I think it will rise eur/usdAt the beginning of the week until election day.

I would agree

Thank you for sharing this. I am looking forward to more updates from you. What do you think about GBP since Brexit talks have started again?

Hi Eli!

Super hard to tell… But in this cases I tend to rely on technical mora than fundamentals.

I see mixed signals all over the place so for me is a bit early to take a posture…

mean time I’m trading both sides

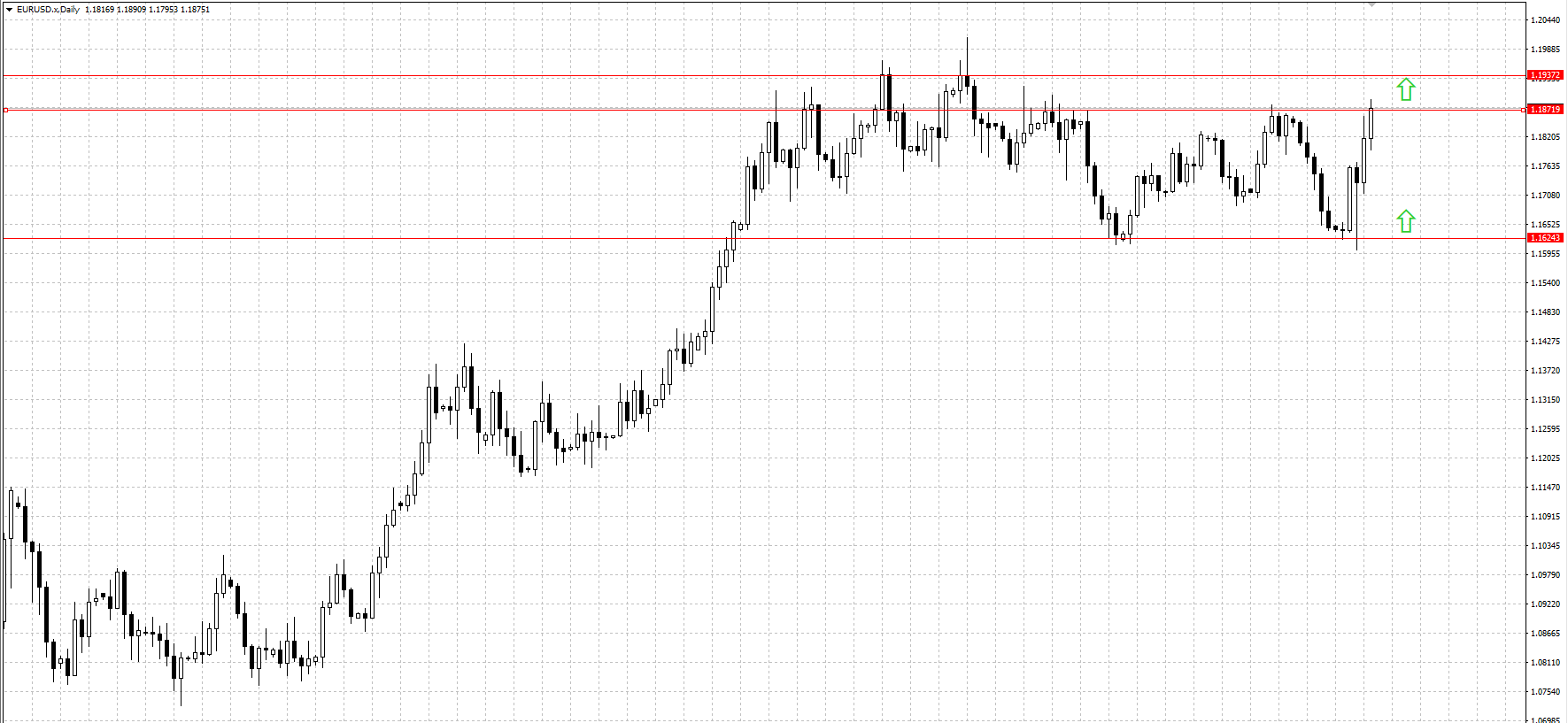

Weekly Trade Idea For EUR/USD

Week: 9-13.11.2020

Key event: POST - USD.Presidential Election. Biden Won. What NOW?

Biden has won the elections.

As we have said before, when anticipating Biden’s victory, we have seen the dollar getting weaker and the EUR/USD reaching a resistance level. After Biden’s first statements, we could see a rupture of those resistances, and the beginning of a new expansionist stage.

Key Levels:

-

Resistance 1.1860, 1.1940,1.2200

-

Support 1.1620

Trend:

Bullish.

Price is at resistance level 1.1860. We expect a continuation to next resistance and probably a breakout up to 1.2200.

Call to Action/Trade Idea

We will be looking for buying opportunities, either a breakout or a pullback to get a better entry price.

Biden’s statements will define currency behavior and volatility.

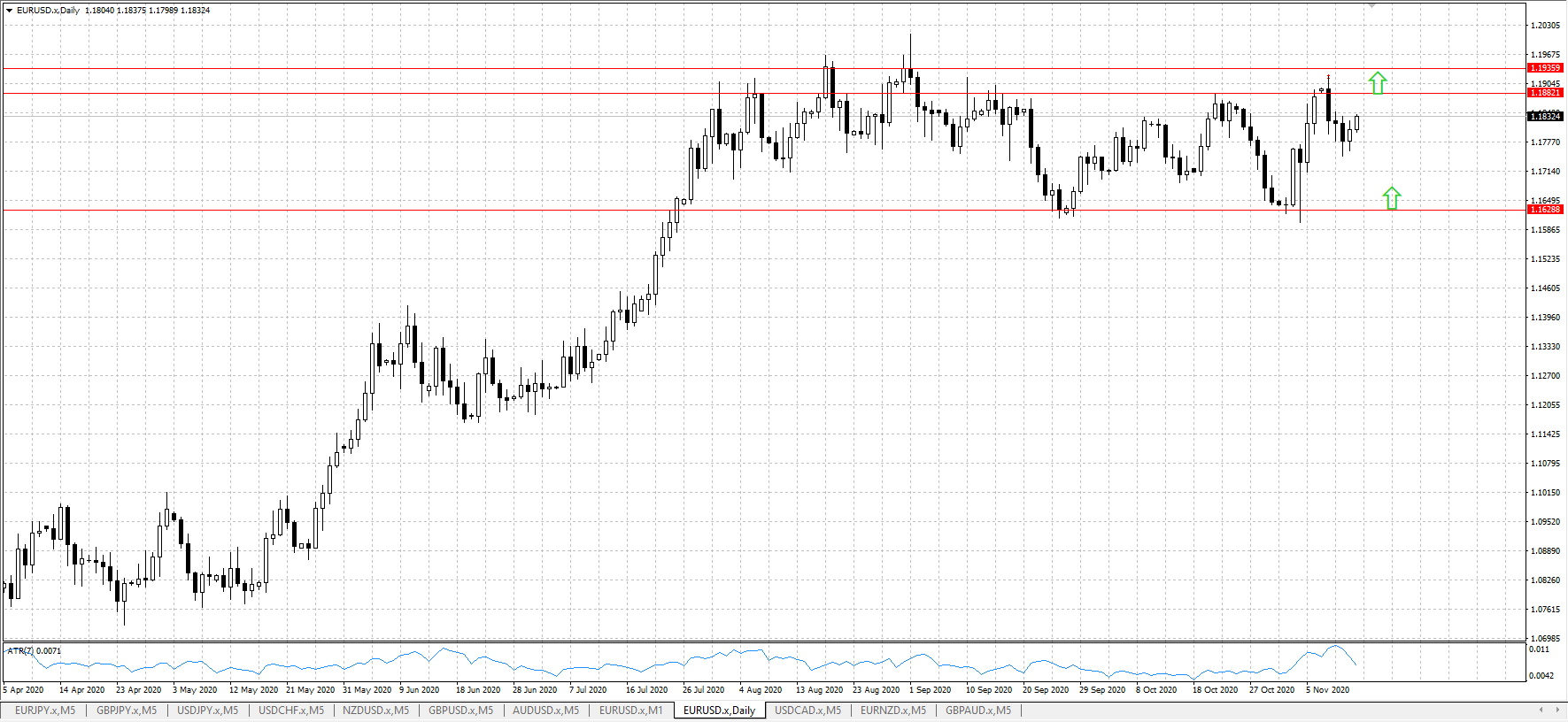

Weekly Trade Idea For EUR/USD

Week: 16-20.11.2020

Key event: USD Retail Sales.

Measure of the total receipts of retail stores. Changes in Retail Sales are widely followed as an indicator of consumer spending.

We expect worse data than last month.

Until Tuesday, anticipating the result, we should see a weakening in the US dollar against other currencies. In case we don’t get a positive surprise in the final value, the weakening is likely to continue during the rest of the week.

Key Levels:

-

Resistance 1.1880, 1.1940

-

Support 1.1630

Trend:

Neutral/Bullish

Price is contained between 1.1620 support level and 1.1630 resistance level. At the beginning of the week we can expect a new test of resistance.

Depending on final data, we might either see a bullish continuation or a retracement to support.

Call to Action/Trade Idea

Until Tuesday we can trade the EUR/USD looking for buying opportunities.

Depending on the results, we will keep the bullish bias looking for a break and test of next resistance or buying opportunities near support level.

Weekly Trade Idea For NZD/USD

Week: 23-27.11.2020

Key event: NZD. RBNZ’s Governor speech

The Reserve Bank uses monetary policy to maintain price stability and to keep inflation between 1 and 3 percent on average over the medium term. The Bank implements monetary policy by setting the Official Cash Rate, which is reviewed eight times a year.

Hints of rising interest rates strengthen the currency.

Until the speech, we expect prices to range in the actual supply zone. The speech will surely cause a break of the zone either to the next supply zone or back to support levels.

Key Levels:

- Resistance 0.6940, 0.7050

- Support 0.6780

Trend :

Bullish

Price is ranging in the supply zone between 0.6940 and 0.6890 levels. The speech will likely cause a breakout of the range.

Call to Action/Trade Idea

We will look for any opportunity to join the bullish trend. Either a retracement to previous support or a breakup of the supply zone.

Thank you for the update about GBP. I am placing my bet on EUR/USD since it shows a bullish trend

How can I set the stop loss and take profit stuff. I’m a beginner demo trading on the Olymp trade platform.

I’m also long on EUR/USD. It might finally broke the range this week

Hi.

Just right click on the order and select modify. There you have the option to set a stop loss and Take profit for the trade

Trade Idea for EUR/USD

Week: 30-4.12.2020

Key event: USD. Non-Farm Payroll

The number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank.

We expect a lower reading than the previous month.

Until Friday, we can expect a weakening of the USD against other currencies. It would require a positive surprising release for the USD to strengthen against other currencies.

Key Levels:

-

Resistance 1.2000, 1.2150

-

Support 1.1900, 1.1600

Trend:

Bullish

Price is testing resistance on the last Supply area available before a break higher.

Call to Action/Trade Idea

We will look for any opportunity to join the bullish trend. Either a retracement to previous support or a breakup of the supply zone.

Thanks Saul!

Weekly trade idea for USD/CAD

Week: 7-11.12.2020

Key event: CAD. Interest Rate

The interest rate at which major financial institutions borrow and lend overnight funds between themselves;

We expect a similar reading to the previous month.

Until release day, we expect a continuation of the actual trend. A negative surprising data value could reverse the actual trend direction.

Key Levels:

-

Resistance 1.2966, 1.3140

-

Support 1.2546, 1.2256

Trend:

Bearish

Last week, Price broke important support levels. It is now dropping towards the next support levels.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend. Any retracement or pullback. Only an unexpected important negative release might overturn the actual trend.

Thank you for the trading ideas

Thanks for the update. Your analysis has been correct since the dollar has been on the bearish side which has benefitted many other currencies

Weekly trade idea for EUR/USD

Week: 14-18.12.2020

Key event: USD. Interest Rate

Interest rate at which major financial institutions borrow and lend overnight funds between themselves;

We expect a similar reading to the previous month.

Until release day, we expect a continuation of the actual Bullish trend. A positive surprising data value could reverse the actual trend direction.

Key Levels:

-

Resistance 1.2175, 1.2230

-

Support 1.2000, 1.1875

Trend:

Bullish

Two weeks ago, the price broke important resistance levels. It is now trading in a range close to a supply area.

Call to Action/Trade Idea

We will look for any opportunity to join the bullish trend. Any retracement or pullback. Only an unexpected important positive release might overturn the actual trend.

I am not expecting a surprise, we almost never get those. That is why I am waiting for a retracement to get in on the long side