The anaylsis is donated by Dennis, the trades belong to each of us.

Been watching this thread for a while. Want to pay Dennis back and do the SWA analysis whilst he’s on leave ![]()

Dollar being battered!

Well done.

Your spreadsheet demonstrates well how rapidly NZD can go from one end of the scale to the other. I hate having NZD positions.

@tommor And over the last few years the JPY has done exactly the same… It’s been known to go from 1 back to 8 in a couple of days…

Thanks @Emorgan90 for posting your formulas… With the JPY, CHF 1 and 2 and the CAD, USD 7 and 8… -5% across the JPY to the USD is a large gap for Dennis’s system…

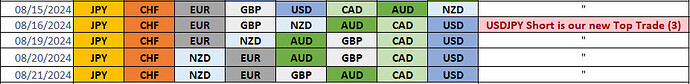

Currency Strength Analysis 4 Hour Chart | 200 sma

This order of SWA is an indication that the markets are nervous…

Maybe they can see something we can’t…

Yes this is true. JPY’s the only currency that does not feature in any pairs with lowest historical volatility.

That is very nice, thanks for sharing, are you able to show how you input the daily data and what those numbers are?

Here is how I’m doing it, close of Wednesday, slight difference is why I’m curious, same order.

Now you need to start tracking the trades, no one else here does, not even Dennis.

I track my trades. I don’t post trades, but I have posted all strategies I have ever written.

I may have used the wrong word there; should have said Track the SIGNALS generated by the SWA.

But, I mean, that is so awesome that you track your own trades.

Assuming that you were mentioning that because of my post, maybe not.

@FOK USDJPY Short since the 16/08… 320 pips+… Nice work…

The SWA Chart I posted above doesn’t have as much lag as Dennis’s system… NZD will move below both the EUR and the GBP and maybe even the AUD in the next sequence…

No change in the order. Slight dollar strengthening Possible profit taking / repositioning ahead of Powell speech later.

I have a Python code which uses the Yahoo finance module to take hourly data and then it puts it into 4 hourly OHLC for me. I take the 18:00 candle UK time. Difference may be discrepancy between brokers. It then calculates the %.

Here are the close and 200_MA numbers for USDJPY yesterday:

146.2169952 152.0049297

Obviously, there will be discrepancy, not only from brokers but 18:00 UK is not the same candle as 17:00 USA New York close, the most widely accepted time for the daily Forex candle.

But still the order remains the same so there is that.

Thanks,

Indeed as you say the order is the same, and the magic of this is the simplicity for me!

Pair the strong with weak, and observe the relative shifts of strength and weakness.

If this indicator is so good you should be able to sell it.

If you’re able to sell it why can’t you afford to market it?

Why do you have to use this thread to get free advertising?

So I have to suppose nobody is buying it…

What would impress me more is to show the entry point for when the Arrows appear; I’ll wager that they are nowhere near the actual Arrow.

And, produce the trade account statement, and show me the $400 - $800 / day profits?

Why limit yourself? If it’s that good, I’m making at $1,000 / day, shoot for 10K / day.

The colors are great, but the left will always be green, and the right always be red; with individual currency color, progression from weak to strong can be seen easily.

JPY + CHF strong is risk off, isn’t it?

I have been following this thread for a few years now and has been very useful to me.

I am really interested to compute the SW spreadsheet myself, is there a code for this to track/ compute the SW?

Thanks in advance

yes ur correct ![]() would u mind sharing ur base sheet? i would love to analyze the data back for patterns in combination with rate cuts/hikes and general fundamentals

would u mind sharing ur base sheet? i would love to analyze the data back for patterns in combination with rate cuts/hikes and general fundamentals

and also in combination to 100 and 200 daily emas