Lesson 2: Review of Workshops 1 to 11

In this lesson of Chapter 12, we will provide an overview of all previous chapters by analyzing price charts in a forward-test manner, identifying dynamic channel patterns, and analyzing the strength and weaknesses of developing trends.

The phrase “The Trend is Your Friend Until It Ends” is a trading adage that emphasizes the importance of following market trends. When a trend is in place, it is often more profitable to trade in the direction of the trend than to go against it. However, it is important to remember that trends do not last forever, and they can end suddenly. This is why it is important to be vigilant and to identify potential trend reversals early.

The skills you have acquired so far are essential for understanding and implementing the first two algorithms of the trend-following Setup T in the Price Action Algo Trading System. The Setup T consists of five decision-making algorithms, and we will practice the first two algorithms to execute them in the correct sequence and make informed decisions.

The first two decision-making algorithms of the Setup T are exactly based on what you have learned so far to identify trending patterns and analyze their strength and can be summarized as below:

Algo 1: Analysis of Patterns: This algorithm verifies whether the observed pattern on the chart exhibits a trending behavior.

Algo 2: Analysis of Momentum: This algorithm ensures that the identified trend is strong and not ending due to a loss of momentum.

The first two algorithms ensure that you only trade strong trending patterns and avoid trading when the trend is ending and transitioning into a sideways pattern.

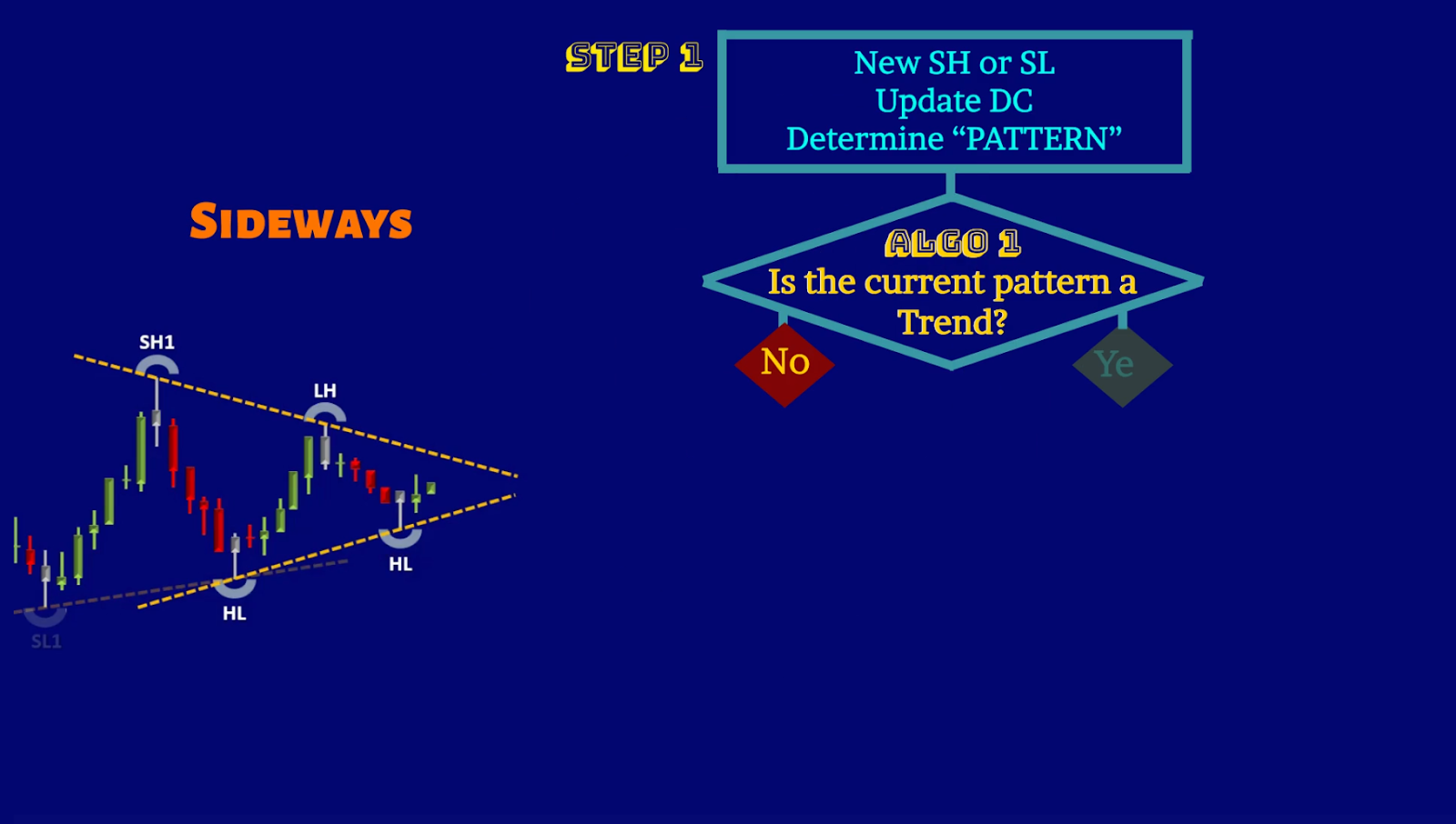

As you have learned and practiced, in the first step, you look for a new SH or SL, update the new dynamic channel, and determine the type of pattern. Then, the first algorithm condition checks if your current pattern is trending, as illustrated below:

If the answer to the first algorithm condition is “No,” step 1 has to be repeated, as shown below:

So, you keep updating the dynamic channel with every new SL or SH, until the new trend pattern is formed, as you see in the below price chart:

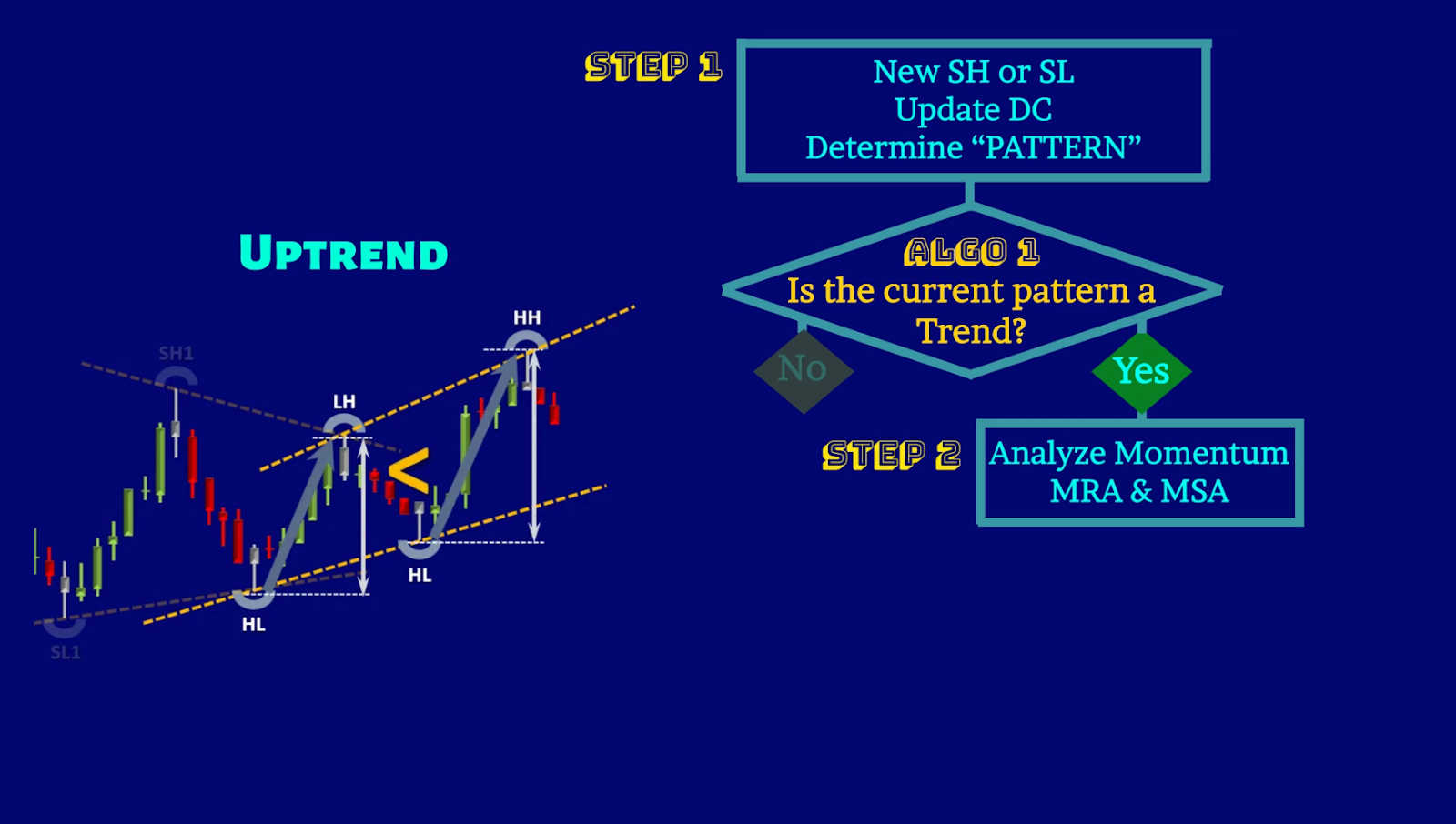

If the answer to the condition of the first algorithm is “Yes,” it activates Step 2, which involves momentum analysis using MRA and MSA, as illustrated below:

The second algorithm condition continuously monitors the momentum and assesses the strength and weaknesses of the established trend.

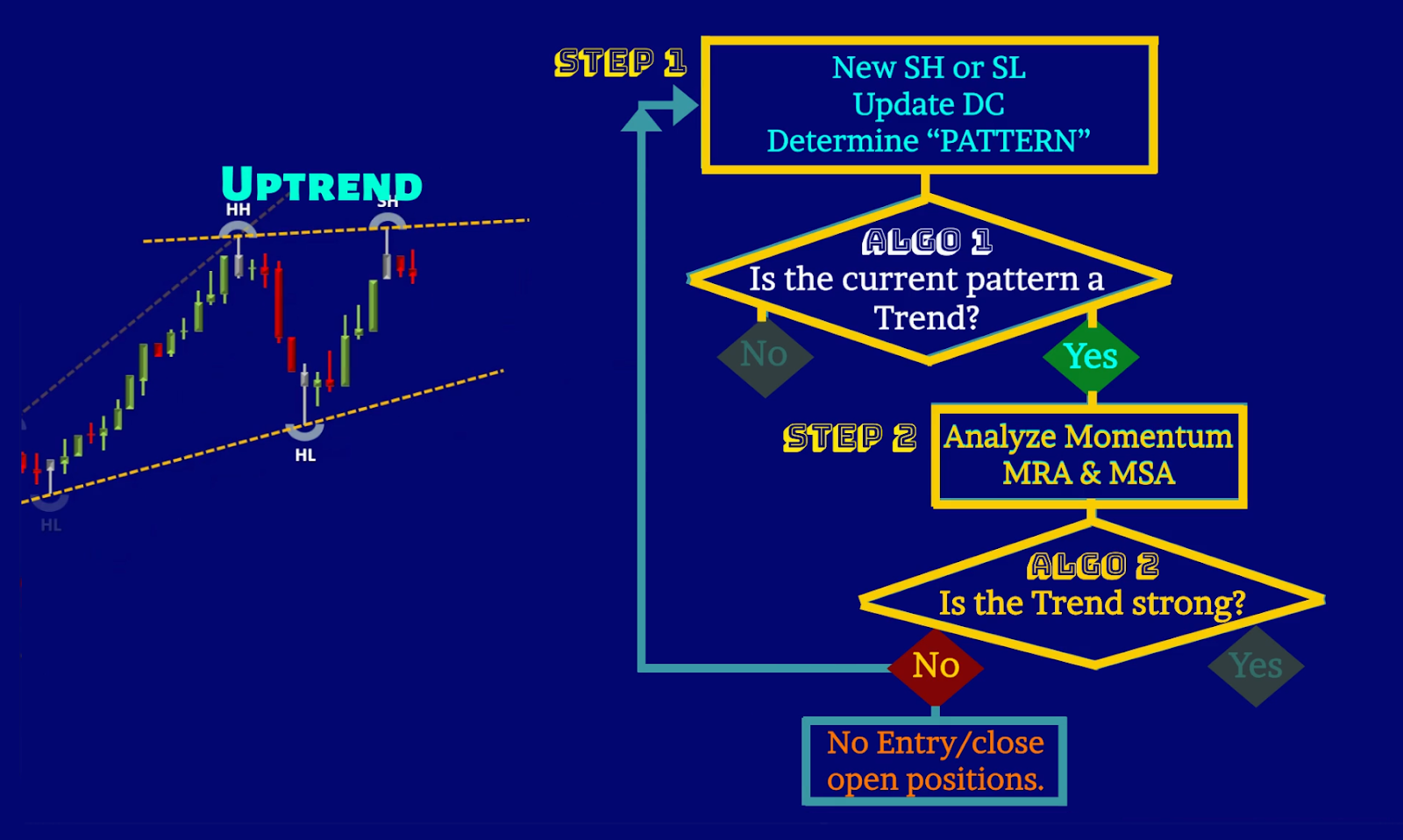

If the momentum range analysis or momentum slope analysis indicates that the trend is strong and has not weakened, you will proceed with the remaining conditions of the Setup T algorithms, as shown below:

While you constantly repeat step 1 with every new price turning point and confirm that the pattern is a trend, and then proceed to step 2 to confirm that the momentum is strong, as shown below:

As you can see in the price chart above, the trend is still strong, and this cycle is being repeated as you check the other entry setup algorithmic conditions to enter this uptrend.

As you repeat steps and algorithms 1 and 2, you may notice that the momentum analysis shows signs of trend weakness, as shown in the price chart below:

In this case, you should not proceed with the remaining algorithms to enter any new positions and be prepared to close all open positions.

Then repeat steps and algorithms 1 and 2 with every new price turning point and update of the DC to see if the trend resumes its strength or transitions to a sideways pattern, as shown below:

As you can observe from the price chart development below, the weakened uptrend has ultimately transitioned into a sideways pattern. Therefore, algorithm 1 will not pass, and step 1 needs to be repeated until a new uptrend or downtrend emerges:

So, let’s practice applying these two steps/algorithms in a forward-test manner, simulating the live market conditions on the price chart based on the below flow chart:

This will develop your skills in recognizing the trend and sideways pattern transition and analyzing the momentum of trending patterns. This will help you not trade sideways patterns and not miss any strong tradable trends.

It is important to allocate dedicated time for practice in order to develop and refine your skills in this area. Utilize various techniques such as forward-testing, market replay, and live demos to acquire the essential PAAT skills necessary for success in trading. Also, you can use practice drills offered in the PAAT-Trial course free of charge to develop the essential skills discussed in this chapter.