Use 20/50 MA’s (Moving average) for direction with 4hr - daily - weekly charts - Use 5/20 for entries 15 mins and 1 hr…ex: is USDCAD I prefer Gold (for experienced traders) Blue = New York Sessions…Asian (Green) I prefer AUDNZD.

Entries are maybe the least important aspect of trading. More interesting would be stops, exits and handling winners - any more details you want to post up on these issues?

The way I trade is based on time zones, interesting that you would find entries the least important, I made it a priority to have good entries and avoid negative starts. There are more segments to my strategy, I establish supports and resistance using the high and lows of the day (I also set weekly SR’s one up and one down to establish my corridor)

My exits are based on the SR’s and average measurement of the NY sessions - My stop losses will be slightly above or below the current day Asian session (green).

Other than Gold, I also use GBPUSD - GBPCAD - USDJPY for NY Session - Recommend you start with Silver until you are comfortable with the process before trading Gold.

Most importantly - I do not trade against the trend even if the NY session shows otherwise skip it and wait for better trades/entries

All sounds good to me. Cheers.

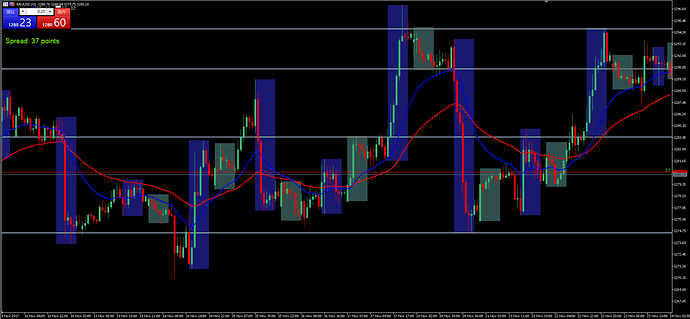

Today’s result on Gold was 20 PIPs - Close call on the SL (Dec 6th) - I thought it would be important to show difficult trades and not only good or easy ones.

Again look at the 3 MA’s open up on the entry point at the start of the NY session (Blue) - Note: SL is always set slightly above or below the Asian session.

Profit/Risk: Average is generally 3 to 1, but as you can see today, smart money took out all SL’s (long green wick), when the candle closes red, I stay in, however when I see an opposite candle with a long wick or 2 candles opposite color, i’m out,

Does anyone else trade the NY session or Gold in a similar fashion?

I do not trade Fridays or Sundays EST NY (from Toronto Canada) i use a 4 day window to earn my pips. Some days i do not trade major news events or charts that are not ready. I do not always trade the same pairs or Gold for that matter.

Indictors:

I use 3 Moving Averages (Bollinger works well too) I monitor for openings and crossovers from the 5-20 through 50.

I also use a session indicator, not my favorite Session indicator however I also use it as support/resistance. I would not mind buying a good session indicator for timezones.

An average daily range or fibo will help you a lot in these type of trades.

The most important tip, look at the fake move just before or at the start of the NY session, that is the signal that you are about to get in, try to ensure the candle engulfs the fake move. (I trade on 15 mins /1 hour) I establish the trend direction using weekly / daily / 4 hrs (all heading same direction)

Here is an interesting move that occurs every now and then, smart money initiates a second fake move to cumulate buyers before taking the trade where it had intended (short). Take a look at the MA’s not only on the current 15 minute chart but also with 4 hrs/daily/weekly time frames, chart indicates short, simple trade nothing complicated,

Remember the trade is trending, you have confirmed this, factor out emotions and set your SL. some of you may want to exit at a predetermined PIP level, I exit when there is an opposite candle with a long wick or 2 opposite candles.

This was AUDNZD for Asian Timezone trades, see you at the NY session.

Time zones involve a lot in the work of the stock market. There are people who are squeezed to give everything, spend hours without sleep just to follow all the movement of the bag (more than all of Asia) but I tell them to work, have a life, go out and enjoy life is a alone. The market is good but it can turn you into an antisocial for life.

Asian Session: AUDNZD - The fake signal was there, the entry was fine, however the pair did not have the same strength as the previous day. 12 PIPs for effort

NY Session: XAUUSD (Gold) - Nice downward trend 4hrs / daily - Fake signal was present, 3 MA opened on the 15 min chart (a bit of noise at the start of the NY session) - if you traded this product and followed the rules you should have collected approx. 63 PIPs for your efforts.

NY Session - Dec 12th (today) - Continuous downtrend in the 4hrs and Daily timeframes - XAUUSD (Gold) If you took this trade and followed the rules, then you should have made approx. 43 PIPs during the session.

Note: This chart is a perfect example of why I exit trades when 2 opposite candles come into play, it is best to secure your profits, money in the bank.

I have provided sufficient information for anyone to trade this system, let me know if you need more information or if you need me to post more trades.

Good luck

Good luck

This system is effective when there is strong volatility, recommend you enjoy the holiday season in the meantime, I will not be trading until January 8th. Happy Holidays everyone!

Like any strategy, the system is most effective when the rules are followed, ensure a good strong trend on 4 hrs daily and lots of room prior to a support or resistance level from daily/weekly.

I use separate accounts to trade regular sessions and full margin trades. The full margin trade account is used to complete 3 full margin trades using the NY Session. (smaller balance account) - Average return is approx. 7.5 to 8.5 times the initial investment. (ensure you have a SL and sufficient PIP room to sustain some volitility when executing full margin trades)

Note: I trade with my regular account most of the time, the full margin trades (3) are executed when all conditions are ideal, this does not mean from the same product, same day or even same week for that matter.