STATE OF THE MARKETS

Global Equities Wobbled as US on Break . With the US markets closed on Monday in observance of Martin Luther King Day, European equities lacked intervention and was moving in mixed direction as London closed. UK FTSE closed 15 points lower (-0.22%) to 6,720.65 points while Euro Stoxx50 edged up 3 point (+0.09%) to 3,602.67 points as investors flock to the safety of the Gilts and Bund.

Crude oil futures was little unchanged after the big drop on Friday as investors worried that the corona virus is deadlier than anticipated after new variants were found in Japan and Brazil. The black gold closed below $52.40/bl, while the yellow metal gold was firmly bid above the $1,820/oz despite stronger Dollar.

Dollar saw a notch up in demand in the long term, while gaining momentum in the short-term at the expense of Aussie and Kiwi. Increased in demand for Yen in the short term, showed that optimism is low and flight to safety is on the radar as investors prepare for the new US President inauguration on Wednesday.

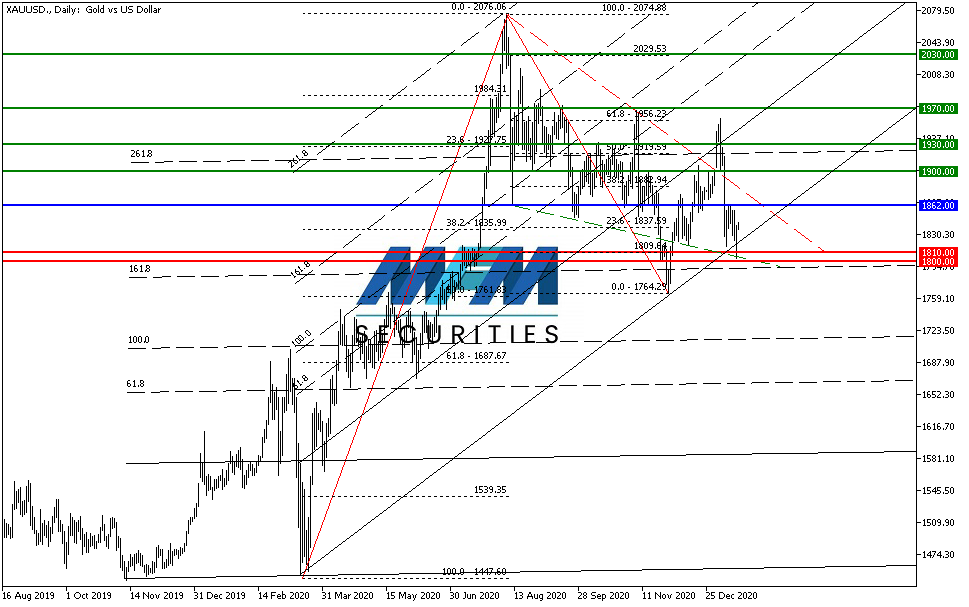

OUR PICK – XAU/USD

Gold spot is intact while futures warrant a re-entry. On 13th January, we pick Gold and in the spot market, the stop is intact but it dipped below $1,810 on the futures market ($1,809.65) which was on firm bid. We believe the precious metal is poised to climb higher as $1.2T US stimulus plan eventually approved by Senate. As bulk of this stimulus goes directly to American taxpayers, we expect inflation will eventually creep up and surpassed 2% inflation target as Feds had expected and this should bode well for gold. If you were trading futures, a re-entry on $1,800 stop is warranted while shall it dip below $1,810 on spot, we would re-enter as well as we see recent dip was more of a liquidity hunting.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.