Good stuff HoG, Stay safe Bro.

I just closed 2/3 of my position at 1.2860 (+218 pips), trailing stop for the remaining 1/3 at 1.2972… above yesterday’s high.

That’s a nice piece of work right there, well done. Cross that I missed it, don’t know what I was thinking!

Congrats yunny, great piece of trading. If I may be so bold as to ask a question though, looking at your chart:

would your short entry point be the close of the Doji candle, or when the NEXT candle breaks below the low of the Doji, or the close of the candle after the Doji, or is it the high of the second candle after the doji?

I wait for the Evening Doji Star pattern to be formed, that is the three candles, then I place the order few pips below the low of the Doji candle, a second order at the origin of the fall. Next the most important thing in trading… wait

http://i1086.photobucket.com/albums/j449/yunny11/eurusd128.png

Great trade Yunny… congrats! :53:

Looks like 8h is long for a retrace. But I have a weekly short running off 1.3019. Mind games! LOL

Yes, looks like a retracement is underway… below is an important support area plus the 21 and 200 DMA, a weekly low, monthly high, weekly S2 and 61.8 fibo… all of that in just a range of 70 pips… I will be ready to go long but only after some consolidation…

I’m guessing your looking to 08/01/2011 (01/08/2011 across the pond)… agreed.

Well done yunny, well done…  That was a great trade…

That was a great trade…

Shorted the bobmaninc this morning @ 1-0406 mainly off of the 4 Hour:

stop at 10425 and target 1-0350.

Sorry, did I say the “bobmaninc”? Meant to say AUD/USD

looks like an exact entry like mine. small lots though

I would have looked at this one, too, but did not get into my analysis as I am still stuck in my increasingly-dull AUD/CAD Short from last week and did not want to double up.

Give me boring profits any day of the week ST.

Only reservation I had was that I failed to check the daily before I placed the trade. Didn’t look so convincing on that time frame.

Morning all by the way, forgot to say that first.

Morning HoG. The boring part is definitely being fulfilled by this trade. The profits part? Not so much. But there’s still hope, leave me my hope! And the others are going okay. Eventually.

I think the Daily looks fine for your Short, it’s a rejection of a 50Fib retrace from from the high of 21st September, with a falling trendline. Although I would look out for the Pivot, which can give some Support - it’s at 1.0363, so I’d have my Stop at least at BE when Price hits that. Looks okay to me, though!

ST

It does have a nice ring to it.

and the daily does not look to bad for a short I was tempted to get short this morning as well but didnt have time at home now at work so it will have to wait till next week most likely. but I didnt see this trade (well judging by your timestamp on the post I kinda of know why) that was a near perfect trade setup. If I were you though I would have placed that stop above the trend line.

Just had a look at my platform and I seem to have entered my stop at 1-0435 when I placed the trade this morning bobmaninc. To be totally honest I can’t remember now if the mistake was made in placing the stop or in typing the details in my post above. It’s struggling a little just now anyway so may not even matter

I would not be so quick to get worried about the trade. As far as I can tell price seems to be diverging with the kiwi so things might shape up. Who knows I dont trade divergence to much as I have not had much luck in doing so but its nice to have when you have other reason for entering a trade. Hope it moves for you and puts your account back in the green

Yunny, where would you place the stop for these two orders in this scenario?

Ok boys and girls, hope we’re all fine and well this evening.

Didn’t get to see the Aussie short fail miserably as I got a phone call to say the youngest HoGette had taken a fall at the ice skating lessons tonight and split her chin open. A couple of hours in hospital was the reason I missed the trade end. Fear not though, she has recovered, maybe left with one of life’s tiny battle scars under her chin, but she feels more than compensated right now by the trip to the Disney store afterwards.

Anyway, that was the reason I missed the trade, but what was the reason the trade didn’t work, Hhhhmmmmm, now there is a question.

4H Bobmaninc

Took the trade purely on the strength of the 4 Hour, thought this candle represented a shooting star after an up move. Top of the wick had approached the falling trend line, though on reflection, (great thing hindsight eh?) I suppose the actual body of the candle should really have been closer to the bottom of the overall candle.

Did mention at the time of the trade that the daily did not look so convincing:

Daily Bobmaninc

The last green candle is Thursday’s candle, so the red one previous is Wednesday’s candle ( yes honestly, and 2 x1 =2, 2 x 2 = 4…)

Wednesday’s candle looked to me like a hammer, the bottom of which had approached what looked like a previous support level. This is what worried me and to be honest, if I hadn’t been so lazy and actually checked that before I placed the trade, that concern may well have been enough to keep me out of it.

Now, all of that said, what now?? Because on the daily we seem to have a bullish engulfing now formed, but on the 4 Hour we seem to have another star formed.

I would probably be tempted to go higher with the AU, GU, EU as, imho, all three look to have formed bullish patterns on the daily, and FXCM Dollar index has formed this on the daily too

That to me looks bearish for that index, so dollar index down, EU, GU, AU up???

Hi, sorry for the late response…

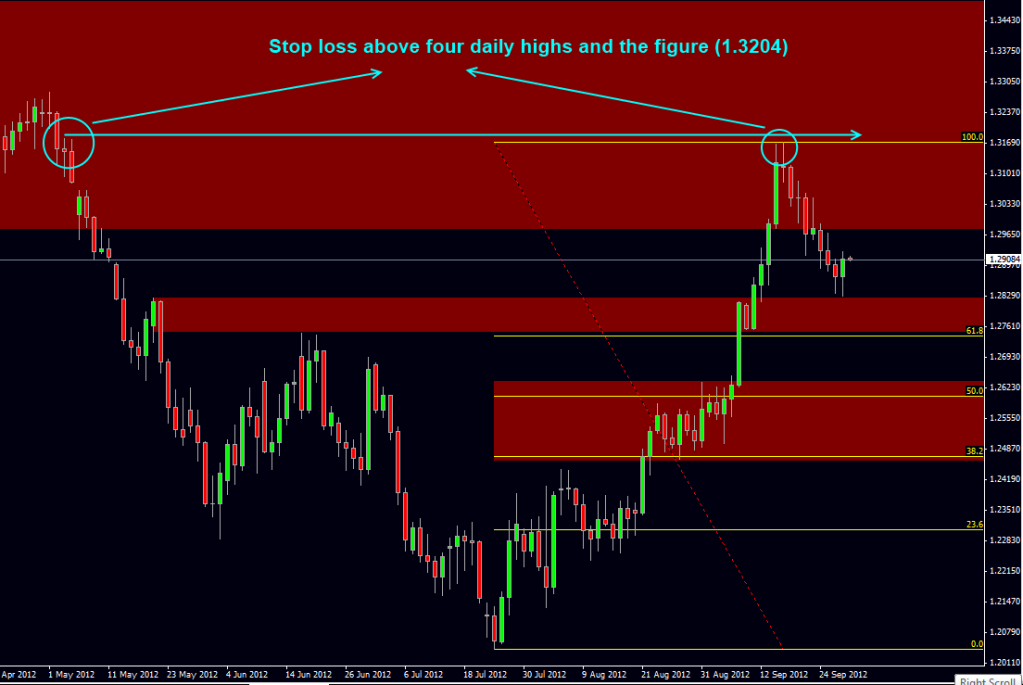

usually when I place a trade off the daily I look for at least 100 pips, my target was around 1.2800 (200-300 pips) so I placed my SL above four daily highs and the figure… but if price had gone against me and over 1.3118 (origin of the down move) then I would have tried to exit at any pullback.

http://i1086.photobucket.com/albums/j449/yunny11/eurusd129.png