If that’s high probability trading I think I’ll pass.

How much are you currently down in April again?

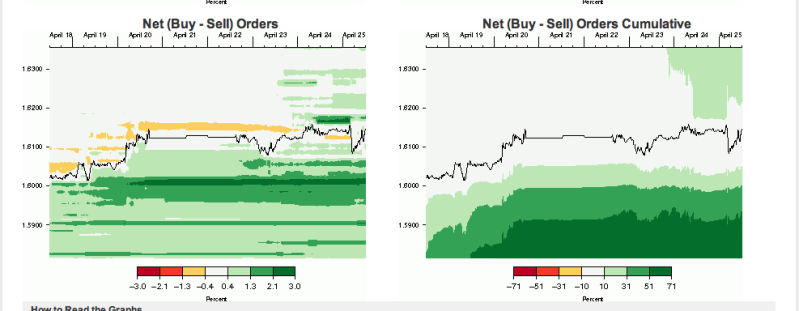

I’m posting a photo of the all the market orders from Oanda’s order book regarding the Cable today. I assume that ALL retail order books look like this, as all neophyte traders trade the same way.

Study it, study it, and then study it some more.

My trading has turned around 100 percent after spending hours and hours looking at it, and LEARNING how the market creates liquidity. Yes I still get stopped out, but for some reason, my short term bias has not been wrong in a month. I’ve been wrong because my entries lack discipline.

Don’t give up. It took me almost a year to stop losing money on my account. Now I eek out a very small gain at the end of each month. Maybe another year from now, that will turn into a larger profit. Enjoy the journey.

Look at the photo and see how the nested breakout BUY orders above the market were tripped on the Cable as the Judas, and then all the abundance of orders sitting UNDERNEATH the market were quickly run through = creating liquidity = profit release. If there are no more orders above the market, there is only one place for it to go. DOWN. Market flow means NOTHING if there are no more orders to push it higher. I wouldn’t be surprised if the cable makes a run down to the 1.60 fig, just to clear out all the buy orders sitting down there.

Edited to mention: If you saw this last week, nobody would be surprised why the Cable and Euro rallied…or if you flip to a pic of the Aussie, you would understand why, along with an A/D divergence, created a short term bottom yesterday…

ICT said in one his videos 'always try to see where price is trying to reach’

This has stuck with me - all of April I could see it trying to reach 1.6170, the banks obviously knew todays bad gbp news some time ago yet they pushed price up - question is are they fininshed yet.

Piphanger I might just take a break with you. This week has almost made me want to take the advise I gave someone else. But I am down to my last laptop

Cant wait for the material ICT

Akeakamai, can you explain your reason for shorting the pair?

I’m not one to judge your analysis i just want your insight as to your reasons for going short. I only ask because i’m bullish and looking to buy on the dips… Ive had a problem with my bias - pretty much this whole month so just want to share perspectives

Cheers, and good luck on your trade :57:

i think you should have set your SL for whole trade at 16110 and be done with trade today mate. Because after such rally down, cable gained everything. And just by looking at Daily, it doesn’t look good for shorts. I mean England said they were back in recession, market reacted… and at the end of day nobody gives a **** about that news  i mean seriously, England - “our eco is pretty much ****ed at the moment”, market - “oh nouzz seeeellll”. Few moments later back at the same level… And thats banks, they will take those cable highs even if whole england is below the surface.

i mean seriously, England - “our eco is pretty much ****ed at the moment”, market - “oh nouzz seeeellll”. Few moments later back at the same level… And thats banks, they will take those cable highs even if whole england is below the surface.

One more thing - it already closed above 16165 level. I really hope it works out for you man, but thats my opinion.

I don’t trade news myself. I rarely look at them, because as i see it (news) as just a post-move justification. I know about England being in recession, because i watch evening news  One way or another, like i mentioned - nobody gives a **** about them anyway. Just a way to put more one way pressure on the market.

One way or another, like i mentioned - nobody gives a **** about them anyway. Just a way to put more one way pressure on the market.

Hi all,

I’m still mainly a lurker on ICT’s threads…trying to catch up reading and watching vids with limited time available. Can someone tell me what times are the preferred kill zone times for ICT?

Thanks in advance.

0-5 GMT Asian Range

7-9 GMT London Open

12-14 GMT New York Open

15-17 GMT London Close

Just something to ponder for those guys who have been shorting and getting stopped out:

- Almost everyone is expecting it to be a short (see pic below)

Where do you think all the money is then? Higher of course!

-

The market flow on every single timeframe aside from the Monthly = BULLISH

-

COT data = BULLISH

-

Look at the following two WEEKLY charts:

EUR/USD - Consider this -> we are in a bullish market and we have just bounced off of the 79 retracement level going upwards, add this to the fact that last week may very well have formed the second candle of a swing low - in other words this week is another buy week.

GBP/USD - Consider this -> we are in a bullish market and we have just had a strong buy week which just so happened to have a nice divergence with the stochastic. The OTE for a short would be somewhere around 1.6300 just looking at previous support levels, as is indicated in the picture below:

Anyway I’m under no illusions regarding the inevitable retracement on cable especially, but I’m just trying to demonstrate that there is still both room and reason to move further upwards first. Perhaps it’s best to stay on the sidelines instead of holding fast to that juicy looking short trade which may not come anytime soon.

Hmmm bad picture quality, but if you click on them and then click again, they open up in full size

Good Job Brother, i hope to get to your level. The is aspiring!

Cheers

PipHanger: Don’t give up dude, the way you’re feeling is normal and part of the development phase. Nobody said it would be easy, but eventually we’ll all get there. As ICT said, now is a good time to take a week or two off, and I think after your break you should do some demo trading until you’re comfortable with applying the concepts. No 2 days in trading are the same buddy, and as a result you’ll have to constantly use ICT’s tools in different ways to identify high probability setups. Trading is in no way linear or black & white, else 90% of traders would not fail…I’ve had a lukewarm April myself, I stopped trading for a month, then this week I resumed and today I only made 1 pip! Haha, shorted the cable, then noticed some bullish SMT divergence and decided to stay on the sidelines thereafter. Remember this: making no trades IS a trade. Anyhow, I wanted to share a poem with you:

When things go wrong, as they sometimes will,

When the road you’re trudging seems all uphill,

When the funds are low and the debts are high,

And you want to smile, but you have to sigh,

When care is pressing you down a bit-

Rest if you must, but don’t you quit.

Life is queer with its twists and turns,

As every one of us sometimes learns,

And many a fellow turns about

When he might have won had he stuck it out.

Don’t give up though the pace seems slow -

You may succeed with another blow.

Often the goal is nearer than

It seems to a faint and faltering man;

Often the struggler has given up

Whe he might have captured the victor’s cup;

And he learned too late when the night came down,

How close he was to the golden crown.

Success is failure turned inside out -

The silver tint in the clouds of doubt,

And you never can tell how close you are,

It might be near when it seems afar;

So stick to the fight when you’re hardest hit -

It’s when things seem worst that you must not quit.

[QUOTE=PureMuscle;344674]Just something to ponder for those guys who have been shorting and getting stopped out:

- Almost everyone is expecting it to be a short (see pic below)

Where do you think all the money is then? Higher of course!

-

The market flow on every single timeframe aside from the Monthly = BULLISH

-

COT data = BULLISH

-

Look at the following two WEEKLY charts:

EUR/USD - Consider this -> we are in a bullish market and we have just bounced off of the 79 retracement level going upwards, add this to the fact that last week may very well have formed the second candle of a swing low - in other words this week is another buy week.

My charts show the fiber bearish since April 2, just now passing the clouds.

Mizugami, what do you mean by just now passing the clouds?

I too have been trading for awhile. Blew up my first 10k live account in 2008. I trade 5 days a week, but I have 2 businesses that support me. ICT has a lot to teach. I have been following him for sometime. I do not use his concepts to make my trades. I trade my own method. But I use his perspective and analysis to evaluate and fine tune mine. You can not mimic a person in trading. It will not work. You must trade your own style. Learn what makes a person successful, don’t imitate.

I use to trade with a friend. We could both trade exactly opposite each other. Yet we could both make money.

Only absolute is trading is not easy and entails lose.

But it is freedom. I can trade from my house in cal, or my apt in odessa…You can even trade during a 12 hour flight with wifi))))

Keep the faith and the dream alive.

And for gods sake don’t trade desperate.

In which case, go buy a lotto ticket.

life’s too short for boring cars and cheap wine.

I use ichimoku to determine my key levels, momentum and such. The clouds have been showing the fiber bearish since early april with an intermediate bull trend on the daily. Just recently price to cross the thin clouds indicating full bullish sentiment. For me. As I see it.

life’s too short for boring cars and cheap wine.

AUD/USD has posted a 3-day pattern, so I’m looking for a buy day today. I will anticipate a Judas Swing in London Open to buy. There are sure a lot of stops below the Asia low.

And UP she goes

How’s that re-set short coming along?

And who exactly are [B]they[/B]?

Your refusal to look objectively at the quite obvious current bullish price action on this pair is causing you unnecessary emotional & financial stress. And by the sounds of it you’ve been exposed to this stress for quite some time.

You’re constantly taking the mick out of the so called dumb money, yet you’ve fallen head long into that same trap this month & especially the past 24 hours.

How come after (5?) 2 years of putting this stuff into practice you’re still continuing to ignore the simple, basic technical background of the current price action?

I’m surprised by this time you’re not asking yourself some uncomfortable questions about why after 2 years of devoted & enthusiastic dedication to this supposedly wonderful material, your trading account is still deep under water.

There’s a thread called Forex Price Action run by a guy named Johnathon Fox in the Free Trading Systems section, I’m sure you’ve clocked it. You might want to seriously consider clearing the decks, getting right back to basics & putting some of that logical information to good use. You might begin to breathe a little easier & actually start making some money.

Ok, not sure if i should be posting this here or the other thread but i have a question…

Both the Cable and the Fiber have made highs today… Now if we were looking to get long in either of these, which low point would people be drawing the fibs from, yesterdays low, or todays asian range low?

(But boy i wish i held onto my Cable long yesterday from 1.61 fig lol)

Appreciate any help

SanJ

EDIT: Ah!! Yesterday’s lows on both cable and fiber were the one shot on kill! I got in on the cable and let it go!