This actually reminded me of something today that I had totally forgot about. Might as well do it now.

As I mentioned at the start of the week, I had done some research over the weekend regarding Average Pip ranges of EUR/USD going back to the 13th September 2010., and initially took it up to the 12th of January 2012.

Just as a quick recap, the reason I chose these two particular dates was that the 12th January 2012 (last Thursday) was the day I started the research, and I chose the 13th September 2010 (roughly 16 months previous) was because the Daily opening price was almost identical for both days. (1-2708 and 1-2710 respectively)

Now initially when I first wrote about this at the start of the week I wrote that I had used the BID price for my figures. That was a mistake, it was the ASK prices I used. Anyway, this is what I found, and it will be interesting to see if it relates at all to price going forward from here.

What I did was take a note of how many pips price climbed above the opening price for the DAILY session as a whole, NOT an individual trading centre like London, or New York etc, it was the whole Daily session, 10pm GMT to the following 10pm GMT.

I also took a note of how many pips price fell below the opening of each daily session. I took an average of the up moves, an average of the down moves, and finally an average of the Daily range as a whole. Since then I have updated the figures to include the Daily session that has just closed at 10pm on the 17th January 2012.

So, here are my figures, based on DAILY price action:

Average DAILY up move from open (13th Sept 2010 ----> Now) 76.5 pips

Average DAILY down move from open (13th Sept 2010 ----> Now) 80.9 pips

Average DAILY total range (13th Sept 2010 ----> Now) 157.3 pips

I’m also so boring I’ve got the whole thing on an excel spreadsheet which I intend to keep running.

Anyway, what good is all that??

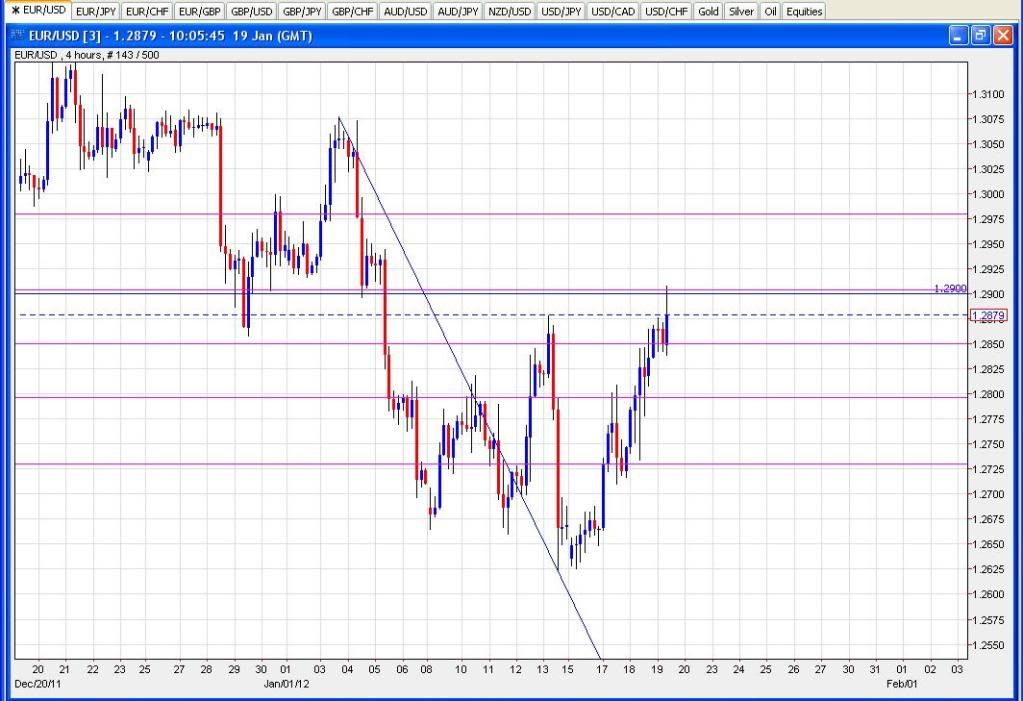

Well, the opening price for DAILY session 10pm GMT 17th Jan 2012 —> 10pm GMT 18th Jan 2012, was 1-2739 (ASK) exactly, as far as I can tell.

So using above figures, on average price could go up to a whole range high of 1-2896, (or an average up move at around 1-2815.)

OR price could fall as low as a whole range low of around 1-2581 (or an average down move at around 1-2658)

These figures may well turn out to be totally meaningless, but you never know.

I did originally write that I would start a tandem thread to demo trade using the ranges alone. This isnt going to happen now. WHY??

Well, as I’m sure the experienced guys already know, a system based on 1 set of figures alone, just won’t work, you need several different agreeing factors to make a positive trade entry decision. And in backtesting a couple of variations of using these figures alone, it has proved very difficult to come up with a winning strategy. (Which is just political speak for "It doesn’t fu****g work !!)

However, as I mentioned at the weekend, even if this excercise proves to be nothing more than just a handy set of figures to have on tap, I enjoyed doing the research. It gave me a look into the method involved in trying to develope a system, how to set criteria for that system, how to back test it etc etc.