What a great morning!

Hey American Trader, would you concur with this?

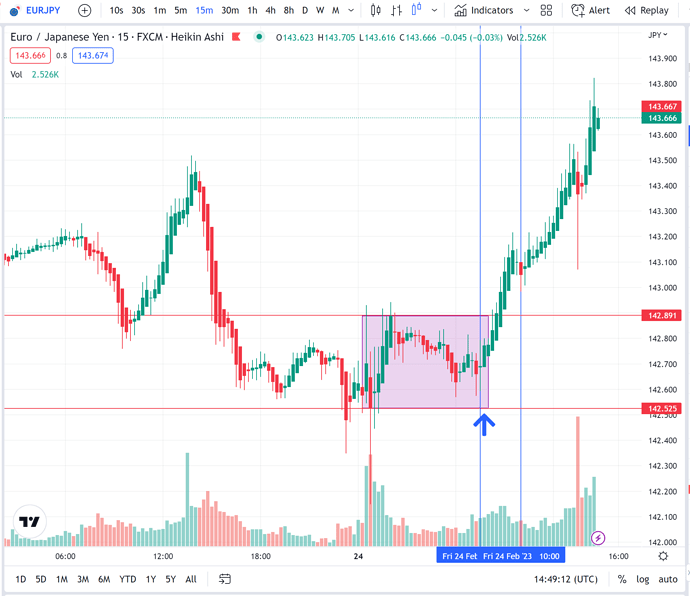

As in do you see changes on the JPY currencies at 10.00 AM GMT.? I was quickly checking out the EUR/USD for today and the theory held up.

@rocktrucker

I have watched very impressive videos and read many comments speaking highly of the London open breakout strategy. I had forgotten about it but thank you for bringing it up because those days when I am awake in time, I should look into using it. The win rate is supposed to be very good since you are looking at both buying or selling at the same time…

I think it would be particularly especially useful for you in those JPY currencies, to be honest it is useful for the Euro too.

Check these out for today, apologies in advance for my horrendous drawing skills.

Around 10 AM GMT seems to be the turning point.

@rocktrucker Very nice, RT. Your artwork works for me.

High impact PCE Data today at 13.30 GMT, slightly favoured to the negative side by analysts according to Bloomberg.

Slept in until 4. Two nice wins on Eur/JPY long. Done for the day.

Have a great weekend everyone!.

80 pip 5 min wick! USDJPY. Wowee!

Have a great weekend!

@samewise

Yes! You deserve it buddy!

So that was the poor data read, the choice for the FED in March is either a 25 or 50 bps rate hike. I have seen loads of analysts talking about a 50? Expect a strong dollar and weakness in the EURO and other major currencies in the weeks to come. It kind of falls into what I was saying about the daily DXY bullish reversal in the dollar above in this forum.

Here are the dailies for the London Breakout Strategy.

As this is pretty new to me I have been plotting where you are supposed to monitor from and it kind of contradicts itself in places about times with times. It says 9.00 for the turnaround of direction but then shows 10.00 AM on the charts. It also says moniitor the direction of the Asian session from 7-8 AM, but the says 7.30 is the important bit and then says 7.45 in other places in the document. If you haven’t seen the turnaround V on the chart from 9? then you must ignore the trade althogether.

These apparently are the best currencies to trade this with, As you may guess the best currency pairs to trade the London breakout system are the GBP crosses like GBP/USD, GBP/JPY and EUR/GBP. Other currency pairs to trade with the London strategy are the majors EUR/USD, USD/JPY and AUD/USD. The highest potential profit comes with the GBP/USD because during the London business hours liquidity is high as major banks and news activity provides traders with a ton of volatility.

Does anyone have experience of this strategy that can help me please with the optimum hours and strategy for this?

@Owsow

Welcome.

Thank you for visiting forum and posting.

I would say a couple of things. First, your question regarding fake outs. Your first circle entry could be considered a fake out. By following the strategy it would be a break even or a very small loss. I have found that many times when I ignore a signal because I suspect it will be a fake out, I end up missing some great trends. I personally prefer opening trades on the signal and not worrying about the small loss because I have found I miss out on far more income by doing that. The second circled entry I would not consider a fake out. I consider 2 to 4 candles in my favor as a good trade.

Then, as far as back testing. It is not possible to get an accurate win/loss ratio from back testing. You will get some good information, as others who have backtested it have. But it will not take into account that this is active trading. So there will be many times when you would close before getting the close signal. Closing trades can be done by eyeballing price action from experience or by moving stop loss to breakeven or by moving stop loss to ensure minimal loss.

There is room to incorporate your personal trading style and preferences into the overall strategy. And I understand that testing is all we have to go on besides trading in demo. I have also been considering lately that like all strategies ever invented, there will be months and years when the results are better and months and years when the results are not as good. But the strategy should provide winning results week after week, year after year.

By far, the most difficult part about this channel strategy, and I think I can see it littered throughout hundreds of comments, is being willing to accept the break even or small loss from getting stopped out. Many times getting stopped out is simply an opportunity to reenter at a modest pullback. There should not be any large losses. There should be no fear of entering a trade at the next signal. With break evens or small losses, there’s no reason why your trading session should not end in a profitable day.

The strategy is immune to smart money concerns. Immune to longer time frame trends.

It is not immune from high impact economic news. However, because stop losses are very tight, even this causes little damage.

I have learned that, unlike my previous thoughts from even 2 months ago, the solution to days of ranging markets when few people think money can be made, is not to go to the longer time frame. It is to go to the one minute time frame. The smaller the time frame, the more trends.

I see thank you! I am new to trading so I think I need more experience to execute trades using your strategy.

Did you backtest or forward test this strategy? Basically it is common way to see if you need to improve anything. Make sure you have quality feed (probably should be paid one) to get significant result.

Great morning so far. 50 pips booked.

I decided to be happy about trading today. I could be happy at making well over 50 pips currently. Or I could be sad that I missed out on 80 pips or more by not working some of the other pairs harder.

Locked in 28 pip profit on Eur/Jpy.

Set Usd/Cad to break even.