it shot up lol

This is nice.

I don’t know what’s happened but I do tend to the view that more upside shocks occur in uptrends and more downside shocks in downtrends. So as well as the underlying trend’s momentum, you also get the benefit of pleasant surprises like this.

Of course, the best ever was EUR/CHF in 2015, but that’s a whole different story.

Yes it did lol, i scored a loss.

My PC died, and i am doing this from my phone.

My journal was an excel file witch is now gone. So i am starthng over.

I have a nice setup for later, i will update in a few hours

My Desktop PC died, so i am limited in what i can do.

Regardless, i am getting a new laptopt this week, so i’ll be back on track.

Since i don’t have the time to update you on what happened, and also my trading journal is gone with the PC, i will just make an update on a trade i am planning to set up this evening as soon as the markets open.

USD/CAD - Daily Time Frame.

We’ve seen a breakout from the Daily support point, and now a full swing retracement has happened, and price came back to retest previous support which now is acting as resistance.

Price formed a pinbar, which is a strong reversal signal, and i am basing my entry and stop loss on that pinbar.

I am setting up a sell stop order five pips bellow the lowest point of the pinbar, and my stop loss will be located 5 pips above the highest point of the pinbar, which is just above the resistance line.

Reasons why i believe this level will hold.

- We already have a clear pinbar;

- We have a Fibonacci level;

- We have previous support now turned in to resistance

- If you add the bollinger bands, you will see price is hitting the upper bollinger.

My final target will be 80% of the full potential of the previous swing, added on tip of the pinbar as a potential start of the new swing.

I will have sequential targets, in which the first one will be the first level of support, where once price reaches that level i will exit a portion of my position, and trail my stop loss to break even plus the spread.

After that i will leave the trade to reach it’s full potential and monitoring my trade along the way in case i need to make some adjustments.

After i post this i will have a look at the economic calendar for the upcoming week and any potential catalysis’s that could mess me up.

Feel free to comment and share your thoughts on this.

Happy trading

Ok, so first of all a small update what has happened to me, and how do i plan to continue regarding this.

As i mentioned previously, my desktop PC died, i finally got a new laptop, it’s nothing special, because i only need it for basic stuff and most importantly Forex analysis.

I moved to a new apartment, and finally the basics are set up so i can continue with my trading journey.

Also, my entire journal is gone, since it was not online. It’s a bummer i know, but instead of redoing the whole thing again, i will just start over with a new trading journal with the current account balance that i have on my demo account.

p.s: i just finished my weekend market analysis, and the entire 3 hours went to waste because my MT4 did not save anything…so i have to do it all over again

Alright now, back to business.

On my last post, i talked about USD/CAD on the daily time frame. Well, that setup did not turn out the way i wanted. But now, something much more interesting is happening.

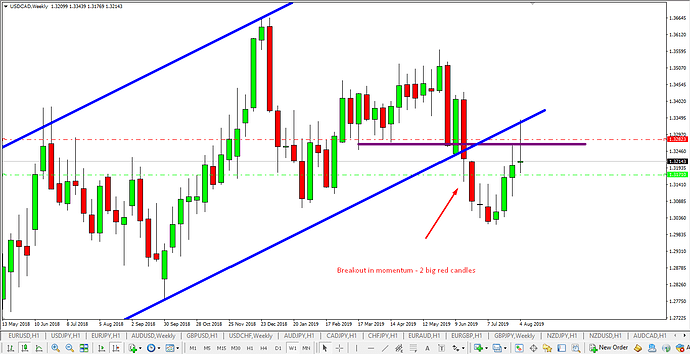

If we zoom out in to the Weekly time frame, we see a few indications that the consecutive moves could potentially and hopefully be to the downside.

There is a breakout from the long-term trendline, which is now being retested from the downside to see weather it will become resistance. Moreover, the retracement made a fake breakout formation with the latest pinbar, which also falls at around a previous level of double bottom within the channel (purple level)

I am setting up a pending sell stop order and risking 3% of my account.

Entry: 5 pips above bellow the low of the pinbar - 1.31710

Stop Loss: 5 pips above the 50% range of the entire candle, because if i put it above the pinbar the SL would be waaay to wide for my taste. 180 pips plus on a daily time frame is too much, on the weekly and monthly yes. - 1.32823

Moreover, the first level of support (major) is at 1.27755, which is 300+ pips away from my entry, so i have a highway free of traffic if this setup gets activated.

The reason why i like this setup is the double level of ressistance i have on a weekly time frame. I mean…as always, anything can happen, trading forex is never easy, but i really like to keep it as simple as i possibly can.

I will keep this journal updated on a daily level now hopefully.

As posted before I like your TA.

On a wider perspective, USD and CAD are both looking totally neutral to me across their respective charts with other currencies. I’d rate 4 of the 7 USD charts as bullish (for USD), 3 bearish, while 3 of the CAD charts bullish (for CAD) and 4 bearish.

I do count USD/CAD as bullish but not sufficiently even in isolation for me to put in a buy order.

Of course it might break out, of course it could. But I more expect it will do absolutely nothing for a week or more.

Thank you, it means a lot that more experienced traders appreciate what i do.

As far as USD and CAD goes, i honestly don’t know what to say. I try to keep it purely TA.

Currently USD/CAD is making lower lows and lower highs, so the bullish bias is over from a technical perspective.

Yes, it sure is. And I don’t disagree so much that I wish to bet long against your TA.

Just checked - I have a bunch of positions open, including 2 long USD, 3 long CAD and 1 short CAD. I guess that sums up my ambivalence towards these two currencies right now.

Why do you keep multiple positions open on a same currency?

Because I can’t pick which pair will be the winner. Honestly. I just follow the direction of the trend of the chart and if it says buy I have to and if it says sell I have to do that too. So I sometimes end up long and short this or that.

I don’t think multiple parallel currency positions are as risky as people think.

But… I might just be the only person who thinks this…

Well, you are braver them me for sure, cause that’s classic double or triple exposure on your case.

Indeed it is, double or triple. Or more.

I keep the view that bad news comes in downtrends and good news comes in uptrends. Its rare that if all the pairs of a particular currency are bullish, that some news would emerge unexpectedly which changed all those situations bearish. Its even harder to think that news would emerge which made all the bearish counter-currencies suddenly bullish.

I hope that the multiple gains I get when events reinforce existing currency trends will more than compensate for the occasions when events reverse existing currency trends. So far so good…

And of course, what i did not mention before is - wherever you find some kind of a trend, you can usually draw a channel there.

Basically this confirms my bearish bias even more. The only thing i am reluctant about is if price starts ranging or sideways price action.

Also bear(ish) in mind that the breakout from this uptrend happened in momentum with 2 big red candles, signifying that this trend is officially over, and the bears are not willing to give any more ground than this.

All input is more than welcomed, i am trying to keep my emotions and expectations to a minimum. I mean, yea, it is easier on a demo, because I’ve traded live a few times, but in this regard i am fully convincing my self that it is a real account. With that being said, yea guys, it is really important that you are completely OK with loosing the money you want to invest, just because it makes your decision taking process much lighter.

Edit: and we have a fibonacci 61.8% almost to the pip

I also recorded a video of this analysis.

I am not advertising or selling anything, just trying to be more disciplined and be accountable towards my self and my trading plan.

it’s better in my opinion to open multiple positions on one pair, instead of having multiple trades on 3 or more different pairs. If you’re sure on that one pair, then why not

Because you’re exposing yourself more than necessary.

I am looking at a potential bounce on the EUR/GBP.

This pair had given me a loss previously, but since i have a solid risk management policy, it’s not a big deal, loosing is part of trading.

You can check out that setup EUR/GBP

Price made a valid breakout from that trendline, and reached a previous significant swing point at around 0.9300.

This week we are seeing a reaction of that level to the downside of course.

Currently i am recognizing a price pattern called “Railway Tracks” in the forming.

Basically if tomorrow this weekly candle closes more or less around the same area where last week’s candle opened, than i will definitely consider entering this trade.

Here is the chart

Also, the sell stop order i setup on EUR/GBP did not get triggered, price this week just kept pushing up.

But regardless i am happy, because this is exactly why i go for conservative entries. I did not get a confirmation, so i did not score a loss. If i was trigger happy or aggressive, this would have been another easy loss.

Slowly i am getting where i want to be in trading, and i am starting to understand that keeping your capital alive and not being greedy and aggressive are cornerstones of being potentially and consistently profitable,

Here is how this week’s candle looks.

Alright, the trading week is over, so here is what I’ve got for the main setup on my whatchlist.

EUR/GBP

The bears heavily rejected the bulls at the major infliction point at 0.9300, consequently price created a certain pattern that i am not sure how to analyze.

This is at the same time “railway tracks” and “outside bar”. However it is still heavy market rejections, so i am going to set a sell stop order for next week, and we will see what happens.

My EUR/GBP sell stop order got activated on Thursday, and it went 50+ pips in profits, but retraced on Friday (understandably). So currently it’s 10 pips in profit, because right around the level where the candle closed on Friday there is a minor level of support.

My trading plan says that i should close 50% of my lot size now, and leave the other 50% to be closed upon the close of the second candle.

Of course what i would like to see next is a nice push towards the downside with a full red candle around 200 pips in length. But i have to wait and see.