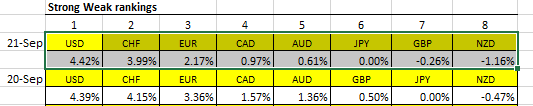

mild up day for stocks, NZD was only currency to lose against the Yen

mild up day for stocks, NZD was only currency to lose against the Yen

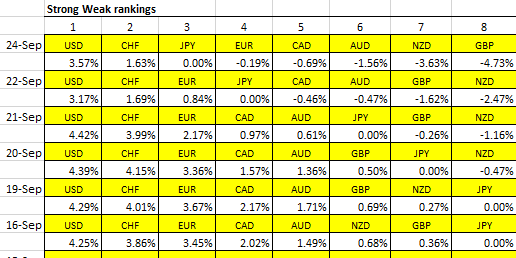

A mostly red day,

NZDUSD is our Top Trade again, this has a long-term downtrend, with multiple entry signals over the last year, but not all of them have worked out

,

Ugly day for stocks as they inch closer to testing June’s lows

Great day for EURUSD traders and the newest Top Trade NZDUSD also had a good day

Another very red day, dow breaks 30K before a slight recovery, how low will it go

So here’s the monthly GBP/USD chart. Thought i’d finally take the plunge and go long, with a little hedge down to the diagonal resistance and then another if it goes down more. Can’t go down forever, right?

You can only go long GBPUSD now, if you have deep pockets like Bill Gates or Jeff Bezos.

I reckon my short/long combo will take me down as far as it goes, then hopefully i’ll sell the short and reap the long reversal. However, i think it will reverse v soon (I have too much faith,perhaps, in my diagonal lines…) But let’s see!

600 pips this week alone! We’ll likely see a pullback next week, but I would be prepared to hold for a bit.

GBP/USD might make a little bounce on Monday/Tuesday. Of course volatility right now means a “little bounce” could be 200 pips.

My broker repots that 68% of clients with open GBP/USD positions are long. They also say that 70% of their clients are losing money.

Its been a bumpy ride. It isn’t going to get easier.

I mean forget all the technicals and fundamentals. To me this is just a case of look at the chart. Unless the GBP goes the same way as Venuzuela it’s got to reverse, whether that be GBP/USD 1, 0.9, 0.8.And as @tommor points out, momentum is so high, when it does uptick, it’ll be big. Just my thoughts. 49% chance I’m right.

Oh yeah. And it’s monthly RSI is below 30. Every time this has happened it bounces. I know ~RSI is only an indicator but I think at some point the technicals become so compelling that they become stronger than news or monetary policy and take over the reigns in price direction. @Dennis3450 I’m posting all this on your thread cos I think it’s relevant to the observations that you’ve made through time, but if I’m posting too much, please let me know and I’ll stop!!

I love your thread.

I love your thread.

The only person you must convince is yourself; this is the thread of die-hard trend traders.

Surely with such a momentous move, I agree, there surely must be some retracement if the past if anything to go by. However, there is scope to observe some price action recovery on lower time frames and not just buy at any level on Monday.

The other thing I think whenever I see a contrarian prepared to buy a bottom or sell a top is - well, he missed that trend completely, now he is feeling left out, not prepared to join the trend, and willing to make a hero call to support his ego.

I never go all-in when I think a trend is topping or bottoming, hence the hedge. It’s what I do when I think we’re getting into reversal territory and it’s an admission that I don’t know the exact point it will reverse, but we’re getting warm… By nature I am a trend trader but I alsoknow that if you follow trends a reversal will come at some point (partic if you trade shorter time frames) and you need to prepare for it. The position I’ve just opened will make some money, unless the GBP/USD never ever recovers from it’s current level or drops to below 0.7. I agree, you need deep pockets (or small positions!!) I’m not betting my house on this!

what a wild end to the week, US stocks hit a new year low, USD is a winner match to anything,

If you are still in GBPUSD from Aug 26th trade signal you are closing in on 1000 pips,

How many 1000 pip trades has Strong Weak given us this year, I have lost count

Serious trading volumes on GBP/USD today…

Another wild ride, I hope you are long USD and not long GBP

GBP/USD had biggest 1 day trading volume today since 2018. I just think something’s about to happen. That may well not be a full-on reversal, but I think enough for a high-low corridor less steep than recent declines. As I said previously, I’m new in to GBP/USD since last Friday - I’m going long, albeit with a substantial hedge in the other direction. I see maybe side-ways trading for a while? I agree that the trend is very strong indeed, but (even if they’re impossible to catch) trends do reverse at some point.

This is agony.