OK, so new week just about to get under way and I though I would just add this.

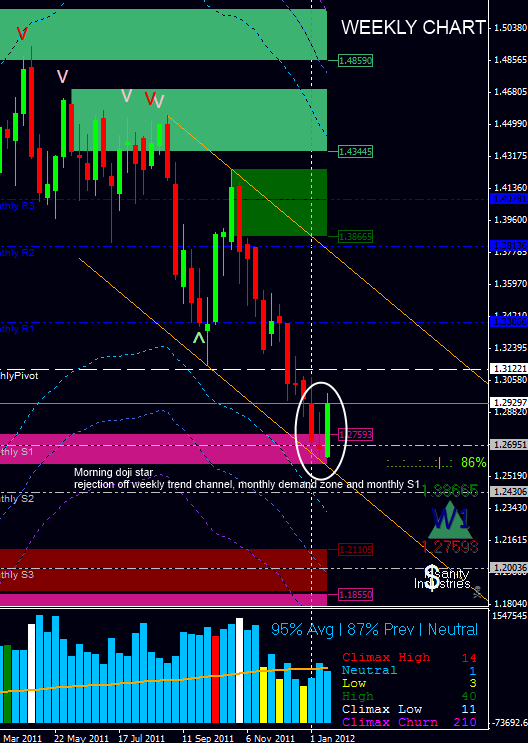

While, as the guys quite rightly mentioned over the weekend, the techninals are probably pointing to a further up move, we are still at the mercy of the Greek decision. And as it stands just now, some 20 minutes before the open of the week’s trading, we looked to be opening with a gap down at the moment, since no decision seems to have come at all regarding Greece.

Obviously any levels we are watching could be blown out of the water pretty quickly if a decision was to come out one way or the other, but in the meantime I’ll add the figures according to the recent research into the Daily pip range averages I did the other week. Again these figures are taken on the ASK price.

One thing I would note just before I add the numbers is that I have seen PipBandit recently add daily ranges, and the figure he seems to be using is around the 130 pip range for the day. Well interestingly enough, my research is giving a daily pip range since 13th Septrmber 2010 of 157 pips, but as I say, interestingly enough, this number has been falling slowly but surely from 161 on 9th Nov. 2011 to the current 157.

So I wonder if the two figures will eventually come together If you do read this PipBandit, could you tell me the source of your numbers please. I would be interested to keep an eye on it to see if the two do eventually come closer together. Thanks.

Anyway, here goes:

Since 13th Sept 2010 until Friday 20th Jan 2012;

Daily Range 157 pips

Daily Av. upmove from open 76.5 pips

Daily Av. downmove from open 80.5 pips

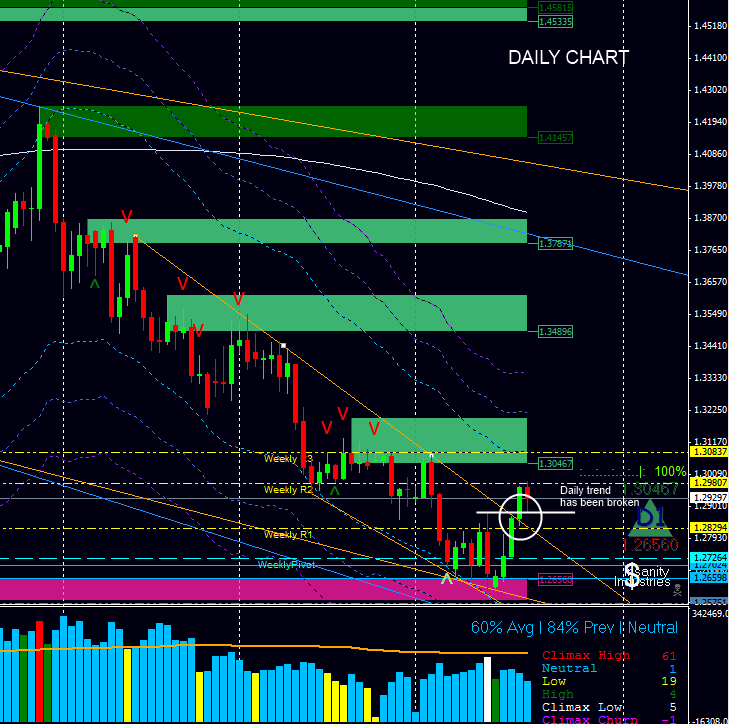

So given Friday 20th Jan 2012 ASK close of 1-29346, we would be looking at extremes of;

HIGH 1-30916

LOW 1-27776

The average upmove would take us to 1-30111, while the average down move would take us to 1-28541

Now obviously, on a Sunday, these numbers would have to be adjusted to allow for any gap, so I’d just add 157 pips to the open to find the high extreme, and add 76.5 to the open to find the average up move.

And subtract 157 from the open to find the extreme low, or subtract 80.5 from the open to find the average down move.

Or, on the other hand, these numbers may well be completely meaningless. Time will tell.

Good luck to all this week in their trading.

HoG

EDIT : Open gapped down 54 pips at 1-2880 so levels would be:

Extreme High 1-3037

Av up move 1-29565

Extreme Low 1-2723

Av down move 1-27995

(from 1.2738) SL already below daily range, TP2 at 1.3190, TP3 at 1.3330

(from 1.2738) SL already below daily range, TP2 at 1.3190, TP3 at 1.3330