I decided to take a quick look at this thread because the tittle cought my interest. Boy what a mistake! LOL

well theirs 10 minutes of my life I’ll never get back.

Yeah, but it was a fun 10 minutes, amirite???

Boy oh boy! This thread reminds me of:

Is that tittle, as in tittle tattle?

10% a month is my average but I also have losing months and breakeven months.

3% a day is just unrealistic.

The whole compounding thing is once of those forex myths that people like to say is possible but it just isn’t psychologically let alone the fact that you may lose 2 days in a row and have to compound down.

hey San Miguel

reply to comment from dale:

“I mean let’s be honest (this is my opinion): the best traders in the WORLD (or should I say the traders that trade with the GREATEST ‘edge’ of all are floor traders and I think I’d be very hard pressed to find a single floor trader that makes a profit EVERY SINGLE DAY, Monday to Friday, week after week, month after month, you ‘get the picture’ I’m sure).”

reply:

i would disagree with you on this dale. spot traders make losses all the time, the only significant advantage they have in FX at least is access to the order flow ( being able to see significant orders before they are executed.) and perhaps proprietary research. but analysts aren’t always right as i’m sure you’re aware. plus the order flow only relates to their clients, so is only really an advantage if you’re working for a big player in terms of liquidity provision.

however the high frequency guys and quants usually never lose and this trading is more efficient because 2 guys can handle a similar work load to 10 spot guys trading with natural ability. the problem is these guys usually only take relatively small orders upto £50m per client. and the spot guys have more sway to take on larger orders.

plus leverage is not employed either, so the ROI is nowhere near the same. literally a hundred times less on a 1:100, you could have a guy running a prop algo entering positions with a size of £10m on the minute candle. and taking only 0.1 pips on the eur/usd for example with a spread of 1 pip. in terms of the value of the trade that would be equivalent to a retail guy entering a position with £100k on a 1:100 leverage…etc…

Hi,

Admiteddly I was referring to equities and commodities floor traders (which is what I trade almost exclusively). And they have a whole lot more ‘going for them’ than any of us do (no matter what markets you’re trading) unless you’re a long term, trend following trader, such as myself (most floor traders, that trade for themselves that is, more often than not are intraday traders, as are you as I understand it).

One thing I did note on your other thread that concerned me a bit (and I don’t remember the exact words that you used): you noted that you didn’t want to take all of YOUR money and ‘lay it on the line’ and ‘be known as the guy who lost it all’ (sorry but that’s what I remember from the thread and I may be misquoting you but I don’t think I’m misunderstanding). That’s not exactly something encouraging to read particularly if you’re trying to raise funds (or ‘start a fund’ as you put it on that thread). At least during my ‘rise and fall’ I was using every last cent of my own money and, but for one client, my own funds by far exceeded any individual investment. I’m not telling you this for the purpose of proving to you my own credibility. The point I’m trying to make is that if you’re not prepared to take every last cent of your OWN and ‘lay it on the line’ then it tells me that you’re not QUITE sure about your returns or, at very least, the sustainability of such returns over time. But, as I said, if I’ve misquoted you or I have indeed ‘got the wrong end of the stick’ then I apologise (and feel free to correct me).

To be honest: I still don’t see that you have a problem of any kind at face value i.e. with a £50 000 account and 2% - 3% ‘effective’ on (just about) every day that you trade that’s a lot of money per month and, if you take your own expenses ‘down a notch’, in no time you’ll not need any other funding from anyone. No pressure. No worries.

I’m not sure if THIS has anything to do with where you’re coming from (because, as I noted above, I still don’t understand your problem) BUT it was quite possibly the main contributing factor to my eventual ‘wipeout’: don’t think that with MORE money it gets easier because you have a bigger ‘cushion’ and can therefore make bigger mistakes more often (the logic being that because you have so much capital to work with you’ll always be able to recover) . It doesn’t work that way. What it CAN do is lead to you take bigger ‘chances’ and ignore risk and money management and, well, the end result is the same whether it be a £50 000 000 account or a £50 account.

You’re talking about wanting to do this ‘full time’ (as I think you’ve noted on more than one occasion). Well: if you’re as sure about your system as you say you are and have £50 000 in capital what’s the problem??? Quit your day job TODAY and ‘go for it’. I’ve already done the math for you. With your claimed returns and with that amount of capital you could ‘live like a king’ EVEN if you’re living in the UK while still growing your account albeit not as fast as you’d like to.

Regards,

Dale.

The return on investment may not look the same, providing they both took the same trades, but they are both earning the same. In all actuality though, the floor trader using no leverage, has a decided advantage. The risk is far less per trade.

Hi, … interesting.

how do u trade at the moment my guy?

Sorry if this is a little off the point of this thread (although perhaps any point that it once had is already sufficiently clouded that I might be forgiven?!) but I don’t agree with that statement. I risk 1% of my account per trade, and I have a calculator that works out what that equates to, ie. before I place a trade I enter my account balance at that moment, I enter the number of pips I am risking, and it gives me the value per pip that I should be placing in order to risk 1% of my account on that trade at that time. I do this mechanically for each trade. So I am compounding as I go and yes, if I lose a trade or two then I lose 1% of my account at the time of placing the trade. I am not formally trained in compounding and financial terms etc., but surely we can’t just say that compounding is a myth? Just interested to know what was behind that, or where we disagree, not seeking to be controversial.

compounding isn’t for everyone. i agree that it would not be fair to dispel it as a myth. the theory is sound, the question is IMO is it viable for you.

it might be more appropriate to say compound at the end of a longer period if your wins are less consistent or you make huge losses and huge gains. rather than continously.

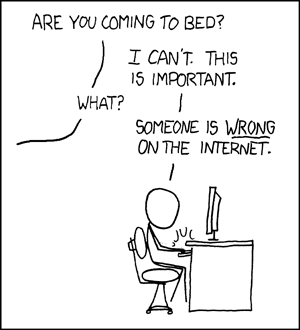

oh dear, another tangent on a useless thread lol

Manni, could you please restate your original requirements / points in simple terms, perhaps as bullet points ?

Im lost

thanks

If I posted my setup, I would get laughed out of this place:p

hello scottish mike. What’s the weather like in Glasgow right now?

anywho this particular thread was intended to introduce myself to this forum and stimulate some debate.

haha i’m sure it’s not as terrible as you say.

I mean do you use an established strategy (s) with particular indicators etc. or a custom approach.

An occasional Bol band, or moving average, but mostly just a clean chart.

I pay close attention to zones and levels.

But the key to it all is money management.

It comes down to simple math, and timing of orders. Very rarely do I enter with a market order. Since it’s all zones, price puts me in, and takes me out of trades. Mostly while I’m asleep:p

Yeah I should have explained it better. There is nothing wrong with compounding, just that daily compounding is going to give you a bit of a different equity curve. The myth I was referring to is the well know get x pips per day compound it up and you could be a millionaire in 1 year.

Hey come on, I didnt expect my question brushed off like that, I feel I have to challenge you on what you said as it seems inconsistent, as has already been pointed out.

i’ve been developing a strategy which yields 3% effective a day, every day.

I’m greedy!

I’ve decided to stick with the tactic rather than more profitable riskier ones, but i’m working with £50k and growth is painfully slow.

Why is growth painfully slow, if you are sticking with a tactic that is returning 3% A DAY, EVERY DAY ? Most people on here would cut off their right leg, or any leg for that matter for such a return.

does anyone have any knowledge or experience of setting up funds?

do you know of any way or have you experience 1st or second hand of raising funds and setting up your own show?

What is it you are asking for ? Setting up money in a forex account ? what do you want to do with these funds ? also, if you

…worked in FX with Barcap and Prime Brokerage with G.S.

why are you asking this as a relative stranger on a relative beginners (babypips) forum ?