back in going JPY strong this time. Well, I know I was nervous about this because when I woke up the next morning (at the start of the London session), I remember my thoughts. Either I made a good move or not…I will either see some red candles or green…and hoping for some red candles. Man…I just hate it when my thoughts run to the market first, instead of my God! He knows. Anyway. I checked my phone. And it took only 2 seconds worth of a look. Every pair was printing a long red daily candle! I was relieved. Man…I made the right move. See, the day before surely showed how much strength the JPY was coming with. And it did seem like it was gonna continue. Well, it surely did. From time to time I would check in to see how the daily candle is shaping up on all of my 7 pairs. Still red. Looking good. But that’s it. I’m not gonna be captivated by the market and what it’s doing. I just want to be aware of the market sentiment. Surely the Yen is switching trends. And I’m on the right ship!

So, now were talking about the end of the week. It’s Friday Jan 3rd. There’s no rush for me to run the numbers because the market is closing and ending for the weekend, right? So, I get around to running all the results. And sure enough the trend does change. You can see it there. 46 pips of a bull market now. And also the pip count was impressive, 515 pips for that day (DAILY TOTAL top row).

You can see that I’m keeping track of the perfect system, a day late system, and my trading. Well, you know we’re gonna have some different numbers for the running totals. See, in the day late system, there’s no way for me to know that the trend will change until it’s all over. Right? So, like, by the book, I wouldn’t know to change till the day ended. And that’s precisely what’s being tracked in that middle part. I would be changing trends right now, at end of day the 3rd. Well, look at the running pip count total. -794. But, I end up with 128 pips of a total (2 days).

And so, Monday comes and goes. No changes. Therefore, I don’t change. Plus no indications for to tell me any different. Actually, there is. See, if you remember, I have a rule of thumb that if I see more than 380 pips of a counter trend, then I should change. Well, what was the result of Monday? A -407 pips of a pip count. Yeah, that’s over that amount. But the thing is, it didn’t even come close to changing the market trend. Sure, it dropped down from 46 bull market to 43 bull market. That’s not much of a change at all. Basically, it was just a retracement of that whopping 515 amount the day before.

Then the next day we got back on the bull market numbers. I’m always just looking at these 2 numbers — the 5/9 pip spread (telling me which market their in, and by how much) (the boxed up yellow/green number) — and the daily running pip count (which can be clues to watch out for) ( comparing the perfect system, the day late system, and my trading). So, the result for Jan 7th was up high, 65 bull market. And the pip count climbed higher.

So, of course, I’m not changing anything.

But then comes change. Jan 8th ends the day pretty counter trend. 31 bull market, which is a pretty steep drop. Also the pip count resulted in -304 pips. Well, look, it retraced. Right? You’ll have that. I’m not worried, at all. Nothing really tells me to change. So I don’t. Sure, 304 is a lot, but not as much as 380. Bottom line is that I don’t move, cause I’m not supposed to.

Then Jan 9th comes. I do check in during the day, and do see that change is coming. But, I’m not gonna do anything till I see the ending results. And their in. We change from a bull market to a bear market 16. Ok. Well. Time to change. And that’s what I did. Lost some pips. But, you’re gonna have that.

That’s all below on my excel sheet. I’ll come up with a standard way of noting it. Anyway. I lost -177 pips on that. And noted that my actual running pip count is simply what I lost last time and this time (-390, and -177).

What can you do? I mean, the market hasn’t been stable lately. The JPY got real strong, but only for a short time. Trust me, it won’t always be like this. And I’m honestly not worried. So, let’s move on. One more time.

End of day 9th. What am I supposed to do? Well, the trend changed. So do I. Now I’m going JPY bear market. That’s all 7 pairs going Yen weak (north on the charts). That was on Thurs evening. Look. I follow. And I believe this is the only way for me to trade. I don’t know what’s gonna happen. Trust me, I’m tired of thinking I know the way it will. I don’t. And I honestly don’t care. I will only follow. And I do believe it will be profitable in the long run.

See. What’s most important to me, right now, is to find out whether this system will work or not. And the absolute only way to know that is to test it out. Follow it. That’s all I’m doing.

Well, Friday turned out to continue on with the JPY bear market. I mean look, the trend goes from 16 bear to 47 bear market. Meaning it’s more into the bear market territory. Not many pips to be had. But oh well. As long as I’m on track, I’m happy.

And this is what’s gonna happen, each and every day, this year, Journal. All that, up there, will just continue moving to the right. Get longer and longer. We’ll just have to see how it all plays out. Rough and rocky right now. But, I’m not worried. Actually, the only thing I’m worried about is whether I’m in the right market or not. But, I absolutely won’t be in the wrong one, for more than a day.

And sure, I’ll continue to keep track on the other currencies. My systems proof of concept. I believe this will be profitable. Actually, very profitable. But, I will not know until it unravels itself. And hey, if not, then I want to learn something, that’s all. He will show me.

I’m super excited about this, Journal.

And. I’m also excited about this Journal. Cause, when I feel like talking, I’m coming in here and talking. Even if it is nonsense.

Thanks for listening Journal.

Mike

Hey Journal.

I’m sorry. How about one more time today.

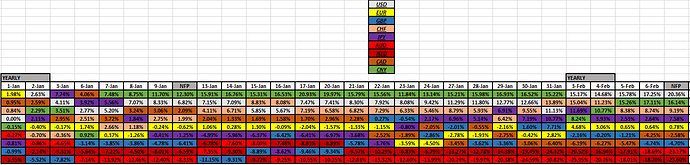

I’ve been looking at my data. It’s all tidy up now. And that’s what I want to show you. This is my proof of concept data, with the other currencies. I don’t know, I think it’s interesting stuff.

Here it is.

So, if you can’t pick it up, it’s like this.

- USD started out the year in a bear market, and immediately (every day) just got stronger, and finally ended up in a bull market now (35).

- EUR started out the year in a bear market, and continues that way, so far.

- GBP started out the year in a bear market, and switched to a bull (35 now).

- CHF started out the year in a bull market, and is still (76).

- AUD started out the year in a bull market, then immediately gone weak, switched to a bear market (fast) but leveled out down there and retraced the losses Friday. (112 now).

- NZD started out the year in a bull market, switched to bear (35) now.

- CAD started out the year in a bull market, and still (76) now.

And the bottom table is just how they all stack up to one another.

The whole entire reason why I’m doing this, is for my systems proof of concept. And the way I will know if it works or not will all come down to the RUNNING TOTAL pip count row, for each one of the currencies. It’s like…for each currency, if I were in with their respective 7 pairs, since the beginning of the year, what would the results be? That’s all.

And in regards to my trading.

I know I haven’t even touched upon the elements of when I add position sizing. Along with taking partial profits. Well, I do have some notes about those things. At the beginning in my mind map and such. But, when the time comes, Journal, you’ll be the first to know. I mean, I do have some ideas about all of that. Like, it would only make sense that I can’t even begin to add size until I’m in much profit, right? And again, another no brainer is that I can’t take partial profits until after I’ve upped some size already. Cause this plan requires me to let things run perpetually. Basically, I’ll need some momentum. And also profits had.

All that is common sense, right?

So, that’s it Journal.

That’s all of what my trading is up to.

Mike

Good morning Journal.

Well, the weekend is now upon us. It’s nice and (very) early. The coffee is hot. And I’m ready to talk.

I had a good week this week. Market wise, sure, it was exciting. My JPY was trending. And if that happens, well then, my system will produce. I’ll get to all of that shortly. But honestly, my system is kind of like watching something in slow motion. Really, really, boring. See. At the end of every day (since I’m a more of a swing trader) is when I am confronted with any kind of decisions I would possibly make. But none this week. It’s all a no brainer.

Oh, I was thinking of coming on in here and giving a play by play at each end of day. But, no way. There’s simply no changes taking place. But, when the time comes, for it, I definitely will. So. Let’s look at how the week went.

I’ll do this in chunks. But basically, all I’m doing is following that line up there. More specifically, whatever color that line is, tells me which direction I’m going with on all of my 7 pairs of JPY. So it’s red. That tells me that the JPY is in a bear market. Aggregately, that is. And those numbers tell me how much in the trend. So on Monday the end of day result was 97, up from 47. Well, that’s stronger. Yeah, that’s nice. And so forth.

But where did I get those numbers? Let’s take a look.

That’s the 7 JPY pairs, daily chart, from the beginning of the year. The yellow line is the 5 ema line, the green line is the 9 ema line. And if you add up the difference between those 2 lines (the inside width part), on each of the pairs, you’ll come up with the one total number (aggregate).

So, it’s simple. Whatever the aggregate number comes out to be, that’s what tells me in which direction I’m going with. Not any one pair. Cause, I’m trading a complete currency. And, at the present time, it happens to be trending in a bear market in each and every single pair (the 5 above the 9). Basically, the JPY is quite weak. But look, it won’t always be this way.

From that view, you can see that it was a rocky start from the beginning of the year. Both the CHF, and the CAD, did keep with the Yen bear market. But not the other ones. The JPY turned bull on those. And well, you know that by simply looking at the 5 and 9 lines. On all these pairs, if the yellow line (5) is below the green line (9), then it’s a JPY bull market.

See. All this nonsense up there is just my way of telling me:

- the JPY trend

- the JPY market (bull or bear)

Well, let’s take it a little farther. How much did it produce this week?

For a total of 347 pips.

That’s all of my 7 JPY pairs, end of day totals, added up.

Sure I’m happy, Journal. But, I do have to admit, that all of this was a whole lot of catching up. Like I said, this year got off to a rocky start. I’ll show you the loaded chart.

This tells me a lot. But look. The bottom line is that if I’m following in the proper trend, then that’s all I’m required to do. I will consider myself successful. I cannot do anything more better. Period. We’ll have to see how effective the system is, over time. Right?

But, I still need to track these 3 things. The perfect system, a day late system, and my actual trading. I’ll go down the line, for all of these results. All I’m gonna do is explain the numbers for end of day 17th.

The perfect system produced 166 pips since the beginning of the year.

The day late system produced - 998 pips since the beginning of the year.

I produced -76 pips since the beginning of the year.

That’s nothing but the last of the running totals.

But you can plainly see where I’m coming from when I said that all I did this week was make up a lot of losses. Well, I should say, my system did. Cause all I’m doing is following it. Right?

Here’s a shot of what my charts look like.

All I can do is hope the trend continues. Cause I’m not gonna play that silly game of trying to guess what’s going to happen next. Honestly. In fact, no one knows. I don’t care who you are. See. I can say that this is nothing but a retracement going on now. Nothing goes up forever. You know, it can come back half way (a fib of some sort), which we call buy the dip. Then continue on up. Technically I guess we can call that a consolidation. Or, we could be having a reversal. I know each pair is on a different scenario. Like the AUD/JPY, NZD/JPY (bottom left and middle). Presently they look like their making a lower swing high. But, mostly all of the other ones seem to be making higher swing highs. Who knows? I don’t. That’s why I want my system to hinge upon following a trend.

Hey, you know what I’ve been thinking? I kind of think that there’s gonna be more downward movement. Know why? Cause look at pretty much all of the last daily candles. There are no real wicks extending down. Meaning the closing prices are not bouncing up any. I would venture to guess that price action is saying there will be more downward pricing. Actually, for all of them. Ok. That’s nice.

We’re gonna have to wait and see the outcome. I’m not worried. Whatsoever. See. I will change when the market shows me. And not until then. When my line goes from red to green, then will I change direction (or when I see a certain amount of pips in the opposite direction).

Following my system is what’s most important to me. It’s not about the pips. The money. Being right or wrong. Even what my account looks like. Nope. All I’m out to do is prove whether my system works or not. Everything will fall into place if it does. And if it doesn’t, then I will want to know why. Get that hard evidence, and make the necessary adjustments. That’s all.

I remember thinking, this past week, about whether I should add more position size. I mean, that will be the next possible move that I do. I know that timing will be pretty important. Cause I could possibly shoot myself in the foot. You know, add on some size, then it goes in the other direction. Right? Well, I came to the conclusion that I absolutely won’t put on any more size until I’m well into profit. And I’m talking about what condition my account balance is in. I’m not gonna go by what I think the market is going to do, but it should be more about whether I can afford it or not. When I have extra to spare, then I can leverage up. Cause if I end up being wrong, that’ll just make it so much harder to catch up. Know what I mean?

To clear up my position sizing factor, it’s like this. I am always running, in the market, with 7 pairs going. They all have a standard size on them. That’s the minimum. It’s a perpetual thing that I always want. But, when I can afford it, I would want to take some profits off the table. And the only way to do that would be after I have put on another standard size. Right? Which means that when I want to take some profits out of the market, it would be with one standard size.

Look. I don’t have all of that completely figured out just yet. I’m trying to come up with the principles to follow by. But, this is what I have so far.

- I need to be able to afford the risk.

- I need to earn the right, to be able to do that.

So, that’s it. I mean, I don’t even know up to how many standard sizes I can go, or anything like that. But, the whole upping the position sizing is basically leveraging up. Which is risky. But, over time, will it benefit me or hurt me?

I have many questions concerning that aspect of my trading. They don’t all need to be answered right now. I really have to see how it all plays out. Cause I don’t know whether I will need some hard rules about it, or will it be more discretionary. I mean, maybe I will have to just go by the opportunities that come my way. You know, strike the iron when it’s hot, and when it’s not, then don’t. Something like that. We’ll see.

What else is going on Journal?

Oh, I remember. I wanted to share this with you. This week I got another good idea. Well, you should know by now how I like to journal. Well, I’m dedicating a binder just for this. I’m calling it "My Business" Journal.

I’ve just started this only a couple days ago. I got a lot of work to do on it. But, the purpose of this is going to be writing down a lot of my thoughts on, what else but, “My Business”. I started out with my thoughts about what I would like to see happen this year, regarding my business.

I got to get down my Anchor Trade. All of the details about it.

End of month cash flow statements will belong in here.

Because I’m not striving on the strategy anymore, I’m pretty much at a stand still. Look. I have a couple hours each day that I can spend on my business. I’m always asking myself how I can build it a little bit more today. And to be honest with you, I’ve been at a loss lately, about what to do. My strategy is running. There’s nothing for me to do! Ok. It’s nice to know that I can possibly make money while I sleep, or am working, or whatever. The system is running. And it runs without me having to do anything. That’s awesome.

Well, anyway. This is a way for me to write down any thoughts about…any operations of my business…how the market is running…any new ideas…any new strategies…things like that. I would like it to be more about my business rather than about what the market is doing and such. There is a difference. I’m sure there’s a lot for me to learn in regards to running and operating a business. This journal is going to be the place where I collect my thoughts about it. I mean look, throughout my day sometimes I will get a good idea and want to explore it more. I just don’t have any particular place to put those possible things, that’s all.

One of these days I would like to look back to these days and be able to see how I’ve built, from the ground up, my business. My thoughts behind my actions. How things came to be. Things like that. Oh, and I do want to go back on this thread and pick out the important things this year so far.

That’s nice.

I know.

Look Journal. I’m not gonna replace you. This is the place where we will mostly talk shop. Like, I was thinking, if at the end of a day I come to a crossroads and need to make a decision about my trading and do so, I will come in here and explain my actions. It should be a real time thing. And I know that these times will eventually come, it’s just they haven’t yet. I mean, you’ve seen the chart (line) up there at the top. It’s red and no indication of changing, yet. When the time comes, I’ll do all my explaining to ya.

Alright Journal.

Thanks for listening.

Mike

Good morning Journal.

Alright, I’m ready now. I just had to finish up some final numbers (ran out of time last night). But here we go. Got another cup of coffee now and ready to type.

Another weekend upon us. But this past week was very interesting. And I’m talking about how the market moved in conjunction with my strategy. But look, I know I told you that whenever I was gonna make a move I would come in here to explain my moves, like in real time. Well, that did occur, but I just can’t! Oh, I thought about you. Wanted to. But just couldn’t. It’s the timing of it. Let me explain.

See. At the end of the day there’s a lot going on. First off, I get home from work around 5pm. Between dinner, Trish, my daily numbers extraction, and then a trading decision is a lot at the end of the day. Plus the fact that we don’t stay up late. Cause around 8pm we like to call it a day. But…that doesn’t mean I can’t explain my thought process during this time, right now.

Well, let’s see. This week encapsulated a market turn for my JPY currency. So therefore that means I must change also, right? Cause all I’m doing is following. I’ll try to unravel it for ya.

Ok. So here’s Monday’s results.

What all this tells me is this. The JPY is currently in a bear market (red). Meaning that currency has been weak (aggregately) against all of the other currencies (red line moving higher means a stronger bear market, likewise, moving lower means a weaker bear market). You can see there by how much also. So, last Thursday (Jan 16th) they hit a high of 167 (I’m not gonna explain that, cause it’s written up previously). So then Friday comes and ends a little bit stronger (139). Again, last weekend I posted about how they ended the week looking like a turn. Well, Monday continues in that direction (120). All this means is that the bear market is weakening (the JPY is getting stronger).

So, do I make a move? Absolutely not. Nothing is telling me to move yet. That line is still red, right? Plus, the number 120 is pretty high. There is much distance it can drop while still being in the bear market condition. Basically, they can retrace very much. Anyway. Tuesday comes, and this is what it looks like.

Now that’s a big drop. The current bear market is weakening. Meaning the JPY is getting strong. Right? So, the strength of the trend drops to 64 from 120. Translated into pips would come out to be -249 (my 7 JPY running trades). And translated into my account would be a drop of 2.30 % of my account balance. That’s in one day. I know…it was a lot.

So. What am I going to do? I’m sitting there, Tuesday end of day, seeing nothing but a turn, right? Basically, my account balance is dwindling all of the profits made previously since last Thursday. That’s 3 consecutive days in a row. So. Again. What am I gonna do? Man…I remember it. Well, my plan tells me to follow. And I do have some clues to tell me when I should change. But given all that, the bottom line is that I’m supposed to stay put. And that’s what I do. All I’m thinking now is what’s most important, to follow my plan (and, of course, I’m talking very much now to Him, about it).

Let’s see what Wednesday brings.

Bottom line is the trend is still weakening. See. It goes from 64 down to 39. But, the thing is that I actually made money that day (53) pips positive. Know why? Well, that’s all thanks to the GBP. See. And this is why I like trading a complete currency. Cause you don’t necessarily have to get them all right, as long as you are on the majority. Well, on that day, the Pound just crushed the market, across the board, including the Yen. And that bodes well for me. Cause my direction is still a bear market JPY (all 7 Yen pairs long on the charts).

But, my aggregate turns out to be even lower. All this is telling me that the JPY is getting stronger. Will the trend continue this way? Or. Will the trend stop correcting and resume the bear market now? See. We just do not know what’s gonna happen next, until it unravels. I’m sitting there, on this Wednesday evening, really in a conundrum. I keep telling myself that I’m supposed to follow. But, the market hasn’t yet turned. And I won’t know until end of day Thursday.

One of my clues (because of backtesting results) is looking at the amount of consecutive pips leading up to a turn. And my magic number is -380. Well, look up there. That hasn’t happened yet this week. This week went like this… +53 pips, -249 pips, +53 pips. So, technically, I’m supposed to stay put.

Well, I’m stalling that night. I keep watching the live charts. 6 o’clock comes around. 7 o’clock comes around. And you better believe that I’m talking to Him a lot. I just want to be guided, that’s all. So, my final decision was this. "I know I don’t have a definitive, preplanned reason, but I’m changing directions."

Look. The honest truth was this, Journal. I trusted Him with the decision. That’s what I did. I exited out of all 7 JPY pairs long, and then immediately went back in with the 7 pairs short (JPY strong). And then, shut it all down. I’m not gonna have anxiety about my decision. Well, I don’t want that to be the case, you know? Honestly though…of course I’m concerned. What am I gonna wake up to? Disaster? See. I’m not basing my decision on a pre-planned rule. That’s what’s bugging me. So, I’m just gonna wait and see what happens. And learn something. That’s all.

Well, I wake up the next morning. You know, about the time London starts out. So, after a minute or so, I grab my phone. Check what my JPY daily candles look like. What am I wanting to see? Sure. All red candles, right? That’s my direction now. Even though the stated market sentiment hasn’t officially changed yet. Well, it only takes one to two seconds of a look. ALL RED!

And I close it up. And thank my Lord.

The market sentiment is still moving that way. JPY getting more and more stronger. So much so that at the end of that day the market did change directions. Look.

You can see that on the 23rd (Thurs) officially the market changed to bull. 10 into it. (That would be 10 pips aggregate of my 5/9 pip spreads)

So, I just stay the course, for Friday. And the market continues in that direction even more. You better believe I’m happy. This is the second time I’ve got the direction correct, this year. See above. There has been 3 market changes so far. Jan 2nd into the 3rd. Jan 8th into the 9th. And Jan 22nd into the 23rd. That’s nice. I know. Anyway.

Look up there. My system is to follow the trend, and in the end hope to come out positive. Sure, I made money all the way up that bear market. But I also lost a lot of money on the way down, right? Well, I’m aware of that. That’s my system. But when I think about it, I believe that’s the best I can do, with the knowledge of this fact that "I do not know what the market will do next."

Some trends are longer than others. And frankly, no one trend is the same either. All I can hope for is that they stay longer than shorter. I mean, last year there was some monstrous lasting trends. Especially approaching May and went through June.

But, another major factor with my system, if you don’t already know it, is how well I can change, when it does change.

Oh, I just now remembered another point that I thought of this week, about my system. You know, I haven’t had the experience yet, but I do believe what will propel my system will be in the adding of position sizing. More precisely, leveraging up at the right times. But I haven’t been able to do that just yet. All I’ve been doing is a lot of catching up lately. It’s ok though. At least I haven’t made any real mistakes so far. And I’m very happy about that.

How about some shots.

You can see where my latest trades have started. All shorted, of course.

Well, at least I’m approaching my break even threshold. See, I started out with 30k. And the current unrealized balance is only $232 short of that. So, that’s all good and nice. I’m still in ok shape. The system still has a lot of proving to do. I have to keep telling myself, that time is on my side.

Here’s my loaded pic.

Bottom lines. Since the year start.

- The perfect system is currently running +600 pips.

- The day late system is currently running -1092 pips.

- My actual trading is currently running +358 pips.

Look. I’m aware of the fact that this is not completely accurate. This is just a way of tracking these 3 things. That’s all. See. My trading decisions can’t be right at 5pm every night. First off, I need some time to run the numbers. And also when you have a basket of 7 trades running, even an hour can produce a pretty good swing of pips, one way or the other. But, all of this is just a way for me to have some kind of benchmark of the system. You know, proof of concept.

And speaking of proof of concept, this is what I finished up this morning. Journal, I’m sure you remember me showing you how I am tracking the other currencies in the same way I am with my JPY. And for the whole purpose of knowing whether the system will work with them (even though I’m not trading them). Proof of concept, right?

Brace yourself.

Well, I think it’s self explanatory. Each currency is either trending strong or weak. Green, or red. And in the middle, tells of how strong that trend is. Which is the 5/9 aggregate pip spread.

Look at the CAD, this week. They changed trends. From bull to bear. I think that was due to their rate decision this week. It didn’t change, but their talking about a rate cut in April, I think. So, the market is pricing that in now.

Oh, and just so you know. I haven’t explained a number up there. Cause I just implemented it this week. I think it’s important to know this. And looks like I haven’t finished CAD. Man, I missed this, this morning. The latest, with them (CAD) is that they are trending in a bear market against 5 other currencies and 2 other currencies they are trending bull. Hence what 5-2 means. Then the day before that they were trending bear market against 6 other currencies and one currency was a bull market. So therefore, whatever market (color) their in is what that first number will be.

Look up to …let’s see … oh, the CHF. Pink. Yeah, since the beginning of the year they’ve been strong. Climbed up to trending 7-0 (that’s against everyone) for a good while. But look most recently. Their faltering. And quickly. 2 things that can tell you that. First, their pip spread (bull market strength, middle number). And also by how many other currencies. This week they went from 7-0 to 6-1 to 4-3. And respectively, 81 to 49 to 25. Big change right? Well, let’s see that that looks like on the charts.

Well, 3 candles from the end, their 5/9 ema’s showed bull on every one. Then 2 candles from the end shows the GBP switching over to Swiss bear market, hence 6-1. Then the last candle shows the GBP, USD, JPY officially switched markets (4-3). That’s just the latest sentiment, but looking at the NZD and CAD (bottom center and right) those look like their turning also. But we really don’t know that just yet. You can see how weak the AUD (bottom left) is. Quite.

That’s all good and nice.

I need to back it up a little.

Proof of concept. This is in those last 3 sets of numbers. Top row is the 7 currencies totals. Then the next row is the JPY. And the last row is the complete 8 currencies total. These are all running totals. In pips.

Basically, if I ran my system, in the same way with everybody (not just with the JPY), what would the pip count be?

All I’m really concerned with is whether the pip count is increasing or decreasing. That’s it! Honestly.

You can go back and see which currency has been producing the most, and down to the least. It is interesting. But, I’m mostly concerned about whether over time there’s an increase in pips. Simple as that. And right now, the final pip count is at 3,415. That’s very good. But look. I know that is not realistic. By far. Cause I can’t change right at 5pm (daily market close). And this is the perfect system, which is impossible to achieve.

Look up there at the GBP. I am fully aware of the fact that their pip counts are very much more than everyone else’s. In fact, everyone’s pip count is slightly different, due to their average daily ranges. I’ve considered this. Believe me.

Am I comparing apples to oranges? And am coming up with an aggregate total that’s not all that accurate? Or distorted in some fashion?

All I can say is that I have factored that in. I know that the Pound will travel a lot. I do have all of them itemized. And I look at that. Like that one day this week (I just talked about that earlier) how the GBP got super strong and skewed the numbers. I factored that in. The outcome would have been in the negative numbers, which did have a bearing on my decision, to switch my direction.

Anyway. Journal…I’m getting lost here. Losing my train of thought.

Looks like I got to cut it short.

Maybe I will continue with more of my thoughts tomorrow morning.

Alright Journal. Thanks for listening.

Mike

Good morning Journal.

Well here we are Journal, Feb 1st. This is a big weekend for me. We have a lot of work to do before the weekend ends. See. Along this journey, there aren’t any more important steps along the way than, well, like right now. The end of a month. These are the times that I will need to check in. Sure, I’ve been giving you a snap shot of what’s been happening on every weekend, but now is the first time for some new stuff.

Let me reiterate some things, from the beginning. This year, for me, is the year of simulation. What that means is that I will run and operate this business of mine like it’s the real thing. Because, in my mind, there’s absolutely no reason why I can’t prove to myself whether I can do this or not. It’s nothing but numbers. I do not need to have a large bank account of real money, to prove this to myself. I have all the tools necessary to see this through. So, why not start here, right?

Anyway. That’s what I’m doing this year. I’m working it.

Well, now is the time that I would pay myself. Whether I rack up some profit or not, I want to (need to) pay my bills. And this is the time for that, at the end of a month. So, I’m gonna track all of this. And I’ve explained this before, but, in my business I have 3 accounts.

- Trading Account

- Business Account

- Checking Account

The first one is the generator. The second one is the pot. And the third one is where I pay myself. All I’m gonna do is keep track of the money flow between all of those 3.

Well, I need 3k to live off of for a month. So, whether I have made profit or not, throughout the month, I need to draw out that much from my trading account. And I did. I’ll show you in a minute. But, the dynamics that come with that definitely need to be played out. Needless to say, I’m very glad to be walking down this path. Cause it’s the real thing!

I wanted to mention this before I forget. See. A big reason why I’ve never been able to do this before is because I haven’t been able to come up with my way of trading. You know, finding my strategy. I think that’s probably the biggest factor that needs to be hashed out. Well, for me anyway. See. I’m sure someone could wing it in a haphazard way. Simply trade away in whatever manner that is, and just keep track of the numbers at the end of the month. But for me, if I don’t have a consistent method, a plan to follow, then I won’t be able to track the effectiveness of it all. For me, it’s like this is the most important part of the whole entire operation. And as I’ve explained to you in the beginning, I believe I’ve found my way. I’m putting it all to the test.

Ok. That’s nice.

Let’s get to some numbers.

The way I read this is line by line, going across.

So, the first line reads, what the beginning of Jan looks like in each account. Look. I can plug in any amount of numbers I want, right? That’s all they are anyway. Numbers. But, I’ve decided on this. $30,000 to start. This is what I really wanted to start out with last year, in real life, when I tried full time. Look. Why don’t I put something like 100k, or 300k, right? Give myself a good cushion. Sure. But, for me, this is not realistic. Whatsoever. And I’m surely not going to trade under the illusion that all I need is something like 1% a month to pay my bills. I mean look. With this amount, all I need is to generate 10% a month. And frankly, I don’t even need to generate that amount every single month. Cause, like I just did, all I need to do is withdraw 3k from the total. And then continue. See. I think this is a big enough amount, in most realistic terms, in which I believe is possible. That’s all.

But, I think the bottom line will be in the viability of my strategy. And this what I want to do most of my talking about, this weekend. But, just let me get this nonsense stuff out of the way first, Journal.

Look up there again. My business account. Yeah, ok. So. I got nothing in it. I know. So what? I could put any number I want in there, right? Well, I’m playing reality here. And this is probably the way it would go. I’m not gonna have all kinds of money to put where I want. I’m not a rich person. What I am doing here is building a business. From the ground up. And sometime in the future, that account, just like any other business has, will inevitably need to be built up. Right? Or it just wouldn’t be a business.

The good thing with my business is that I don’t have much in the way of expenses. You know, the overhead costs that come with every business. I’m sure I could incorporate some risk management into that aspect. But not now. Anyway. The expenses that would come my way would have to be paid out of that account. Right? So therefore, I need to build that up. And there will be a time for that. But what I’m doing right now is making a priority out of paying myself, first. I just want see whether I can sustain this. Can I trade, with this amount of money, while drawing out that amount of money, every month?

Now that is the question I’m wanting to answer. Also it would answer the question whether I could do this full time. Basically…is this self sustainable?

Look. If the answer is a no, then at least I should be able to find some answers.

- How much does my system generate?

- How effective is my position sizing?

- How well does my system work under certain conditions?

The answers to these questions should enable me to make the adjustments I might need. And I’m sure I will carry out those adjustments. Right?

And over time, however long it takes, it will be clear to me when I’ve proved this to myself.

Ok Journal.

Enough nonsense already.

I need to get into this.

I have so much to talk about. So, I’m gonna cut this short and come back with how I thought the month went.

I’m just getting started.

Mike

Good luck! Looking forward to your results.

Journal.

Here we go.

- My system is profitable. So far.

- End of month dynamics.

- Need more work on when to add more sizing.

Let’s see…where do I start…

How about a play by play of how the week unraveled.

This is what last weekend, at this time, looked like.

- JPY is in a bull market (green line).

- 82 pips of an aggregate 5/9 pip spread (strength of their trend).

- Trending bull against 6 other currencies and 1 bear (6-1).

- I’m (been) in with 7 JPY trades short.

Monday comes and the result is…

Unless you’re under a rock, you would know that there was a nice gap to start the week out with. JPY strong. And that’s how the rest of the day went.

- Bull market still, with strength of 170.

- Trending bull against all 7 of them now.

- The days total pips turned out to be 409.

I was all kind of happy, I remember.

Then Tuesday comes, and ends.

- Bull market strength moves up to 189.

- Correction of a day. -128 total pips.

- Again, no changes to my 7 open running trades.

Wednesday comes and goes. Results.

- Bull market strength goes higher to 210.

- Pip count for the day comes in positive 169. Covered yesterdays losses.

- Made a change to my trades. I added another position sizing, to each (first time for this…am very nervous).

Thursday comes and ends. Results.

- Bull market strength loses some to 202.

- Pip count for the day comes in at -14.

Now, I got to stop things right here.

At this point, as I have been all week, I’ve been wondering how am I going to navigate my money?

- I want (have) to pay myself.

- My trades perpetually run.

- How will I do this?

I’m only gonna be honest with you Journal. By the way the market was behaving, I was getting scared. I was dealing with some serious emotions. And I’m sure a lot had to do with having 2 sizes on each of my 7 trades. That didn’t help matters. And what about what the market looks like? I mean look, doesn’t it look like a possible top? Plus, we’re heading into the very last day of the month. Why won’t there be some good profit taking from the market participants? Right?

And while I’m still being honest with you, I guess it doesn’t help when I’m watching the market way too much that day. Boy, I remember it. Towards the end of the day, in the last hour, it was swinging way too much for me. I think it was the Pound that was moving the entire market in sort of a risk-on kind of mood. It was that day in which they had their interest rate decision going on. So, sure, things went differently than what the underlying sentiment was. Right?

I do know one thing though. I can’t make any moves until the end of day. That is something I won’t budge on. It’s a rule. Even if it was only an hour before time is up. Plus, I need to see some numbers. Like what I just showed you up there.

That’s when it happened.

I jumped. And my reasons were:

- It’s the end of the month.

- It’s the time to pay myself. By restarting a new demo account with the correct balance, as like I would be drawing out money from a real account.

- Give the market the last day for any clues of a change.

I took a picture moments before I exited out of all my positions. Take a look.

The dotted lines are my (short) entry places. 2 on each. See them?

My second size doesn’t look so good against the GBP (top row, third over). Also against the CHF, same thing. But quite decent against the bottom 3 (Comms). Well, remember, I trade a complete currency, and this is how it is.

Look. It’s not pleasant when you’ve seen your account balance at a much higher place than where you’re presently at. But, it’s something I had to do. I was happy though to be in the positive. Cause, if you’ve been paying attention Journal, you should know that this month has been mostly negative for me. I think it was this past week that I finally got caught up. But, wouldn’t you know, after I upped the size on everyone, is when I temporarily seen a big account balance. I was well over 32k. I remember thinking that a 10% increase was just awesome. I was approaching that figure, anyway (33k).

Man…yeah…it was nice while it lasted. But, this is business. I got to do what I got to do. I’ll take profit…period. Better than being negative, right?

Anyway. Let’s move on.

I’m out of the market now, going into Friday. What was the result?

- Bull market strength goes higher, to 215.

- Pip count that day ends with +227.

- I don’t benefit from any of that, cause I’m out.

Well, I do have to tell you the latest. And this answers the question of

- How and When do I get back in, continue?

Something did trigger my decision. I was reading some news later on that Friday. And when I read that Asia will come back from their holiday (Lunar) on Monday. “And you better believe there will be some heavy selling when they do.” Honestly, when I read that, that made me think to get in the market before the end of day hits. Cause I was wondering whether to start the week off when it starts, or at the weeks end. See. I remember that gap that took place (and I benefited majorly from it) last weekend. So, those 2 things tilted my decision to get in just before the close. And that’s what I did. Now…whether it was good decision or not will be determined. I’m just stating how and why I did what I did.

Also. My trading strategy dictates that I run with the market. I’m not gonna play that silly game of trying to figure out when to get in and when to get out. I’m done with that nonsense. It’s in the long run, that determines my outcome.

- The market is bullish JPY (green line).

- No indication of a changing market (215). That’s quite high for strength.

- I’ll start off the month from the beginning.

- I don’t know what the market will do next! Therefore, I follow it.

Alright Journal. Got more coming.

Just need to block this off.

Mike

Good morning Journal.

Feb 8th. Another weekend upon us now. And I got to tell ya, I had a great day yesterday, Friday. Check this out. We finally had a snow day. And that closed down the schools. I mean look. For being in Pgh, this used to be normal for us. Back in the day, it seemed like the schools always used up their allotted snow days every year. But, it just hasn’t been like that in recent years. I don’t know, maybe there is something to this global warming nonsense. In any case, it sure was wonderful to have off. Even though we only had like 4 inches. But being on a Friday, it was awesome! Three day weekend!

Yeah, that’s nice, I know. So therefore, since I wasn’t bus driving, I did get a lot of work done on my business. Oh, and being an NFP Friday, was all the more fun. I got to see how the market ran. And yes, it did run, the way I was hoping. What a week I had. Talk about a roller coaster ride. Unbelievable.

Well, ok. I will tell you about it. But let me get some more coffee first. I do have very much to get off my chest this weekend. I had to get out a piece of paper, yesterday, and write down all the main points. Which led to a lot of writing. So, now is the time to hit them all.

Hold on.

Alright Journal. Here we go.

- January’s summary -

I really didn’t do this yet. I did accomplished it this week. But, I need to answer the question of How did I do last month?

I’ll break it up by the weekends.

$30,000. starting balance.

Jan 11th weekend (first full week).

- Account balance $28,343.97

- -5.52%

- Up to this point, the market switched trends twice.

- I performed a perfect switch, and a day late switch.

Jan 18th weekend (second full week).

- Account balance $29,237.59

- -2.54% from the starting balance

- +2.98% for the week

- 1 trend (JPY bear market)

- 4 positive days (pips), 1 negative day

- I performed no changes (trades just ran)

Jan 25th weekend (third full week)

- Account balance $29,768.98

- -.77% from starting balance

- +1.77% for the week

- Trend switch one time (JPY bear to bull market)

- I performed a perfect switch

- 4 positive days (pips), 1 negative day

Jan 31st weekend (fourth full week)

- Account balance $30,654.16

- +2.18% from starting balance

- +2.95% for the week

- I performed no changes (trades just ran)

- JPY stayed a bull market

Well, as I stated last week, it seemed like this month was nothing but playing catch up. You can plainly see that within the first 10 trading days of the month I dropped a good bit. And, for the rest of the month, it was nothing but up. Right? But hey. This is none of my doing. All I’m doing is following the system. And as for what I can see, the system is working.

This is my job.

- I let my 7 JPY trades run perpetually

- Stay in the correct market

- Switch directions when the market signals it

That’s it.

Pretty simple.

I’m not gonna play that silly game of trying to determine when to get in and when to get out. You know what? There’s a great chance that I will catch those big moves the market often does. In fact, I will catch them, cause I’m always in. So therefore, my only concern will be whether I’m in the correct trend. And yeah, that’s probably the biggest part of my job, to be sure I am following correctly.

This is a good segway into what I want to talk about next. It’s what happened this past week.

Here’s how it rolled out.

You can see that the JPY has been on a serious bull trend. That’s all last weeks numbers and Mondays E.O.D. Remember I got back in minutes before the last week closed out? I missed last Friday (31st), due to squaring off the month.

Well, we’re pretty lofty here. Hey, you never know, the Yen can continue to go straight up, right? Oh, let me explain those numbers. Yellow (5ema) below the green (9ema) tells me it’s a JPY bull market. The middle numbers tell me the strength. The 7-0 tells me their trending high against all of the other 7 currencies. And on Monday the pip count was a +100 pips. And the running pip count for the perfect system stands at 1363 pips (for the year). We shouldn’t be concerned with that. Honestly.

Ok. Well, let’s proceed on to Tuesday.

Yeah boy, it wasn’t pretty. The JPY weakened. It was a risk-on day. So my numbers go like this. The strength of the bull trend goes down to 128. Man, that’s almost a hundred pip drop. Basically, they got sold off majorly. So, let’s continue. Their still trending bull against all of the other 7 currencies. And the pip count for that day turned out to be -632.

Yeah man. I remember that day. It hurt. For sure. I went through the whole process (psychologically).

- Stay in the trend

- I follow my system

- I trust my system

- Success is keeping with my plan, no matter what my account looks like

This is all the stuff I had to remember, going through this. Believe me, it was hard to stomach. Let me show you this table again, which sheds some light on the amount of pips gained or lost.

So, as you can see, I was losing probably over 6% of my account (-632 pips). Well, I can tell you that I started the month of Feb with an account balance of $27,654 (all explained last week). And I seen it dive all the way down to right at 26k. But…what can I do? This is just temporary. Let’s move on.

Wednesday comes and ends this way. More of a beating!!

The strength of their bull trend goes down to 60. Now their trending strong against only 5 other currencies and 2 turned bear trend. The pip count that day turned out to be only -56 pips. Now that’s much easier to stomach. Right?

So…what do I got? Well, I remember it so well. That end of day didn’t feel good. And, what’s my job again? Oh yeah, to stay in the correct trend. Look. I made it this far. I must see this to the end. I trust my system. Plus I know that NFP Friday is coming. And I’ve known that big moves usually don’t happen before that time. Sure, there’s a lead up to it, but no major moves. Anyway. My main concern is following that dog-gone colored line up there. It’s still green and I’m still hanging onto my short 7 Yen pairs (JPY strong).

Look. I’m gaining some real character during all of this. Plus. I’m getting closer to my Master. Trust me.

Here’s Thursday’s results.

The current bull trend strength goes lower to 26. And they are still trending bull against 5 other currencies, and 2 bear. No changes in that regards. Right? The pip count turns out to be +36 pips that day. My, my, my. Maybe we are turning. I don’t know yet. But, all we have left here is Friday. And that’s an NFP Friday. Things are gonna fly. So, this is my thought process.

I am very happy that I am in the correct trend. Hey, that line is still green. It’s still a JPY bull market. And I’m still in the market short on those 7 Yen pairs. So…I’m actually trading successfully. Again. It’s not what my account is looking like. It’s whether I’m following my system or not. So, all good. I just want to know what we have in store for Friday. Hey…you know what? If I see a change in trend, I’m gonna switch. Look. That 26 number is pretty low. And it won’t take a whole lot for the market to turn the other way around, at this point. Right?

Well, Friday comes. And so does the snow. It started to snow around 4am. It was forecasted. I got the call around 5am for a 2 hour delay. It’s snowing more and more. And then close to 7:30am I got another call for the closing of our school for the day. That’s along with all of the other school districts in the Pgh area. Ok. That’s nice. Let’s get some more coffee and check out some NFP.

Well, I watched it. Not gonna make any moves unless I see something major. Basically, all I’m concerned with is how my JPY pairs are doing. And when it came time, there was no real move. Which I was very happy about. I just didn’t want to see my account balance fall any more. It was steady. Actually, it started to rise up. Slowly. But then. It was an hour later. 9:30am my time. That’s when I first noticed some real movement. Yep. The JPY is coming back alive!

Oh yes. And well, that was the tale of the day. It was nothing but a rise on up. Across the board. It was a good feeling. Man…you know what? I kept thinking that this unbelievable risk-on sentiment going on this week was just abnormal. I mean, this coronovirus isn’t over yet! Why is everybody (stock markets) shaking all of this off? That just didn’t make any sense to me. I really figured the risk-off sentiment was gonna come on back. Look. These were some of my thoughts. But, I have to remember, there’s only one thing that’s most important to me. And that’s me following my system. As I have been telling you, Journal, this whole time. And guess what? I have been.

The JPY bull trend is still in tact. 63 pips of a strength. They are now trending bull trend against 6 other currencies now, and one bear (USD). And that days pip count turned out to be +435.

So, for the week. What’s it look like?

- -117 pips

And you can see who the top dog is, right? The USD (top left). My trade is not looking so good there. But guess what…I trade a complete currency. Let’s take into account what the rest of them look like.

- Against the EUR, looking pretty good. In profit now.

- Against the GBP, looking awesome. Man did I get lucky where I got in with them.

- Against the CHF, in profit now.

- Against the Comms, not in profit. Heading in that direction though.

Well, I’m happy how things turned out. What a week though, huh?

Ok Journal. I’m gonna cut this short.

Oh…I’m just getting started. I’ve only covered 2 of my 5 points.

Need a time out.

Be right back.

Mike

Hey Journal.

- The Trend

- Proof of Concept

- Trading a complete currency

So, I want to talk about the Trend.

- My system is rooted in this methodology

- Clint puts it in most simple terms, regarding what we should do with a trend

I’ve often thought of this every since he wrote this up. This was back in Aug.'13.

So now, I just want to talk about what I consider what a trend is.

- 5 ema line

- 9 ema line

Those 2 lines on a chart will tell me what market (bull or bear) that pair is in. I’m not even considering where the current price is, believe it or not. To me, it’s exactly where those 2 prices are at, at the present time. I’m looking at, presently, where the average of the last 5 days price was at. Also what the average of the last 9 days price was at.

Look. Of course I need to know what the present price is, because that’s factored in on the last 5 time periods (it’s the last period), along with the last 9 time periods. Right? Anyway. That’s what is most important to me. What’s been the average price lately?

So. I have 2 prices. That’s nice. But, there’s more. What I’m really doing is monitoring and following what the difference is between what those 2 prices are. Now that’s my indicator.

You can’t really see that on a chart. That’s why my excel tables are important. But if you were to look at a regular chart, it would be the inside width of those 2 lines. Look.

Now those 2 pics are correlated.

USD/JPY

- Bear market (5ema above 9ema)

- 13 pips in between the lines

EUR/JPY

- Bull market (5ema below 9ema)

- 9 pips in between the lines

ETC…

If you add them all up, the result is 63 pips. That, to me, is my indicator.

Shown here.

So, let’s back it up a little.

Clint.

He says to (1) identify a trend, (2) enter in the direction of the trend, (3) identify the end of the trend.

- My line, up there, identifies my trend. The JPY trend.

- Since I’m perpetually in the market, all I do is orient my trades accordingly (long or short).

Now, look up there at that red line (JPY bear market). I just counted the pips ( all 7 JPY pairs totaled) from that Jan 9th to Jan 22nd. That equals +298 pips. It’s positive. Sure, not a whole lot. But, as I have backtested this system for all of last year, & over time it adds up. And every single trend is different. But, at least I have picked a definite place to switch directions. Look. As all this was unraveling, I simply did not know that at that red 167 point (market top) that we were going to have an eventual market change, 5 days later. If I would have known that, I could’ve changed early, right? But we just do not know what’s gonna happen next! I change when it tells me that it changed.

Now look at the most recent JPY (green) bull market. This didn’t change markets, like previously. It sure did come back on down though, right? I mean, I don’t know what’s gonna happen next week, either. It could go right back on up. Or, it could be just a minor delay and eventually switch trends. Who knows…I surely don’t. And I’m done with the guessing game.

I thought about this. What if I did change directions prematurely, as I was losing my shirt this past week? Can you image how bad, and messed up I would’ve been right now? I would have to admit that I can’t follow properly. I would have a real mess on my hands because of all the slippage that comes with getting out and in again with my 7 pairs (getting back on track). That’s a serious cost!

I have learned some things in the last 7 years, of my tenure so far. I think it’s a kind of personal integrity thing.

That’s nice.

Let’s see all of the different trends. For this we’re gonna have to look at the other currencies.

I also want to couple this with another point that I want to cover.

Proof of concept

- USD is currently in a long bull market. The pip count from the beginning of it to the present comes out to be +557, +337 (perfect system, day late system). This weeks pip count is +345, +19, +169, +151, +274. Equaling +958 pips. Nice week for them.

The perfect system (impossible, because at end-of-day is when that day’s trend is determined) is the first number. The second number is the day late system. Which is achievable because it’s a day late. Look at the USD, on the 9th. On that day it was +110 pips for the perfect system, but -110 pips for the day late system. This was the only time this year of a change in trends.

-

EUR started on a bear market, went bull for 4 days, bear again and presently on a bull market. The latest strength shows being quite weak. Every day this week they went straight down. -13, -208, -239, +7, +46.

-

From years start the system produces +491, -805. Perfect, day late, respectively.

-

GBP back and forth also, with the trends. Recently, this week, changed from a bull market to a bear market.

-

GBP produced this year +1849, -1097. Pips. Perfect, day late.

-

CHF have been on one trend from the beginning. Bull market. The system produces +958 pips. Both perfect and day late are the same because there’s no changing of the trends. Right? That’ll be the 7 CHF trades simply running.

-

AUD started out bull and went bear. Long bear market. But look at what happened this past week. Remember the risk-on sentiment for most of this week? What was their pip counts? -496, -508, -279, -5, +423. This is a counter trend direction they traveled in this week.

-

AUD year total for my system turns out to be +1354, and +684 (perfect, day late).

-

NZD is similar to them. The system turns out +1075, and +993 (perfect, day late).

-

CAD switched markets one time also (bull to bear). The system turns out +866, and -186 pips. Know why the big difference? Cause look there on Jan 22nd. That day’s result was 526 pips. Meaning, the perfect system adds on 526 pips to the running total, and the day late system subtracts 526 pips from the running total.

So here’s the entire currencies all added up together (including the JPY). This is the total proof of concept numbers.

The top row is the perfect system. Bottom is the day late system.

Take a look at how the month of Jan ended. We had a huge run up to the end of the month. A climax is attained on the very last day of the month, in both systems. The perfect system produces 10,723 pips and the day late system produces 3,647 pips.

Then you get the counter trend trading at the beginning of the month. Or you can call it retracement trading. Don’t forget, all I’m doing here is following the trend.

And so, for the year in total, so far, we’re sitting at a total of 8,296 pips for the perfect system. 338 pips for the day late system. I would consider that profitable. Surely it isn’t unprofitable. Right?

What does all this mean?

All I’m saying is that trading my way of trend determination, so far, is profitable.

And trading a complete currency is profitable, also.

And this brings me to my last point. The fact of my trading a complete currency. I want to do a lot of talking about this. But I’m out of time now.

I’ll come back tomorrow for this.

Thanks for listening Journal.

Mike

Good morning Journal.

I hope you don’t mind me talking this nonsense. You know, my system, the way I trade, etc… I don’t know. The more I talk about it, the more I realize how this is the way in which I should be trading. Cause it’s all me. It’s how I look at things, and frankly nothing makes more sense.

But lately, I have noticed how I do look at the market differently than probably most people (traders). I mean look. I can’t imagine going to the charts just to see what one particular price pattern is looking like. Sure. I do understand where that is coming from. It’s called TA (technical analysis). Or maybe you can call it the old price action …action. I mean, my beginnings did come from that orientation.

I know myself. I am a numbers guy. In fact, I know this because of how my dad was. Now HE was into numbers. He invented games to play, by himself (cause he was an only child, and was a loner). And it all came down to the numbers. He called it his thing. I remember him mentioning one time how he’s been doing his thing for over 50 years. Look. Some people like to read. Do puzzles. Or whatever hobby that brings happiness to you, on your spare time.

He did sports. He invented a way in which you can play, manage, see an entire baseball game played on paper. Well, he had developed teams, leagues, played entire seasons, the whole thing. And not only that, but other sports games also, like football, basketball etc…I don’t even know to what extent. Other than when he had any kind of time to himself, this is what he did. And we’re talking this was his life.

Of course this all started back when there was no such thing as computers. He had notebooks upon notebooks filled up. Yeah man, the good 'ol paper and pencil. There was a time where my brother (who’s very intelligent) helped him develop a computer program in which to generate a random number. He did incorporate that. I mean, he was old school, but thanks to my brother he was able to automate some aspect of it. (My dad is no longer with us)

Anyway. All of this reminded me of how I started on my journey here with the Forex market. I ended up doing the same thing. I ran the numbers. I figured if there was a way to organize, compare, relate the numbers in such a way, you should be able to learn how the market moves. In some predictable manner.

Alright. I say all of that nonsense just to make the point that I did start out with the technical analysis way. I went down the road of reading price action. It was fun to run the numbers. Actually, I still do! But, there’s more to it.

This is what I want to know.

- What are the currencies up to?

- How are they relating to one another?

- What’s happening from a certain time frame?

And guess what? You can only come to answer this, correctly, from an aggregate stand point. You will not even come close to knowing anything just by looking at one pair. One chart. Lines drawn here and there on it.

-AGGREGATE-

Formed by the conjunction or collection of particulars into a whole mass or sum; total; combined:

See. This is my premise. This is where I start from. Before I will do anything (trade) there are some things that I need to know first. It’s nothing but answering the question of What’s happening?

- What’s going on with the USD?

And how am I supposed to know what the answer is if I only look at one pair? Say the AUD/USD. Sure. That’s tell me some stuff. One is stronger than the other. In some kind of time frame. Short term, medium term, long term. So basically, that to me right there is just like this. Someone looking at the Forex world with a telescope (you know, the ones that a pirate would pick up and look through). But it’s zoomed all the way up close. You’re looking at the finest thing you can see. We can plainly see how the Dollar is (has been) relating to the Aussie. That’s nice.