I think you’re probably right about the small range day today. I re-opened another short at 1.2676 again as price turned over at the recent high from earlier this morning - looks like we’re just ranging from 1.2740-80. Around 10 pips to the good at the moment and will be looking for 20-25 pips profit.

Finally decided to close out for roughly 1.7%. May try to play the little range if I’m not too late after sitting watching it all day.

I never bother with intraday during a Bank Holiday. I let my end of day trades trail through Bank Holidays, but I just find things drift around too much for intraday, doesn’t have its usual zip. Good work on the 1.7% - in your position I’d quit while I’m ahead lol.

My only open trade is NZD/USD Short off the Daily, but that’s pretty sleepy, too.

ST

Just entered another short at 1-5321 on Cable. Raised the overall account by 4.9% today just playing the very little range. Will be getting out completely very shortly as it is time to go to the dentist’s with the 2 girls. Overall very happy with today. Made my new weekly target of 4.5% so could just sit out the rest of the week and be happy.

Yeah I’m flat too now. Closed my previous short for a small gain to bring me up to +0.76% for the day. Looks like 10pm trading out there at the moment.

Anyone here a fan of Old Peculiar? I could murder a pint!

HoG, may I ask if you are using a strategy that you have developed yourself? Or are you a graduate of the ICT thread?

I seem to have made every mistake in the book, and keep flirting with various ‘systems/strategies’. I seriously can’t seem to settle on one thing to give a go at for any length of time.

I do believe somewhere in me is a disciplined trader, I just need to find it within the next 17 months before I retire from the RAF.

I’m quite frankly terrified of trading a large account. Does anyone have any advice on how you would scale up an account over a period of months? The thought of risking £300 per trade initially would send me pale.

The Traders Arms appeared to be the correct place to ramble on a minute on the wrong side of 1/2 bottle of red!

Regards

GG

Unfortunately, and maybe quite unusually, I’m not a fan of any alcohol. I don’t drink at all these days. Don’t worry, I haven’t found religion, I just don’t bother with it now.

As for my “system”. I still don’t believe I have one as such. I’ve tried to read through the other threads, but if you’ve read the Beginner’s Disaster thread, you’ll know I’ve stated before that I find it difficult to read through things, which is probably part of my own difficulties.

I just try to trade support and resistance levels.

As for scaling up an account, I think I’ve done it pretty much the right way. OK, fair enough, I DIDN’T know enough when I first started, but you should open a micro account first when you DO go live. Play for 10 cents a time. And gradually move up from there.

Even though I’ve been doing this 7 months now, I still wouldn’t be comfortable trading upwards of a dollar a pip yet. Not even comfortable trading a dollar yet !!

So it’s a build up of psychology experience as well as trading experience.

HoG

Hello again.

I have family in Tunbridge Wells, and the pub up the road from them serves Old Peculiar - very nice indeed!

Don’t mind HoG and his abstemiuous ways - he’s just waiting until the trading really takes off, then he can cut straight to the Bollinger lifestyle.

There is no simple answer to scaling up the risk, unfortunately, we are all different. For me, it was just a case of increasing steadily. I had a £2000 account initially, then increased that to £5000. I always risk 1% per trade, so obviously that meant £20 and then £50 risk per trade. That was sort of okay - I had spent more than my account size on training at that point, so it still felt like Monopoly money risking £20 per trade. Then I hit a good run of results, so we increased my account to £10,000. £100 a trade felt a little sharper, focussed the mind, but I knew that over the course of a month the strategy worked. I had made a few hundred at the old risk level, so I was able to make some losses at the higher level but only be losing my profits, rather than eating into ‘real’ money. We took a view that if I lost all the early, £20 and £50 profits at the £100 risk level, then we would go back to risking £50 for a month and see how it went.

Actually the £10,000 account went well, so we put in a further ten grand. Suddenly risk was £200 a trade, so five losses would be a grand - and a decent percentage of my training costs. Ouch. But I had faith in the strategy, so risked £200 per trade, this time we decided that if I ever got to the point of losing a net £1000, we would cut risk back to £50 per trade for a while. My first three trades were losers, fastest £600 I have ever lost, all in one day, had more than a half bottle that evening lol. Went to trade the next day, knowing that two losers in a row and I was back to £50 risk. Fortunately I bagged a couple of decent winners, and have not looked back since. We subsequently increased the account again, and still if I terrace some losers I get a little grumpy, briefly, but my overall faith in the strategy keeps me focussed on the overall picture.

I don’t believe that there is any strategy that gives 100% winning trades, all the time, in all markets. So there will be losing trades (like my NZD/USD Short overnight, nice way to wake up on Mrs Templar’s birthday, not, lol). The thing is, if one has started with smaller sums attached, there has been a period to learn the approach and see that it works. So as long as one continues to execute the strategy mechanically, the results ought to keep coming.

So I would advocate two things: scale up the risk incrementally, to minimize the terror as the numbers attached get bigger, and secondly have an exit strategy from that level, a plan B: something like ‘if x happens, then I will change risk per trade to y level for z period of time’. Then stick to it. It might be depressing to have a £40,000 account, lose £2000 and then trade that massive account at £20 per trade risk for two months, but this business is about capital preservation first and foremost. If you made a plan, you made it for a reason, so stick to it. It might feel like it will take weeks, months or long to recoup the losses at a reduced risk level, but if the strategy works over the long haul then you need to keep executing mechanically, which means scaling back the risk if you scare yourself, find your confidence again, then scale it back up after a set period (which keeps emotions out of the decision).

It’s like motor racing - if you have a spin early on in the race but don’t hit anything, so manage to continue, it can be an idea to go a little more gingerly for the next lap or two, to build up your confidence again, get a feel for any damage on the car and warm up the tyres and brakes again. If you go straight back at it at 110% and immediately have another spin, your confidence might be shot and that’s the end of your championship.

Anyway, apologies for the ramble, but that is my take on it, for what it is worth. There will be others, but one of them should be a decent fit for you. You’re asking the right sort of questions!

ST

Listen, us Glasgow boys have a bit more class. None of yer Bollinger nonsense. If it ain’t Cristal, we ain’t neckin it !! I used to enjoy a couple of pints of Cristal with the lads, or if it was warm that day, a Cristal shandy and a packet of pork scratchins !! LOl !!

Oh yes, we know how to live up here !

Happy Birthday to the good lady incidentally. I hope her day goes well. Since the technological revolution hit the Templar household at the end of last year, I have no doubt you have got her some gadget that will take anyone over the age of 35 a few months to work out how to turn it on !! LOL

Mrs Hog has long since lost her Birthday present to the HoGettes, who have downloaded a world of mystery on to it that we just don’t understand.

Anyway, decided to take a long EU at 1-2787 looking for 1-2820, with a stop at 1-2765. Truth be told it was a bad entry point, and I know that. If price gets back to entry point ( currently - 9 ) I may cancel out, depending on how things look. If I’m still in the trade come New York open, I’m hoping for a little pop above 1-28.

Overall it’s less than 1.5% risk so although it was a bad entry, it’s not a bank breaker. Again first to admit it was entered more through being too keen to trade rather than any technical or chart indication. At least the stop is in place though.

HoG

I’m also long EU at the moment and believe its worth holding on to. The commercials are net long at a ratio of 4:1 at the moment.

Alas too late for me Gliderguider. Stopped out. As I said, wasn’t a bad idea, just a terrible entry level. Another Cristal while planning the next move LOL !!

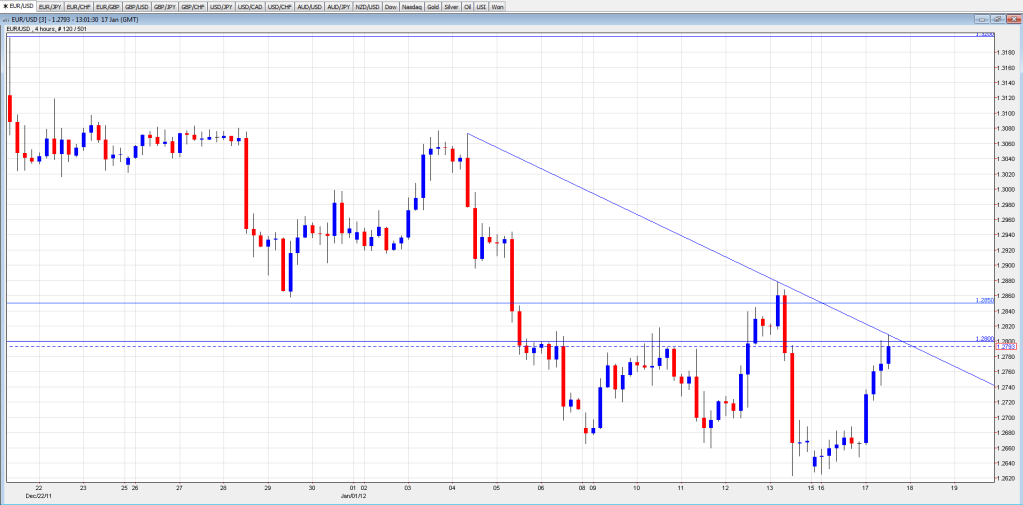

With price currently at 1.28 we’ve travelled the ATR(14) daily range of 131 pips. I’m not saying it won’t go higher today but the odds are higher that it won’t be. I was long from 8.30 this morning after the pullback but I’m flat now. Probably quite a bit of wood to chop in the 1.28-1.2850 region which might also slow any rise down. We’re also bumping up against a trendline on the 4H. I’m more on the lookout for an opportunity to step back into the downtrend as optimism in the EZ tends to fade pretty fast these days.

Edit: Nevermind - just saw your post above now. On to the next trade I guess!

Actually I’ve went short from 12791 PipBandit. Didn’t like the tall wicks on the hourly last couple of candles so took the short

Nice - looks like you’ve made back the earlier loss already. Missed it myself. Was hmming and hawing and then it was gone.

We’ll see if you stick to that when you make the first million…!

Thank you for the birthday wishes, 38 today (although thinking about it I’m probably not supposed to publicize that lol).

Yes, continued to ride the wave of the technological revolution, here, a few years after everyone else enjoyed it. Also bought a fair few episodes of Grey’s Anatomy on DVD, to which she seems to be addicted, so that’s me taking one for the team for a few weeks, being a viewing buddy. We have sons and no daughters, so I get chick flick duties from time to time.

Hilarious that the kids have hijacked Mrs HoG’s birthday present already. Reminds me of my Xbox 360. I’m sure I saw it around here somewhere? I haven’t even finished Assassin’s Creed, yet!!

Erm… keen to trade rather than seeing a sound technical setup? Reminiscent of the last days of Beginner’s Disaster…? Need I say more?

I took a very similar trade, HoG, largely for the same reason outlined by PipBandit, above, nice falling trendline on the 240. Also had a Fib level around there, the 50ema, and 1.2800 is a decent level to trade out of. Looks okay so far. Have you set a TP? I have 1.2665 set in case I get hit by a bus or something, but as I am sitting at the computer I can it manually if the world changes so I left it moderately ambitious.

ST

Too easily done - but always better to be out of a trade wishing one were in, than in a trade wishing one were out.

I have been meaning to say, by the way - love your avatar!

ST

Nice trade! I had a short waiting at 1.2813, but NY traders decided to move price down without me

Only thing ST that separates last long from end of Beginner’s Disaster was at least this time I did remember to put a stop loss into a crap trade !! Other than that, you’re right and it’s always worth having it reinforced.

Mrs HoG is also a huge fan of Greys Anatomy. What can’t girls just like Top Gear like any other human being ??

Anyway, talking of my last bad long trade, it has actually threw up a point which I think is worth mentioning. I have heard you saying a few times in the past ST, that your K2A coach is always trying to reinforce in you to trade what you SEE, and not what you FEEL. Well keeping that in mind, here’s a quick wee summary of this mornings events.

I was sat watching Bloomberg this morning. Indexes were all up, Euro was rising against the dollar, Futures were looking at pointing higher on open and the commentary was all about a possible rally for today.

So I decided to take my long trade on the back of all this optimism, even though at the time, the 1 Hour chart was showing this:

As you can see, the last candle on the right isn’t exactly screaming, “GO LONG NOW !!”

However, I traded what I felt, and NOT what I could see. Then told the community I had entered long. To which Gliderguider replied;

Again, with all due respect to Gliderguider, again sounds like a trade made with a certain amount of “feeling” in it, just like mine.

After this had happened:

I was forced to write;

Due to the fact that price had indeed fell.

PipBandit then wrote this;

Based on what he could SEE, NOT based on what he felt.

Then after I’d mentioned that I had went short from 1-2790 area, ST wrote;

Again, as detailed, based on what could be SEEN on the charts.

As we all know now, this is what happened;

and this is were I regained my loss. Because I had traded the long upper wicks on the previous candles, and NOT because I had continued to listen to the ongoing “How fabulous the world is today” stuff that was still coming from Bloomberg.

I hope this all makes some sense when I hit the ‘Post Quick Repy’ button. And I hope it does just reinforce, even in me, the Trade what you can see message.

Incidentally, even though I made a profit on the short, and we should NEVER complain about any profit, I hit my Target which I had set at 1-2760, stop had been put at session high of 1-2807. So I could have been in a bit longer, but happy just to be showing a slight profit for today.

Intresting turn of events today HOG. Sorry you were made an example of but make alot more sense.

It’s all part of the learning process bob. Turns out, again, it was a cheap lesson. $2 loss to reinforce trade what you see.