Journal - there is no “disagree” button that I can hit - best I can do is comment - your author is very far from being stupid - in fact I’d say he is the complete opposite.

Good morning Journal.

Let’s see. What’s going on…

Well, looks like it’s May 1st. And we know what that means.

Yep. I did it yesterday morning, Journal. Already done.

The month’s summary.

Man… another one in the books. I just can’t believe how quickly the month went.

But. On the other hand. It seems so long ago when I look back at all that had happened (cause that’s exactly what I got to do when I reflect back on it all). Especially back at the beginning of the month. Surely, that seems to be such a long time ago. No kidding, Journal.

Well, for as humbling as it is, I still got to do it.

Face it.

Remember it.

Relive it.

All the past mistakes that I went through.

But, this month wasn’t too terribly bad (as you’re going to see very shortly).

At least I made some kind of progress.

I had my first positive trade, of the year. How about those apples, huh?

I don’t know.

I just hope this is the start of something good. Like a string of good trades.

We’ll have to see about that, cause that reminds me of what happened at the end of the month. This is definitely something I got to talk to you about. I hope I don’t forget, later on.

In any case.

Here it is.

I’ll just let all this speak for itself. Cause it can get exhausting thinking about it. And moreso talking about it.

I don’t know if I ever told you Journal, but to read it you have to start from the top right and go around. That’s how I do it.

And see. I totally forgot about that Anchor Trade #17. Man, that was so long ago.

I don’t know if that’s a good thing or not. Cause I’ve moved on.

But if there’s something I need to remember about that… well then… I’ve failed.

See? Cause I forgot all about it.

Well, at least I can say that I have revisited it.

Alright Journal.

It’s all there.

I took the time yesterday and got through that process.

Let’s see.

I do want to talk about that successful trade Journal.

Boy, it was going so well. But then it finally happened. The JPY started getting strong. This was last week. And, I mean, the Bank of Japan was hitting the wires about how weak their currency is getting. And I kind of think they might have been intervening a little, to stem it.

Ok Journal. It’s story time.

Let’s go through what happened this week.

This is what I was looking at last weekend at this time. BTW… I’m long CHF/JPY.

You can see that I have 2 positions open. Light blue triangles. That’s exactly where I bought them at. Plus, I have to show this being candlesticks. I just doesn’t work so good on my single line that I prefer.

Well then. Monday comes and goes.

It looks like this.

But yeah, now it’s slipping alright. In fact, my second position is in the negative at this point. See that price is below it? But my first position is still positive.

So. Of course. I stick with my rules. Which means that I have to play out the week.

Journal, I’ve told you a million times. I play the entire week.

Sure. The daily time frame is extremely important. I believe it. There’s nothing as important as that. Except for what happens in the entire week. Now that, actually, to me, is more important than what happens on the daily time frame.

Well, this is what goes through my mind. It’s how I think. And you know this Journal.

Here comes Tuesday.

Yep. I did it now, alright.

Now price goes below my first position. I’m really in negative territory now.

What can I do?

Well, if I don’t look, then that helps.

Right?

Right.

Boy… it’s been a while since the JPY dropped (got stronger) like this.

So, I’m like, got to see the rest of the week.

Here comes Wednesday.

Now this surely gives me hope. Got some life to it.

But still, I’m totally in the negative. And honestly, I don’t even know what the account balance is looking like. Are you kidding me? I don’t even look at my broker’s site. Why? It wouldn’t make a single difference. Other than me getting upset. Therefore I just stay away. That’s all.

Ok then.

Come on Thursday.

Basically, this is what I woke up to. Cause most of all that happened during the Asian session.

Now that’s what I call relief. Boy, was I glad to see price climb up like that.

And not only that, but look how high it goes. Above BOTH my open positions. So now I know I got to be in the positive.

So. I go about my day.

But look. I don’t stress about this stuff that’s going on in the market. I mean, I got other things to worry about. Like life.

Like, the kids.

Being safe on the road.

My other job of fueling up the busses that I do in between the morning and afternoon runs.

And anything else that comes my way during a day.

It’s the truth.

But I say all that because there did come a point during this day that I got to thinking about what’s going on in the market. In regards, to my trade. I honestly think God was giving me a hint. Cause it just popped into my mind.

I was like, “you know… maybe it’s a good time to just take the profit and run.”

Cause that still is one of my rules. I want my trade to end in the positive.

Now would be the time.

So. I did it.

See the triangle? That’s where, and when, I jumped. You can see that it was kind of late in the day even (towards the end of that candle).

All I know is that I was happy that things turned around, since the week wasn’t looking so good. Right?

Plus. I can start all over next week, if it wanted to go much higher. But it didn’t matter to me what would happen afterwards. I just know that I finally got a successful trade under my belt. Been a long time.

Well, here’s how it all ended, anyway.

Wow. I wasn’t even paying attention to this afterwards, on that Friday. Cause there was something else that caught my attention. And this is what I want to talk about also.

But by the looks of that, it does seem like I’m a genius, huh Journal?

Man!

I definitely would have been in negative territory. For sure.

That’s nice.

Well, how about one more story.

This is what happened on Friday.

See. Every day, on the job, at about 8:20 - 8:32am I got a lay over. It’s not that much time. But I have to kill the time somehow. So it works out perfectly, everyday, that I can park my bus at this Sheetz. It’s a gas station with an awesome store inside. They have these MTO (made to order) foods.

And so. Each and every day I do this. Mostly because I have a buddy who does this also. But he has like an entire hour to kill there. So, I’ll pull up. Park the bus in their big parking lot. I get out and walk past Len, and say hi, in the parking lot (cause I park right next to him). Then I’ll go inside and order up my favorite breakfast sandwich. So, by the time I pay for it, and then go to the bathroom, it get’s done. They are so good at what they do. They make that sandwich quicker than anything. Oh… and it’s so good too! No joke. But as I come out (I’m already eating it) I usually go over and talk to Len for the little time that I have left. It’s all like clock work. Each and every day.

But on this particular Friday (last Fri) Len wasn’t there. He had a different run he volunteered for that day. So basically, the only difference this day was that I couldn’t shoot the breeze with him. But you better believe I had my awesome brkfst sandwich. Sausage, egg, cheese on a croissant, toasted. Oh, by the way, that’s double sausage on it. It’s made to order, remember?

Anyway.

Sorry 'bout that Journal. Good times.

In any case, Len wasn’t here this day. So, I had a little time on my hands. I checked my phone and checked in on the market. I remembered the previous day (Thurs) the US came out with some poor GDP figures. - 1.4% QoQ. Boy… I think that was quite telling. Especially when the consensus was for us to at least be a positive, productive, operating country for the first quarter of this year, +1.1%. Nope. We contracted! Well, that stuck in my mind. And this was yesterday.

But today, at precisely 8:30am, the CAD had their GDP figures come out. One of my favorite sites is the Trading Economics site. You’ll get immediate postings here. But, I seen that Canada’s GDP figure came in quite positive. I forget exactly what the numbers were, but all I know is that it beat expectations.

So then. My mind starts thinking. I’m putting 2 & 2 together. Right?

The USD. And the CAD.

GDP’s quite the opposite.

So then, I look at the USD/CAD pair. And pretty quickly do I see that the CAD has some room to run. Let’s see if I can illustrate this on the charts.

So. What do we got?

Daily chart, zoomed out. Up to the EOD Thursday (no Fri yet).

Up and down. Up and down.

But now we’re up, very possibly might be coming down. Right?

Now, trend wise, we might be having lowing swing highs. And we could be on the 3rd one now. This is all what I was thinking. And honestly, happening very fast.

But when I seen the CAD numbers beating expectations, I’m wanting to go USD/CAD short. And remember, I don’t have much time on my hands at this point in time. I don’t want to immediately jump right in, so I put in a limit order. Right? Sounds like the smart thing to do.

This is what it looked like, at the time.

15 minute chart here. It’s definitely moving in the right direction, south. That’s CAD positive. All this is just before their economic indicator news comes out. And do you see where I put a limit order at? There at the yellow box. 1.2720 I placed it at.

I thought it was a good place. And so I did. And then I got going, on my bus. I finished up my awesome sandwich and went to pick up my little ones (kindergarden up to 3rd graders). It’s the most trying run I have. I mean, some days are better than others. Yes. I do have the same things happen at the same time, and the same place each and every day. But on the other hand, I never know whether my kids will be angels or devils. Nevertheless, I love them all the same. In fact, I remember. We had a birthday that day. Of the 40 of them that are on the bus, it was Nikky’s 7th birthday. And we do what we do every time. We all sing Happy Birthday! And today it was to him. Boy… I remember… he was so good that morning. I praised him as much as I could. I said, “Boy Nikky… you sure are starting out your sevens being such a good boy!!”

Anyway. Sorry. It was a good day that day.

Well, back to the story.

But yeah, I go on living. Like I’ve shown, I got life to deal with. Not market stuff.

But I checked later on what was happening in the market. Did my limit order get taken?

Let’s look.

Yes, it did. Only a half hour later it took. See the triangle? And it’s pointing downward also. But price looks like it doesn’t want to do down, does it?

Nope.

Boy…

It goes the other way.

What did I just do?

Well, I know what happened. My broker went down and snatched up my limit order and ran with it, in the opposite way!

I know new traders think that way.

And sure, that ran across my mind.

But I don’t particularly believe that my broker is after me.

It’s just what happened, that’s all.

So.

What do I got now?

This is how I see it.

I’ll play the game.

We got the daily time frame.

We got a daily candlestick with a very long wick on the bottom. Right where I sold it at.

But we got lower swing highs also.

That wick is gonna mean one thing or the other. Either it’ll go much higher in the coming days. Or, it means that price has tested out the waters for lower and it’ll eventually go back down there.

Of course, I’m gonna want to believe the latter. Right?

On the other hand.

I’m giving it a week to play out.

If it ends up above the most recent swing high, then so be it. I’ll have to jump.

Here’s all my rational.

— I’m thinking the fundamentals (GDP) will favor the CAD, over the USD.

— I think the USD has topped out.

— I think the CAD (as a commodity currency) have a better bet than the USD.

That shows you their trends. Which they both are trending high. Because they both are above their respective line in the sands.

But if you look very closely, the USD does have their latest line coming down. That was the last day of the week (I’m sorry but it’s so hard to see).

What can I say? I think this Dollar appreciation has been too sharp lately.

It almost resembles the sharp rise it went through when the bomb went off back at the beginning. And we all should know how big of an event that was.

Am I trying to call a top?

Am I trying to catch a falling knife (in the opposite manner)?

Well, we’ve just entered a new month. I think it’s the perfect time to come back down. We’re just gonna have to see what happens.

Like I said. I’m giving it one week.

To be perfectly honest with myself, the only problem I have with this trade is the fact that one of my rules in my anchor trade mind map is that I should not be trading the USD short. Cause, as you can see, their trend is for high. And yes, I of course, have their stated trend as high. Along with the CAD stated trend for high.

And this has bothered me a bit.

I am breaking my rules.

I shouldn’t be trading the USD for low.

Well, there it is, Journal. I said it.

I don’t mind losing a trade.

But if I look back at this, and I lose my butt on it, it’s going to hurt bad because of breaking my rule. I know it. Cause I don’t mind losing when I stay the course, and the market does crazy things. I need to stay true to myself more than anything.

But I’m already in it!

What can I do?!

Take the next opportunity to get out, maybe.

I guess I will consider that, Journal. Just because I broke my rule. That’ll be my excuse for jumping out before the week ends.

Sorry Journal. I’m just thinking out loud.

Well, this is the latest on my anchor trade, mind map.

I broke the one and only rule in regard to the micro aspect.

That’s why it bothers me.

Anyway.

I’m gonna get going.

But I do remember the last thing I said to you last time. And that had to do with following price. Let’s see if I can make this short.

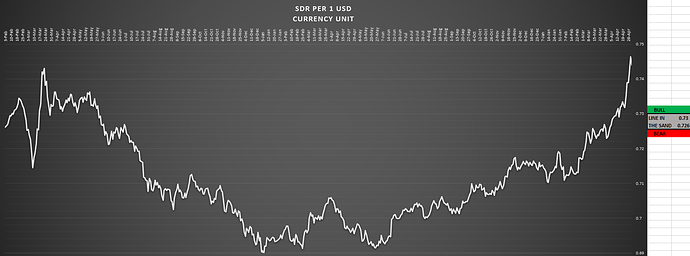

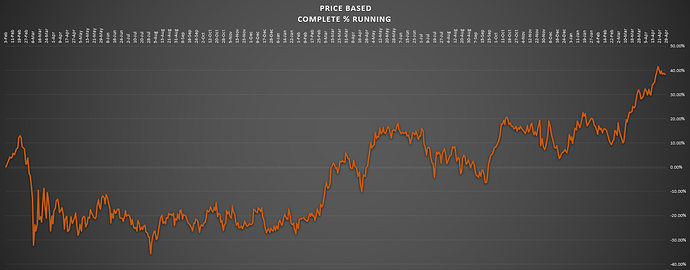

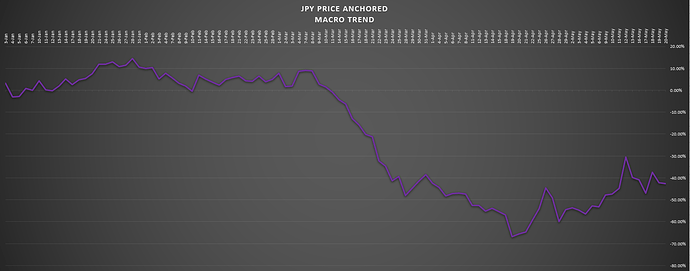

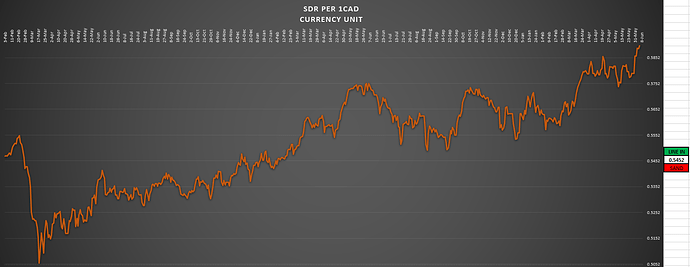

I followed it through to the end. And my conclusion of the matter is that I still prefer the IMF’s method of an index for every currency. That’ll be the SDR per one currency unit of measurement.

This is what I was after.

Price based trend.

Every currency pair has an EOD price.

All slippage that occurs on the weekends will get caught up in the EOD prices that follow. This is the biggest difference on how to keep it all price based.

This the USD back in 2020. And we have each and every USD pair, with the total aggregate amount on the bottom. That would give you their index value.

And all that is, is the % ever since this all started, from Feb 2020. And don’t worry, I added them up correctly. Some pairs you have to take the opposite value (EUR,GBP,AUD,NZD). Because of the USD being the quote currency in those.

See Journal. All this is a far cry from the way I was doing it. You just cannot add up what each day’s % comes out to be. And then string them together on a chart. Price is not factored into that whatsoever. And that’s how this is completely price based.

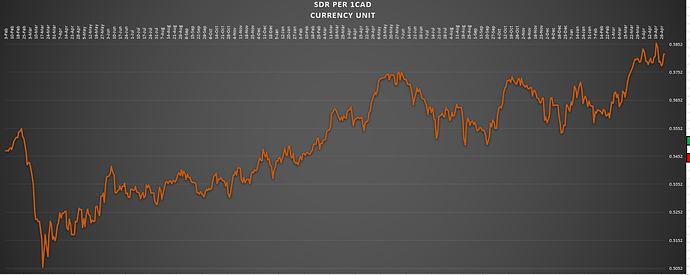

I got all the results. For every currency. And came to the conclusion that it’s not as accurate as the weighted basket the SDR gives. Oh, it does come a bit closer, but falls short. I’ll just show you the biggest difference that I’ve seen.

It has to do with the CAD.

This is the pip count method. But trust me, it’s the same as the % count.

Then we have this price based % method. What I just got done explaining.

This makes me very happy. And I almost would settle for this methodology.

But the SDR method beats them both.

Look.

Boy… I’m telling you, there’s so very big differences here. Only on this SDR method is this showing the CAD appreciating shortly after the bomb went off. I mean, you got to ask yourself, what’s the truth? Macro related… what’s the trend?

I’m sticking with this SDR method.

That’s that.

Oh…one more thing Journal.

This weekend I changed the (macro) trend to one of the currencies.

Guess which one?

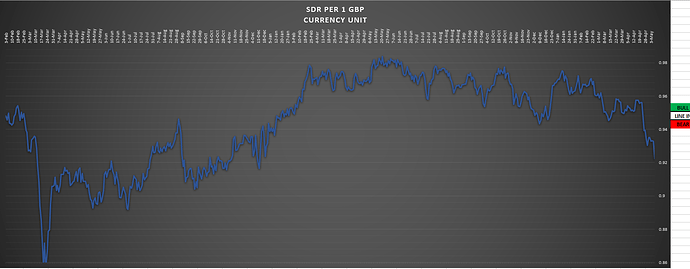

The GBP.

Yep.

I’ll show you why.

I matched up, as best as I could, where the line in the sand lies on the chart.

Bottom line is that this index falls below that now. Look back at the most recent swing lows. Predominantly two of them touch this line in the sand. And I tried to line up the white part with that. Anyway.

It’s been coming. Right? No real surprise. Lower swing lows, and highs.

I probably should keep this in mind. Cause I’ve always thought that it would be a very good idea to trade a currency that has just changed trends. I mean, I really do think this is having some kind of edge in the market. I’m not keeping track of this stuff for my health, you know. Right? It’s good to know when things change. Cause it only makes sense that if you can get in on something early then you should have good opportunity to ride things out, without being under so much pressure.

Well, I got to deal with this USD/CAD short trade first.

I’ll keep you updated on that Journal.

But then afterwards I’m gonna have to keep my eye on this GBP currency.

Alright Journal.

Thanks for listening.

I appreciate you letting me get it all off my chest.

Now I’m content.

Mike

P.S. — Peter… For as much as I look up to you, that compliment was extremely meaningful to me. Thank you!!

Good morning Journal.

Let’s see.

What’s been going on around here.

Well, I can’t trade, that’s for sure.

Man, did I mess up that USD/CAD trade I told you about, Journal.

And I really don’t feel like talking about it. But I think I have to. Just so I can’t get passed it. I made some big mistakes.

I talked quite a bit about this.

So, let’s see if I can find what the real problem was.

The USD/CAD short trade.

Well, it was a rash decision. — Bad —

I placed a limit order. — Good —

The market took me in and immediately price went the other way. This was how it ended up last weekend at this time.

Yep. Those are the things I said. And did mean.

So, what happened anyway?

Monday comes and goes.

This is what it looks like at the EOD.

Not good huh?

So.

I seen that it went higher. It ended the day that way. So I jumped. You can see the triangle where I did. See how it’s at the very end of that candle? That means EOD.

But what did I tell myself?

That I would give it a week to play out.

Did I?

No.

I broke that rule. Well, I didn’t follow the plan. So, same thing. I didn’t follow through to what I was planning.

But then I said that if it ends up above the most recent swing high then I’ll have to jump. So, at this EOD, I basically thought that it did go up that high. That is the reason why I jumped. That, and the notion of wanting to protect my account. All that was going through my mind. Take the loss. That’s exactly what I did.

All that means nothing, because first of all, I didn’t wait this out till the end of the week. I jumped prematurely. Therefore, that nullifies everything that happens afterwards. Right? The bottom line was I failed to follow through with what I was planning.

Ok. So. Here it is. I am not staying true to myself. I just proved to myself that I didn’t follow through with what I was planning. Plain and simple.

Well, there’s more.

What else happened?

Well, I wasn’t paying attention to it until 2 days later. I was seeing price come back on down. Doesn’t that figure. Well then, that gets me thinking. I should have just stayed in it. Maybe I was right all along.

I get back in it, on that Wed. The triangle shows you where and when. See it? Well, that means that I got in it before the end of the day. Cause price ended way back down below. So, I was happy how it was turning out, especially at this Wed’s EOD.

I figured I would just stay in this for the duration. Well, as we see, price turns and burns. Back on up it goes.

So much for that.

I finally couldn’t take it anymore and jumped out completely towards the end of the week. Again, the triangle shows where and when I did it.

Well, how about that Journal? I managed to break every rule more than once on this. Basically, it looks like I just went rouge with it. But what would have happened if I would have stuck with following my plan?

— I should have stayed in it till the end of the week.

— I should have exited out. Cause it ended up above the most recent high. Which is that 1.2900 line.

I don’t know.

Well, yes, I do know.

I failed. Big time.

Exactly where did I go wrong?

What do I need to learn here?

Stuck with my plan? — Would have lost.

Stayed in it till midweek and then jumped. — Would have saved a lot of money, cause look where I originally got in at. Could have broke even, looks like.

Or… Maybe I should realize something else to begin with.

This trade shouldn’t have been, to begin with.

Yeah.

The more I think about it, I lost before I ever started.

Sure, there was a chance of saving it, but it’s just too hard to do.

Hindsight tells a different story than when you’re actually going through it.

Cause I didn’t know we were going to have a roller coaster of a ride.

Man… there’s so many would of, could of, should of’s.

I’m done with it.

I have got to move on.

I can’t, won’t, trade the USD short. And the reason why is that I have them trending high. Not low.

Let’s see if I can not do this very thing again.

You dummy.

But I do want to put on another trade.

The question is, what?

Oh… and one more thing Journal. I thought about this. Who in their right mind (a swing trader anyway) would pick up a USD trade on a FOMC decision week? Going short?!!

Yeah, there was so much wrong with that trade.

Ok. Now I’m done.

Moving on.

I want to figure out what to trade.

And this is a good time to tell you what else I was preoccupied with, this week.

Journal, I decided to overhaul all my data collecting. This is gonna take some time. I don’t want to rehash the reasons why again. I’ve told you this over and over. But needless to say, I was dealing with some very wrong data. Deep down, I’m still in shock that for the last 3 years (each and every day) I was collecting and putting together numbers that were totally incorrect. Giving me such misinformation about the macro, even micro, state of these currencies. I honestly can’t believe it. Well, I know I can’t erase the past. But I can erase my excel spreadsheets and make new ones. And that’s what I’ve been doing lately. At least I know now that I got the correct data. So that’s a plus.

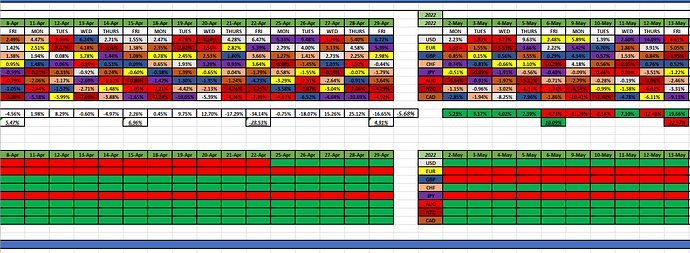

Well, here’s an extremely zoomed out view of what this year looks like. With my correct data. The top part is where I copy and past the daily raw numbers. They get automatically inputted below, in that second table. Then in the blue box is where I got the yearly, quarterly, monthly, weekly, daily, line-ups. It’s all in %'s.

How about we take a quick look at what’s happening.

Let’s bring it in. From big to small. Yearly context.

The USD (white) running at +48.33% against the 7 other currencies. You can see the progression that took place, of how they got there. In white, they overtook the Comms that were in control through April. So, it’s pretty clear what’s been happening. We had a change for what’s been most dominant. It was the 3 Comms for the first quarter. Look at the 1st quarter results. Left bottom corner. See it? All 3 of them took charge that entire quarter. And the only other currency that ended in the positive was the USD, of course. The rest of them were negative resulting.

But then a new quarter started. And when you reset all of them to 0 and they come out of the gate what happens? The USD, quickly, takes up the top spot. But the CAD looks like the only other currency to give the Dollar any kind of competition. The other Comms kind of fall apart. That’s in that context. But in the yearly context they have enough percentages accumulated in them to keep them elevated, when they slipped. See what I mean about what context we’re talking about? I can say that the Comms were weak, and yet they were strong, at the same time. Now if you were trading the Comms, I kind of think you would be losing some money during the last month or so. Right? On the other hand, I guess it depends on what other currency you’re trading against.

Now the JPY (purple) is holding up the bottom once again. Not coming up off of bottom on the yearly context. No way. Now on the quarterly they’ve actually come off of bottom. How about that. And it was the NZD that got pretty heavy and upended the Yen down there.

Remember last weekend I changed the GBP trend? From bull to bear. So, this past week was the first week for them in their stated bear market. Let’s look in a little closer, with this in mind.

Top table is the month running. Middle table is the individual daily results. Bottom is the weekly results. Now, the GBP. What did they do this past week? Bottom right. Dragged bottom, ending up -10.80%. They had their interest rate decision Thurs. Well, bottom line there, is that they followed through with their newly found trend.

BTW… all this is what I consider micro stuff. This has no bearing on how I come up with what macro trend they are in. That macro trend comes from my SDR per currency unit chart. I explained all that earlier.

I want to go back to the JPY. Cause I’m wondering about whether to trade them again. As I’ve had my first successful trade with them recently. So, why not?

We know how weak they’ve been. But has their been any kind of strength to them lately? Well, just look at the last week of April (bottom middle table for Apr 29). They were running as the most bought currency for the first 3 days of the week that week. But slipped up some. Then ended as the 2nd most bought currency. Aggregately speaking. But that’s EOM don’t forget. Things usually don’t go by way of the trend during that time. Right?

So, then what happens afterwards? Last week? Well, I think the market forgot about the Yen and simply wanted a weak GBP. Man… even the CHF. Even the NZD got sold (aggregately) more than the JPY. Does this mean the JPY is getting a bit stronger? Or has the market put them on the back burner?

I’m sorry. But the more I think about it, it still holds true. It’s what I said a few weeks ago. There isn’t a bigger story, or shall I say anomaly, than a weak JPY. There isn’t. And nothing has turned that tide yet. I seriously don’t think that consensus has changed. There’s no signs of smart money wanting to go that way. Their central bank hasn’t put on the breaks yet. They just keep saying, over and over, that they don’t want to see extreme moves in the value of their currency. So, I’m thinking that if there is a sure bet it would be a short JPY.

On the other hand, we just had a change in (macro) trend. The GBP. And I’ve said it last week. I really think it’s some kind of edge when you can get in on a newly developed trend. How about I take a look at their latest macro trend (I haven’t yet, so this will be the first time I’ve laid eyes on this, since last weekend).

Yeah boy, did they fall through my line in the sand.

This trend has changed. And from what I know of the GBP, they like to go to extremes. This could be the beginning of a long fall.

Look. I’m tired of the talk. Anything can happen here.

Nope. I’m not gonna do it.

I’m gonna stop right here and not go into the hundred or so scenarios that can possibly play out from here. There’s just as many bullish possibilities from here as there are for bearish possibilities (break and retest scenarios).

So.

Do I go with something new? Hence the GPB.

Or do I go with something old? Hence the JPY.

That’s for the short currency.

What about the long currency?

Honestly, I’m afraid of the USD.

Man… if I thought that last weeks chart was scary, I wonder what their latest macro chart shows.

Alright. Here it goes.

Ok. Their bullish alright.

That’s nice.

Still scared.

Cause watch if I go long the USD, boy, it’ll come back down alright.

Look. I just don’t know what’s gonna happen. All I know is that I’ve gotten burned so many times with them. I’ve got a serious mental problem with the USD. Therefore, I can’t trade them.

What I do like is what’s going on with the CAD.

The Commodity Currency that it is.

The elevated % numbers we were looking at earlier, on my tables.

Well then, what does this look like?

Well, it’s up there alright. Up on a higher shelf. And no signs of slipping either, right?

This makes me want to go with a commodity driven, long trade.

The way the world is going, it doesn’t seem like we’re going to have any kind of changes soon.

- Higher and higher inflation

- Longer, drawn-out war

- Mr. Oil will keep going up

Until something cracks.

So.

What do I have?

- Go short JPY

- Go short GBP

- Go long CAD

- CAD/JPY - long

- CHF/JPY - long

- GBP/CAD - short

I put up the CHF/JPY possibility because that’s the pair with the strongest yearly running pip count.

Man Journal… do I hate looking at charts. These pair charts. Know why?

Cause all of them simply can go either way!

I always come to this conclusion. Like always!

I get so tired of coming back to this and doing what every other trader ends up doing. And that’s looking at all of the charts. Saying to yourself, "This should go this way…This should come back on down…This has to turn…This one is extended way too much…This trend should continue…This trend needs a breather…This trend needs to turn down… It’s exhausting. I honestly hate looking at charts. I get so upset each and every time. Because I know it’s a crap shoot. You can roll the dice and be right just as many times as you would think that a particular technical pattern should turn out.

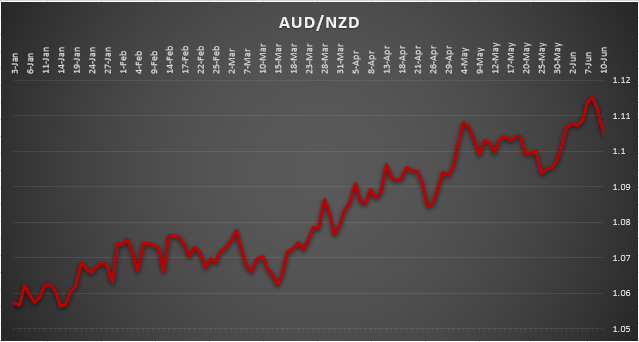

What I want to do is go with a short GBP, according to my numbers. The new short trend that I have determined. But when I look at the charts all I see is they’re so overextended. Like that GBP/CAD chart. Who in their right mind will go short that?

This pair has been bearish for so long now. But my data tells me that the GBP has just begun it’s short, bearish, trend. I mean, are we always going to be late to the party? How about the weekly chart?

Wow. Now who will go short this?

Yeah, probably me.

Know why? Cause I bet you every trader out there is looking at this chart and saying that we are due for a rise off of the bottom. It’s like the no brainers of no brainers.

Well, I guess I need to decide what I trust in. My data, or the charts.

More specifically, do I trust my GBP SDR chart above?

Or these broker charts?

Well, I have got to pick something that I trust in.

How about this.

I am trusting that the JPY has more depreciation to go in.

That’s for the short part of a trade.

Now the long part. Let’s look at the AUD, macro.

Well, looks it’s coming back down. Off its high.

What about the NZD.

Boy have they come down, huh?

Now this is scary to think that the Comm currencies can come back alive. Cause lately they haven’t been. Remember way up above how they’ve faltered all through April?

Well, that’s why I would split the difference by going with the CAD.

See?

Ok then.

I’m gonna trust that the commodity play is still alive.

That leaves me with only one pair.

The CAD/JPY. For long.

I also realize that I’m trying to preempt what should happen. You know, speculate.

But I’m not going to speculate.

I know it’s better to follow than speculate.

So, my plan is to keep an eye out on what happens in the market.

I’m not going to watch a particular pair. I just don’t want to do that. I’m getting tired of getting mad, upset, frustrated, livid… when I do.

I’m going to watch for what is strong and what is weak.

I’ll be looking for a strong CAD. And a weak JPY.

If those 2 factors come to be, then I’ll go in with that pair.

I just want to see these trends continue.

If I start seeing some Comm buying, I’ll get in.

If I start seeing some more JPY selling, I’ll get in.

I’m just gonna keep it simple.

But I am not going to watch that pair.

I want to work of following.

This seems the way to do it.

Alright Journal. I’m running out of time.

Man… I’m so sorry for all this nonsense. I really have thrown out here so much stupid talk. But thanks for listening anyway.

Mike

You have a very cool magazine. Especially recommended for beginners!

Good morning Journal.

Well, this week I finally accomplished what I was setting out to.

A revamping of all my EOD data collecting.

Yeah boy, that took some time, alright. Oh, that’s right, last week I did show you some of what I was doing. Well, that’s just a little snippet of the whole thing. I got it all now.

Look Journal. I know that I’m not doing all this for nothing. It’s got to mean something. I can’t be spending so much time on stupid, nonsense stuff. I’m aware of that. Not that it takes so much time to do, but when you add it all up, day after day, sure, it is a lot. But honestly, it does make me feel like I’m building something. Like, all of what goes into building up a business. There’s a sense of accomplishment that comes with it, no doubt. I feel it every day. But I also realize that it has to mean something. Like, knowledge. Real clues that the market puts out to us every day. I just hope that that’s exactly what I’m uncovering. And nothing more. Know what I mean, Journal?

But anyway. I believe I got it now. And I do want to show you and prove to you that this stuff is important.

This leads me to the other point that I wanted to bring up to you Journal. Man… it was something I said last weekend. This stuck with me. And I think I got to continue on with this.

Follow the market.

Don’t speculate.

Journal, I’ve adopted this quite a long while ago. I’ve never heard anyone say this before. This is all proprietary thinking. I know this derives from within myself. And no one else. In fact, I don’t even know if anyone will understand it, to begin with. But I’ve said this to myself over and over again.

I’ll prove it.

I remember when I wrote this up on my wall, in my office. That was back in '18.

I’ll have to dig this out.

Hold on Journal.

Well, this was a pic of my office, at home, back on Jan '19. I had a lot of things written up on my wall. And I did show you a whole lot of those things. But I know that I kept changing the content that was up there. I guess I never shown you those big, huge, words that said, “Don’t speculate, FOLLOW.” In fact, I remember it was written right in front of me, on that wall, just to the right of the window. Man… so many different things got written up and taken down on those walls.

Wow. Talk about a journey down memory lane. Well, that time was when I had a complete year, at home, devoted to trying to make the day trading thing work out.

Of course, we all know what happened then, right?

Tragedy.

Yeah, and that was at the 5 year mark too.

Boy, I don’t know who I thought I was, but whatever it was, it wasn’t the real thing. That’s for sure.

Well, I shouldn’t beat myself up too terribly much. I mean, I did get laid off from my job. We all got the axe. And I wrote all of that up in detail also. What was I gonna do, anyway? I thought that after 5 years of complete devotion that I could make it on my own. I gave it a shot. And I will bet that I put in my 10k hours worth of time up to this point. Actually, I think I remember that during this time in my life I might have made it to only 7k hours. Cause I ran the numbers when I developed my business plan. Man… I really went through a grueling, mental internalization during all that time.

But I couldn’t do it. I am thankful to God for giving me that time, for a trial. I just know that it wasn’t the right time. It was like I went into the promised land for a short period of time. It was a taste of what I want to be when I grow up. It was just too early.

And now… just about another 5 years later than at that time… I kind of think I just might be at the halfway point now. Yeah, like, apparently the time, anytime soon, is not right.

Well, at least I’m gaining experience. And no one can take that away from me. I am learning something each and every day, believe it or not. This business is not easy. I just might be the slowest learner there ever was.

Or… on the other hand… maybe God just has me going around for 40 years out in the desert before I am worthy of the promised land.

Timing.

It’s all about the timing.

One of these days, it’ll happen.

But on His timetable, not mine.

To own and operate my own fulltime business. Successfully. Self-sufficiently.

Ok. That’s nice.

Where was I?

Oh, that’s right.

“Do not speculate, follow.”

Well, in order to follow something, you got to know what’s been going on, in the first place. Right? And this is the whole reason why I collect a bunch of EOD market data. It’s to know what’s been going on.

— It’s facts.

— It’s truth.

— It’s history.

— It’s clues.

I think this is the place to start. It only makes sense that in order to follow something you got to know what you’re following. In this case, it’s the market.

Well, I guess now is the time to prove it to you, Journal, whether this stuff is important or not. I’m gonna go down the line on what I collect. It might seem like a lot, but each and every day this only takes me just short of a half hour to do. During that time, I end up with all the data that I need. So, here we go.

This is probably the most important information I can get. Price. That’s EOD price.

Everything else, below, stems from this. And it takes no time to copy and paste these 28 daily prices.

Well then, all that gets automatically inputted into this.

The colored part in the middle is the aggregate. In this case, the USD aggregate. The macro. It’s just a way to see how the currency has done as a whole. Nothing but all 7 of its pairs added up, that’s all. And so, I have all of the currencies done this way on down the line.

So now all I’m gonna do is consolidate these aggregates.

Yeah, I showed you some of this last week. So, we’ll just look at what’s been happening this week. (top table is month running, middle table is daily results, bottom is the week running).

Let’s look at what happened last week. Bottom table.

The majors started the week out more bid than the comm currencies.

EUR on top. JPY about the same. GBP and USD all being bid up. So we can easily say that it was a risk off day to start the week off. Right?

Then Tuesday comes in with some very small numbers. Results. Must have been a bunch of back and forth going on that day. See it in the middle table? I mean, the USD ends the day as the most bid currency being only +1.39%. Very unusual. But for the week running (bottom table) we got both the JPY and the USD on top. Actually, the GBP and the EUR are about right there with those 2. So we can see where most of the buying went to. And where the selling went to also.

Wed comes in with some small resulting numbers also. 2.60% and -4.78% for the top and bottom are very minute results. Again, I think it’s a lot of back and forth with not much consensus between everybody. That’s all. But look at Wed’s weekly running result. Who’s being the most bid currency? The JPY. Now sitting at +8.59%. This is not normal. When was the last time the JPY showed any kind of buying like this?

But then Thursday comes. If you think you’ve seen it all, you haven’t. Just look at how much the JPY is being bought up now. They end the day being bought up by +14.09%. Bringing up the weekly total to a whopping +22.68%!

Now were talking unusual. It’s a Yen show this week. It was the consensus. Everyone was on board with buying them up, against all other currencies.

So… what do you thinks gonna happen come Friday?

A JPY sell off.

Well, believe it or not, I placed a short JPY trade after the Asian session (cause that’s when I seen that they were being sold off).

I think this is a good example of following the market.

I watched. Waited. Then before the week ended, got in on the retracement.

Look. I’ll show you.

I took this pic on my phone on Friday morning. This is about 3 hours after the London session started, and a couple hours before the US session started.

So yeah, I went with the CAD/JPY long trade. I kept with my trading rules. Only trade with their stated trend. Sure, the JPY was having a great week, but they are still trending low. Remember? And the CAD is trending high. I just took the opportunity of how a week plays out.

Well, how did the rest of the day turn out?

It turned out quite nicely. +96 pips, + 41%

I know I put a lot on that one. This is nothing to brag about. In fact, I shouldn’t have even brought it up. I was confident about this, that’s all.

Anyway.

The point here is that I had in mind, this whole week, about how to follow.

And I think this is a very good example of how to follow. Right?

I mean, I didn’t speculate about it. I watched how the week was going and then jumped in on the last day.

I’m gonna stop talking about this, because I know that this doesn’t happen all the time. I got lucky.

But I do have to know what I’m gonna do now.

When am I getting out?

Yeah… good question. Cause I need a plan before the week gets going. Honestly.

Well, it comes back to the data. And that’s what I need to look at now.

This is the question.

Will the market go back to the prevailing trend this coming week?

Or will we see some more JPY buying? Which is counter trending.

How about I continue on with showing you all of what I keep track of. Maybe I’ll get some answers.

Ok. Moving on.

This is volume.

Volume for each pair up above. Then aggregated for each currency, in the box’s.

Then on the bottom all totaled up, for a complete market daily total. Well then, I make that visible in the form of a column chart. The actual bars are in dark and the average daily bars are in the yellow color.

The only point here is that we have been above average, like all year!

This market has been moving and moving. Lots of trading been going on.

The only thing I don’t understand is how the 2 pairs NZD/CHF, and the CAD/CHF have been consistently below their running average. I just don’t understand why.

I don’t know. But is interesting, nonetheless.

So. Moving on. I’ve kept with the macro numbers up to this point. I purposefully did this because I believe macro comes before the micro.

Still with the macro.

This is the SDR’s per currency unit. This is where I initially place them. Copy and paste. But they’ll get automatically transferred to other places, from here.

These numbers tell me each currency’s macro trend. Journal, I’m sure you remember me showing you all this stuff before. But how about we just look at a couple of currency’s trend. Like the JPY. And the CAD. Because we need to.

So, what’s the latest showing us? Well, what can I say, but this is not showing much of a retracement that occurred last Friday. The IMF comes out with these daily results much earlier in the day. I think I read that it comes out when London ends their day. Right around our 11 o’clock am. But still, the JPY was nose diving ever since the Asian session got going. So, I don’t know why we haven’t seen much of a drop. Maybe by Mondays end will we see some of that, I don’t know.

Anyway. This shows me that it’s still too early to tell of any kind of change in trend. Don’t forget, this is macro stuff. The JPY will need to stay pretty high for much longer if we will ever see a change in trend, right? So, I guess we’ll need some micro data for some help with this (my decision whether to jump out or not, of my running trade).

The CAD. Macro trend.

All kind of bullish. And no signs of a retreat either. Not yet anyway.

Moving on with the data.

Still keeping with the macro. Top table is the daily macro results. In %'s.

The bottom table (red and green) shows what macro trend each currency is in.

Then underneath the daily %'s is how the day ended aggregately. Whether the market ended the day with the trend or against the trend. Actually, this shows normality. Did the market go with the trend? Or did the market go against the trend? And by how much of a %. Just look at what happened this past week.

Monday comes in extremely non normal. -31.29%. That’s unbelievable. How?

- USD is trending long, and resulted +4.18%. Trended.

- EUR is trending short, resulted +5.89%. Counter trended.

- GBP is trending short, but resulted +4.34%. That’s counter trended.

- CHF is trending long, but resulted -0.09%. That’s counter trended.

- JPY is trending short, but resulted +5.42%. That’s counter trended.

- AUD is trending long, but resulted -10.41%. That’s counter trended.

- NZD is trending long, but resulted -6.54%. That’s counter trended.

- CAD is trending long, but resulted -2.79%. That’s counter trended.

Well, there it is. Look at how many went counter trending? And only one went with the trend, the USD. But if you add them all up it should equal the total -31.29%.

Ok. That’s enough of that. I think it’s important to know how the market went. Whether it was a normal or not so normal day. Even for the week. So yes, I think it’s important to know. It’s not for nothing. I mean, I’m not gonna hinge any trading decisions on it, but I do think this is useful info.

Moving on.

This is the only time I am collecting pip movements. I did swear it off, cause price is most important. But, it’s what follows, of why I do this.

Now we’re going to be getting into the micro data.

Well, I got pip movements on each pair, for the day. Not only for the day, but for the week, month, and the year.

Let’s see. Anything standing out this past week?

Thursday was a big day for the JPY. Btw…forget about the bluish colored right column. That’s only when I want to add up a basket of trades, for the day. Disregard that. It’s the left and middle column that means anything. Look at Thurs. The JPY’s 7 currency pairs are in the top 8 spots for the day. That tells you how much buying was going on with the JPY. Basically, everybody was buying them, and all of them.

And looks like I picked the best pair to trade on Friday. Look at which pair was the most bought that day. CAD/JPY +193 pips. Interesting. And how does this compare to what happened just in the day before? Well, the CAD/JPY ended Thurs as -156 pips. So, for that pair only, we seen more than a 100% retracement. Now that’s interesting. That just might want to keep on going.

See Journal? There’s a difference between looking at the macro & the micro.

On this particular pair, this Fri result shows me that this pair just might want to continue on with its prevailing trend. Which is long (bull CAD, & bear JPY). Cause of how much it retraced. It very well could be a clue. Maybe I should stay in this.

How about what happened with this pair on the week as a whole?

It’s there in yellow. What was the weekly result? -36 pips.

What does that tell me? The JPY had slightly more strength. But 36 pips isn’t much to sneeze at, is it…

I don’t think so. For as strong as the Yen got this past week (as I’ve shown you on their macro) this pair isn’t agreeing all that much to that. Well, what about any other Yen pairs this week? It’s all there in the yellow table.

- USD/JPY = -90 pips

- NZD/JPY = -166 pips

- GBP/JPY = -197 pips

- CHF/JPY = -201 pips

- AUD/JPY = -208 pips

- EUR/JPY = -240 pips

Well, I surely did pick the best Yen pair. CAD/JPY = -36 pips.

But I got to say though, there’s a lot of pips going by way of the Yen, right?

Ok.

Well, this is micro analyzing for ya.

Right?

Moving on.

All this is, is taking the strongest and weakest currency pair (top & bottom one) and seeing the results if you would have traded this for the entire year running. There’s 2 methods here. The % method, which has been the USD/JPY pair lately. But the bottom method has been the CHF/JPY pair lately. That method is going by which currency pair actually has the biggest spread. I get that info from this table.

Whichever pair is on top has the most amount of pips accumulated since the beginning of the year. It’s been the CHF/JPY pair, but look at what’s been happening lately. We have a new sheriff in town. The EUR/NZD pair has taken over as the pair with the most amount of pips accumulated since the year started.

Anyway, you can see which method is churning out better results (boxed up #'s).

The actual method.

Well, that table right there is the last of my data. Well, not really, but it is on that excel page. That’ll be all that I get for a day’s worth of data.

All of that is on this 2022 tab.

The volume tab is what I need to figure out what average. It’s the supplement that I need in order to come up with my volume data that I’ve shown you.

Then I have those tabs dedicated to each currency. That’ll be where my macro charts reside. Plus other stuff pertaining to them.

And then, I got a prices tab. That was developed this past week also. Oh, that’s right. Man, I wanted to show you stuff from there also. Well…

I’ll just show you one currency. I prepped all this stuff yesterday, for this very reason. So, therefore, I’m gonna show it to you Journal.

Keeping with the JPY.

I’ve always cherished this particular way of looking at a complete currency. I used to formulate my brokers charts this way. It was the only way I looked at a currency. But I don’t really go to my broker anymore. I make my own charts now. For diagnosis purposes, that is.

This is YTD context. And you can see how recently on every pair (except against the USD) that the Yen has been getting strong. Let’s see. Probably against the GBP have they really appreciated the most, right? Even against the NZD. Oh, and even the CHF. Just look at that one (top right). So really, the question is, will this trend continue? How about we zoom in a little more. This month of May.

Well sure this is a trend. Except against the USD, of course. But against all the others, man, we’re coming down. Even against the CAD. Sure, it retraced that last days worth, but that’s about it. There’s all kind of reason why it could go back on down.

Now here’s a good reason why the macro is important.

Cause when you have most, or all, of the pairs looking very similar, then I think that’s a sign of consensus. Meaning, they just might be picking up some momentum.

Ok.

Enough talk.

What am I gonna do?

Hold and ride this pair?

Or take the profit that I have accumulated?

Well, when I think of it this way, why not take the profit?

I can always get back in, right?

I can play the week with a focus on whatever the JPY wants to do.

The story will continue on, will it not?

Either it will try to keep with its strength, or it will revert back to its long standing bear market run.

It’s got to be one or the other.

Alright Journal.

I’m done talking here.

I am going to take this profit at the open.

Thanks for listening Journal.

Mike

Good morning Journal.

Let’s see. What’s been going on?

Not too terribly much this past week.

I haven’t been on any kind of mission or anything like that. You know, like, when I get bothered about something and I got to get to the bottom of it.

Nope. Not this week. It’s been quiet.

I think I’m completely satisfied with all my EOD numbers… finally.

I don’t think I’ll be changing anything anymore. I mean, I hope not.

Look. There’s been some very good reasons why I’ve had to keep changing things.

Like, for the very first time, I’m finally dealing with correct data. I mean, that’s a biggie. Oh… I’m still very upset with myself for thinking this whole time that I had right numbers. Boy was I wrong. I guess now is a good time to begin.

Begin what?

Begin establishing my own historical currency data base.

With correct data.

Now I can go back and start backfilling previous years. With the most important time period being when the bomb went off, 2020 to the present. That’ll be what I work on next. I mean, I think it’s important. Especially if I would ever want to do some projects. Or just some good old fashion back testing. See? I believe the market leaves behind all kinds of answers. If I wanted to look back at a particular pattern, or a dynamic, or a certain relationship, etc… then I’ve got to have all this stuff available for me. Know what I mean Journal?

Anyway.

That’s nice, I know.

Well, all I really want to do is to wrap my head around what’s been going on in the market lately. And then I should stumble across the trade that I got into.

Alright then.

Let’s give the story.

What’s the narrative the market has been giving us?

Well, we’ve got to start out with how the week played out.

I think this is the most important time frame we can possibly get. Why?

Cause we have a beginning and an end.

The top table is the daily individual results. Bottom tables are the weekly running.

So, the gate opens up. Monday results are all not that impressive. Nothing really flying away, because these resulting numbers are very small. I’ll have to say that a daily average amount will be around 5%,for the top position and also for the bottom position. So around 2% means no currency is dominating. And also if you look, for the top 3 spots, their all real close. The market is not moving. But the top 4 spots all happen to be the risk on type currencies. So we had more risk-on buying than risk-off buying. Just look at whose on the bottom. Right? The 3 safe havens.

Tuesday comes in, with a purpose. The GBP takes the top spot (+6.14%) and causing them to be the most bought currency up to that point in the week (+8.31%). And the EUR comes in pretty close behind them. Definitely being bought up (+3.19%). So again, we have the risk-on currencies being bought up and also the safe haven currencies being sold off, in these first 2 days of the week. That’s what I see.

Then Wednesday comes in. Just look at the top 3 spots. Who’s dominating now?

I’ll give you a clue. Not the risk-on currencies anymore, this week. We got the JPY very strong. And the CHF also very strong right behind them (+9.65%, +7.69%).

So, how’s that make the week net so far, at Wed’s EOD?

Well, let’s welcome the CHF. For the first 3 days of the week, they become the most bought currency, by far (+7.30%). Way much more than any other currency. It’s their show this week. And I hate to say it, but the GBP goes straight to the bottom. Man, what a turn around. Basically, they pretty much gave up all those gains. But still coming in positive for the week, at this EOD.

How about Thursday.

Wait.

Before we go on. I need to tell you something about this CHF.

I didn’t tell you last weekend, at this time, what was going on with them.

But I had to change their stated trend. It’s actually more of a longer time frame trend. But nonetheless, they changed. I’ll show you why. This is what tells me this.

Well, this was last weekend’s look. See my line in the sand? 0.754

I had to change their long trend to short. See how far down they’ve been coming? That’s nasty. Straight down. And then below the line. So I knew I had to change their trend to short.

But. Look at what happened the last time they’ve played around this area. It’s a place where they want to bounce. Sure. Maybe the SNB wants them to be below this area, but not the market. That’s for sure. And I knew it. I kept saying to myself that these guys need to be watched. And for sure I won’t be trading them. I would be out of my mind if I did. Absolutely no way.

And well, we know how this week went, right?

Let’s see it in this chart form.

Yeah boy, I knew it.

I knew I would be changing their trend back.

I did Journal. Cause I was thinking of giving it another week, just to be sure. But no. I went ahead and changed my trend data anyway.

It’s ok. I’m just going to change it all back. Cause they are NOT trending low. Not now anyway. We need more time to play out to get the accurate picture. But boy, that’s like a hot plate down there. The market doesn’t like a weak CHF. Sorry SNB! It’s not gonna be the way you want it to be!

Well, I think this was the story this week. But also, important to note, is what the USD did. I’ll throw it up again.

Who’s the most sold off currency this week?

Yep. The USD. -11.21%

That’s the outlier this week. Cause it’s the biggest number we have, when you add them all up. Right?

But what a mixed-up week we had.

Even more, let’s step back a little and see what’s been happening in the last few weeks. What I’m saying is, just look at the results of the last couple weeks, ending the 13th and the 6th.

The JPY dominated that previous week. See it? And on the opposite side of that was the Comm brothers on the bottom, except the CAD. They pulled away from them guys in the last couple days of that week. But the bottom line is that it was the JPY show that week. 13.55% is a lot.

But then for the week of the 6th there wasn’t much a consensus. We got some small numbers for the whole entire week. Well, maybe the GBP was the outlier. For short. Other than that, not much noteworthy.

See my whole point here?

What would be the story?

Each week someone has a turn. And dominates.

We just don’t know who it will be until it’s over. That’s all.

But… I would have to say that the risk-off scenario keeps showing something at the top. But the USD is not being the most favored currency for it. Man… especially for this past week, huh? If that’s not evident, nothing is.

How about some other data (cause I’m not doing this for nothing).

This is micro data. Just counting pips here.

What was the best pair to have traded this week?

GBP/CAD = +414 pips

Wed was the only day this pair netted a negative daily result. It went 94 pips to CAD. So, that’s nice. I guess. What does it mean? I don’t know, just interesting. It’s all after the fact, facts. But look up above. Their macro numbers. The GBP ended the week in second place +4.20%. And the CAD ended the week second to last -6.35%. I guess that’s interesting also. Ok then, what was the biggest macro spread? The CHF on top, and the USD on the bottom. Macro wise. But what did that pair do?

— - 257 pips. Ok then, # 3 out of all 28 of them. Makes sense.

That’s all good and nice.

But Journal, I found something out this past week that has me bothered. And it has to do with this information. Just look at the pair with the most pips since the beginning of the month. What is it?

The EUR/NZD. Netting +534 pips. What exactly does this mean?

All I’ve been doing is adding up each daily pip results. That’s it. And these guys have the most amount of pips summed up. Even look over to the right, the yearly counted amount of pips summed up. The EUR/NZD comes in second with +1961 pips. Same thing. All it is, is the daily pip results added up. That’s it.

Well, I think we have a problem.

Cause look.

This chart is nothing but EOD price, charted. That’s it.

Now. How many pips are between price at the start of the month and at the end of the month? It’s right there.

147 PIPS

147 pips is a far cry from 534 pips. How can this be?

This was the same problem I encountered back when I was counting pips only.

Well, first off, I don’t understand why my numbers don’t add up equally.

My monthly running table shows a result of +534 pips. But when I go through each day this total comes out to be +606 pips. I double checked this, and it’s correct. I just don’t know why I’m 72 pips off. Yes, it’s upsetting. But I don’t have the time to figure this out now.

But, the main point is why this +606 pips (or +534) is so much different from +147 pips. We have 3 weeks of data here. That’s 3 times that we had an open and a close difference. Or 3 gaps to account here. But, like, 400 some pips though?

Look. I know there’s a difference when you track price, and price only, than when you are tracking daily pip results. I know that. And that’s why I’ve boiled down all of my data to EOD price only. Well, except for this one thing.

Maybe I shouldn’t track this daily pip count anymore. Cause now the question is:

Does stringing daily pip results mean anything?

I have the pair EUR/NZD as having the most amount of pips in this month of May. That’s adding up their daily pip results only. Irregardless of what price is. But you would think that this pair should be bullish because of that result. But are they? Well no, not by looking at their price chart. No way. They went bullish but turned around and went bearish now.

I just don’t understand what this daily pip count is meaning.

I’m very seriously considering chucking this all together.

I’m talking about adding up daily pip counts.

Maybe it’s only good for the short term, on the daily, and that’s it.

Anything further out than that something is skewing the numbers. And is not truth. Know what I mean Journal?

Ok.

Sorry about all that.

I think I’m gonna stop doing this weekly, monthly, even yearly pip counting method.

I don’t think it means anything.

Well, there are trends of stupid stuff. And this just might be one of those stupid trends to keep track of.

Plus, I seriously doubt if any market participants take this data into consideration.

Price just might be the only important factor.

Alright Journal, I’m losing it here.

Got to get going.

But I told you I would share about my trade.

So here it is.

How did I come up with this in the first place?

Well, you know that I’ve been eyeing the JPY. It’s the most interesting currency, taking all things into consideration.

So. Let’s go to the charts. Here’s the SDR per currency unit chart. It’s what I look at for their macro trends. This is the JPY ever since the start of the year.

We all know how bearish they’ve been, and for how long. But when I look at it from this perspective (especially since that strong week they had recently) this is interesting. What do you see here, Journal?

I’ll tell you what I see.

A very possible bottom being carved out. See it?

See the bottom that took place on April 20th? Well, it boosted up from there and then leveled off. Then did another boost up. And now we have some higher highs taking shape.

So. All I’m saying is that there’s a better chance of moving higher than moving lower, because of all that recent strength lately. More possible, that’s all. Don’t worry, I know they are, technically speaking, in a bear market. And that tells you of how possible they can easily go back down on lower. I know this.

How about a look at what EOD price shows us. This should be different than what this SDR method shows us.

Oh wow. This is the first time I seen this. Very interesting.

Boy… this confirms to me that the JPY just might be carving out a bottom, huh?

Man.

Ok. Well, I feel better about going long the JPY.

Remember, I have rules going against the prevailing trend.

I’m aware of this.

But I told myself that if any of these charts (actually it was the SDR chart) start to show a breakdown of this analysis, then immediately I need to get out.

Anyway. I was thinking of this long JPY.

What about the short currency?

Well, aside from the CHF, the other currency that most recently changed trends was the GBP. Remember Journal? They switched from long to short. Look.

At the start of May is when they switched from a long bias to a short bias. Stated trend, that is.

And the good thing of it is, it’s kept true (thank God).

How about the price anchored method.

Yep. We’re still talking about the same thing. A change in trend. From long to short.

So.

Journal.

Do you see where I’m going with this?

This past week, this is all what I was looking at.

A short GBP/JPY pair.

We got a GBP that recently changed trends, and is continuing it.

And the JPY that seems like it’s carving out a bottom. So far so good. Right?

Well, I can’t exactly remember when I did it, maybe Thurs sometime. I went short this pair. Let me go to the broker and show you.

Wow. Ok. Looks like I got in on this very late on Wed. See the triangle?

But, it doesn’t look good for the home team. Right?

Look. I kept my eye on this in the last couple days of the week. Even right before the week ended. But there’s no way I’m jumping out of this. No way. I got to stick it out.

Sure. I didn’t get lucky for all that happened before the week ended. Nope.

But, as I just got done showing you, there’s nothing nullifying this trade for me.

Now when I start seeing the GBP, on my macro chart, start breaking up higher, then of course. That’ll be grounds of nullifying this trade. And same goes with the JPY. On their macro charts, when I see a breaking down, then you better believe I will nullify this trade. Cause I know that I’m on the verge of breaking my rules. Which is to only trade the currencies according to their stated macro trend. And as it presently sits, they both are trending low. Right? I’m, kind of, bending the Yen currency analysis. I’m going against their stated trend. AKA counter trending.

But anyway.

Yes Journal, I know. You don’t need to bring it up, alright? I know I got a little much of a position size on this pair. It’s showing yellow on the margin factor. But, in all honesty, I checked just before the week ended. And it didn’t look like this. I had margin available. Plus, I know my broker (Oanda) will let me know about it. Everyday they check at 3:45pm. That’s an hour an 15 minutes before the close. But I didn’t get the notice that says, “Presently you’re below margin limit…if this occurs for 2 consecutive days you’ll be forced out of the trade…” Journal, I’m too familiar with this. You don’t need to remind me.

So therefore, I got a couple days to play with, cause I haven’t gotten any notices yet. I just need next week to turn back around.

We’ll see what happens.

But that’s what’s going on with that, Journal.

I’m not worried.

Ok.

Well, I talked enough (nonsense).

Thanks for letting me get this stuff of my chest.

And for listening, Journal, once again.

Mike

Good morning Journal.

Let’s see.

What do I want to talk to you about?

Well, there isn’t all that much going on, trading wise. I mean, I do have the one trade still running. I guess I can talk about that, but honestly, there’s not a whole lot to say about it. Other than the fact that it’s still running and I got to wait it out. Nothing has told me to get out of it yet. Maybe I can come back to seeing what this looks like.

But actually, there’s more going on with me in the outside world than anything. Man Journal, I’m not sure this is the place to talk about that stuff. I mean, it doesn’t really pertain to how this journey is playing out. You know, regarding my business. My vision. The road that will get me there. This journey.

But on the other hand, I’ve told you personal stuff before. Hey… if I want to talk, then this is where I do it, right? I mean, you have to listen. That’s what I want. And like. And afterwards I feel better. I set it up this way. Cause not only do I want to document this marathon of a journey, but I use you as my therapist also. Why not?

Ok then.

Let me lay down here and get comfortable.

So.

It all started around 2 weeks ago. I ran into an old buddy of mine. He still drives a school bus, just for another school though. He left us a year ago. I guess it wasn’t working out between management and him. But we had some good times me and him. My most favorite memories were when we would drive for the band trips. The Friday night football games. This always took place when school just starts. In the fall. But, in all total, we would have 8 bus drivers to take the band to the away games. And you better believe I signed up for every away game. This was my favorite kind of trips. This just brought back good times for me when I was in high school. Cause that’s what I was into back in the day. The band. Yep. I was one of them. A trumpet player. And that I was, for a lot of years of my life.

But anyway, Bill would join in on the fun. He signed up for as many as he could, also. And when we would get to the destinations me and him hung out together. Sure, we would watch the football game. We would watch the band perform, at half time. But mostly we loved to eat. We always made a b-line to the concession stand before the game ever started. I guess that’s what bus drivers do during this down time that we have.

Sorry.

Getting off track here.

But we were buds.

So, he drives for another school district. But it isn’t that far away from ours. So, I started to see him out there on the road, you know, on a normal school day. I guess his route crosses mine at one particular time of the day. And not only that, but we both have one private school in common. He drops off students around the same time that I drop off some students there also.

Basically, what I’m trying to say is, that I’ve been running into him lately. Even if it’s only in the amount of time for a wave. You know, just passing each other by in our bus runs. That’s it.

But.

One day a couple weeks ago he stopped me.

I was checking my bus to make sure all the kids have gotten off, and you know, just making sure nothing was left behind, things like that. But he pulled up right next to me, in his bus. I only had a minute or so to spare. Cause we’re always on some kind of tight schedule.

So. He opened up his service door and I opened my left small window and we chatted for a minute. He asked me if I was looking for work this summer. Boy… what a shocker this was. On one hand, if there’s anything I am looking forward to it’s the time off we get during the summer. Like every summer time. Right? Like, who wouldn’t? We get to collect unemployment during this time. Yeah, it’s not all that much. In fact, it’s a lot less. But it’s something, to keep things afloat. Kind of.

But, on the other hand, honestly, I’ve been praying a lot about what I should be doing come summertime. Cause I actually need to be making a lot more money. So. Here I am being confronted with an opportunity. And the very first thing that enters my mind when he asks me about this, is how I’ve been praying. Basically, about what I’m going to be, or should be, doing this summer.

So.

I listen.

He gives me a phone number to call.

It’s a guy who needs 2 bus drivers. And Bill just became the first driver. This guy needs one more position filled. And I guess Bill tells this guy about me.

It’s a business. It’s a touring company. You know, where you can travel around the city (Pgh) and get a tour. I mean, we’re talking, with a tour guide and everything. And if I can quote the tour guide himself, the star of the show is this big double decker bus. You know, like the ones that are in London. Well, maybe not as big as that, but we’ll just call it a carbon copy of that. Where the site seers are on the roof.

Well, looks like I’m getting a little ahead of myself.

Yes. I called this guy up. And we set up a time for me to come down there and check it all out. So yeah. I went down on a Sat. And took the tour with him. The tour is over 2 hours long. I went along as a visitor. Up on the top. And guess who was driving?

Yep. Bill himself.

And the boss went along the ride also. We had a little time to talk. But mostly it was all business. Cause, you know, the customers were coming on and getting off the whole time. So, he was quite busy.

Let’s see if I can get a visual. Without giving the name away.

See the people on top?

It really is something to be on that.

And I bet it’s something to be driving it also.

Well, Journal, the bottom line is, that I’m gonna join this outfit. I have a good feeling about this. I really like the owner. And I think he likes me too. We are very similar people. Like, he was explaining to me how he feels that we need to be neat about everything. How the bus looks like… just how things need to be taken care of.

And you know what I told him?

I told him that I’m the only school bus driver who cleans my bus windows, inside and out (but to be fair about it, very old people probably can’t even do what I do in the first place. So I really shouldn’t compare myself with the older generation). He thought that was impressive given that I’m only dealing with kids. As opposed to the public, you know. But he is doing things the way I would. About how to run a business. Oh, there’s so much. I have a feeling we’re gonna get along very good.

Well, school is gonna let out on a Thursday (9th). I’m gonna start with him on Friday. He says it’ll only take 2 days of training, to get to know the bus. And basically, I will be employed with him. We both know that this could just be a summer employment. But, who knows, this very well could lead to a permanent position. They run 3 buses during the summer, when the kids are out of school. But for the rest of the year he runs only 2 buses. So this isn’t just a summer thing. You know?

Ok. That’s nice. I know Journal.

But what we’re talking about here is full 8 hour days (at least). I will be busy. Much more busier than I’ve been used to. And I’m sure I won’t be able to come home before 5pm, daily. See. That’s when I run my EOD numbers. In fact, I don’t even know what kind of time I will have on my hands with this new schedule. It’ll be a real change to what I’ve been used to. I’ve always devoted any kind of extra time that I have to my business. This sort of thing just might go away. See? Ever since 2018 up to the present I’ve had ample time in my life (a school bus driver is only a part time job). Basically, I’ve not been out in the workforce, full time, since then.

So. There goes my summer. So much for taking it easy.

But, what else would I be doing, anyway?

Well, I just said it, taking it easy, I guess.

But, anything constructive though?

I can only do so much, in regard to my business. I think I’ve exhausted every avenue that I can possibly go down. Honestly.

— I’ve assimilated as much of the business as I possibly can. Meaning, I’ve operated it as real-life as you can get.

— I’ve analyzed this currency market from every fundamental aspect you possibly can. Cause I remember all the research and notes that I used to do. All in notebooks I used to keep.

— I’ve analyzed these currencies from every (many) possible technical data as possible. If you could only see the tables I’ve scratched, on my excel.

— I don’t know how many different strategies I’ve tried. Even getting to the point of analyzing how you come up with a strategy, is a serious topic. But mind maps are wonderful for this sort of thing.

My point here.

I’m not going to have time to keep myself busy with things like that.

Maybe there’s nothing else that I should be doing.

Cause where has it all gotten me, anyway?

Satisfying a curiosity?

Experience?

Am I any closer to the goal, because of all that?

Well, I happen to think that it’s all about timing, (just like how the market goes).

God’s timing, for the business. Not mine.

If it was determined for me to have this business up and running. Fully self-sufficient. I’m sure it would have happened by now. But that’s not the case.

Don’t get me wrong.

I’m a trader.

I was born a trader. I know it.

I think I will always have this indwelt love for the inner workings of this market. And I’m sure that’s what keeps me in it.

Now, being able to be fully capitalized and smart enough to uphold and grow a successful business in this market is another thing.

I’m not sure which is more greater, in me.

The fact that I love this market.

Or the fact of how much I want my own business.

I can remember wanting my own business ever since the early '90’s.

No doubt about that. But when I finally discovered what business it is (ever since the week in-between Christmas and New Years '12 - '13), I’ve never spent more time on anything else, than this.

I know myself, Journal.

Therefore, I have to chalk it all up to timing. When it’s the right time, it’ll be.

But Journal, you can see that I’m not going to have the time to be playing around with the business. Like I’ve been used to, lately. I am kind of getting a little nervous about this. Honestly. I’m sure it’s the unknown.