RJ’s Trading Plan

Version 1.0 - Last updated 11/28/18

About

This is a beginner Price Action strategy based on the James 16 and krugman25 ‘Price Action that Matters’ threads. I will focus on finding PA setups around areas of SR, trendlines, EMAs, and fib levels.

I will not trade very often for the time being and will spend the majority of my time studying charts, reading, and writing trading scripts in Python, Pinescript, and MQL.

I will check the charts every day for at least half an hour in the morning then periodically throughout the day. I will check the forex calendar and news every day.

I will not enter a trade unless I have followed my trading plan and the outcome says I should enter it, It is the only way not to feel any guilt if I lost the trade and make objective decisions. Before entering each trade I will check this trading plan, and I will track each trade in my trading journal.

After I am in a trade I will not move my Stop Loss unless it is in my favor. I will manually exit a trade if I determine that it will not go in my favor - I must document my justification from exiting trades prematurely.

I will never trade over my risk threshold and will stick to my pre-determined risk management strategy.

I will not edit or change my trading plan while I am in a trade or within 24 hours after I exit a trade (winning or losing one).

Long Term Trading Plan - From Demo to Profitability

From the James 16 thread:

WHATEVER / WHICHEVER WAY YOU DECIDE TO TRADE YOU MUST (AT A MINIMUM):

ON DAILY AND WEEKLY TIME-FRAMES, YOU ONLY DEMO-TRADE FOR THREE CONSECUTIVE PROFITABLE MONTHS IN A ROW. YOU DO NOT PROCEED TO STEP TWO UNTIL COMPLETED.

OPEN AN ACCOUNT WITH HALF OF THE INVESTMENT YOU INTENDED TO GO FULL WITH AND CONTINUE TO ONLY TRADE DAILY AND WEEKLY TIME-FRAMES UNTIL YOU ARE PROFITABLE THREE MONTHS IN A ROW MINIMUM. YOU NEVER RISK MORE THAN TWO PERCENT OF YOUR ACCOUNT ON ANY ONE TRADE. YOU DO NOT PROCEED TO STEP THREE UNTIL STEP TWO IS COMPLETED.

FUND A FULL ACCOUNT AND CONTINUE TO ONLY TRADE DAILY AND WEEKLY TIME-FRAMES UNTIL YOU ARE CONSISTENTLY BUILDING YOUR ACCOUNT FOR AT LEAST SIX MONTHS. YOU NEVER RISK MORE THAN 2 OR 3 PERCENT OF YOUR ACCOUNT ON ANY ONE TRADE.

IF AND WHEN YOU DECIDE TO DAYTRADE ON A SMALL TIME-FRAME AND YOU DON’T FOLLOW THIS TEMPLATE, AT A MINIMUM, YOU ARE ALMOST CERTAINLY GOING TO FIND YOURSELFE IN TROUBLE. IF YOU ARE GOING TO FOLLOW A SYSTEM OR ANY TRADING STYLE AND YOU DON’T FOLLOW THIS TEMPLATE AS FAR AS THE DEMO PROCESS, YOU ARE NOT TREATING IT AS A BUSINESS AND YOU HAVE NO ONE TO BLAME OTHER THAN YOURSELF IF YOU LOSE YOUR MONEY.

IF YOU EVER SUFFER THE LOSS OF 30 TO 35 PERCENT OF YOUR ACCOUNT, YOU STOP TRADING. PERIOD-PARAGRAPH. YOU GO BACK TO DEMO AND FIGURE OUT WHAT WENT WRONG. WHILE DOING THIS, YOU REFUND YOUR ACCOUNT BACK TO ITS ORIGINAL AMOUNT. YOU DO NOT GO BACK TO LIVE TRADING AGAIN UNTIL YOUR DEMO HAS SHOWN YOU WHAT WENT WRONG AND YOUR ACCOUNT IS BACK TO FULL STRENGTH BY WHATEVER MEANS. IF IT TAKES ONE MONTH OR SIX MONTHS, IT DOES NOT MATTER. YOU MUST FOLLOW THIS APPROACH IF YOU DON’T WANT BLOWN ACCOUNT AFTER BLOWN ACCOUNT.

Your goal should be this. Learn, learn and learn some more and don’t do anything stupid while your getting your feet on the ground. The ultimate goal of any trader is to build an account to a size where just a few good trades a month produces a staggering income. Hardly anyone ever gets there because they don’t treat it as a business. They do stupid things that they would never do in any other area of their life and it’s because of the money that can be made. If it takes you a couple of years or even five or ten to reach the level of a staggering income, is it worth it? The choice is yours.

Before entering the trade

Risk Management

Never risk more than 2-3% of your account on any one trade, and no more than 5% of account total on all open trades.

Shoot for 2-3% R:R ratio.

What Timeframes

See above quotes from James 16 thread. At this point in my trading, I will be trading W1 and D1.

What Pairs

Mainly Major Pairs, and variations of Major Pairs.

From krugman25 thread:

Support Resistance areas used - in order of importance

Horizontal S/R

Trendlines

Channels

Fibonacci (50% and up)

EMA (8 and 21) - for short and medium term S/R

Trade Requirements:

A valid price action signal must have formed, this provides the entry signal

These price action signals must have formed at key S/R level(s)

The trade must provide at minimum 1:1 RR, preferably 1:2 or higher

The signal must not have formed in a choppy or noisy area of price

At a minimum the candle must be the size of the previous candle, or fairly close

Chart Requirements

Must be candlesticks chart

Must be NY close

While in the trade

First Target Area

I will not touch the trade before the first Take Profit or the stop loss is reached.

After FTA is reached

When the FTA is reached I will move the SL to the entry point and let the rest of the trade play out

From krugman25 thread:

Trade Quality Measurement(The 5 star system):

I’ll give a rating on the krugman 5 star scale for the trade you are taking - I’ll record this in Edgewonk.

Personal Trade Filters:

No trading during 24 hour period around the fed announcements and nfp.

THESE ARE THE PRICE ACTION PATTERNS I USE IN MY TRADING:

From james 16 thread:

- DBLHCDoubleBarLowHigherClose

- DBHLCDouble Bar High Lower Close

- Two Or More Matching Highs Or Lows.Must be within 2 pips of each other. If

the high or low is broken, it means the resumption of the current trend.

- BEOVDBearish Outside Vertical Bar(This is Simply Bearish Engulfing Pattern)

- BUOVBBullish Outside Vertical Bar (This is Simply Bullish Engulfing Pattern)

- Pin Bars

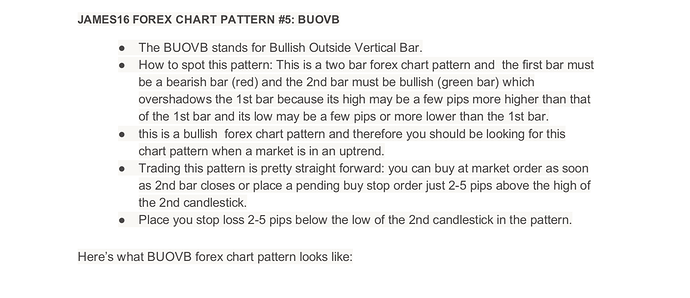

Below are screenshots illustrating how to trade the 6 james 16 PA Patterns above: