So what does this imply to the top trade, EurNzd or EurAud?

Nothing except plan on a wide stop, and greater risk

here is a pretty good piece why the British pound has collapse

Those of you living in the UK, please way in on how accurate this is

It sounds like 2008 all over again

I think I’ll be OK as long as I don’t ever buy anything ever again.

I understand that the consensus is that everything will probably keep just going down, but the USD/GBP is now above where it started on “black friday” and is now between the 20 and 50 MA on the 1D charts. Yes, our economy is a basket-case at the moment, but I always get wary when there’s too much agreement…

Outside of food that is pretty much what I am doing, if it gets any worse there are plenty of squirrels running around here

this is why you do not chase these moves, and when something gets a lot of media attention the worse might already be over

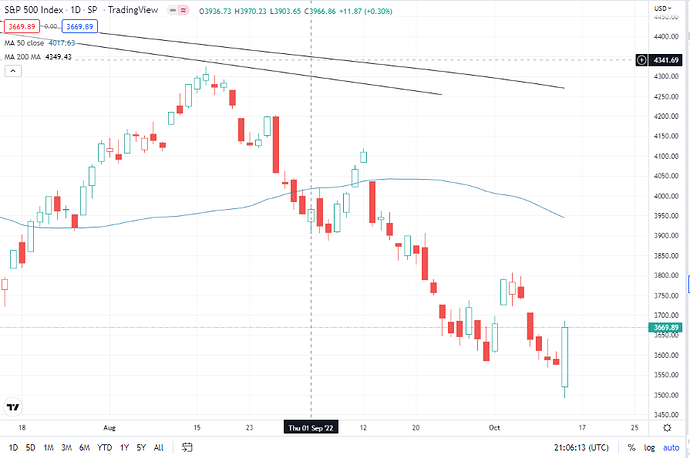

Another wild ride, stocks retraced most of early trading losses

Every pullback is buying opportunity for the US dollar

After a wild ride of ups and downs, we end the week where we started

More of the same

it is amazing how strong the US dollar is everywhere except here in the States

GBP/USD has been in a consistent downtrend since mid-2021. Now that’s a long time but this morning’s unemployment figures were the best since 1974 - 48 years ago!

There has been no significant positive impact on the GBP/USD price. It looks like maybe it has stopped falling for this morning but its still well below yesterday’s close.

Which just proves the old saying, there’s no good news in a downtrend.

All yen pairs were up today, led by the Pound

Huge up day for yen pairs, led by the Pound, was it not just two weeks ago all the news was about the British economy and pound going down the toilet

This might be one of the biggest one-day engulfing candles in the history of the market, If history repeats then we had our October bottom and we should rally from here

This completely justifies my decision to stay out of GBP trades as of 2-3 weeks ago.

At this point anything could happen. We could have a new Chancellor by tea-time. We could have a new Governor of the Bank of England by Monday. We could have a new Prime Minister by Tuesday. We could have no government by Wednesday.

All these things could happen without the market knowing whether they are good or bad.

Mitigates my controversial suggestion that we may be seeing a reversal…

Agreed. GBP not a good place to be at the moment. Whether you a buyer or a seller be!

Looks like the Pound was the big winner for the week, US dollar remains strong, No follow through for stocks, the market remains confused about its future direction

I would say that is accurate with a whole raft of other contributory events yet to come.

The Conservatives Republican equivalent) whom we have in power (and Labour (Demorats)) like to have unemployment which is still a big issue but with a large amount of employers looking for staff and getting no takers. We are still recruiting overseas from Africa and Asia (now) wheras it was Europeans before.

We next have Pensions which are subject to the triple lock which the government has said will be honoured.

This increase either with be

(1) Average earnings

(2) Prices, as measured by the Consumer Prices Index (CPI)

(3) 2.5 per cent.

Whichever is the greater will be adopted and was introduced in 2010 by the coalition of Conservatives/Liberal Democrats.

Next benefits will also be increased by the rate of inflation.

This can go on and on but the last one I will mention is Fuel Duty. We pay Fuel Duty and VAT and this gets increased every year so, for people like myself who got a 3% pay rise and travel to work We have seen no increase in the value of our income. I travel 250 miles per week and this takes a large slice of my salary.

I unfortunately work in the public sector and also cannot expect a generous employer to share his /her greater wealth to improve my lot.

We are now back to the good old Boom and Bust scenario.

Well, I think the market has made up its mind with a huge move for stocks and an all-green day for yen pairs, led by the Pound, Remember how just 2 weeks ago the world was ending for the GBP. I am going to go out on a limb and say we have seen the low for the year in stocks. Now does that mean the bear market is over, and the current stock rally is not another bear trap, time will tell

I am going to be without my computer and excel sheets for a few weeks so I will be posting manually, you might want to check my math

I messed up, corrected

1.USD 4.16

2. GBP 4.14

3.EUR 3.61

4.CHF 2.18

5. CAD 1.55

6. JPY 0.00

7. NZD -0.69

8.AUD -1.37