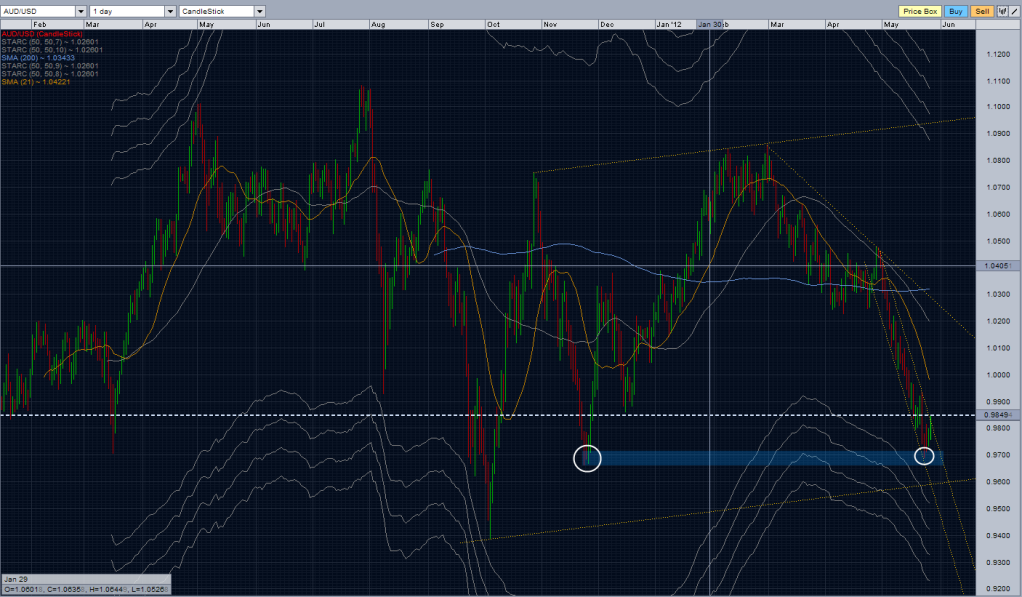

This was my daily chart view for that long:

Nice trade hope to see it work out for you. On a side note can you guys in south america take the storm back that you sent my way lol. Almost a hurricane doubt it will get there as it is expected ti make land fall in a couple hours.

Agree 100%.

The hours were horrendous, the frustration when just as you thought you were on to something turns out to be false.

Not for those who are into forex for quick money.

Hi Yunny,

We have been thinking the same way, which is always reassuring - I went AUD/CAD via an overnight order on Wednesday 23rd May, it just hit TP overnight for +4.7%, so a nice way to start the week.

I agree with you on focussing on the Daily chart at the moment. I ventured into intraday a couple of weeks back when NZD/USD was tumbling so nicely, but I’m otherwise a Daily man at the moment.

Nice work on the AUD/USD trade.

ST

Aren’t London and NY market closed today for some holiday?

I saw on the weekend and didnt even bother opening my charts last night for my top down analysis this week, figured i’d get cracking tonight ready for tomorrow…

London’s open today. Our Bank Holidays are next week… Monday and Tuesday for the Jubilee.

Yes, Aussie and Kiwi look good. I’m waiting for them to break previous highs on the 4hr then pullback before going long.

Nice wee short on the EURUSD this morning when it retested January’s low that it broke through last week. (Good old daily chart again). Took it with a small position and a (for me) ridiculously tight stop loss. This time on Monday morning definitely not my favourite time to trade so minimised risk. Quickly ran to 1:2 R:R so took some off and moved stop loss to break even.

Good call taking some profit and trailing the Stop quickly - personally I never trade Monday mornings, and between Greece and the cluster of holidays and various other factors I’m doing very little intraday business at the moment. Nice steady end of day stuff is less stressful at the moment!

Good Morning all,

New to the forum/site and just wanted to say hello to all. Really like the site and went through the whole educ course last night (awesome material for newbies). background in equities and venturing into FX full time as a result of lay off - trading FT for 9 months now with some mixed results (net up … just), but have to curb my poor discipline and get more patience!! look forward to interacting in the future on the site. happy hunting :51:

Nine months is a good time to be able to break even and start getting some Profits.

I will also suggest that you try the approach that i am using of Multiple accounts at the same time.

This will keep other accounts protected and growing if any 1 account gets lost:)

That’s pretty quick studying. I am still learning from the course, but I work nights and I’m really tired during the day. I guess I should have some kind of excuse. Hope you do well.

Possible breakout trade forming on 4h CAD/JPY… one to watch? Large uptake of buys during the 14:00 GMT 4h candle. Break above 77.66 would be a confirmed entry for me.

USA is memorial day to honor the dead soldiers.

Ah cheers, yeah caught up with what was going on later in the day… As i thought all markets were closed yesterday was no trade for me…

However, i think you’ll especially be happy to know i shorted the AU this morning - i realise thats your thing lol… In short from 0.989… See where this goes…

Provisionally, AU now looks to have crossed over to a longer term up trend… a rejection of 9820 (34 EMA).

I took first profits at 0.986, had next TP set at 0.9815 but after the strong rejection from the 0.982 area i closed up shop at 0.983… Happy to be out with 60 pips…

Trying to going long the last couple weeks hasnt done my account any favours, so ive switched to only looking for short opportunities until things look a little more bullish on the daily… Running all my trades at reduced risk until i can recover some losses… So far, decent start to the week… 1.5% up with todays trade… Think im out till tomorrow now

Yeah I shorted last night at .989 stop just above 9910. Looking for a test of the 9800 figure. However Thanks to tropical storm Beryl my internet went down last last at home so that trade is just kind of floating out there right now. I would have most likly closed it this morning if I could or at least have moved my stop to BE. I was told it could be a week before I get internet back. But be careful on shorts I am not saying we have hit a bottom yet but expect some strong pushes to the north side this week.

I was looking for pretty much the exact same thing…

That sucks about your internet being down though, no access to your account via mobile internet on a phone? Thats what i pretty much rely on for managing my trades at work as my work has most Java apps blocked which rules out my Oanda based account…

Yeah, it’s starting to look like the nice month long AUD/USD & NZD/USD down trend might be trying to turn north.

These days my favorite set-up for major trend direction is the 60ma on the 4-hour, aka the first of the three ducks.

The set-up isn’t flashing “long” yet but both AU & NU are printing around & above the 4-hour 60ma levels, so I’m standing by waiting. But… a break of the .9800 level and I’d be back favoring shorts. :44:

Yes know what you mean. I have been fooling around with GRAB candles and 34 EMA high/close/low for a few weeks. Boy those trends last a LONG time! LOL but you do trade off some pretty large counter trend trades.

closed 2/3 of my A/U long trade for 125 pips profit, 1/3 still running. Seems like the pair is resuming its downtrend, I will try another long around 0.9600