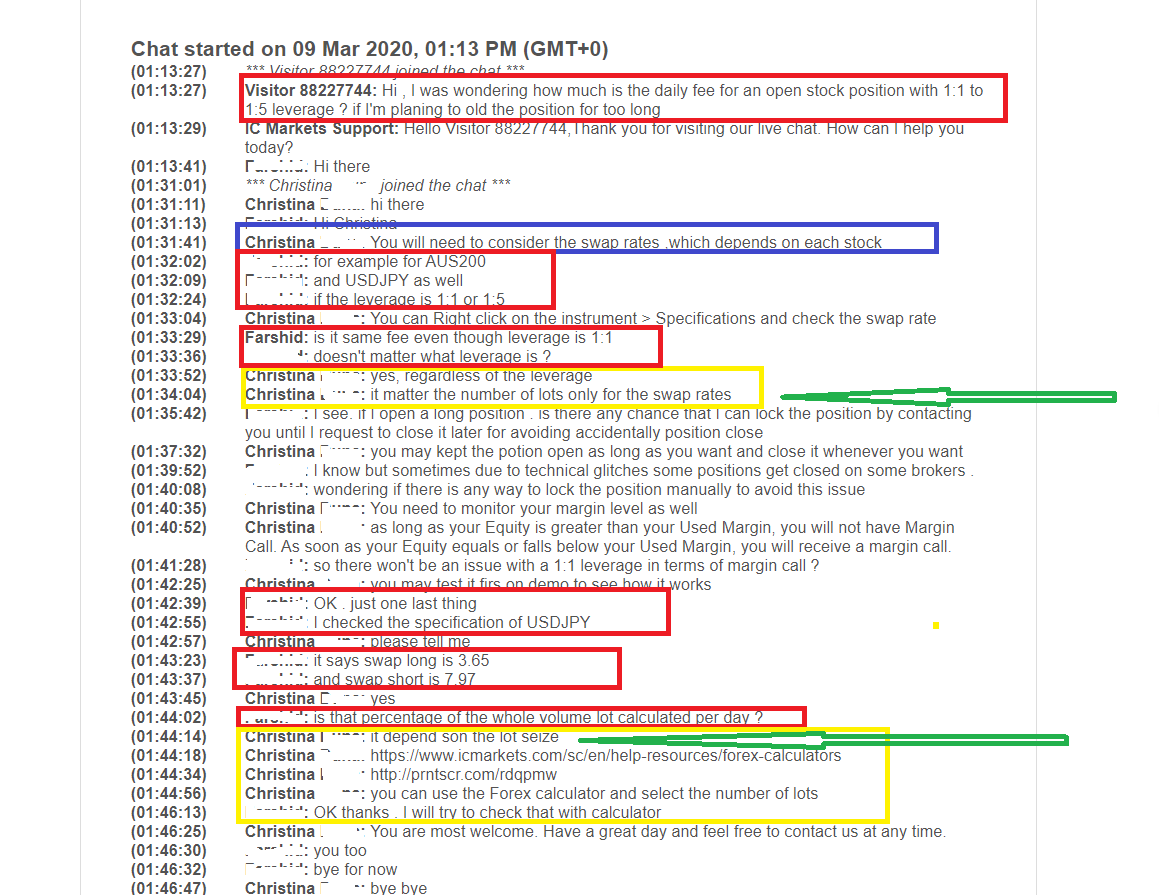

Their support gives false and misleading information. I contacted them before my investment and wanted to know about their swap rates. Once in later part of 2019 and then again before depositing money to their account Support told me to look at the swap blog and said it “only” depends on the lot size.

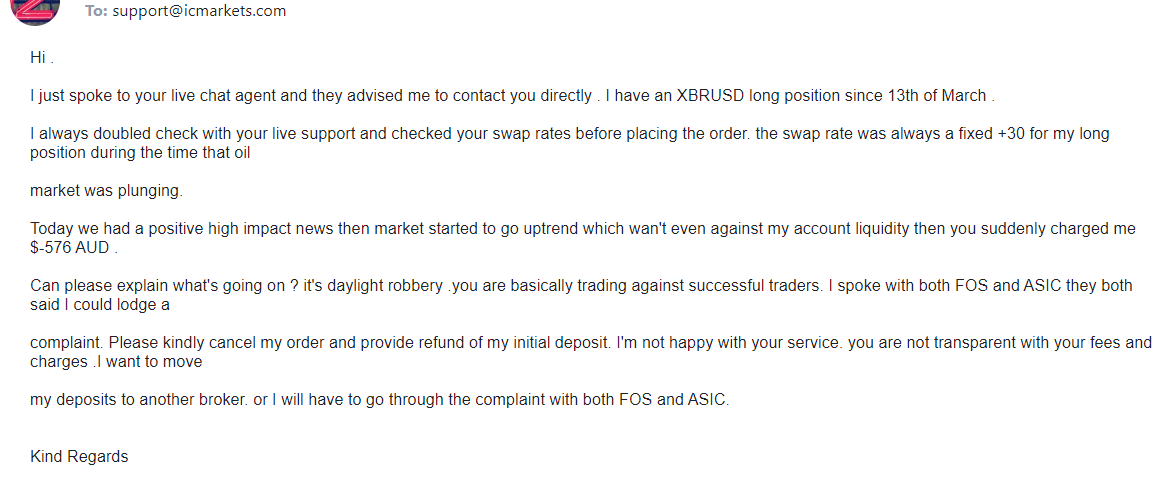

I opened my long Brent position because I’m familiar with this instrument due to its cash settlements properties. it had receiving swap of +.30. Everything was normal in March but in early April when market moved in my favor, swap change suddenly jumped to $-570

This is when sudden charge showed up

After I complained and told them that I will report them to relevant authorities, they claimed it was an error!

Very same day that they made a swap adjustment less than the amount that they took out of my account. They changed a receiving swap to paying swap!.

I was getting +50 cent a day for my position then it went to almost -$100 a day and tripped on Wednesdays against my balance

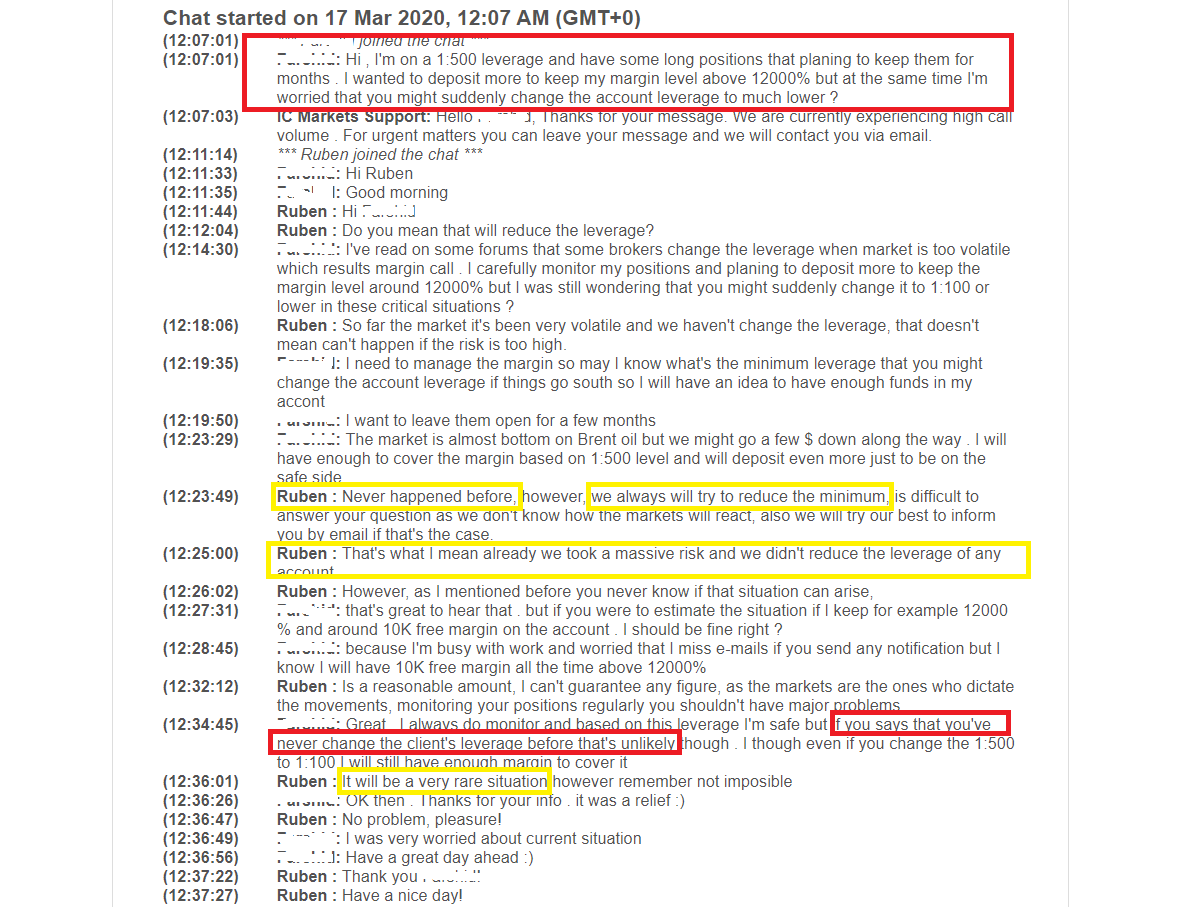

I contacted their support a few days after my investment and told them that I want to deposit money to my account but I’m worried that you suddenly restrict my account leverage . They told me it is “rare” and “never happened before” and as you can see I believed them at the end of conversation

later I found out that they had done it many times. I just attached the documents they admitted themselves. if you check the reviews there are lots of clients complaining about that

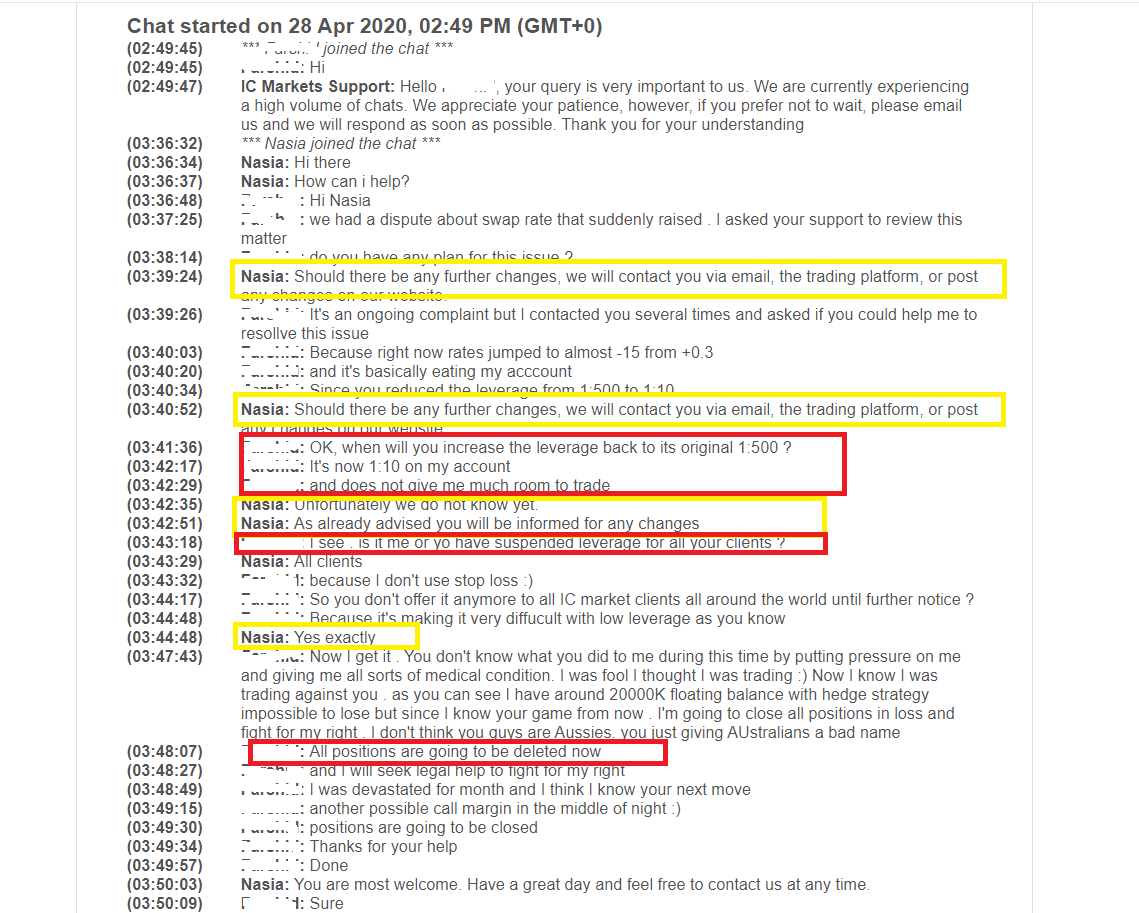

I complained about the increasing negative swap rate which was against my trade to AFCA. But while market was in my favor I changed my strategy and opened more trades to naturalize the high swap charges

Then all of a sudden after I deposited money to be on the safe side while my complaint was being processed, they reduced my account leverage from 1:500 to 1:10 and said it’s because market is very volatile !

However market was in my favor as you can see . I was forced to close my positions in $5000 loss to survive the leverage restriction because free margin went from 12000% to almost 100%!

A few days later I contacted many Australian brokers to check if they had restricted their leverage, they all said no! Some of them were surprised when I told them mine was restricted ( I have their transcript as proof)

One of my friends told me later that she registered an account with ICmarkets AU and they offered her highest leverage 1:500 for Brent and even opened her a temporary account!

I contacted them the same day after waiting for almost for a month for a resolution. They told me if there will be any changes they will let me know repeatedly! I asked support when they return my leverage back to normal 1:500, they said we don’t know !

I decided to close my positions and continue with my complaint because swap charges went around $3000 against my balance and they increased it again to -15 and they told me they can reduce the leverage continuously and increase the swap or other charges to whatever they want !

This what you get back in return when you complain!

“Margin requirements are highly likely to change continuously” (They told me it’s rare and never happened before)

“IC Markets has discretions under the Account Terms which can affect your Orders

and positions. You do not have any power to direct how we exercise our

discretions. When exercising our discretions"

“You should consider the significant risks that arise from IC Markets exercising its discretions”

That’s a lot of money oh my gosh.

That’s a lot of money oh my gosh.  I really wish you get your money back.

I really wish you get your money back.