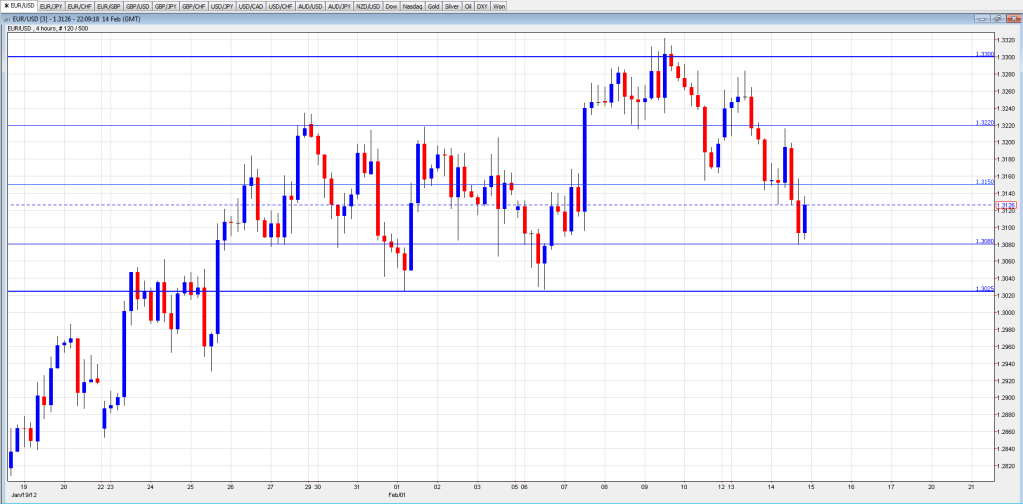

TP1 has been hit to the pip  , I have moved SL to B/E, risk free trade now…

, I have moved SL to B/E, risk free trade now…

I actually took a long around the open tonight yunny from 1-32088, to 1-3250. Worked out but over the last couple of weeks, when I have only been doing some “imaginary” trading, the EU would have kicked my bum, so I may start to open my horizons and look for another pair.

One I was annoyed I DIDN’T take last week was EUR/CHF when it was low 1-20’s. SNB told us all they would not tolerate a breach of 1-20 and it was as sure a trade as any imho. But there you go, life goes on. Well done on the TP 1 anyway.

Good luck for the rest of the week

HoG

Took a similar trade to you Yunny. Felt that we’d gap up over the weekend given that Greek vote was probably going to get passed so opened a long near the close on Friday after the initial lows seemed to be holding. Closed it out at 1.3250 last night.

Long again now from 1.3254 -61% retracement from European open to early morning high. Aiming for around 1.33 where there’s some large option expiries later.

Greece … is a very small country. If they opt to exit, good for the fiber. But they won’t. Even then it’s not as bad to the fiber to push it to parity for the dollar. Looking at a chart. 1.18 was the lowest so far while this crisis lasted.

What drives currencies first place is interest rates. Before the increasing of the rate last year fiber went up ~ 3000 pips. Before the decreasing by half a point back it went down again ~ 2500 pips.

Greece news are like those statistic news. They drive the price, but not on a large scale. More on a daily/weekly scale. Market psychology, maybe with a little more impact than statistics, but not real numbers like interest rates, which drive the fundaments of the price.

Hey Buckscoder. I trust the travels went well??

Anyway, took a long at 15.50 GMT @1-3212. Only risking 20 pips (22 actually, stop at 1-3190) looking for price to move upwards of 1-3250. Anything above that level I’ll take.

Just in case anyone is wondering why I’ve picked 1-3190 as a stop, there is a good reason which I will explain later today, don’t really have the time just now.

talk later gang

Hog, actually sitting on my baggage and then I’m far away from Europe for some months. Just letting my bot run and watching it. Plus as well looking in here, if there is time between the walks at the beach …

Have a great week!

Interesting day trading for me, decided that due to greek decision traded cable today and scalped fiber .

Using my strategy looked for price bias went long fiber early on spotted then was looking heavy for today so went short on cable at miday highs on my first run made b/e. +5 got stopped out decided was still looking heavy so entered short again and took + 15

All in all new plan working well so far finished up +8 pips for the day not bad as all my trades made sense even my loser . Will start to share strategy if I get 2 weeks of consistent pips last week was up + 166 pips

Well done Scratch. Keep plugging away at it, building steadily. My mistakes in the past have been to have a good run then swing for the fences since I was overly confident. Always backfires the minute that bit of complacency creeps in.

Best of luck to you !

Ok , quick update. The reason I picked 1-3190 as my stop in earlier trade was simply that it represented a % risk to my new account balance which is $50. Yes that’s right, my new balance is $50.

Now never panic, there is a good reason for this. Even though before I stopped trading for a little while there, My balance of around $250 was still small in relative terms, it was still big enough for me to make some pretty shoddy trading decisions and hand on to them, even at a biggish loss to the acount, or muck around with my stop loss levels again.

I had said at the beginning of this year that I will give myself this year to prove to ME that I am disciplined enough to go forward with FX trading. And if at the end of the year, if I am still making poor decisions, it would be time to call it a day.

Well, this is my method, rightly or wrongly, of teaching myself better risk reward, money management practices. In the beginner’s disaster thread, when my account was this low, i said I was in survival mode. I couldn’t take risky decisions, I couldn’t enter trades just anywhere I felt like, I HAD to make good decisions because my balance just couldn’t support bad decisdions.

I took my account up out of that situation, but obviously still didn’t learn the lesson at the time. So I’ve intentionally put myself back in that situation, to hopefully learn it this time. Who knows, the plan may backfire and I may blow the account all together. But to be honest, by waiting patiently for ONLY the better set ups, I don’t see any reason why I should.

Anyway it’s another experiment. Progress will be documented as normal. At least If I do make it to $400 this time, it will mean I’m actually in profit !!

HoG

You can do a lot of learning from a $50 base (although £50 would be even better, obviously ;-)) so it makes sense to me.

ST

Got burned on my last long for 1% which in retrospect was a dumb trade. Got caught thinking how I thought things would play out on the day instead of seeing what was on the chart in front of me - especially on the 4H which really looked like it was rolling over short. Another 1% lesson.

Long again at 1.3080 which has been a decent level to key off from previously.

Hey Mr. HoG I don’t know if you do this already or not, but I started journaling every single one of my trades in excel at the beginning of December last year and let me tell you, it’s made a HUGE difference. Whats really helped me is that right after I enter a trade I force myself to write down the reasons for taking the trade, why I place the stop loss/TP where they are, and reasons why I might move the SL or exit the trade. This has really improved my self control and because of this I haven’t had a losing week yet this year (with my luck this week will prove different haha…). Not to mention I can look back on trades I no longer remember and see what I was thinking at the time and work out why that/those trade(s) failed (which is where snapshots of each trade on one or two different time frames really helps me).

The reason I started my journaling was because of a fellow named eremarket on this forum (his real name is Jay). I went to one of his webinars and he told us that he had been trying to trade unsuccessfully for (I think) 4 years before he started a journal and after he started things changed completely. He’s now a (successful) professional trader.

PipBandit, I wasn’t as sharp as you but my long from 1.3096 is looking good now…

Totally agree with that. I started doing the same from January and it’s been a very helpful discipline to get into. I do it in Excel so can track cash, percentage gains, R/R and graph equity balance over time.

I closed out for +78. Didn’t like the way it was struggling near 1.32. Maybe some positive Greek news or whatever will give it another leg up but I got stopped out at B/E yesterday when I was long from 1.3150 and watched 60 odd pips go down the drain. Banking the money today!

Nice decision man. Greed is the foremost killer of accounts (in my experience haha)

price hit my SL(for profit) last night at 1.3149 below hourly support

Now I am long again at 1.3070 (S1), I hope 1.3040 will hold at least one more time…

I was long too from 1.3075 but I closed it a few mins ago for +10. More interested in looking to short rallies at this point or waiting for 1.3025 to be hit where there should be some good demand.

Like this thread is an interesting view into other traders thoughts have given a lot off thought since the new year on my trading so far this week am up 65pips

Here some of ideas I have now ingrained on my forehead hope they help HOG

1)The trend is the basis of all profit

2) every trade is a losing trade

3) the daily chart is key to all my intraday choices

4) i cut my loses straight away

5) small ranges beget large ranges vice versa

6) i try not to get stubborn

Still learning how to let my runners run but to be honest the biggest change to my trading is my risk managment I can’t stress this enough

Is that a pennant formation I see forming on GBP/USD (1H)? She could be getting ready to unload here!