I assume you mean 43 pairs. Do you base this on something like margin requirements, or do you just avoid certain currencies altogether?

Goodness, yea I meant 43 pairs. I don’t always trade each pair, just when a setup comes along. But I do go through the charts on 48 different instruments. The other 5 are USOIL, AUUSD, AGUSD, AUEUR, AUAUS.

I don’t avoid any particular currency, FTMO allows me to trade 44 pairs and I trade 43 of them. I don’t trade the USDILS.

I don’t come close to minimum margin requirements lol. Never been margin called. When I open trades with my lot size, I know what the lost would be before I open the trade. Even if all my trades hit my SL I’m still under the daily lost limit.

I mostly trade off support and resistance but do keep an eye on supply and demand. Really just depends on whats going on with price.

Nice content you got here sir, I have a working strategy that made me 10- 15 percent this month how more months do I have to test it with demo trading before going live account?

If you could backtest it from the last six months then I would be comfortable using it. But just for me, I always try to backtest the past six months before trying something new. You want to try and capture different market conditions that may happen. And even then 6 months is a small sample size, but it’s where I start.

Here are the journals for the week and weekly round up for the charts.

I made a change in the way the journal looks, you’ll notice I have an area colored in grey. It’s the same trade I opened but just a break down of pips and value where I closed some of the position. Usually at my TP1. If it hit TP1 then retraced back to BE you’ll only see one line item for it since the other position closed at BE.

Journals:

Here are the final charts for the week. And how the trades finished out, should be able to match them to the journal post above this one as well.

AUDCAD

TP1 then retrace back to BE

AUDCHF

Hit Full TP

AUDNZD

TP1 then retrace back to BE

CHFJPY

Both trades ended up hitting Full TP

EURCAD

TP1 then retrace back to BE

EURJPY

Full TP

EURPLN

Had to close early due to the weekend, but was in profit.

EURUSD

Getting close to end of the week, so moved my SL up. Taken out at BE.

GBPCAD

TP1 then retrace back to BE

GBPJPY

TP1 then retrace back to BE, missed a good move later on too.

NZDJPY

Full TP

NZDUSD

Had to close early, but in profit.

USDCAD

Had to close early, back in profit.

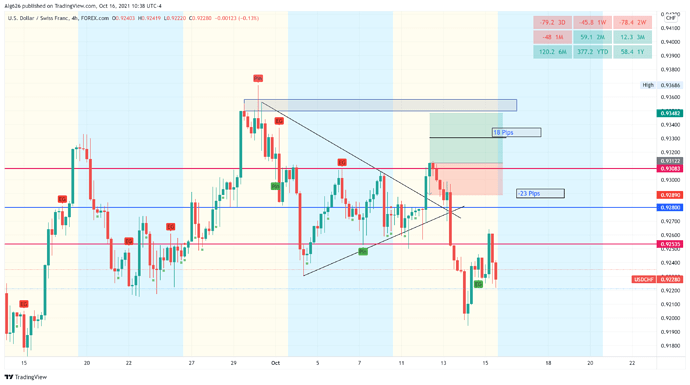

USDCHF

Hit my SL

USDHUF

Hit my SL

USDSEK

Hit my SL

I have also re-organized the first post in the thread, added a link to a good video series on psychology from Tom Hougaard.

Have also added links to the weekly round up post and any post I want linked at the top for ease of access.

awesome brother, going to check it out later this weekend. really appreciate all the info you share with us. nice gains!! i trade USOil too but on my Futures account, spreads are tighter

Good luck to everyone this week, let’s get it!

Indeed, charts are ready.

wanna see if USDCAD gets above 1.24 tomorrow. if not, i’ll probably open a short position and look for it to get past Friday’s low

true, thanks for the pic. let’s see how it plays out

Have added a couple links to videos on the bottom of the top post of the thread if anyone wants to take a look at them. They’re more about the psychology side of trading.

please i want you to make something clear to me about supply and demand. i thought supply and demand is similar to support and resistance, like they both are just same thing

I’ll post up some charts with examples when I get back in front of my computer on how I view the different zones.

Sometimes they all happen at the same price. And sometimes they have their own little areas going. I think of supply/demand as a weaker support/resistance zone. I usually call it accumulation more so then supply/demand.

Which all that probably confused you more then before. Lol.

wondering if GJ topped. watching

Seems to be ranging at the moment. Not a lot of moment so far. But it is Monday which is usually the slowest day of the week.

Looking at your chart. If it closed above 157.2 I’d buy and if it closes below 156.6 I’d sell. But those are just my takes on it.