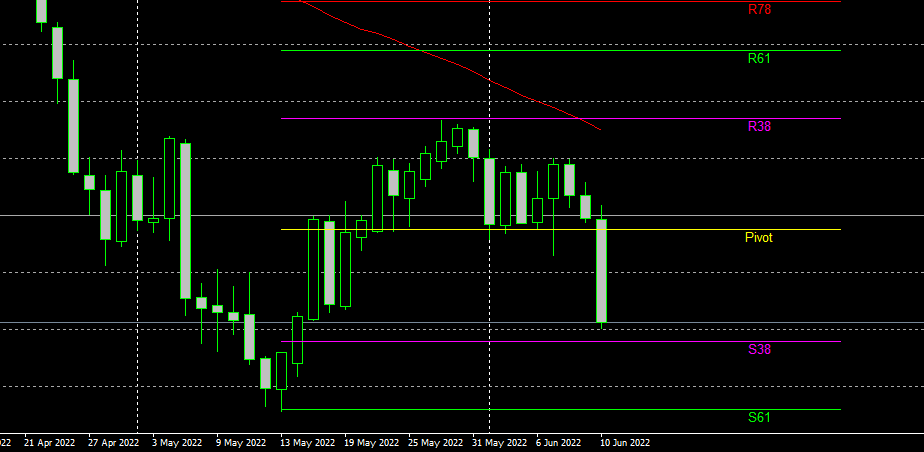

Exactly @FOK, it is to remove the guess work of were a pair is likely to go next… A perfect proof of concept was the US30 Chart I posted 24 hours ago…

Compare the two Chartshots… A slam dunk of a move or a shear fluke??

No… I didn’t trade it… I was busy elsewhere.

Dennis, I have spent a few years in this thread trying to expand and improve your SWA concept so old and new members can fully utilize this strategy, and from the patronizing response I just received shows once again I am just wasting my time in this forum…

You may remember a few years back when I posted the concept of trading within the SWA Matrix. So traders could get into a move early, reducing one of the risks with this strategy of opening a position when the Strong and Weakest momentum is over… (See Here from Feb 2019)

You can follow down the thread to see how this was applied in real time…

This encouraged me to start mapping your Matrix, which I did for 12 months or so to show traders the ebb and flow of the currencies within this strategy… Being able to visualize how this works was a game changer for many… (See Here from Oct 2020)

All I have displayed in the latest installment is a way to gauge how strong the momentum is for each and every permutation that your SWA Strategy signals as a possible opportunity… That’s it!!!

There seems to be a religious fervor in these forums…My System or Nothing… which is a really sad, sad state of affairs. It crushes any open, critical and constructive discussion of what is posted.

If any of you have the time… Read back through my profile… I never EVER discourage members from proposing new risk management or trading ideas… I attempt to post concepts designed to make traders think about concepts outside the blinkered Forex educated box… To discard this Religious close mindedness…

There is 1000’s of ways to Skin this Cat (Sorry, Cat lovers…)

Although not showing in the SWA Matrix yet… These currencies are on the move…

NZD and GBP are headed for 8 with US on it’s way to 1… There, I put my money were my mouth is!!

Check your charts where the USD crossed above the GBP and the NZD on the 8th, the EUR crossed above the CHF on the 3rd… the AUD above the CHF on the 2nd…

How many others here are prepared to show the Courage of their Convictions…?