Good morning Journal.

Let’s see.

What’s been happening?

Well, a lot of the same.

Again.

Busy working.

Trading.

What?

Yeah Journal, you heard me correctly.

Got another trade to tell you about.

With a different set of circumstances and scenario that played out. Cause I didn’t have any days off during the week, like the last time.

So. I’ll tell you how it went.

Let’s see.

You know how my strategy goes, Journal. I’ve plastered it up here how many times.

I’m just a lion. Lying in wait, on the sidelines, all week long for an opportunity.

And all I have is the EOD results. Those tell me everything.

Of course, already established on the previous weekend, is my prep work. Basically, it all boils down to a few pairs I have waiting in the wings. My possibles.

Well then, I know that come through Wed I’m not even considering a trade. Usually. I don’t even think of anything till Thurs at the earliest. But this Thursday, after I ran the EOD numbers, honestly, I thought that I just might not put on a trade this week.

It’s just what was going through my mind. I remember.

My point being, I just know that I’m not trying to force any trading. I know very well that the end of the week is coming up, quickly. And I’m aware that I don’t want to put on a trade simply because time is running out. Honestly. Cause I really don’t want that to happen. I would hope that some time I would let the week just roll on out without getting in on something.

In any case, I just got done with my EOD numbers for Thurs. And since I don’t get home until it’s way too late, I end up running the numbers Friday early morning (which ends up being when Asia ends their day and London has just gotten underway, after a couple hours).

Then it hit me. About what day it was.

NFP Friday is upon us.

What kind of opportunities did I have waiting in the wings concerning the USD?

Ok then, those 2 were my possibilities.

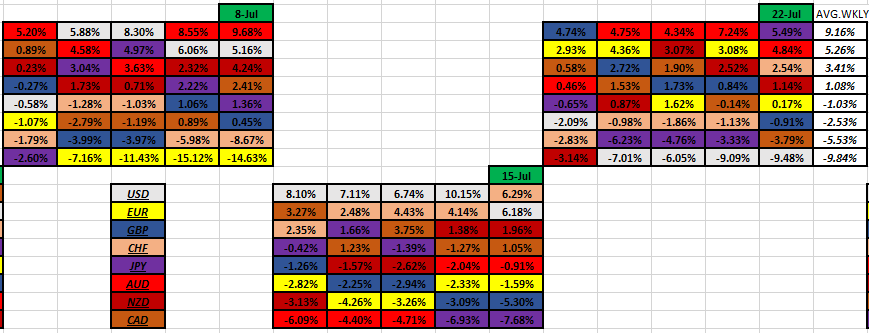

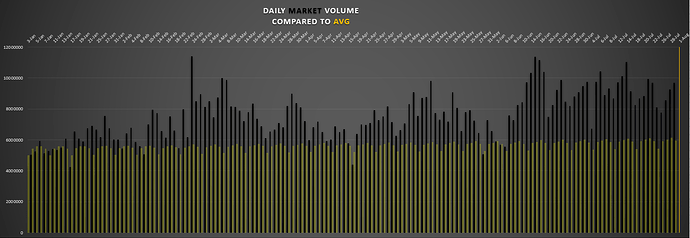

What were we looking at, up to this point, anyway?

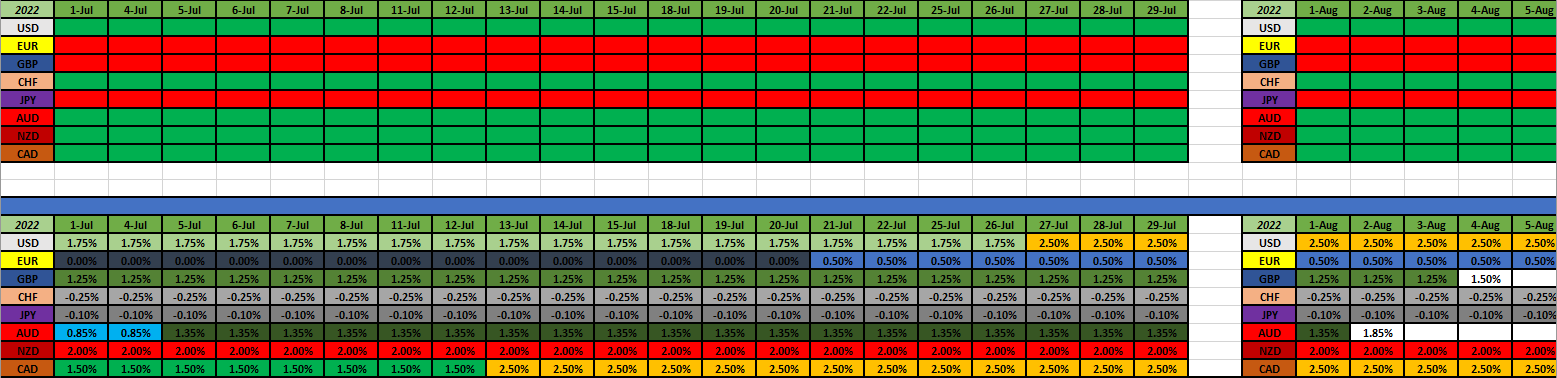

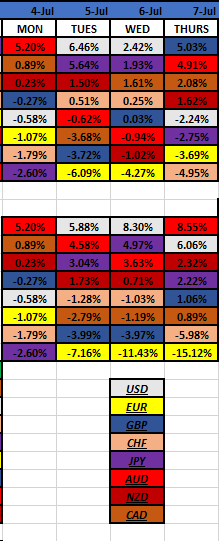

The top table is the daily individual results. Bottom table is the weekly running. Basically, that shows me who’s having a good week as it rolls on out.

Well then, what has the USD been doing this week?

Tuesday, they come in as the most bought up currency. And wouldn’t you know it, the JPY is doing the same thing. With the EUR and GBP on the opposite end. Sold.

Look. We got to remember that the market knows what’s up and coming. All things point to Friday’s NFP time. And all I’m looking at here is the run up to it.

Even Wed we had the very same thing happen. The USD and the JPY was the most bought up currencies. Man… even the EUR did the same thing. Sold off the most.

Then comes Thursday. We got a bit of a turn, don’t we? Instead of the safe haven currencies being bought up it went the other way. Just look at the top 4 currencies. They’re all the risk on currencies. And safe havens on the bottom. And man… along with the EUR. I don’t know what’s going on with them, but the EUR is not having a good week!

Well, I’m not even considering the USD/JPY pair. Let’s just get that one out of the way right now. Because you can see how those 2 have been running together this whole week. Man… I remember how this was so common. But those 2 correlating currencies have been breaking down more and more nowadays. Not today though.

That leaves me to be looking at the USD/CAD pair. And my homework told me that if there were to be a short case, I should consider it. Short. Which means a strong CAD and a weak USD.

Well, if you ask me, on Thurs the USD gave up all of Wed’s gains. And I’m thinking this looks like a case of buy the rumor, sell the fact scenario. See it? See how the USD was being bought up this week (that’s the buying the rumor part). But when the facts come out, it could be the selling part. Well, this is what’s going through my mind, at this time.

And then we got the CAD. In a macro sense, there’s not much going on with them. Been lost in the middle of the crowd the whole week. Oh, and don’t forget, the CAD have their labor market figures coming out at the same time as the US. Basically, I’m thinking things are gonna fly.

Well then, I consult some of my other data.

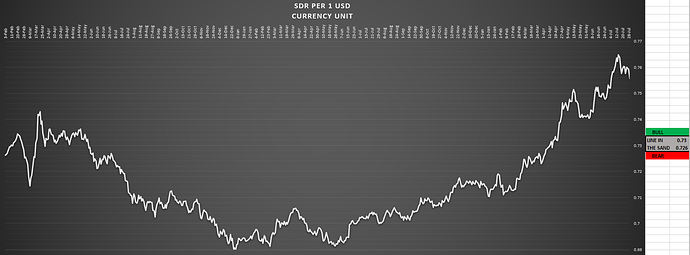

See. I still have these highlighted. Cause I need to know what’s been going on with this pair. And you should know by now, Journal, how I hate diagnosing things by looking at the charts. But anyway, what does this tell me?

Monday they are a wash. Tuesday the USD takes a huge chunk out of the CAD. 168 pips that day. Even being the 4th most bought currency pair that day, out of all of them. Then Wed it goes back to being a wash. Then Thursday’s results tell me that the CAD gets bought up more, 61 pips over the USD.

Well, I don’t know about you, but this looks like a pattern emerging, to me. It looks like the CAD is clawing its way back. All this is what’s going through my mind. Mind you, I have both of these currencies trending high. For the longer term sentiment, both of them have some serious strength.

It’s just like a baseball game. Yeah, I’ll use this example.

This past week, the Pittsburgh Pirates were hosting the New York Yankees.

2 games at home. Boy… you should have seen all of the N.Y. fans this week Journal. I did. Our tour bus was filled with them. Cause they all were wearing their jersey’s. Plus, we drive by the stadium a lot.

Anyway. Look. The Pirates stink. We are by any means a good ball club. Bad I tell ya! And the N.Y. Yankees are… let’s just say they are monsters. Yeah, it’s because they have the money to buy anyone they want to. Money talks. So, whoever is on their team, basically, is a millionaire. Big dudes. Talented. Good!

Well, guess what? The Pirates beat the Yankees in the first game. I forget the score, but they beat them by a couple runs. I couldn’t even believe it, when I heard. But guess what happened in the second game?

The Yankees beat the Pirates… 16 to 0.

Now that’s more like it.

That’s reality.

My point here is, that in any 1 game, any team can win. Any professional team, that is, can win. Sure. We had a good day, and they had a bad day. Resulting that way.

But in the long run, the trend usually wins out.

We absolutely stink.

And they… well… they have more money than God and can buy only the best.

In this case, the USD would be the Yankees, and the CAD would be the Pirates.

It can happen. Absolutely.

Anyway.

I’m going with it. I think the CAD is growing legs and the USD is faltering, going into the last day of the week. NFP Friday.

I place that trade. It was about 2-3 hours before NFP time.

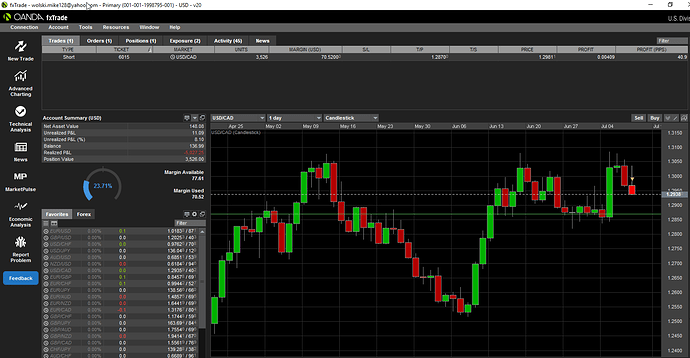

This was right before I pulled the trigger. All I got to do is hit Submit.

And then I did.

You can see that this is the daily time frame. I liked that wick on top of this day. Was a good sign, I thought.

And I struggled a bit on whether I should put on a take profit or stop loss.

Oh…I see there that I did put on a take profit. See it there?

And even though I didn’t put on a stop loss doesn’t mean that there isn’t one.

I don’t believe in showing my broker where it’s at. But when I calculate out what my position sizing is, I got to know how far I’m willing to let it go.

Look.

Anyway. I remember it was at 1.3080. But was willing to let it go up to 1.3100.

And since I can’t really watch this during the day, hey, I can dream can’t I? Maybe this will drop down like it’s hot. And I won’t be around to exit out with some good profits. Like, why not? Right?

But on the other hand, I kept telling myself that I need to check in on this throughout the day. I really tried to remember this. Trust me. Cause I can get quite busy during the day. But I needed to know whether I will get into trouble if this gets out of hand and wants to move higher than what I stated.

The good thing was that I was going to be able to watch what happens during the actual NFP time (which is 8:30am my time). And I have to leave with my tour bus at 9:00am from the garage, to go to the store. So, at least I have this time to see how it’ll start out.

Well, what happened then?

NFP comes out with better-than-expected data. Not good for the home team.

And wouldn’t you know, CAD came out with bad numbers also. Again! Not good.

Well, price action goes straight up. What can I do?

I mean, the only thing I am concerned about is whether price will go all the way up to where I don’t want it to go. Cause I’ll have to jump manually, remember?

But it didn’t.

Here’s the 5 minute chart. You can see where I sold it at (triangle). And then what happened during NFP time. Yeah boy, it goes up alright. But look at how far. 1.3035. And what’s my threshold again?

1.3080 - 1.3100

Well, I’m not in any danger yet. But honestly, I do feel good that this only went up that far. We got an entire day to go. Anything can happen. We just need the dust to settle and hope this weekly trend will catch. That’s what I was thinking. And sure… hoping.

Well, I start sweeping and cleaning my bus. But before I have to depart I check in again.

Here’s the 5 minutes charts. And it’s looking good for me!

Now I’m not too worried. Cause if it had plans on moving much higher it wouldn’t look like this. Would be more green than red.

Well, life gets in the way and I got to work.

Although I did check in on it a couple times during the day.

All I remember was that I’m not in any kind of trouble. Of course, the plan is to stick it out to the end. It’s that simple. In fact, I forgot all about it till I was coming home, that evening. The market closed hours ago, at this time.

Well, what do we got?

Hourly charts here.

Oh yeah.

Money.

All I remember, when I was coming home, was that I’m 40 some pips in profit.

Very happy.

There’s all the proof. Daily time frame.

Man, I can’t believe this was over 8% profit. Anyway.

As you know, I haven’t been able to exit out of it. So, I’m still in it.

But boy, do I have a decision to make. Let me explain.

As always, I run my numbers, Sat morning.

I get to see the whole week’s results. Most fun work ever!

And then once I’ve compiled all that data, I got to go through and check in on all of their trends. Any changes? Things like that.

Boy, the NZD still is in limbo. That’s so very interesting to me.

Anyway.

I got my prep work to do for the following week, right?

That’s the last thing on my agenda.

Very important stuff.

And what do I find?

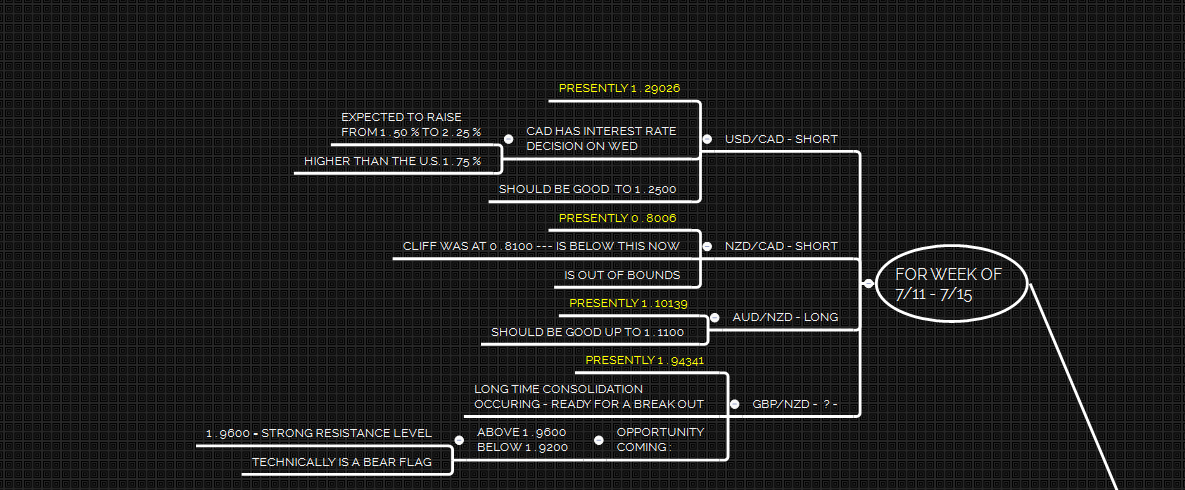

Guess who has an interest rate decision to make this coming week?

Come on Journal. Take a guess?

The CAD.

And guess what they are supposed to do?

Higher!

Well, just take a look at my table here.

Part of my prep work also.

Let’s just cut to the chase.

On Wed (13th) their supposed to hike 'em higher to 2.25%.

Well, what does this mean?

Just compare them all. Who’s gonna have the highest rate?

They are.

And how does that compare to the USD?

Up and over them. See it? From 1.50% to 2.25%. That’s over the USD’s 1.75%.

Boy… I just kept sitting here yesterday morning and thinking about this. Mulling this over and over in my head.

Is the market looking at this?

Is this the reason why it got up and over the USD on Fri?

Does the market have plans on tearing the US a new one?

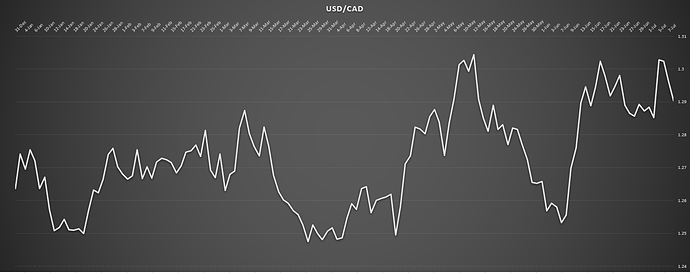

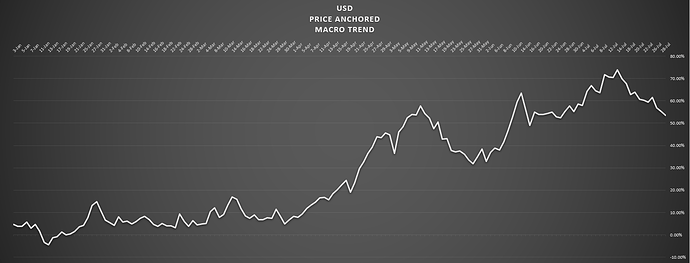

I guess you should see exactly am I talking about.

I’ll just show you the homework I did.

Macro view of this pair. Pretty choppy and back and forth.

But look at the latest. On the high side.

Zoomed in. This year.

And this is the reason why I think it can go all the way down to 1.2500.

Boy… I don’t know.

It seems a bit too easy.

I’m kind of scared.

Cause the day when I think I know what’s going to happen in the market, will be the day I swallow a humble pill. I just know it.

Maybe because it always has happened that way.

Alright Journal.

The question is… what do I do with my open trade?

My strategy states that I close it out!

I won.

It was successful.

Regardless, it doesn’t matter. I should close it anyway.

If I can’t get it before the close, I get it right at the open.

Plus, if I keep it open, I won’t be able to count it along with all my other Anchor Trades. Cause it’ll end up being another strategy. Right?

Because I’m the lion who waits for the prey and take the stab. Win or lose, that’s my one shot. I’m not supposed to hold onto it for longer. That’s all.

What I care about more than anything is how successful my Anchor Trade is.

But boy do I feel the chances of this moving all the way down is quite great.

It’s opportunity, for the taking.

Man… I got to remember.

I’m on a mission. And it’s not about the money. Or my account balance.

It’s about proving my strategy.

I’m gonna keep to that.

But at least I got it all off my chest. Thanks for your ear, Journal.

I got to exit out of this first thing tonight. 5pm. I’m out.

I don’t care.

Well, I did my homework Journal, for next week.

This is what it looks like.

We got 4 possibilities.

But, again, they won’t be for until later on in the week.

I just got to see how things move first.

I was thinking about this. I think my edge is knowing what the flow has been, first.

If I don’t have that, I think there’s too much more risk. Cause I surely believe,

there’s a predictable dynamic that happens in between the open and the close.

Alright Journal.

We’ll just have to see what happens this coming week.

Keep you posted.

Mike