Nice rally in stocks today, oil continues to move higher, but our currencies ignored all this and finished with little change

Nice rally in stocks today, oil continues to move higher, but our currencies ignored all this and finished with little change

I am seeing lots of green, unless we get an afternoon reversal we should have a bullish finish to the week, the long term trend is still down, and this is most likely another bear trap, as long as oil is over $100 the American economy will start to contract as Americans stop all unnecessary spending to free up cash to buy gas for their cars

AUDCHF* short is our new top trade, this is not one I normally trade and it is happening during some rotation, so proceed with caution

Did the market just turn Bullish, 5 up days in a row for stocks, the first time this year we have had such a streak, but before you get too excited, note, that this rally is being led by the DOW, which means investors are still looking for safety and another step down could be coming. But it is nice to see our IRA’s and 401K’s have a good week

Just for the advice of traders outside the UK, we have two special public holidays this week, Thursday and Friday, to celebrate the Queen’s Jubilee. I assume London forex firms will continue trading throughout but volumes might be thin as a result.

Currencies up, stocks down, oil keeps creeping higher

I like this action in USDJPY, could we see a new high soon?

EURUSD is our newest Strong Weak trade, but is it a good trade, EURUSD short from last November gave us +1000 pips on the way down. To me this looks like a short term countertrend move, I like long term trades and I do not see shorting the US dollar at a time of rising interest rates as a good long term strategy

No where near the +2.0% spread you like to see too, Dennis?!

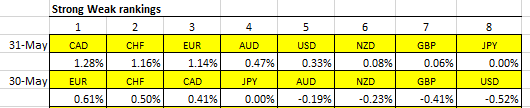

Things have really tightened up from top to bottom.

Just like in stocks, I see this as a possible bear trap

I just set up a spreadsheet to follow some of tehse assessments @Dennis3450 - And without looking at anything else the EURUSD is my first “paper trade” at the level on your post.

[ and for the sake of completeness Stop 1.02350 - but that was AFTER I saw the chart below]

Then when I look at the “Bear trap” possibilities - we see this;

Bang on Support at pretty High Volume

I’d be pretty content with that entry on a “Real money” account ! - We’ll see !

Thanks for all the work you put into this thread mate

It took less than a week for Yen to move from #1 down to #8

USD #1 on the day just ahead of Canada,

CADJPY has been a Top Trade since October and looks ready to hit new highs

Top Trades CADJPY and USDJPY continue to lead, CAD is breaking out to new highs

In this turbulent market, Strong Weak continues to rack up the pips, Is there another thread that can claim multiple +1000 pip trades this year?

How quickly a counter-trend rally can end and long term Yen weakness is back

as stated before, I like the USD and CAD , USD because of rising interest rates and CAD because of rising oil prices

True ish dennis and I sort of take your point later about oil - but when I look at the CADJPY - I see some evidence of Wyckoffian “Distribution” starting - as well as the blatant “Double Top” - so I’ll pass on this one for the moment  - but it seems your system called this “Buy” some time ago. Not sur e tho’ when your system calls “exit” - perk=haps I need to read more

- but it seems your system called this “Buy” some time ago. Not sur e tho’ when your system calls “exit” - perk=haps I need to read more

No exit signal, I leave the trades open ended and just track their progress, Some will use a 100 pip stop loss or a old support area as a surrender point. Proft, taking is up to each trader. I like taking 100 pips profit on half an letting the rest run, there is not a greater feeling then catching a 1000 pips move

Political turmoil and war can really move markets and we sure have had that the last 16 months

after two days of pullbacks, we seem to be back on last week’s risk-on move.

With stocks rising the USD may find some weakness but should hold up well against the Yen

If you believe this current market move is not another beartrap then long AUDUSD is my play for risk-on markets, CAD has lots of room to run as oil was up again today

I agree but maybe a little early. I’m waiting for 20/50ema cross up on the daily.

The AUD is making a run up the ladder of Dennis’s matrix… The RBA is making an interest rate announcement next Tuesday so be careful… Rates are expected to rise.

But so is the USA

Oil will make another weekly new high, $10 a gallon gas will start hitting US states starting with California this month

The only safe haven seems to be the energy sector, I am not sure how long this party can last until the American economy crashes

Currencies are back in risk-on mode

Both CAD and USD had monster weekly moves against the Yen, Euro also had a big move

Stocks finished down on Friday but stayed in a tight range for the week, I would look for price move outside this week’s range to indicate the direction the market wants to go