I admit, I’m a total n00b when it comes to scalping – I’ve never tried it before. But a few weeks ago when I got a renewed interest in “fixing” my trading, I decided to purposely look for radical changes to what I had already been doing.

I never even considered scalping, because I assumed the following:

[ul][li]It would probably stress me out to be glued to the screen watching each tick. After all, this is what us swing-traders try so hard NOT to do to keep from getting emotionally involved;

[/li][li]My brain could not think and react quickly enough to jump in and out. This was mostly based on the extensive calculations it would take me to get in and out of swing trades (mostly figuring proper leverage, which I calculated based on the unique stop for each trade);

[/li][li]Brokers don’t like scalpers and might even prevent your success;[/ul]

[/li]

But after stumbling onto Pip-Siphon’s most excellent scalping wisdom thread, I became hooked and determined to give this an honest effort.

Things I really love about this trading style:

[ul][li]No heavy-duty analysis needed. Mostly I just take note of the upcoming news releases and then check for major trends in place. That’s it.

[/li][li]Oanda has a really nifty platform feature that lets you enter and exit trades with a single click of the mouse. Wow, this must be made for scalpers. No thinking required. No math brain cells needed at 4:30am LOL.

[/li][li]This style can be fit into a tight little box. I absolutely love this part!! I can wake up, do my trading, then turn off the computer and I don’t have any obligations or worries until the next time. This is NOT the case with swing trading EVER.

[/li][li]The repetitive nature of this style promotes mastery I think. I’m a firm believer in perfect practice makes a perfect trader. When you are constantly exposed to new trades, you can quickly build a repertoire of wisdom.[/ul]

[/li]

So first thing I did was jump in straight-away with Pip-Siphons method on a demo account. Wow, it was SO MUCH FUN. I can’t even tell you how thrilling it felt. Actually, I had to take a step back, because I felt like I should not be this elated about trading. Most experts recommend that you not be too elated, and not too upset either. It could mean that I don’t have a good control of emotion.

After several good experiences, I moved to a live account. From this point, I did not do so well. I think it really was a psychological impact. Watching money go “poof” faster than ever before was scary. At least in swing trading, you can turn off the screen and walk away knowing you are following your plan. But this method feels more like riding a rollercoaster in the dark with no seatbelt… you have to be able to react as a reflex without too much thinking. That is the skill I want to perfect.

So the next thing I did was go back and study pip-siphon’s wisdom a little more closely. It’s amazing how much more information you can pickup when you go back a second time. His thread is really filled with some good nuggets of wisdom. I highly recommend you go back through it yourself when you have time. I am a note-taker, so I took notes on the first read, and then more notes and tweaks on the second.

One of pip-siphons recommendations for someone trying to learn this style of trading is very very good I think. Here is what he said:

Another piece of advice for scalping I can give you…

Is to strip your charts of all indicators.

Bring up a 30sec chart, and a 1min chart.

Then try for a month to trade succesfully without indicators.

But with REAL money. ($50 in Oanda, trading 20units a trade)When you can achieve between 0.1%-0.5% a day, then add whatever indicators you think will strengthen your edge. But NEVER rely on the indicators. Only use them for strengthening ideas/trades.

So that is exactly what I have done and it has been a TON OF FUN. I can really feel myself getting better. I still make mistakes, and I know where the problem points are. But what’s even SWEETER is that I am learning how to identify and FIX those problems.

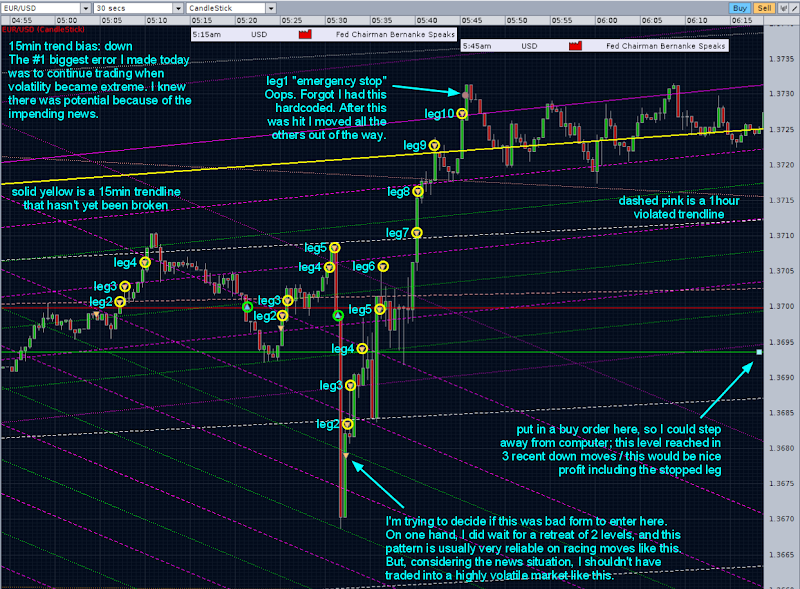

I’m going to use this thread to journal in. If I can find enough discipline in my hectic schedule, I’d love to analyze my trading every single day. Because I do trade this every day for 1.5 to 2.5 hours on average (before my dayjob). This works out to 4:30am to 7am Eastern. Usually between 4:30 and 5 I am prepping for trading and saying my prayers, so the actual trading doesn’t start until 5-ish.

I’m also tracking my live account performance here.

Thanks for following…

I rely heavily on that avg position line to know where to get out. I basically determined the idea wasn’t possible.

I rely heavily on that avg position line to know where to get out. I basically determined the idea wasn’t possible.