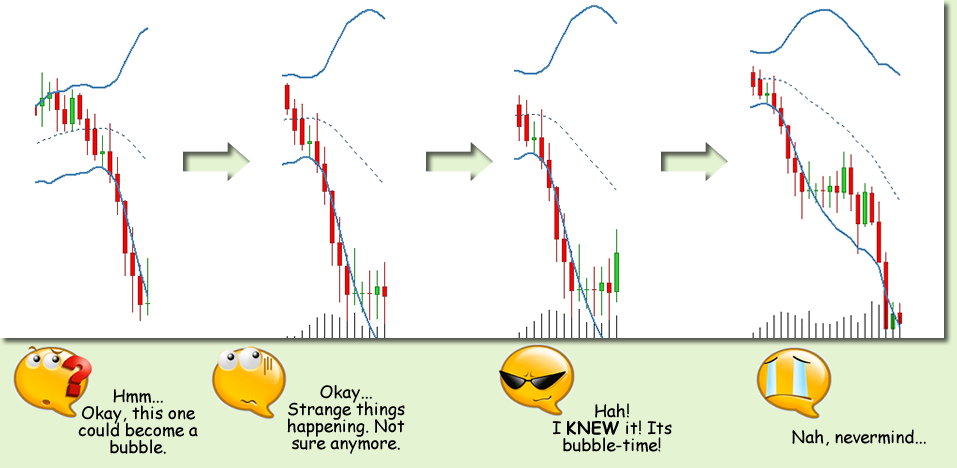

Excellent graphics NForex. You made me chuckle. Let’s see what we can get from this:

In the first pic on the left, the bbs are a little rough, not pretty and smooth as we often see in a bubble. We will get a very few rough edged bb bubbles, but it’s a clue.

The best indication though is the OBB price action. PA goes all the way from the top band to the bottom, then proceeds to walk down the bottom band 5 or 6 candles. Bubbles rarely have OBB PA that walks 5 or more candles down down the opposite bb. Usually when that happens, it’s a sausage. Another clue.

Note that after PA touches the bottom bb, most of the PA is below and outside the bb. By definition, the bbs should contain most of the PA most of the time. This is acting in an unusual fashion, by definition. Bubbles are pretty and smooth and usual and predictable. Sausages are rough and unusual and difficult to predict. This isn’t acting like a good smooth pretty bubble. It’s PA isn’t contained as it should be. Another clue.

The second and third pics are fake outs. In the second pic, the opposite bb contracts as PA pulls away from the lower bb. That meets one criterion of a bubble. But that can also happen very many times in a sausage, so if you were still short here you’d probably want to TP2 and wait it out, looking at the doji candles and long wicks in TP2. This seems like conflicting information, but it’s really not since all info could possibly be consistent with a sausage, but all info is not consistent with a bubble. Don’t be faked out by a single contraction and bb bounce of a sausage. Since a sausage will usually have many of those, it means nothing by itself. We need to look deeper. More importantly, we need to balance having the courage of our convictions vs. keeping an open mind and considering the opposite case. Well, we’ve considered the opposite case, but do we have the courage of our convictions?

The temptation is always to over trade. The greater temptation, and the cause of missing many huge follow-on profits, is all of us have a “one bird in the hand is worth two in the bush” mentality hard wired into our brains. It’s an evolved survival strategy that served the cavemen well for millions of years, but it will kill your trading profits. Work on erasing that mindset and process data like Mr. Spook on Star Trek. Just look at the cool clear logic of the situation. Don’t over trade. Don feel you just “have to do something”. Most of your profits will be made doing nothing, or letting your profits run. Most of your losses will be avoided by doing nothing, or not entering a questionable trade. There is only one situation where you need to act fast and decisively and that is when you are cutting your losses short. When a trade isn’t following the story you have laid out in your head for it, and you incur your first loss in it, then there is no room for hope. Abandon all hope ye who enter here into the Forex market. Cut your losses fast and look for a trade that goes with your plan. But in the cool logic of trading, this one is still working, you have profit, so the rule is, let your profits run.

The third pic looks bubbly, but we have already convinced ourselves that PA is more sausage like. There is a Tymen system entry, but should we take it? Look at the long pin top on the last green candle in the third pic. It’s a seed of doubt. I think Tymen will have more to say on this, but generally, bubbles turn into sausages, sausages rarely if ever turn into bubbles. So I think if we had decided in pics 1 & 2 it was a sausage, it was a sausage, it is a sausage, it will remain a sausage, unless it is conclusively prooved otherwise. I wouldn’t consider pic 3 conclusive proof, so it’s still a sausage. Pic 4 just confirms that. Once a sausage, always a sausage. But bubbles can be turned.

Of course, if you had traded the whole sequence per Tymen’s method, you would have made major pips on the OBB PA in the first pic. And even if you didn’t recognize it’s unbubbly behavior and exited early, which now I hope you see would clearly be a mistake, and took the entry in the third pic, you would have a small stop out. So in the end you would be even or a little ahead. Tymen’s system is very forgiving, but you must think like a trader, not a caveman, to make the most of it.

So there are three good reasons to trade this as a sausage and stay in the trade to ride it to even more profits:

One, to do so, you don’t have to risk any of your trading capital, only profit. Get ready, here comes a HUGE realization. Even though profits and trading capital look the same, they are WAY different. You can never blow out an account risking a part of your profit, no matter how many bad decisions about doing that you make. You CAN blow out an account risking your trading capital if you make enough bad decisions. This difference is HUGE!!! Think about it, and then think about it some more. Trading profits and trading capital are NOT the same. They should be treated differently.

Two, if you thought this was a sausage, then it will always be a sausage. It won’t change back to a bubble later. After you have considered the opposite case completely, which you should always do, have the courage of your convictions.

Three, the trade has already moved a long way in your favor with much PA outside the lower bb. A short pull back is now expected, so this trade is really following a very logical sequence, one that you can plan for, rehearse in your head so it isn’t frightening. Don’t be afraid. Don’t be greedy. Fear and greed are the profit killers. Be cool, calm and logical and let this trade come to you.

That’s my analysis of your graphic. Take what you like and toss the rest.

Happy Trading