Hello Fellow Traders!

Trader Here From Pakistan

First of all lots of love for the BABY PIPS Hands Down It has one of the best forex community here!

Apologies In advance for my language barrier.

Okay, Lets Talk about something I learned which seems pretty interesting and effective on the Forex Markets

As we the title suggests this tool is like the RING from the (LORDS OF THE RING)

If Used Correctly with Patience Believe me you are in for lots of pips.

Lets Talk About Buying and Selling.

When Do We Buy A Product?

Ans: When Its Offered at a Discount.

When Do We Sell A Product?

Ans: When It Reaches a Premium Price.

Forex Is the Same!

But Its Designed So we (RETAIL TRADERS) Don’t Know when its offered at a Discount or a Premium Price.

A Computed Algorithm Delivers these Prices to the Banks and Institutes through a system called

INTERBANK PRICE DELIVERY ALGORITHM (IPDA)

The Prices for The days are set in this algorithm before each trading day then the price moves accordingly and reaches its destination after giving these Retail traders losses and banks and Institutes Profit!

Okay. So Enough About the Markets Lets Talk How to Identify when the Banks and Institutes are going to buy or sell.

That Is Where the Tool Comes In The (Fibonacci)

Oh Wait Not This Fibonacci thing again  But Wait!

But Wait!

We are not talking about the Classic Old Fibbo

The Altered Fibbo Levels!

We are not going to use them as confluence Instead We are going to identify is Pair offering a

DISCOUNT OR A PREMIUM PRICE to the banks and the Institutes!

The TOOL

SETTINGS

- Level = 100%

- Level = 0%

- Level = 0.5% {EQUILIBRIUM}

- Level = 0.62%

- Level = 0.70% {OPTIMAL TRADE ENTRY}

- Level = 0.79%

Q:How to USE?

1. TIMEFRAME

-

WEEKLY AND MONTHLY FOR THE BIAS.

-

Daily Is the most Important Timeframe As the Banks and Institutes Trades of a Daily Timeframe.

2. ENTRY

Take The TOOL From Swing Low To the High Or Vise Versa.

Then Wait for Price to Be Offered At any Discount Or Premium Price

It Can Be from anywhere to 50% to 0.79% Level

Once the Price Reaches these Levels Go down to lower Time Frame Such As H4

and then Wait For Rejection and Enter.

-

This Tool can Be Used to Determine:

-

ENTRY

-

TAKE PROFITS

-

KEY LEVELS

If Used Proper It Can Result In Great Deal Of Profits.

EXAMPLES

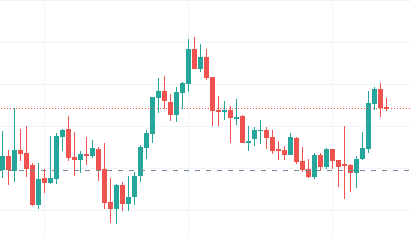

GBP/JPY DAILY

Another Example…

NOTE: 50% Is Not the Key! Price Can Brought at any of these levels

Example:

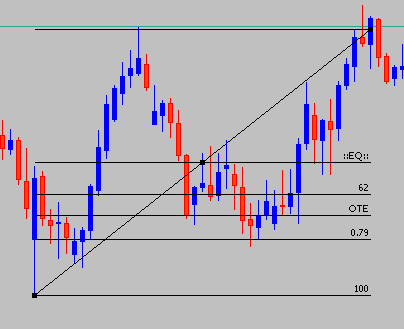

NZD/JPY Daily

As the Example Above Shows The Price went all the way down to 0.79% level before the Big Orders Came along and then the Price went all the way up 670Pips!

That is why its important to wait on the h4 for rejection and always go Break Even after Securing first TP…

Take Profit: MAIN TARGET IS THE 0% Level. Secondary Target Can Also be Predicted through the TOOL!

Also if you have successfully predicted the correct direction then even the fundamentals/News will push your Trade through the Structure in other Words Trump and Boris Johnson will tweet only for your trade to reach the target quicker

Once Again Thanks to the Babypips for providing us this beautiful Platform.

[Removed for Forums policy violation]

I hope I haven’t missed anything

Wish You all good luck in your future endeavors!

Long Live Pakistan  Long Live Humanity!

Long Live Humanity!

Regards,