Long live short GBP

There’s a saying:

“Don’t be a bull, don’t be a bear, just be a trader”

No idea who said it but it just made sense to me when I heard it. I interpret it as don’t have a bias, be open to and ready for anything. That of course takes some practice.

Quite often, the thing that you think cannot happen, does happen.

I’m not saying it WILL go on forever, but guessing the bottom is IMO gambling.

Best of luck however!

I must admit that although I am 90% a trend-follower there are a few situations in which I take a counter-trend trade - but these have to be signalled by price action. There are just two set-ups like that I’m thinking about -

Bullish examples -

-

Inside bar break-out - we get an inside bar and price the next day closes above the IB’s range. At that point I would set a buy order at the break-out bar’s high.

-

Swing break-out - price makes a swing “leg” of at least 3 consecutive daily bars with lower highs and lower lows, followed by a bar with a higher high and higher low than the previous bar, and which closes above the previous bar’s high. At that point I would set a buy order at the break-out bar’s high.

In both cases if the break-out is against the trend I set a TP at +1.5r: if with the trend I set no TP but instead pyramid at +1r.

Maybe a retracement is on the cards, and a nice short term swing set up, but I will need to see some significant GBP strength and USD weakness before I can back a full on reversal.

EURUSD ‘could not possibly’ go through parity -and duly bounced off that point in mid July, but has since continued to fall.

Agree with all the above opinions and I didn’t mean to sound too much like a maverick. I, too, suspect gbp/usd will likely continue to fall. All I was saying is that I think it’s getting to point where reversal more likely than before. Hence going long with a short hedge to get some returns while it’s still falling. I’m more of a swing trader than a day trader and this is often how I set up a trade. Of course, been caught out by this before (I bet on the EUR/CHF reversing), I realise I might be in this trade for weeks or months before I see a profit, but you’ve got to start from somewhere… (although I appreciate many would say you wouldn’t start from here!!)

It should be no surprise after yesterday’s drop that GBP had a bounce today, this is why we do not chase

While the DOW is getting crushed and is at a new low for the year, the NASDAQ has not hit a new low. Could this be signaling a bottom?

What we know is August and September are the worst months for stocks, and the markets sure did live up to that, what is also normal is for markets to make bottoms in October. With September only having 3 trading days left we seem to be headed for an October bottom, and rally. But what we don’t know is if the rally will signal the end to the current bear market or will it be another bear trap

Time will tell

Reversal day, if you buy this reversal be cautious that you are buying the longer-term trend and not stepping into a beartrap

Currencies are mixed and a crushing selloff in stocks, so much for yesterday’s rally

Market is clearly still in risk-off mode

Following July’s bear market rally we have seen a crushing selloff following every attempted rally, today could be the start of another leg down,

Stocks ( S&P500) are down 22.56% YTD, making this the 6th worst year in history for US stocks, and we still have 3 months to go

big rebound day for the Pound

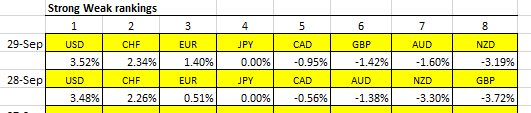

We end the month with more blood on Wall Street , that is one huge gap between Strong and Weak

Yup, grabbed some profit from the up-tick last week, but now I’m back in the fold.

Reversal day, big uptick in stocks and risk-on currencies, but is this the end of the bear or yet another bear trap. I would be cautious here

Huge follow through day for stocks, but oddly the risk-on currencies are down

remember how green everything was yesterday