It’s 7:48 am

@Alg626

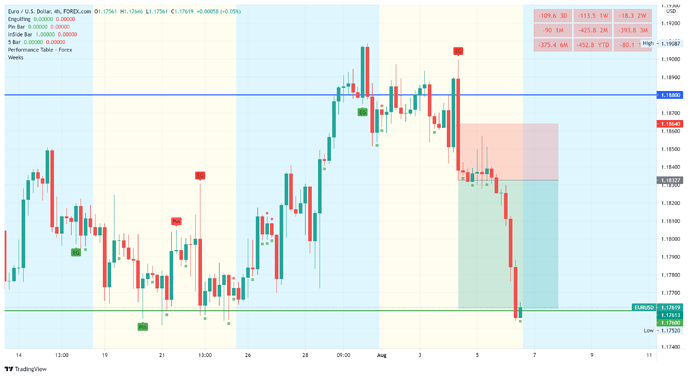

To hit the EU 80pip, I think it will last through the week, when your account doesn’t hold through the week?

Correct, I may not reach full TP before the weekend. But whatever I can get by Friday works for me. Didn’t want to miss a good setup though.

@Alg626 I support this approach.

USDPLN on D1 looks tempting

@ramddo

Both setups are very good when the signal is strong and meet the criteria of the strategy.

Yes, was a good setup. My order activated last night.

Some nice charting bro

Thank you @Jungletrader

My strategy and @Alg626 are very similar, we only differ in the order of time frames to approach the currency pair.

But they all gave us some profit

Thanks, learned from a simple thread here at babypips.

I have been backtesting again just to confirm this strategy lol. I do enjoy a good backtesting session. Should be done this weekend. It will be just the majors and using this strategy taking nothing but a pin bar, engulfing, 2 bar reversal, and the classic j16 double bar low higher close, double bar high lower close.

I started using 3 bar reversals as well but truly just haven’t done enough backtesting for me to have a good reason behind it. So I have stopped using that pattern for the moment.

I feel like the toughest part of this strategy (leaving out emotions for now) just making sure you have your zones marked correctly and the price action before your entry confirms your entry along with the confirmation candle.

And don’t take weak confirmation candles as well. Example…For me if the pin bar doesn’t really stick out pass all the other wicks. She ain’t for me

I’m going to go ahead and post what I got so far. Only two majors are not finished.

I showed the date and position so you can back check yourself if like. Just to make sure the numbers are correct. I even calculated different lot size values at the bottom of each pair. Also scroll to the right and you’ll see a total per month and then an overall total as well.

Everything based off 4HR chart and locating zones using only 4HR charts.

Using the strategy that I mentioned in my previous post, except I didn’t use 2 matching highs or 2 matching lows.

PA - Backtesting - 4HR-1.xlsx (49.4 KB)

Love NFP day

First of all great thread, I’m finding it helpful  and also well done on getting funded with FTMO!

and also well done on getting funded with FTMO!

Can you elaborate on how you handle the weekend rollover for trades you entered late in the week that are still running their course? Do you close for good and move on to the next setup or do you enter again on Monday and eat a spread?

Thanks in advance since I’ve always wondered if prop firms like FTMO are suitable for swing trading.

Sure thing…

I don’t open any trades after Thursday 9pm(eastern) that way they have time to run and move one way or the other.

If I have trades that are open and running through Friday, I close them out at wherever they are between 3:00-5:00pm. Or if I think the move is over.

Most of the time though I’m done trading by lunch on Friday.

I don’t reopen that same trade Monday. I just move on. There is always another set up coming. So I never worry much if I miss a trade or have any issues with FOMO.

With my account, FTMO doesn’t allow you to hold through the weekend. They now have a swing account available at the same cost just a little less leverage. Which isn’t a bad thing either.

They have adapted to the guys who want to hold trades and given you that option. Just have to sign up for that type of an account.

Hi Alg626,

First of all I want to express my support for this topic as I am slowly moving away from indicators and into price action (been into forex around 6-8 months now).

I haven’t read the whole thread though I did do a search with no results, can you elaborate if you haven’t already - how can your order not get triggered? Do you use buy/sell stops? If so, what’s the pip distance?

Thanks!

For sure…

Let’s say I have a setup that looks good for a buy. Once I get a good confirmation to go along with the price action before. And let’s say it’s an bullish engulfing candle.

I set my buy order at the high of the candle not the close but the high. But once the candle has actually closed, I don’t set orders before the closing of the candle. If you want to be a little more conservative you can also set it 5 pips or so above the high.

My stop is placed at the low of the candle.

https://www.tradingview.com/x/k0Vo2KWA

Everyone manages trades different. On a trade like this I will set my first TP at a 1/3 of the trade. Once price reaches there I close some of my position to bank some profit and move my stop up to where my entry was plus up a little to cover commission and swap fee if I have one(what I call BE).

Once it reaches the 2/3 mark I move my stop to my original first TP which is where the first 1/3 was. And then let the trade run from there. It’s either going to go on up to full TP or come down and hit my SL which is in profit as well.

Thanks for sharing how you handle that practical aspect of the strategy. I’m currently playing catchup and learning what I can from the original thread you posted by J Fox and then ultimately hope to be following along with you and Pinbar1993 in real time. Keep it up, learning loads

Off topic but might be useful since you’ve mentioned Jonathon already, if he sold his website - who is running that website’s telegram channel, does anyone know? I’ve joined the free one but there is a commercial one as well let by “their top trader” who I assumed was Jonathon before reading about the website being sold.

Your guess would be as good as mine lol